What to do When Credit Card Debt is Out of Control

Credit card debt can blow out of proportion at times. The holiday season is a classic example. Everyone wants to spend money as if it is going out of fashion. We all get caught up in the moment, buying gifts for family and friends or lashing out on travel home to see family. Waking up after the new year to find your credit cards are out of control, is stressful but need not be the end of the world.

Take heart. There are ways to reduce the interest on your credit card so that the bulk of your repayments actually contribute towards lowering your original debt instead of being swallowed by bank fees and interest payments.

Reduce your Interest on Credit Cards

Take Advantage of Reward Schemes

No longer a cash society we rely more and more on the convenience of credit cards. The lure of reward schemes and collecting points for every dollar charged to a card makes us want to spend more with plastic and less with cash. If managed well, this can be a smart way to spend but only if the interest is kept at a minimum.

Getting rewards for every dollar purchased is a tempting proposition. But you have to take advantage of the reward scheme or it means nothing. Accumulated points for frequent flyers make flying cheap and easy but only if this is something you will do in the near future.

Money in your Bank

Options for Getting Credit Card Debt under Control

- Pay more than the minimum monthly amount.

- Credit card balances are best paid in full as the due date nears.

- Transfer the balance to another financial institution offering low interest for the first twelve months. This can save hundreds of dollars..

The financial institutions providing a credit card service set a minimum monthly amount that must be paid or further penalties are incurred. Quite often the minimum amount will be almost as much as the interest. This means the overall balance of the card will never reduce. Only paying the minimum off the credit card will result in an excessive amount of unnecessary interest.

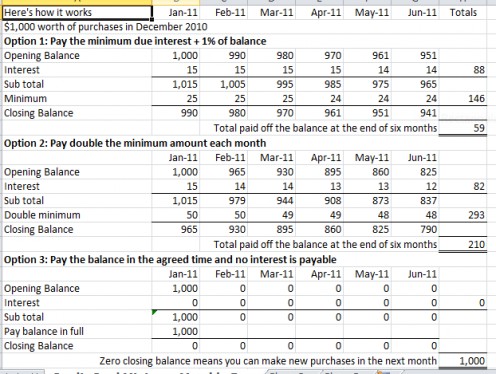

Table: Credit Card Payment Options

The table above shows the total interest payable on credit card purchases of $1,000 and looks at three different options for making payments. By simply paying the minimum monthly payment the bank assigns, you are only paying 1% off the balance each month (Option 1). At the end of six months, even though you have made payments totalling $148 your balance has only reduced by $59.

Option 2 shows by doubling the minimum amount, the difference in the interest paid is actually $6 less over the same time frame.

If at all possible, paying the credit card balance in full as shown in Option 3 and before the due date arrives will save hundreds if not thousands of dollars in the long term. If this is something that doesn’t happen on a regular basis, it may be time to look at why you are using a credit card instead of cash.

Transferring the balance of your credit cards to another provider offering low interest can save you dollars in the short term. Make sure you check out their ongoing interest rates for future purchases though, or this can cost you money in the long term.

Shop Around for the Best Deal

Shop till you Drop - You know you want To

Credit Card Balance Transfers

There are several credit card companies offering to pay the balance for you at a greatly reduced interest rate. Be aware that this only applies to an agreed amount of time, for instance three or six months. Some do offer the reduced rate for a year so make sure you shop around and get the best deal.

The pitfall of transferring a credit card balance to another provider is that the interest on new purchases may be even greater than what you are paying currently.

Time to Rethink the Way you use your Credit Cards?

Some questions you might like to ask yourself:

- Are the purchases necessary?

- Would you buy those items if you had to pay cash for them?

- Will you have enough money to cover the debt when it falls due?

- Shop till you drop, but can you afford the repayments?

The convenience of using credit cards for in-store or online shopping is too good to resist. Managed well, buying on credit can bring great rewards. Beware of ringing up a huge balance that is totally out of your reach to repay. It could leave you paying nothing but interest for years to come.

Copyright © 2011 Karen Wilton

Finance Hubs from the Contest

- How to get a Good Credit Rating and the Long Term Effects of Late Bill Payments

It is not easy getting or maintaining a good credit rating, but the long term effects of late bill payments means it is essential in these unstable financial times. For those new to the game; school leavers... - How to Get Lower Credit Card Interest Rates And Get Out Of Debt Faster

If you have decided it is time to get on top of your finances, and finally took the time to sit down with them, you may have been disheartened, when you looked at your credit card balance. You notice that...