Household Investment Technique I: The Personal Pyramid I Plan

PLANNING: A MUST for Successful Investing

YOU NEED A PLAN! YOU NEED A PLAN!. And I say again. you need a plan and you need to stick to it. I bet you have seen that a million times if you have been hubbing through sites that talk about successful investing. This hub is no different, I will be presenting and discussing a simple, conservative plan for saving and investing your money. Be forwarned, you won't find recommendations for specific stocks, bonds, funds or any other kind of investment but you will find a recommendation on a method of distributing and managing your investments between them. (Please see my profile for a disclosure on why I think I can talk about this.)

BUY ME, I AM IMPORTANT AND EASY TO READ

FIRST and FOREMOST - SAVE 6 MONTHS OF GROSS PAY

BEFORE YOU EVEN START THINKING ABOUT BUYING stocks, bonds, options, land or any other investment instrument is save, in liquid1 accounts, at least six months worth of gross2 monthly family income. That is a minimum! If you are a family with only one income earner or if you have two earners but if one or both jobs are not all that secure, extend that up to 12 months. I know that is a tough nut to swallow but an uncountable number of families ended going bankrupt because they didn't follow this simple advise, even though it might hurt.

This is key! When you invest your money in stocks, bonds or other financial instruments you are taking a risk of losing what you have invested. If that happened right after you lost your job (which may be connected), you have a problem. So, do yourself a favor, and create a solid foundation on which to safely build your investment. I will give you examples in a bit.

1. Liquid means your ability to get to your money quickly, that means checking, savings, and money market accounts and 3-month or less certificates of deposit.

2. Gross means before taxes or other deductions are taken out of your pay

BOOKS YOU NEED TO READ!

THE INVESTMENT PYRAMID

NOW WE CAN GET TO THE PLAN. This plan is based on a technique presented by a professional financial planner to a comptroller class I attended back in 1985. It impressed me then and I used it in my early life. In my retirement years, it doesn't really apply, but it has nevertheless stuck with me. I wish I could give attribution to the financial planner who presented it but I no longer remember his name.

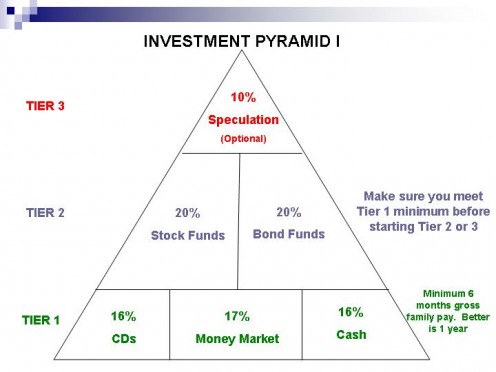

The plan is simple: Divide your total portfolio3 according to the percentages in the figure below. The point of the plan is to keep, over time, those percentages relatively constant.

This will take maintenance on your part because, obviously, things will change. You will put money into and take money out of your portfolio. You will earn dividends and interest plus your investments will appreciate or depreciate in value. Therefore, your percentages will change and you will, periodically, need to re-balance your pyramid back to the original percentages. You will see how in a bit.

3. Portfolio is the sum total of your major assets not counting your home, car, furnishings and other things you would normally consider personal assets. Assets included in your portfolio would be such things as, but not limited to, stocks, bonds, cash, CDs, land, rental homes, art, retirement, etc.

Investment Pyramid I

SOME RULES FOR FUNDING YOUR PORTFOLIO

THERE are a few rules you should follow in funding your portfolio, especially if you are first starting out and you don't have much in your portfolio.

- Make sure you completely fund the bottom tier, Tier 1, first. I can't emphasize that enough.

- Make sure that the first six months of your reserves are in cash, savings, money markets, and CDs of 6 months or less. The reason for this is your money needs to be easily and quickly accessible when an emergency happens. Once you are assured of this then you can look at longer-term CDs or similar instruments that pay higher interest rates.

- Once you have your foundation set, you can start working on Tier 2. Invest in Stock and Bond Funds, not individual stocks or bonds. The reason for this is that funds spread out your risk over many different stocks and/or bonds so that a failure in one or two won't wipe you out.

- Make sure you invest evenly, in terms of dollars, between stock funds and bond funds.

- Only after you are well on your way to getting to your 40% of your portfolio invested in stock and bond funds, can you consider speculation, Tier 3..

- There is no requirement that you need to invest in speculative investments at all.

- Speculative investments cover a wide range of investments from individual stocks and bonds to options to land to rental property to hedge funds.

NY Times #1 Best Selling Book. Also See Clark on CNN HLN (I have personally saved more than the purchase price using his tips.)

