How To Trade Options On Scottrade

Trading Is Easy On Scottrade

Trading options on Scottrade is easy, almost too easy. Scottrade has full access to the North American options markets and allow qualified traders the same. As with any form of investment, trading options with Scottrade is risky and not suitable for all investors, any trading decisions should be based on qualified advice and sound practices, not because it is easy. Now that is said, let's take a look at how easy it is to trade options on Scottrade.

Requirements For Trading Options On Scottrade

There are a few requirements for trading options on Scottrade.

- You must open an account. This is a simple process and can be completed online.

- Next you must fund your account. Scottrade requires a minimum deposit of $500 for each new account.

- Wait for cash to settle and account activation.

- Begin Trading.

- Pay commissions.

Technical Analysis

Suggestions For Trading Options On Scottrade.

I also have a few suggestions for trading options on Scottrade. Following these simple steps will greatly enhance your trading experience.

- Learn about the stock market. Learn about its history and how it works. There are some great books on the subject, one that I recommend is "Remeniscences of a Stock Market Operator", this is the self written biography of one of America's greatest traders, Jesse Livermore. It is useful to know about the different exchanges, types of markets and market makers.

- Learn how corporations work and the business cycle. It is helpful to understand about the board of directors, the CEO, earnings, margins, valuation and other fundamental drivers of stock price. Even so-called purely technical traders use some form of fundamental analysis in their trade systems.

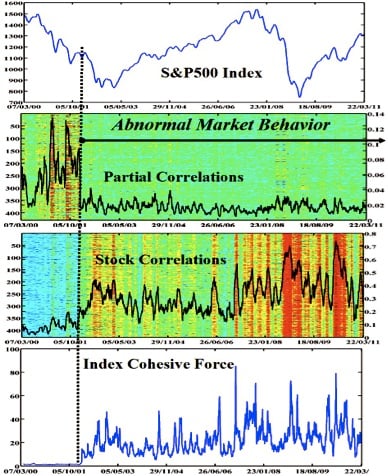

- Learn how to use technical analysis. Technical analysis is one of keys to developing a strategy, picking entry and exit points. Trend, support and resistance, momentum and volatility all affect stock value and options prices.

- Learn about options and options strategy. Since options are what we are trading it is very important to understand options and how they work. You must be able to read the option chain, know the difference between calls, puts and strike prices and have at least a basic understanding of the options greeks. Delta, theta, vega and gamma are your friends.

- Choose a small portfolio of stocks to actively watch, create a watchlist. Keep a journal and learn what it is that makes them move. I recommend 2-5 stocks to begin with and then add more as your experience grows.

- Develop a system. Learn to apply basic options strategy to the stocks in your watchlist and practice them until it is second nature. Keep records of trades and why you made them in order to adjust your system for better success. Systems help remove the psychological factor from your trading. Any reasonably successful trader will tell you they follow a system.

The Pattern Day Trader Rule

Trading options is done on a very short term basis and carries increased risk. The Pattern Day Trader rule is a regulation enacted by the SEC following the Tech Bubble of the late 1990s. Short term and risky traders had leveraged their accounts so much that when the bubble burst many traders and brokerages were wiped out. The damage from the risky trading and subsequent investment bubble was so widespread it is still talked about today.

The PTD rule was adopted as a way to prevent the same type of over-leveraging from happening again. It requires accounts engaged in high risk, leveraged trading to maintain a margin account to cover the added credit risk of day trading options. Even if you do not plan on day trading you should still know how the PDT rule works because using automated buy orders and stop-losses it is possible to trigger the PDT rule without intending to.

- PDT Rule: Any trader/account that buys and then sells the same security in the same day, 3 or more times in one consecutive 5 trading days, is a Pattern Day Trader. Pattern Day Traders are required to maintain a margin account with a minimum balance of $25,000.

- Once flagged as a PDT it is very hard to get the label removed. Usually traders are given one free-pass when they violate the rule. This can result in frozen or suspended accounts and loss of access to trading markets.

- There are other requirements for Pattern Day Traders, the margin account is just one of them.

- A day trade is any trade that is opened and closed on the same day. This includes buy and then sell or sell short and buy to cover. Trades executed in pre-market, regular hours and after market hours all count. Day trades on Friday and Day trades on Monday are considered to be consecutive.

- Day to day trades are not counted. This means that a trade opened one day, even in after hours trading, and then closed on the next day, even if it is in pre-market trading, do not count.