How To Examine Expense Ratios To Uncover Possible Problems With A Rental Property!

All active rental income property has operating expenses.

So the idea of operating expense ratios will not be something new to real estate investors and other professionals who have been around investment real estate for any amount of time.

Nonetheless, there are some ways to examine the operating expense ratios that might not have been considered and could certainly prove helpful.

It seemed fitting, therefore, to discuss this because close examination of operating expense ratios can alert you to possible problems existing with a rental property you are considering to make an investment on.

Operating Expenses

Operating expenses are costs an owner incurs to keep a property in service such as property tax, insurance, repairs and maintenance, utilities and so on.

Operating Expense Ratios

Operating expense ratio is the ratio of individual operating expenses to the gross operating income which essentially shows you how big a bite each operating expense partially takes from the gross operating income.

Formula:

operating expense

divided by gross operating income

= expense ratio

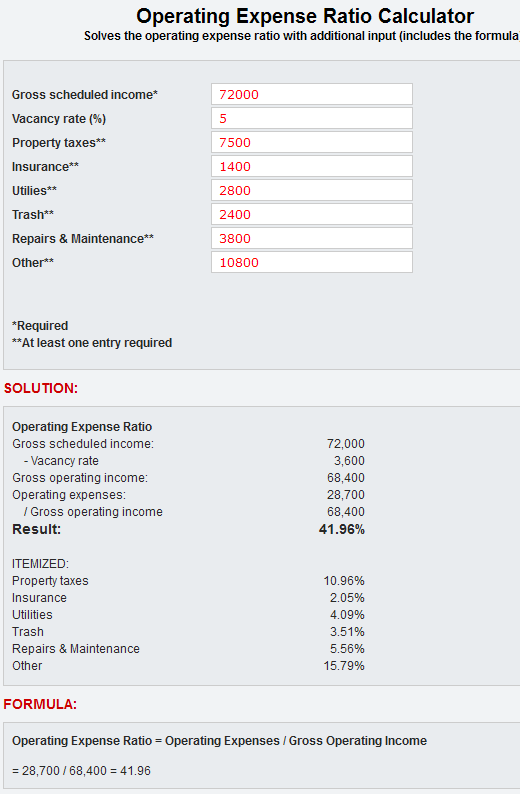

For example, if a rental property's annual property tax is $7,500 and it's gross operating income is $68,400 then the operating expense ratio for that property tax expense would be 10.96%.

Here's the idea.

As an experienced real estate investor you undoubtedly have already compiled enough data on similar other rental properties to have developed reasonable ratio expectations. Now you want to examine the subject property's operating expense ratios to see whether they are in line with your expectations.

Significant differences in the ratios you expect to find with those actually presented, of course, could signal a possible problem area. So you definitely would want to pay close attention and maybe request more information.

Here are seven operating expenses common to most rental income property so you should have enough data collected from examining the operating expenses of other income property's to recognize when their ratio appears abnormal for the property you are interested in. What you might not recognize is the potential cause for the abnormality which is included for each of the seven expenses.

1) Property Taxes - This might be a clue that the subject property’s data or the county tax assessor’s data is faulty. Request the tax statements, and maybe meet with the tax assessor to become reasonably assured that nothing hidden or misconstrued might be lurking in the background.

2) Insurance - A higher-than-norm insurance cost ratio should prompt you to have someone from your insurance company do a field inspection and advise you whether there are violations or other issues with the property that might affect insurability.

3) Electricity – This could be the result of separate metering or (more or less) lighting of common areas. If the subject property were not separately metered, would you, as the new owner, be compelled by local codes or ordinances to install them? If electricity is non-existent in the subject property’s operating expenses, you would want to know why.

4) Heating – If the ratio for this operating expense is higher than you would expect, it could indicate a faulty heating system. Is it possible for you to affordably correct the deficiencies and cut costs? In any case, always verify heating and other utility costs by contacting the utility providers directly, and always conduct a careful inspection of the property.

5) Repairs and Maintenance - Whereas a higher-than-norm ratio could spell “money pit” (or perhaps indicate some recent remodeling or updating), a lower-than-norm ratio might mean the owner neglected caring for the property, perhaps shaved costs by doing the work himself, or maybe the property simply didn’t require much maintenance this year. Whatever the reason, as you approach repairs and maintenance costs, remember to ask yourself, “Yes, but what will I pay when I own this property?”

6) Property Management - A lower-than-norm (or non-existent) ratio might mean that the seller acted as the property manager. But this might apply to you, so be sure to include some rate for property management in any event.

