How to Let the Power of Compounding Help You Get Richer Day by Day

Many people have told me that they do not understand the concept of the power of compounding. Since it is such a key concept in understanding investments, it is an important term and concept to learn. I will attempt to explain it to you in a way that makes sense to me, and hopefully you can use it to become richer day by day, maybe even on your way to become a millionaire.

The easiest way to explain it is to use an example. Let's say that you put $1,000 in the bank ten years ago. To make the calculations easy, let's say it earns 5% every year. You earn $50, which is the principal of $1,000 times the interest rate of 5%. 1,000 x .05 = 50. Every year, you get a $50 check in the mail that you get to spend yourself. This is called simple interest, to distinguish it from compounded interest, which we will discuss later in this hub. If you kept the principal invested for ten years, you wound up earning $500 from your $1,000 investment. The formula is principal times interest rate times time. 1,000 x .05 x 10 = 500. That is a pretty nice amount of money to earn.

Investing $1,000 at 5%

Amount Invested

| Interest at 5%

| |

|---|---|---|

Year One

| $1,000

| $50

|

Year Two

| $1,000

| $50

|

Year Three

| $1,000

| $50

|

Year Four

| $1,000

| $50

|

Year Five

| $1,000

| $50

|

Year Six

| $1,000

| $50

|

Year Seven

| $1,000

| $50

|

Year Eight

| $1,000

| $50

|

Year Nine

| $1,000

| $50

|

Year Ten

| $1,000

| $50

|

Total

| $1,000

| $500

|

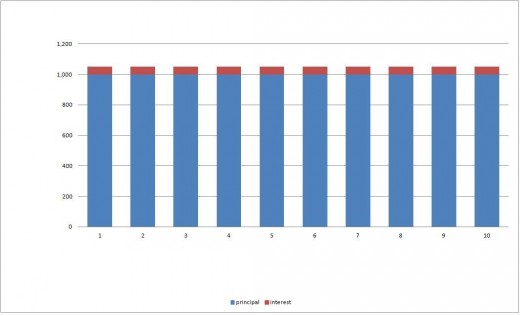

Here's what it looks like on a chart. You can see from the graphic that the numbers stay even throughout the ten year period.

Simple Interest, $1,000 invested at 5% for Ten Years

The Power of Compounding

There is a way to earn even more money by letting the power of compounding work for you. It simply means that you leave the interest in the account. You then begin to earn interest on your interest, making your money grow much faster.

Let's take the example above, with $1,000 invested at 5% interest. Now, instead of taking out the $50 each year and spending it, you keep it in the account and let it earn more interest. The interest is rolled into principal, so in the second year, you are earning interest on the bigger amount of $1,050, so the amount you earn is $52.50. Each year, you earn more and more interest, because your principal continues to grow.

Amount Invested

| Interest at 5%

| |

|---|---|---|

Year One

| $1,000.00

| $50.00

|

Year Two

| $1050.00

| $52.50

|

Year Three

| $1,102.50

| $55.13

|

Year Four

| $1,157.63

| $57.88

|

Year Five

| $1,215.51

| $60.78

|

Year Six

| $1,276.29

| $63.81

|

Year Seven

| $1,340.10

| $67.01

|

Year Eight

| $1,407.11

| $70.36

|

Year Nine

| $1,477.47

| $73.87

|

Year Ten

| $1,551.36

| $77.57

|

Total

| $628.91

|

Now, with compounded interest, instead of having earned $500 on the initial investment of $1,000, you have earned $628.91. That is an even nicer amount of money to earn.

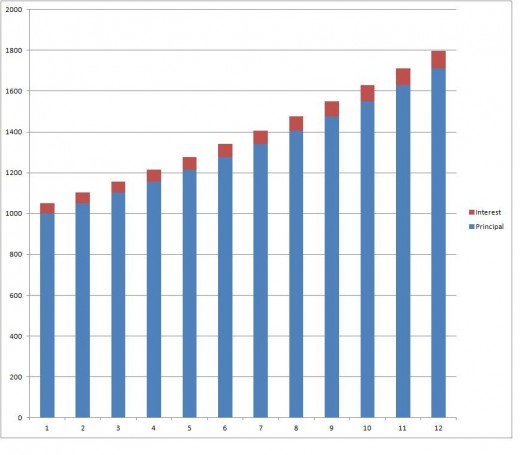

Here is what it looks like on the chart. The first year looks the same, but in each additional year, notice that the principal is growing, as the interest is deposited back in the account. The interest is also growing, as it is accruing on a bigger principal amount each year. Notice that the scale on this graphic has changed slightly from the previous graphic to accommodate the bigger numbers.

Compounded Interest, $1,000 invested at 5% for Ten Years

How to Use the Power of Compounding to Become Richer Day by Day

That's it, compounding is just a fancy way of saying you are earning interest on your interest.

In order to make compounding work for you, you simply put your money into your savings account as early as possible. The longer you keep the money in the account, the bigger your savings grows. This is why you should start saving when you are young, and teach your children how to save young. The earlier you start the better. Start today.

Once you make your deposit, you don't have to do anything, except choose your investment and open your statements to make sure everything is going as it should. Your money grows and you become richer day by day without your having to do anything else.

To make the power of compounding work for you, you try to increase each of the numbers on the equation. Remember the equation, principal x interest rate x time. For example, you can invest in something that earns you a higher interest rate. Okay, probably not in this economy, but eventually you will be able to find investments that earn more. Just be careful not to put your money in investments that are too risky, because you could wind up losing your principal.

You can increase the amount of time you keep your investment to more than ten years. The longer the money stays invested, the more your money continues to grow exponentially.

To make it grow even bigger, you can and should continue to add to the account regularly. Since principal is the biggest number, it is the one that has the greatest influence on the equation. Principal is also the part of the equation over which you have the most control. There are so many years in your life, and you have to choose your interest rate from your available options, but you can find additional principal in so many different ways. Even if you don't have the money all at once, if you invest another $1,000 each year to your account, it will grow even bigger. As your income increases, you can add more than $1,000. The bigger the amount of your deposits, especially at the beginning of the investment period, the bigger the total amount of earnings.

Compounding and Loans

The same concept works for loans as well as it does for investments. By borrowing less money, finding a lower interest rate, and by shortening the loan period, you will pay less interest. The earlier you pay additional principal on your loan, the less interest you will pay overall throughout the entire term of the loan.

I like to create a spreadsheet showing the amortization of a loan. Then, when I make additional principal payments, I can see how much I am saving overall on my loan. It is very motivating to see that my extra $100 payment is saving me more than $100 overall on my loan.

The power of compounding may seem to be a hard concept to grasp, but it is a very powerful method of becoming richer and richer each day. By investing as much money as you can, at a high interest rate, as early as you can for a long period of time, you can earn more interest. You earn interest on your interest, making the amount of your deposit work harder for you.