Internal Rate of Return (IRR): Measure Rental Property Financial Performance!

One of the measures of a rental property’s financial performance more commonly used by real estate analysts is internal rate of return (or IRR).

Primarily due to the fact that internal rate of return considers time value of money.

As a result, because of this time value of money consideration, the real estate analyst can take into account the amount of the cash flows generated by the investment property as well as the timing of those cash flows and therefore is better able to determine whether the property will be profitable compared to other investments.

This is not the case with many other rates of return associated with real estate investing.

The cash-on-cash return, for example, simply shows the ratio between the property’s cash flow in a particular year and the amount of initial capital investment. That is, cash-on-cash regards the amount of the cash flow projection, but ignores the timing of that cash flow.

So you could conceivably compute a cash-on-cash return based upon an income stream anticipated five years from now with no regard for the “present value” of that money.

What internal rate of return does differently is to account for time value of money by considering the present value (PV) of those future income streams.

In essence, this is how it works.

The amount of cash you must invest in order to purchase a rental property is a present value (PV). That is, it is money you have in hand today worth today’s dollar. The future income streams, however, will not have the same purchasing power as they do today; therefore they must be “discounted” to also become a present value (PV) equal to the initial investment, thus making the net present value zero (0).

In this case, then, that discount rate would be the internal rate of return (IRR).

In other words, the IRR is the interest rate received for an investment consisting of payments (cash flows) that occur at regular periods; in turn telling the investor the rate of return he or she can expect for their investment based upon the property’s projected future annual income streams.

It might help to think of it this way: In the context of savings and loans the IRR is called the effective interest rate.

From an investing point of view, the real estate investor would generally go ahead with an investment when the internal rate of return (IRR) is greater the cost of capital investment, and reject it if the IRR is less than the cost of capital.

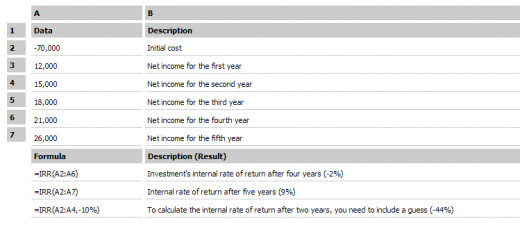

Excel Example

About the Author

James Kobzeff is the developer of ProAPOD - leading real estate investment software solutions since 2000. Create rental property cash flow, rates of return, and profitability analysis presentations in minutes! Calculations include internal rate of return (IRR) automatically. Learn more at => http://www.proapod.com

ProAPOD also offers a real estate calculator that will teach you the definitions and formulas for dozens of real estate calculations as you calculate.

More Articles from this Author

- How to Project Rental Property Revenues to Determine...

A look at the proforma income statement. Learn why real estate investors and analysts use it to project revenues and determine a property's possible profitability. Learn the basics for creating one. - The Proforma Income Statement

Discover what a proforma income statement is and how real estate investors use it to evaluate a property's future performance. - Rental Property Improvements, How to Compute a Rate ...

Learn how to compute the rate of return you might receive on the money you invest for rental property improvements. - How to Examine Expense Ratios to Uncover Possible Pr...

Learn ways that a close examination of operating expense ratios can alert you to possible problems existing with the rental property you are considering to purchase. - The Present Value of a Future Cash Flow - Why Unders...

Learn the difference between present value and future value and why these time value of money concepts are crucial to your cash flow analysis of investment real estate.