7) Miscellaneous- There are a host of expenses typically applied to miscellaneous operating expenses such as licenses, permits, subscriptions, general administration, and legal fees. A lower-tan-norm (or non-existent) ratio might indicate that the seller is hiding something. Be sure to make your offer subject to your approval of the seller's IRS Schedule E for the past three years just to be sure you know the facts (you should ask for this, regardless).

You get the idea. Examine each of the operating expense ratios looking for notable disparity between rental properties you consider purchasing and what is reasonably expected. And when discovered ask plenty of questions before you consider investing in the property any further.

Better yet, why not re-run the numbers for yourself based upon what you feel the rental property's operating expense ratios should be? This way you can feel confident that the income and operating expenses are more reasonable, plus it gives you the ammunition to perhaps negotiate an alternate price. It's easy with good real estate investment software.

Here’s to your real estate investing success.

Sample (calculation)

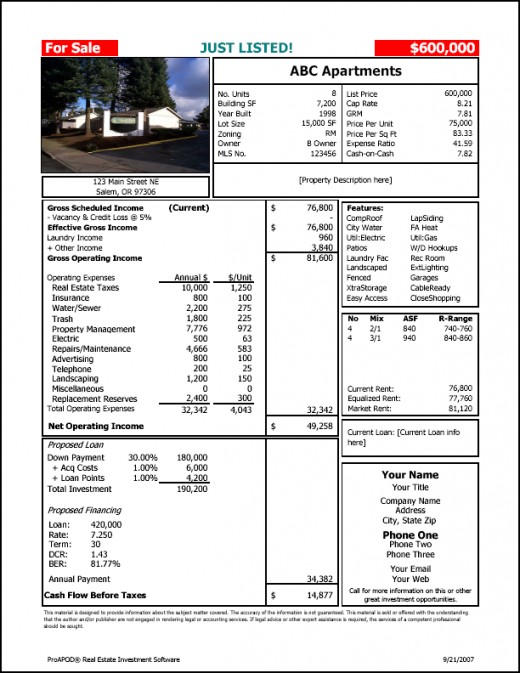

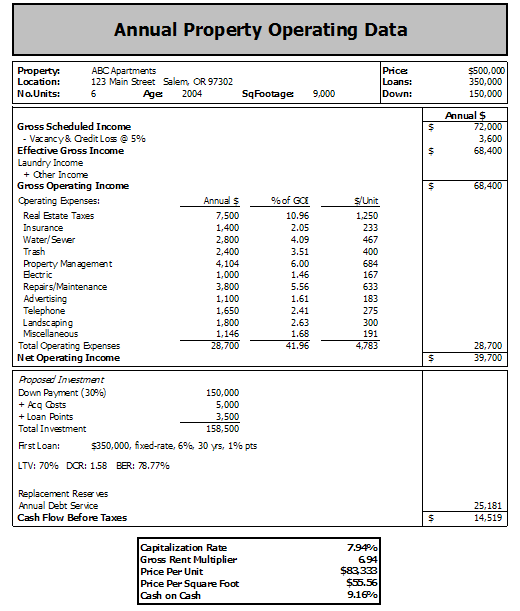

Sample (in report)

About the Author

James Kobzeff is a real estate professional and the owner/developer of ProAPOD - leading real estate investment software solutions since 2000. Create cash flow, rates of return, and profitability analysis on rental property at your fingertips in minutes! Learn more at www.proapod.com

ProAPOD also provides iCalculator - an online real estate calculator that enables you to learn dozens of real estate definitions and formulas as you calculate. You save 64%. Learn more at real estate calculator

Other Articles

- Understanding Net Present Value: Knowing Whether The Real Estate Investment Achieves Your Desired Yi

Learn about net present value, including its calculation, formula, and how to use it in a real estate analysis to determine whether a property achieves your desired rate of return. - The Annual Property Operating Data (APOD): Why Real Estate Investors Use It and How to Construct!

Learn about the APOD. Why it's a popular real estate investing report and how to construct one. - How To Buy Rental Property To Help Insure You Make a Profit

Four insightful real estate investing tips that will help insure that the next rental property you purchase will result in a profit. - Internal Rate of Return (IRR): Measure Rental Property Financial Performance!

Learn the definition and uses for internal rate of return (IRR) and how you can apply it to measure a rental property's financial performance. Includes instructions on how you can make the calculation in Excel. - How to Compute Rental Property Improvement Budgets to Prevent Overspending

Learn how to calculate a rental property improvement limit according to your desired rate of return.