How to Get Out of Debt by Debt Stacking

This is the Goal

Do you know what debt stacking is?

If not, and you have debts, you need to carefully read this article.

With so many people caught up in the vicious cycle of credit card debt, I thought I would share with you the absolute best way to get yourself out of debt, years before you ever thought you could. You will not need to get another loan. You will not need to fork over huge amounts of extra cash to get them paid off early. Debt stacking is the easiest and fastest way to pay off your bills and become debt free. Take a close look at the solution spelled out here and you will be amazed at how well this solution works. Follow the steps and mold them to your individual bills and start getting debt free today.

Debt stacking or snowballing as Dave Ramsey calls it, is a means of paying your bills with real determination. Also called debt elimination, this plan will get you totally out of debt years before you ever dreamed possible.

Plans similar to this are available from almost any financial adviser and could cost you as much as $1,500 to set up. However, if you follow the step by step guideline, you can avoid paying those high fees and do this on your own.

After seeing this plan work for neighbors, friends had their own debt stacking plan drawn up and they offered me the details of their plan to show you how to make the steps needed to set up your own plan. To protect their name and credit details, I have changed their names and the names of their creditors but the dollar amounts and interest rates are exactly as they listed. These are real figures showing real solutions.

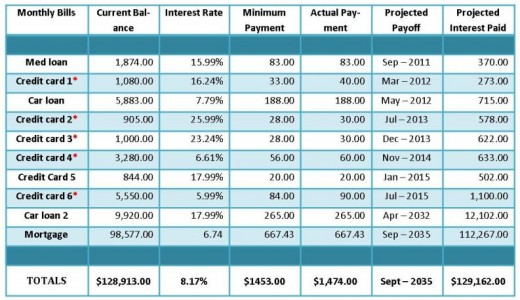

Bob and Mary have debt

Bob and Mary Wilson have a mortgage, 2 car loans, a medical loan and 6 revolving credit cards. The total of their debt equals $128,913.00. They do not make a lot of money and based on their income, their debt-to-Income ratio is 41%. This means that for every $100 dollars they make $41.00 goes to paying off debt alone. That is quite high. They would not qualify for much more credit even before the economic downturn. That percentage is almost half their income and they were eager to find a solution that would work for them. Debt stacking offered them a productive and simple way to help them achieve their dream of being debt free.

The current balance is what they still owe on their bills = $128,913.00.

The average rate of all of their interest rates combined = 8.17%.

The minimum payment on their bills = $1,453.00 a month.

The amount that they paid every month = $1,474.00, * shows the accounts they paid extra.

The date that they will get those debts paid off = September 2035.

The amount in interest alone that they will have paid = $129,162.00.

The total amount paid in principal and interest is $258,075.00.

A few things to notice

Notice the amount of interest paid on the 2nd car loan and mortgage are more than the original cost. Just to show you this in detail, if only the minimum payment is made on their 2nd car loan, this 10k loan will cost them 22k over the length of the load, thereby giving the lender over 12k in interest fees. Far too often, we the consumer, overlook this and end up just giving our money away.

Assuming that Bob & Mary stop using their credit cards, these figures are accurate and they will be in debt until the year 2035. This includes the 30 year mortgage they refinanced on their house in 2005.

As a side note here, the amount of interest that they will end up paying on this house will cost more than the house did. The home loan was for $103,000.00 and the interest is $112,267.00. This means they will have paid the mortgage company a total of $215,267.00 by the time the house is fully paid for.

Now what I am about to show you is no real secret but it isn’t common knowledge. Credit card companies and mortgage companies would rather you take all the time you possible can to pay off your debts. It means a whole lot more money to them, as you are about to see.

Bob & Mary did not have a lot of extra money to put into paying bills with. If you’ll notice from the above graph that they paid a few of their credit cards a couple of dollars more than the monthly minimum, about $21.00 more, marked by the red * in the above graph. Their minimum payments total $1,453.00 and they paid $1,474.00.

