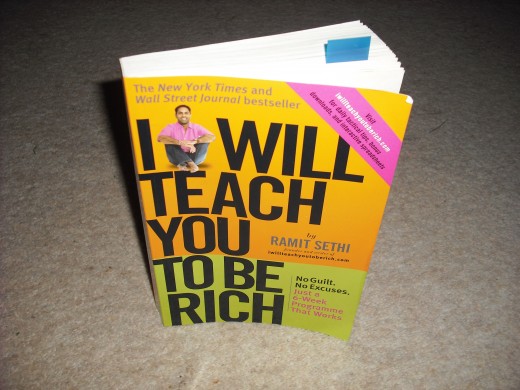

I Will Teach You To Be Rich - Ramit Sethi. Will he really?

I Will Teach You To Be Rich, a pretty ballsy title for a book isn't it? On the other hand the title did help me buy the book. After a flick through I could see this book was well worth a read. When I buy books on wealth, money, investment, the book has to pay for itself for me to be happy, this book has definitely done that. It isn't the greatest book however and the first few pages nearly made me put the book down never to pick it up again. I have the adapted edition for the UK reader and at the very start the book repeats itself which takes up a good handful of the pages. I don't know if it has anything to do with it being a adapted version. The author doesn't do the best to try and connect with the reader at the start. I started to think this New York Time best seller was going to be an egotistical rant and all theory. As I said before though the money books I buy have to pay for themselves so I gave this book a chance and hoped that I'd get my money back. As I continued to read I started to see that I will teach you to be rich is very different to other money books I've read so far, it doesn't have the mindset approach, or the affirmation approach or even theories ( Although I think it will help massively if you've read these types of wealth books like Think and grow rich and Paul McKenna's I can make you rich both powerful books). It contained solid facts on how to build your wealth the real way, nothing glamorous just solid advice on what you should be doing, now. At last I started to enjoy the book.

As with all money books, the sooner you read them the better the results will be. This book is suited to the 20 - 30 age group but I'd say this book would make a great 18th birthday present. This is not to say if you in your 40's + you wouldn't benefit from this book, anything you do now to help your financial nest egg for the future is better than doing nothing. I think aswell with this book its good to have a little life experience behind you, because this is about being serious with your money and using money and credit to work for you rather than against you. If you're in debt right now then the price of this book will help you reduce you debt and save you potentially thousands if you follow the advice. The greatest thing about this book is that it has a 6 weeks plan to follow, this plan is to start your financial future whether your aim is to save for your retirement or to get seriously rich, this plan puts the wheels in motion and it is down to you how much you step on the accelerator. If you've lived pay check to pay check then by taking the step to setting up a savings account as Ramit suggests in couple of months you'll a little bit of security behind you and your mindset will start to change towards money.

My favourite chapter in this book is the use of credit cards. I've never had one, or intended to get one. Im strongly apposed to debt and credit but this chapter changed my perception a little bit. I understand that we are credit scored and have a credit rating and these are 2 separate things but I've only ever thought of them guides for lenders, to assess if we are eligible for credit. I overlooked the fact that our credit scores/rating can help us get credit at a lower percentage rate! It was a hand to the forehead moment and a light bulb went off. I now realised the importance of credit. As I am strongly apposed to credit, Ramit's advice really struck a chord and that was to use credit cards to help with obtaining a excellent credit history and score. The reason why I liked this Idea so much is because you can have credit on a credit card in very small amounts rather than taking a loan which is usually in the thousands. I've had one and they're a burden. The other reason why I loved this approach so much is because the only loan I plan on having in the not too distant future is that of a mortgage and can you imagine the difference on what you pay back on a 25 - 30 year term if you get the loan at lower percentage rate by even 2%. That advice is saving me thousands and was the point in the book it paid for itself ( many times over as you can see ). Obviously if you use a credit card in the wrong way and use it to buy you things you can't afford to pay in cash at that moment, then you're heading for trouble. Remember this method works if you pay the card balance in full at the end of the month, if you only pay the minimum payment on the card you'll get the interest charges slapped on top and you aren't saving anything.

This was chapter was the clincher for me, this isn't to say that it's what the book is about and what I have taken from it is a small part of what is discussed about credit cards. As I said before the book has a six week plan from it's 9 Chapters.

- Optimizes Your credit cards

- Beat The Banks

- Get Ready To Invest

- Concious Spending

- Save While Sleeping

- The Myth Of Financial Expertise

- Investing Isn't Only For Rich People

- Easy Maintenance

- A Rich Life

As you can see, I got the greatest gain from this book from a very small part of it and just goes to show all the other places you will find bits of gold in this book just like I did but I can't give them all away. There are great diagrams to help understand the jargon and Sub text that hits home the facts. Although the Chapter titles dont give too much away but I can say this books cover a lot of areas of personal finance, the bits that you may not be taking much notice of on your journey to be getting rich. Savings, investments, interest rates, credit cards, loans, money management, planning, retirement, pensions, assets, investing and more. So you can see this is going to cover something you don't know or teach just that bit more on what you may already know on each of these topics. Remember each topic is discussed to get the most out of them rather than for general knowledge.

- Napoleon Hill's Think And Grow Rich A Must Read

If you are reading this then you are already aware of how popular this book is, It is often referred to as the personal development, self help, spiritual book written today. Think and Grow Rich by Napoleon Hill is a blessing for all of us that have.. - Dale Carnegie How To Win Friends And Influence Peopl...

If you haven't bought this book yet, Buy it, Now ! Stop reading, get it!!! I can not rate this book highly enough. If you are stuck in a rut and know things need to change, this book is where you start. It is not about manipulation or obtaining fake.

So will this book make you rich? There is no such thing as getting rich quick and the quicker you realise that the quicker you will become rich! This book is aimed at people who really want to take control of their finances. I would say if you have some debt then this book will help you reduce that or put the fire in your belly to get rid of it and start having the banks pay you for the privildge of having your hard earned money and also start making your money work for you. True riches take time and following Ramits 6 week plan will put you in considerably better position come your retirement if you put it in to practise today Ramits plan. Take this plan seriously and you could be generating an extra income with your money and retiring early! Ramit has given you a well oiled machine to get the money churning out. Combine this with your desire to learn how to make more money whether it be learning more on investing, learning a skill to give you a second income or learning about real estate the returns from the machine will be far greater. I Will Teach You To Be Rich is a must have.