LET'S LOOK AT AN EXAMPLE

OK, those are the basics. I believe the best way of learning how to use this tool is by example, so here we go. Assume we are starting with the following:

- Two earner family with stable jobs that gross a total of $50,000 annually

- You are buying your house, which is worth $150,000, and your car, which is worth new, $20,000.

- You both have just signed up for your companies SIMPLE 2% IRA program and you decide to contribute 10% of your gross each while your company will contribute 2%.

- You also decided to save an additional 10% on your own because you know how important it is to save now while you are young so you can go cruising when you are 60.

- You have $20,000 in a no interest checking account and you are able to pay your bills, including your retirement and savings, without reducing that amount.

- It is January 1.

A few days ago you read this hub and you are going to try to apply it. So, the first three things you need to do is figure out 1) how many months of emergency savings do you need, 2) how big is your portfolio right now, and 3) how much money are you able to save each month?

- Since you are a two earner family with stable jobs, you should keep in reserve a minimum of 6 months of gross income. In your case that would be $25,000.

- Your current portfolio is $20,000, the amount you have in your checking account. Remember, the house you live in and your personal car do not count.

- This is actually a two-part answer.

- The first answer is that you said you will save 10% of your gross monthly income which, rounded down for simplicities sake, is $400/month.

- The second answer is the retirement savings you said you were going to begin. That also was 10%, or $400/month but your company will add an additional, rounding up this time, $100/month for a total of $500/month.

OK, you have your basic information. How do you apply it?

(1) The first rule is to make sure you have your six months of emergency savings in Tier 1.

(a) You are already most of the way there! You have $20,000 in your checking account that you say won’t be tapped for bills. So, you will only need $5,000 more.

(b) You also said you are going to save $400/month, not counting your retirement. You can’t count your retirement because you cannot (or rather you should not) get to that money quickly or easily.

(c) As you can see, you will need to bide your time. At $400 per month, it will take you at least 13 months, including earned interest, to save your additional $5,000.

(d) If you look at the pyramid, it says to split your money up equally between checking, money market, and CDs.

(i) In today’s economy, however, this needs some modification to accommodate reality. Back when I first learned of this technique, CDs, even shorter-term ones, earned more than money markets and were just as safe. Their main downside was the time it took for them to mature. Today, this is not true; money markets have much better returns than traditional CDs.

(ii) So you would merge your CDs and Money Markets together and put 1/3 in your checking account (you should be able to find one that even pays interest) and 2/3 in Money Market. Today, the average return for a money market is 1.15% per annum.

(iii) Therefore, you would move $13,333 from checking to a money market account.

(2) The third rule is that once you have your foundation set, start investing in Tier 2.

(a) Well, here you sort of have to violate that rule with your retirement savings. This is a Tier 2 investment but it needs to start now given that one of the best things you can EVER do is, everything else being equal, take up your employer’s offer of matching funds in a retirement program.

(i) In this case, your employer is offering 2% matching funds in their SIMPLE IRA program; jump on it, it is free money!

(ii) Put in at least 2% of your own money but since this is “before-tax”4 money, you want to maximize it to whatever your budget can stand. In this example, I used 10%.

(b) Rule four says to invest your money evenly, assuming your company’s retirement program lets you do this, and most do, between stock funds and bond funds.

(i) Put $250 in a stock fund and bond fund, respectively

(ii) Historically, these funds tend to move opposite of each other. When one is going up, the other is going down. Because you are putting equal amounts of dollars in on a regular basis, you are doing what is called “dollar-cost averaging”. I will talk more about that in another hub latter or you can find one that has been published already, it is a popular investing method.

(iii) You are able to take advantage of (ii) when we begin to talk about balancing.

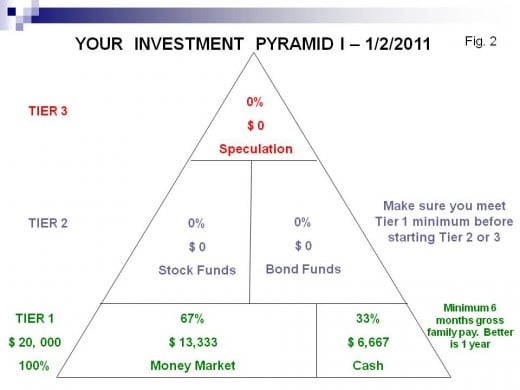

It is January 2, 2011, and you have just initiated your investment plan. To summarize:

- You have $6,6667 in your checking account and $13,333 in your money market account

- You will be investing $133/month into your checking account and $267/month into your savings account.

