Different Types of Bank Cards

Nowadays, there are different types of cards available in the market other than credit and debit cards. People often get confused in between debit and credit cards; many in fact do not know the difference between the two. So, they simply stay away from using the cards and instead use only cash as their primary source for paying bills and other expenses. Though as an informed and smart spender, you must know the difference between different types of cards offered by banks. Few types of cards are not much popular as credit or debit cards, but offers whole new range of features which might be useful to you. Today, various banks and financial institutions offer many different types of cards to satisfy the needs and wants of their customers.

Which is the Right Card for You?

From these various available options, choosing the right type of card as per your need is very important. So, here are some types of cards to choose from.

Credit Card

A credit card is the right card for those who do not want to carry much cash in their wallet and also want to pay their shopping bills later, not at the same time of shopping. A credit card will not only slim down your wallet, but will also provide lot of benefits ranging from cash back to reward points which can be redeemed. Even if you do not have the cash right away, holding a credit card becomes handy as it helps you to purchase something really important or during an emergency situation. You just need to make sure to arrange the money before the due date or get ready to pay the late fee charges along with hefty interest charges.

Credit cards are of many types, so choose the one as per your need. Every credit card comes with a credit limit which can be increased or decreased from time to time depending on your income and credit history. While most of the credit cards are free of cost, the premium versions come with an annual fee which might range from Rs. 500 to 5,000 ($10 to $100) ; but then you get more privileges such as concierge services and double reward points with the premium ones. Do not forget that using a credit card and paying the bills on time helps you to create a better credit history which can help you to easily get loans in future.

Charge Card

Unlike a credit card, a charge card has no credit limit, so one can spend as much amount of money as he/she wants. Though, charge cards come with a restriction, that, you cannot roll over your balance, i.e. you will have to pay the entire bill amount at the end of the bill cycle. It will help you to make sure that you will not keep on rolling over the balance and get trapped in big debt. So, it is a good choice for those who have a hefty bank balance and a lavish lifestyle. But for those who want to spend money within some decided monthly budget, charge card may not be the card of choice.

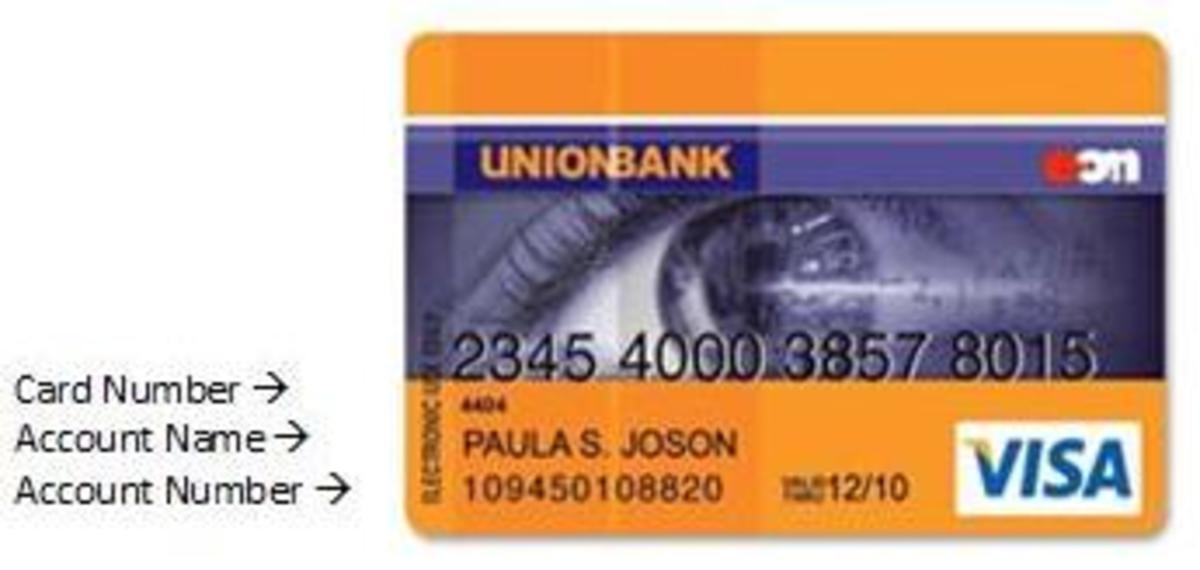

Debit Card

Debit card is the card which is usually offered while opening a bank account. When you make any transaction using a debit card, the same amount gets debited from your bank account at the same time. So, it is the right choice for those who prefer to pay by cash rather than by credit. Debit card makes you ensure that you never overspend as you can swipe the card only till there is enough money in your bank account. With the help of debit card, you can also withdraw money from an ATM whenever you require it. So, using a debit card might be a smart choice if you usually pay by cash.

Prepaid Card

Prepaid card is the one which helps you to keep a tight control over your finances. It ensures that you do not spend more than the amount loaded on the card. You can get a prepaid card issued from any bank for Rs. 50-100 ($1-$2) and load it for amounts ranging from Rs. 500-50,000 ($10-1,000). The prepaid cards have no hidden fees and are also the most secure as they are not linked with any bank account. Using a prepaid card is the best option for one time costly transactions, like buying a laptop, etc. It is also useful if you want your children to learn managing their expenses; as you can provide your children a prepaid card with the specified limit for their use without overspending.

Now, as you must have got the fair idea of different types of cards, take your call which card is right for you to meet your needs. You can also choose the combination of cards depending on the type of transaction or you may choose to stick with one particular type of card. Take this quiz to find out which card might actually be suitable for you as per your spending habits.

Quiz to choose the right type of card

view quiz statisticsWhich Bank Card do you think is most suitable for your needs?

Recommended Articles

- How to use Credit Cards

Holding a credit card or two is not a bad thing but if you are not paying your dues on time, you will see it as a burden with heavy rate of interest and a life full of debt. - Quiz on Personal Finance

If you find it difficult to understand personal finance and its terms then play this quiz to learn about finance in a fun and easy way.