The power of Dollar Cost Averaging

What is dollar cost averaging?

Dollar cost averaging is the act of adding money to an investment over time. If you are fortunate enough to come into a good sum of money and choose to invest it most experts will advise you to dollar cost average (also known by the acronym DCA your money into an investment. By dollar cost averaging you average your costs out over time.

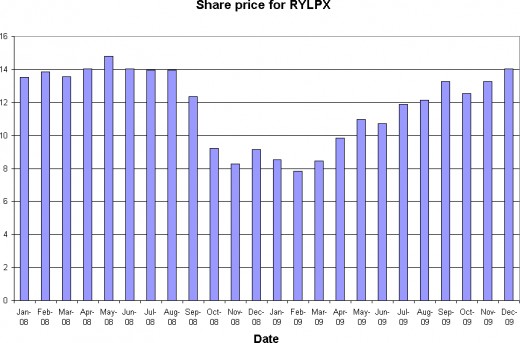

Most 401K participant’s dollar cost average and are unaware of the fact they are doing so. Contributing a fixed amount every pay period has benefits many investors are not aware of. Merely as an example for this article an investor is investing 1000 dollars every month into the Royce Low Priced Stock Fund symbol RYLPX. The assumption is made that the investor is paid at the end of the month and invests on that day. The example shows the power of dollar cost averaging over the period Jan 2008 through the end of 2009. When the investor whom I shall call Joe first purchases the fund on January 31, 2008 the dividend adjusted price stand at 13.52 per share. When Joe makes his last purchase on December 31, 2009 the price stands at 14.05 per share a modest 4 percent gain.

In this example Joe invests $24,000 over two years. Using dollar cost averaging his investment is worth $29,653 on December 31, 2009. This figure is a handsome 23.5 percent gain over the total Joe invested. Had Joe invested all of his money at the beginning of the period he would have realized merely a tad over a 4 percent gain ($24,941). Witness the power of dollar cost averaging.

I have run model examples of dollar cost averaging over several periods in time. Unless you are able to find the bottom of the market and invest you money at that time dollar cost averaging is a great tool for you.

People tell me dollar cost averaging gives them peace of mind. For them it is a win win. If the price goes up they are making money. If the price goes down they are getting a better value.

Price VS share price and shares purchased

An example of the power of dollar cost averaging

The first table shows the dividend adjusted price of the Royce Low Priced Stock Fund for the last day of the month over the period January 2008 to December 2009.

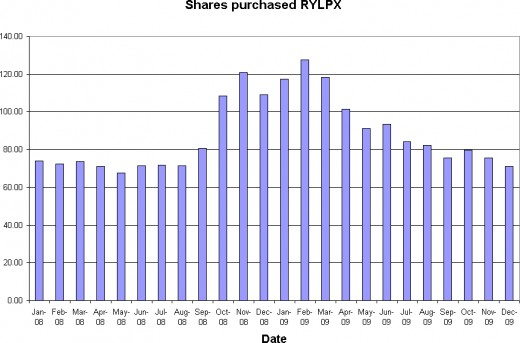

The second table shows the number of shares purchase during the same period. When the market is down significantly more shares were purchased. At the end of February 2009 almost 128 shares were purchased, while when the fund was at its highest price in May 2008 fewer than 68 shares were purchased.

I would like to look at those two dates alone. On May 30, 2008 the price of the Royce Low Priced Stock Fund was 14.78 per share. On February 27, 2009 the price of the fund was 7.83 per share. The average price for those two dates was 11.30 per share. Joe the investor got a better deal he paid an average of 10.23 per share. Joe purchased significantly more shares when the price was down hence the power of dollar cost averaging.

Dollar cost averaging will not always obtain these excellent results but often allow the investor to buy into the market at a lower average cost and reduce risk. One could say the day to invest was March 9, 2009 and if all of their funds were invested on that date one would be up 200 percent. The truth is few of us will ever know when the market will peak and when it will bottom. Dollar cost averaging allows the average investor to buy more when the market is low and less when the market is high hence improving returns.

If you want to make the most of your investments dollar cost average, invest in the best mutual funds, have a good asset allocation. Be it in your IRA, 401K or taxable account sound investing pays handsomely. The 2010 portfolio contains excellent mutual funds and an aggressive asset allocation.

Dollar cost averaging should be part of your investment strategy.

More investment tips by Daddy Paul

- Daddy Paul

Hubs by Daddy Paul - Mutual Fund and investing tips

These are some of the finest investing articles available on the web. They are designed to help you make the most of your hard earned money.