In Your Own Best Interest

From one debtor to another, live and learn.

Plugging the leaks is preferable to continuously bailing.

Solutions exist for many property owners and others who have debts that are draining their finances.

What follows is from my own personal experience, and if learning from my experience helps you, I'm glad.

I have just completed a drastic overhaul of my finances. In the process I lowered the interest rate on my interest payments to 4.375% while eliminating all my credit card debt.

It is foolish to be a slave to what I will call MVD, using the initials of some of the major players in plastic card lending.

For all the convenience MVD offers consumers, their interest rates can be what is actually consuming!

In the process of working on authoring five books, I had resorted to being one of MVD's major consumers, and the debts piling up had interest rates ranging from a low of 4.49% to a high of 24.99%. That high rate (and even some lower ones) is my definition of the biblical term "usury".

I once asked former Utah Governor Michael Leavitt why a very religious state like his allowed interest rates on credit cards to be clearly usurious. He replied that he believed in giving Utahns "the maximum number of choices" for their financial needs.

I suggested to him that, if Utah set reasonable upper limits on what interest rates the credit card companies could charge on cards issued in Utah, credit card users would flock to have a credit card provided by Utah banks; and, Utah would be doing all such users a favor by better protecting credit card users from the extreme fees and rates the MVDs of the world were getting rich from (often to poorly educated consumers who had no idea what they were getting into).

While I still believe that permitting usury in modern times is as repulsive as it was in biblical times, the fact remains that credit card users are left responsible for the consequences of their own choices, just as I was.

When my own financial boat was sinking, I looked to see what I could do to plug the leaks (other than publishing my books so I could simply keep paying off the credit cards over time).

I consulted a bankruptcy attorney and examined the different types of bankruptcies. After going over my debts and finances, he suggested getting the popular Reverse Mortgage.

After looking at the up front charges and the possible end results of taking out a Reverse Mortgage (besides noting that each time I queried the possible lender about the closing costs the costs seemed to edge upward!), I chose to simply refinance the mortgage on my home.

I found that by doing so the closing costs were lower than those of a Reverse Mortgage, the interest rate was slightly better, and that by doing so I could not only drop the existing rate I was paying on the mortgage, but best of all I could also eliminate all my credit card debts to MVD!

I estimate that doing so is now saving me approximately $3,100.00 per year, while at the same time eliminating the hazards MVD thrives on which come from any possible late payments and their accompanying rate increases.

Yes, my mortgage payments are only some $180 less per month by replacing a mortgage that was due to have a balloon payment in 2019, with a 30 year term on a larger mortgage, but look at the math. When would I have ever been able to pay off MVD at their usurious interest rates, fees, and possible penalties? By contrast, I can now meet all my living expenses and the new mortgage, even If (perish the thought) no one of my book manuscripts sells.

If you are looking at a similar topsy turvy world caused in part by MVD and their peers, take a serious look at where you might have any assets you can tap before they do. Bankruptcy is more difficult than in past years, but it is one alternative for gaining a fresh start. A Reverse Mortgage is another alternative with its own needs for caution.

My own choice was to tap the improved equity in my home. It might be a choice you and others can evaluate, along with looking at other assets.

The best solution for everyone? Don't let MVD and their peers start creating leaks in your financial boat. Never take on more monthly debt than you can handle easily at the end of each month, and never make routine or major purchases using a credit card when a little patience, and an effort to save for such expenses, can permit paying cash.

AND, best of all you will eliminate the stress of being 12 years (or more) a slave to MVD.

__________

© 2014 Demas W. Jasper All rights reserved.

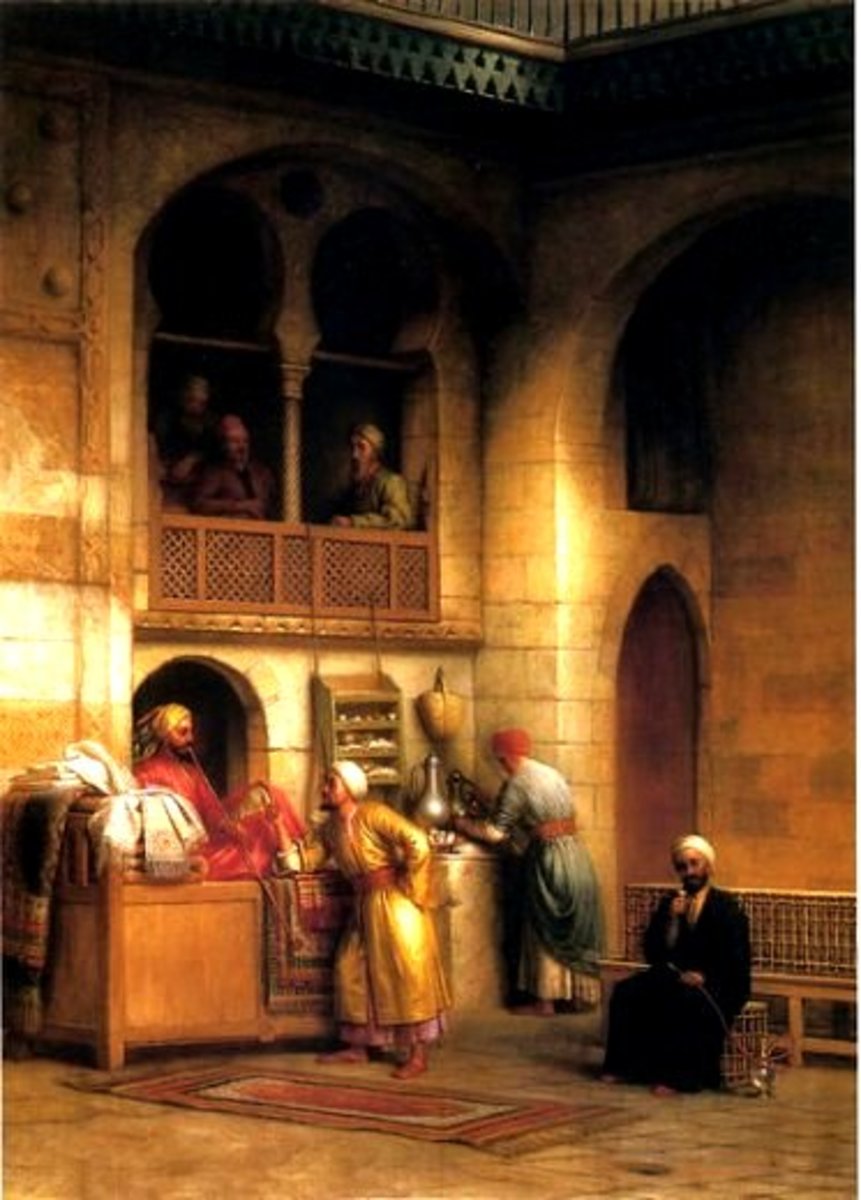

There just might be a pot of gold in your own property or assets.