How To Buy Flood Insurance When Living in a FEMA Flood Zone?

Many Communities Are Affected By Flooding From Time To Time

How To Buy Flood Insurance

With extreme rainfall events and flooding increasing, as more atmospheric moisture is available in a slowly warming world and increased land development is causing faster rainfall runoff, many homeowners and business owners living in FEMA flood zones are asking: how do you buy flood insurance? Before answering that important question, it is equally important to make sure that you actually need flood insurance. Flood insurance is not cheap and is not required for all properties. Even some properties in FEMA flood zones are exempt from the federal requirement to buy flood insurance under certain circumstances.

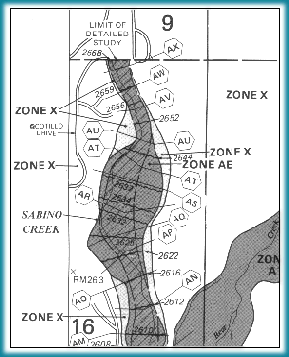

A FEMA Flood Map

What Is A FEMA Flood Zone?

To better understand flood insurance, it is a good idea to understand what a FEMA flood zone is. FEMA is a United States federal government agency that is officially known as the Federal Emergency Management Agency. One of FEMA’s responsibility is producing flood zone maps that designate the risk of flooding in specific areas. FEMA takes into consideration historical flooding data, historical hydrogeological data, and elevations to devise maps throughout the United States that define areas susceptible to flooding, based on the expected frequency of flooding, from 100 to 500 years. In FEMA nomenclature, a 100-year flood zone is called a Special Flood Hazard Area (SFHA). These areas have a 1% annual chance of flooding.

It is important to understand that just because FEMA designates an area a 100-year flood zone, it does not mean that flooding cannot occur more frequently than once every one hundred years in a given area. FEMA does not designate more frequent flood zones (i.e., 10-year or 20-year flood zones) because such designations are irrelevant per flood insurance requirements. It is also important to understand that areas that are in 100 to 500 year flood zones are still susceptible to flooding. Although floods in 100 to 500 year flood zones are fairly rare, they can occur, and will likely occur more often over time, as extreme rainfall events and continued land development cause higher future flood crests.

How To Determine If You Need To Buy Flood Insurance

If you live in FEMA 100-year flood zone (which can be determined by consulting FEMA flood zone maps : https://msc.fema.gov/) and have a mortgage on your home that is written by the federal government or by a federally regulated lender (which includes just about every lending institution), you must purchase flood insurance. If live in a FEMA 100-year flood zone and you pay cash for a home, or paid off the mortgage on your home, or obtain a private mortgage from an unregulated lender you do not have to purchase flood insurance. However, it would be wise to purchase flood insurance, even if not required to do so, since federal flooding statistics indicate that homes in 100-year flood zones have a 26% chance of flooding over a 30 year period. The chances of flooding in a given time period increase dramatically in greater frequency flood zones, such as 10-year or 20-year flood zones; although FEMA does not provide data the outlines these more frequent flood zones.

How Do You Get Flood Insurance When Living In FEMA Flood Zones?

Once you determine that you are required to buy flood insurance for your home because you live in a FEMA Special Flood Hazard Area 100-year flood zone that requires flood insurance, the process of purchasing flood insurance is pretty straight forward. Private insurance companies do not underwrite flood insurance because the losses could wipe them out of business. Instead, the federal government sells flood insurance through private insurance agents and companies via a government program called the National Flood Insurance Program (NFIP). Flood insurance cannot be purchased directly through the federal government. Flood insurance rates are codified in law by the federal government and will be the same for your home no matter which insurance agent or company you contact. The full year's flood insurance premium must be paid up-front and can typically be paid via personal check or credit card.

To find an insurance agent in your local area that is familiar with the National Flood Insurance Program and the various options regarding purchasing flood insurance or contact the National Flood Insurance Program via telephone at (888) 379-9531.

If the community you live in participates in the National Flood Insurance Program Community Rating System (CRS), you may qualify for insurance premium discounts of between 10% to 45%, depending upon the level of flooding risk in the area in which you live. The Community Rating System rewards communities that are proactive about meeting the National Flood Insurance Program requirements by taking actions to prevent or reduce potential flood losses.

The time to buy flood insurance is when no flooding appears on the horizon because in most cases it takes 30 days for a flood insurance policy to become effective,. There are a few exceptions in which the 30 day waiting period is waived, including: when it is being purchased as part of a real estate loan, if a home has been placed in a FEMA Special Flood Hazard Area within the past 13 months, and if additional flood insurance is purchased during the annual renewal process.

Some Tips When Purchasing Flood Insurance: 1) Have your important documents handy to provide information to the insurance agent about the size of your home and other pertinent features. 2) After signing up and paying the flood insurance premium, take some time to photographically document the valuable possessions within your home and save it in a place that is not prone to flooding (such as a bank safe deposit box that is on high ground), as this documentation will be very important, if you ever need to file a flood insurance claim.

How To Reduce The Cost of Flood Insurance: Flood insurance rates for a home can be reduced by raising a home above the 100-year flood threshold in the area the home is located in or by taking approved flood proofing measures, such as sealing water pathways into a home. Taking such actions not only will reduce flood insurance rates, but will likely reduce the impact of any future flooding events.

Should you buy flood insurance?

© 2013 John Coviello