How will we live when the money economy collapses?

A world that works for everyone.

Is financial collapse likely?

I would say that there is absolutely no question that it will happen, with predictions by very credible sources that it is only a matter of months ahead. It is simply not possible to continue just to print trillions of dollars worth of worthless currency. Like a dog chasing its tail and never catching it, the pirhouette goes round faster and faster until the dog (or humanity in this case) falls over dizzy and confused.

Karen Hudes on dollar collapse

Why haven't we heard about it?

The plain fact is that the same people who own the central banks also own all the major media channels, so it is not in their interest to expose this truth even though it is becoming more and more obvious. No company will make a fanfare announcement about their forthcoming bankruptcy, especially banks whose prime focus is confidence in the existing system. Confidence is essential for them because their ‘product’ is a fiction with no value other than the paper and a ‘promise to pay’. What happens when the population loses confidence? There will be a run on the bank and people will rush to withdraw their cash. Why is this bad for them? Because there is simply not enough money in the banks to pay back everyone who asks. There is now less than 10% cash in the system, the rest being figures on the mainframes.

In the course of daily life and as appropriate I will ask people I meet if they have ever thought that financial collapse might be a feature on the event horizon, and I get blank stares. They simply have never found out, or if the idea did casually cross the TV screen of their minds, they are likely to be too scared of what they might lose to admit the possibility. Occasionally one will get answers like “I am expecting a turnaround” or they will quote some bullshit statistic ‘proving' that everything is getting better.

Creative solutions

Community Exchange Systems

Community Exchange Systems have been attempted for many years, but in the pre-internet era they got bogged down in too much administrative paperwork. Not only that but previously members could only exchange with each other (barter), provided of course that each party wanted what the other had, (my potatoes for your eggs for example). The internet has changed all that, making it simple to keep track and manage everything. The system I have given a link to below is actually a mutual credit system with absolute transparency built in. The system is always in balance so that members in debit will always balance perfectly with members in credit.

I will give you an example of one series of trades that I was involved in in the early days of this exchange. I wanted my house painted so I placed a Want on the system and got a response from an unemployed man. I supplied the paint and equipment and he and another supplied the labor. It took them a week, and when they were finished I had a freshly painted house and he had a lot of credit in his account. Now he wanted to know what he could buy. I had a friend with a working, but older model computer plus modem, so I suggested that he could buy it. First it had to go to another IT guy on the system to check that it was in good order, but at the end of the following week he had a computer in his home in the township. His next move was to open an internet café for his neighborhood, the first in the area at that time.

The Talent Exchange did get a visit from the tax man, but he went away rather disappointed and not able to include us in his tax net. Don’t know about you but I am certainly NOT in favor of paying taxes unless I absolutely have to.

The Talent Exchange as it became known, went on to achieve great success by helping hundreds of skilled but unemployed people to lift themselves out of poverty. These days there are more than 2000 members and millions of dollars traded. There are branches all around the world and the Australian government just signed up to keep track of their 600 000 volunteers around the country.

i-Opeen

A group called Cyclos has developed an open source banking system which enables anyone to start their own bank. One of these is called i-Opeen founded by Angel Lucci. Anyone can issue a currency, but it is a question of credibility as a means of exchange as to whether it is successful or not. Forms of ‘currency’ have been issued for some years in the form of Book Tokens which can be spent at any book shop or gift tokens that can be spent at a particular chain store. In recent years the banks have been issuing their own form of what I would call reward currency which can be spent at major online stores.

It is now also possible to transfer airtime (cell phone credit) to someone to whom you owe money as a form of payment.

An interesting feature of i-opeen is that members get credited with 100 IONS (their unit of currency) daily from the day they sign up. At the moment I have just over 19 000 units which seems to be equivalent to $9500.00. Quite a lot of money to spend! There is also a section where one can advertise services or goods or post wants.

“Where does this money come from?” I hear you ask. As far as I understand it is legally gleaned from your collateral account, essentially your value as a human being.

Interesting also that one can exchange IONS between other currencies. One individual has posted an offer to exchange Bitcoins for IONS.