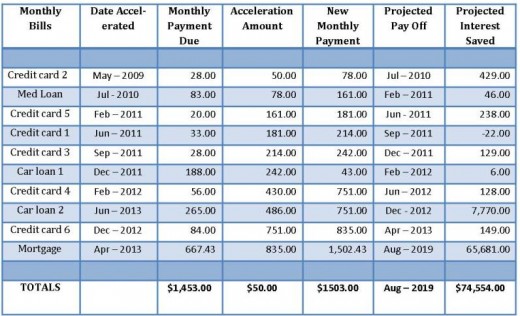

They agreed to contribute an additional $29.00 more each month to their bills, for a total of $50.00. They would now pay out $1,503.00 every month on their debt. But watch how just that little bit helps.

Let's go through this

Here is exactly how it works. You may have to refer back to the examples to follow along. Starting in May of 2009, Bob and Mary paid the minimum balance due on every one of their bills except credit card #2, the first item listed on the 2nd graph. To pay credit card #2, they added the $50.00* to the $28.00 dollar payment for a total payment of $78.00. They paid this $78.00 every month until July 2010, when the bill was paid in full.

*(The $50.00 is the $21.00 more that they paid previously and the extra $29.00 a month that they agreed to add.)

In July 2010, they took that $78.00 and added it to the medical loan payment. This made the $83.00 medical loan payment $161.00 dollars every month and by increasing the size of the payment, the medical bill was paid off the following February. Then they took the $161.00 and added it to the credit card #5 for a total payment of $181.00, which paid off this card in only 4 more months.

Now remember, only $29.00 extra a month is coming from Bob and Mary, and they are still only making the minimum payment on all of the rest of the bills.

So, in June of 2011, since credit card #5 is now paid off, they will take that $181.00 and add it to the payment of credit card #1 for a total payment of $214.00. This will get credit card #1 paid off by September of the same year. Next, they add the $214.00 to the $28.00 payment and make $242.00 payments to credit card #3 and within another 3 months, that bill is paid too. The $242.00 gets added to the car loan #1 for a total payment of $430.00. The car is paid off by the following February.

Follow the plan and become debt free

If Bob and Mary continue to follow this payment plan, they will have both car loans and all of the credit cards completely paid off in just 4 years. Remember, they started this in May 2009 and by April 2013, the only debt they have will be their mortgage.

They will be completely out of debt by August 2019, including their 30 year mortgage, in just 10 years from the time they started, simply by adding $29.00 to their monthly payment and using the method described above. Taking the payment from the paid off bill and adding it to the next bill on their list, Bob and Mary will save over $74,000.00.

This is incredible.

A good financial adviser would then advise you to continue putting the $1,503.00 away each month in a mutual fund or IRA. Within just 20 years, you could have a hefty nest egg to supplement your retirement income. This plan will work for everyone. It will take dedication and determination to see it through but the rewards are tremendous. Even if you do not have the extra $50.00 to start, just pay off one of your smaller bills as quickly as you can. Take that payment amount and add it the next bill on your list and you are on your way.

A proposed debt elimination solution is a guide to help eliminate your debt. The results of your plan will depend solely upon your commitment and adherence to the proposed optimization payment schedule. If you continue to use credit, your debt elimination solution will not work. Changing your spending habits is essential. You are only answerable to yourself. No one will knock at your door if you mess up. Just get back on your debt stacking plan as soon as you can.

There may come a time when you need to use credit for an emergency and let’s face it, stuff happens, just keep your eye on the bottom line and commit to your plan to become debt free. There is no one to stop you from veering off your debt stacking program. It is just your determination to be debt free that will make this debt solution plan work. If you fall off the plan? Start it up again as quickly as you can. The plan will work for you just like it is working for Bob and Mary.

Eliminate your Debt

For Bob and Mary’s debt stacking proposal, a computer calculated interest rates and payment amounts to arrive at the best possible solution to paying off their debt with the greatest amount of interest saved. That is the benefit you get from having a debt stacking proposal done for you.

But you can do this yourself, start with a small debt and add those that can get paid off quickly. The sooner your payment grows the better. If you want a debt program to use, you can download free software to help you on the internet. There are no guaranteed results. It is only your determination to becoming debt free that will make this solution work for you.

Live Debt Free