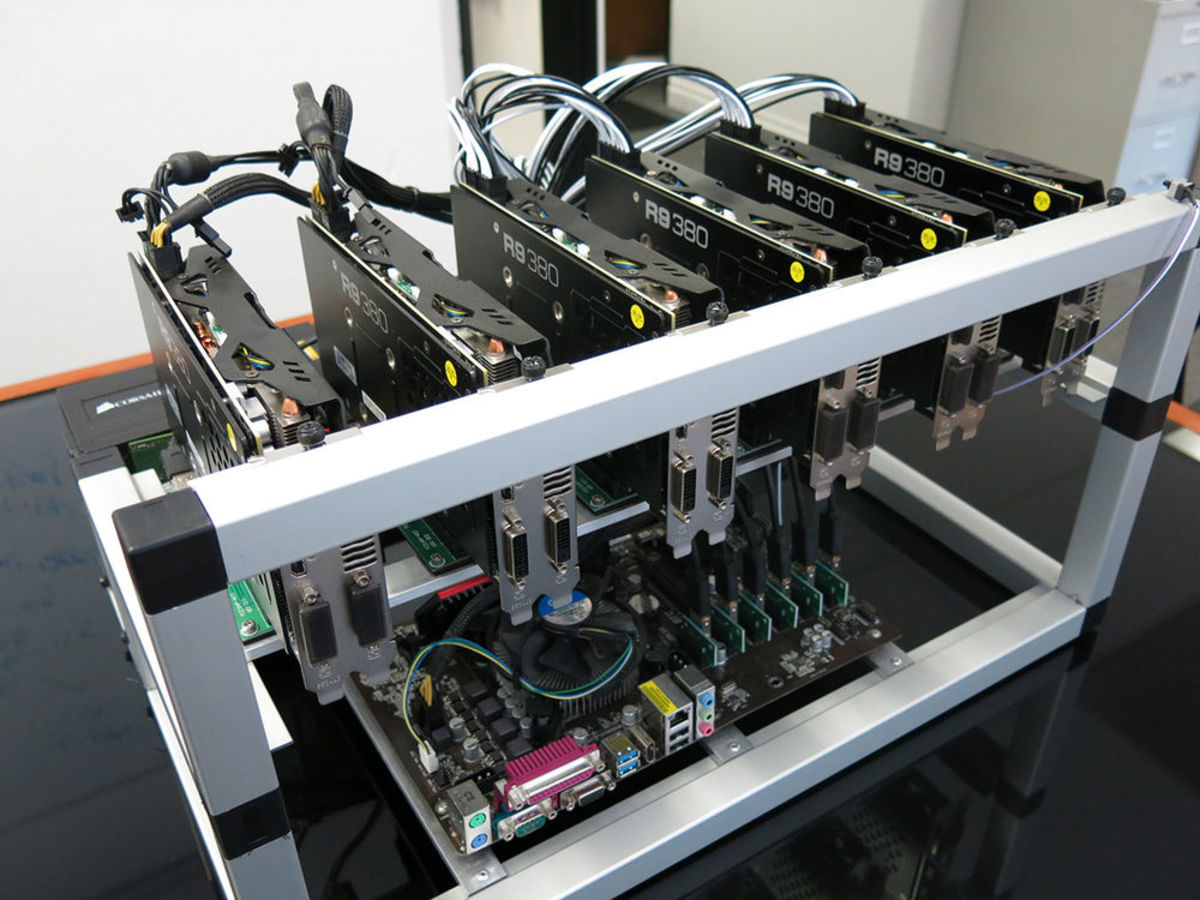

Bitcoin

Bitcoin is an online virtual currency that was started in Japan four years ago in somewhat mysterious circumstances. The creator has kept a low profile, but was always assumed to be one distinct individual. Now this individual has come forward to deny his involvement. Maybe it was a namesake! Nevertheless Bitcoin is now headed up by Alex Joyner with even a face to put to the name.

You do not need to give your real name when buying, a pseudonym will do. The currency is held in an eWallet by a service provider and if you do a trade with another user then you will be able to see his eWallet number but not his name.

Bitcoin exchanges are not banks in that they do not invest the money and also do not charge a transaction fee. Smaller traders like Pizza joints like it because there are zero fees. Big players in the underground economy also like the anonymity and that fact that money can be moved around the world easily and without costs.

At any rate a limited amount of currency was issued to begin with so as to maintain the value. This has worked because Bitcoins value started out at around $1.28 each and are now valued at $555.00 each. It has become increasingly popular, but of course governments don’t like it because they do not have control and they are unable to collect tax. Some Bitcoin ATM’s have recently been launched in Canada.

Interest free financial exchange outside the banking system

My wife and I have recently heard rumors about a new form of debit cardthat works person to person without the services of a bank. It will be usury free and all it will cost to send money to someone in another country is the small ATM fee of about $1.00. It will apparently be supported by MasterCard and Visa (who are not banks). The ATMs are also not owned by the banks (they pay a fee to brand them). This is significant in that the ATMs will continue to work even after a bank collapse.

Being interest free (none charged or earned) will make a huge difference because it is the charging of interest that has led to our financial ruin. The banks create the debt out of thin air, but not the interest they charge, and that in the end leads to inflation and ordinary people having to work several jobs just to keep themselves financially afloat and continue to pay the interest demanded.

It will also apparently not be necessary for an applicant to have a bank account or even a corporate owned identity. There are millions of people like this around the world who are unbanked simply because they do not have enough income for the banks to be able to charge their exorbitant fees. I quote below some wise words by Prof. Andrew Skadberg.

"(This is) a way for individuals to manage their money without a bank as a middleman. This eliminates many of the concerns associated with the deleterious influences of the fractionalized banking system that is behind many of the ills and problems of the world.

"Handling your money without extraneous and exorbitant fees and charges and possible misuse of those monies should be more than enough reasons to join.

"(The) vision is to free humanity from a global financial system that has left millions, or billions of people living in poverty and destitution. We are ending this chapter of the human experience and creating an economy based on abundance, sharing and giving. We are erasing the idea of debt and scarcity and ushering in an era of free exchange and support to encourage people’s creativity and spiritual advancement."