- You will be investing $250/month into your retirement IRA stock fund account and $250/month into your retirement IRA bond fund account.

Here is what your Pyramid will look like.

4. Before-tax means that the amount of wages considered for income tax and, in most cases, social security and Medicare taxes is reducedby the amount you put into your SIMPLE IRA or other retirement program that receives a tax benefit.

TIME GOES ON

YOUR PLAN IS IN PLACE AND YOU HAVE FUNDED YOUR investment scheme. $400 per month is going toward your emergency fund and $500 per month is going toward your SIMPLE IRA retirement account.

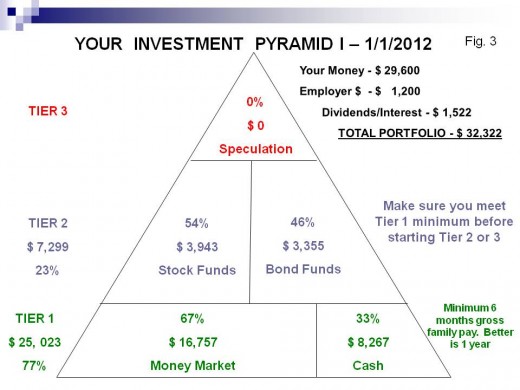

Here is where you will stand after one year has gone by. It is now January 1, 2012.

Household Budget Corner

BALANCING ACT

IN THE UPPER RIGHT CORNER OF FIGURE 3 is a table of what you, what your employer, and what your investment has contributed over the last year toward your current portfolio of $32,322.

This is a nice improvement over the $20,000 you had laying around in your checking account just one year ago. However, your work is not done.

As you can see, only 23% of your portfolio is in the Tier 2 stock and bond funds which is earning a lot greater return, about 26% for the stock fund and 6% for the bond fund, than the 1.15% you are getting from your money market. It should be 40%.

(my figures are based on the 2009 monthly returns from a fund that replicates the returns from the Standard and Poor's 500 Index and the Barclay's Capital U.S. Aggregate Bond Index.)

Also, the stock and bond funds are now unbalanced with the stock fund having 53% of Tier 2 and the bond fund only 47%. Both of these imbalances need correcting.

Balance between the Tier 2 stock and bond funds is simple; just move enough stock fund money over to the bond fund to equal things out. This is about $294.

It is not so straight-forward between Tier 1 and Tier 2, however. Because Tier 1 must have at least 6 months of emergency funds in it, or $25,000 in our example, you can't move any money out of it. Instead, you can start depositing all of your monthly savings dollars into Tier 2; all $900 of it. That means you would need to open an IRA stock fund and an IRA bond fund account (assuming you do not go over the IRS limits).

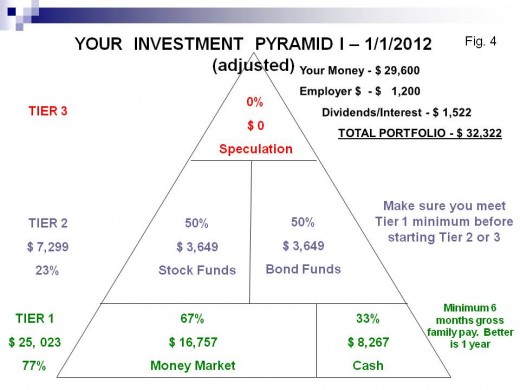

After your re-balancing, your Pyramid will look like this:

MORE TIME GOES BY

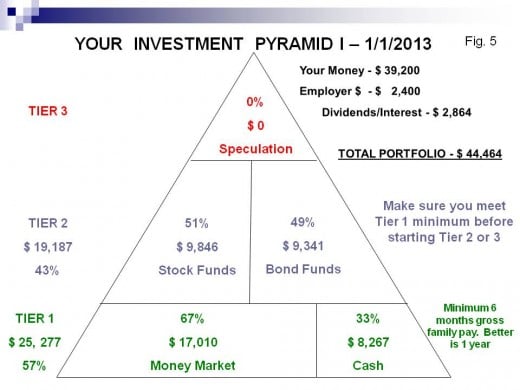

TWELVE more months have past and now it is January 1, 2013. Where do you stand? See Figure 5 to see.

WHAT IS HAPPENING?

YOUR portfolio as grown by 37% to a little over $44,000. Over 10% of that has been from contributions other than yourself! Your employer contributions and dividends are starting to have an impact.

Also, you have fully funded Tier 2 at 43%. This means you can start investing in the more risky Tier 3 investments. Let's assume you want to do this and go for one more year to see the effect.

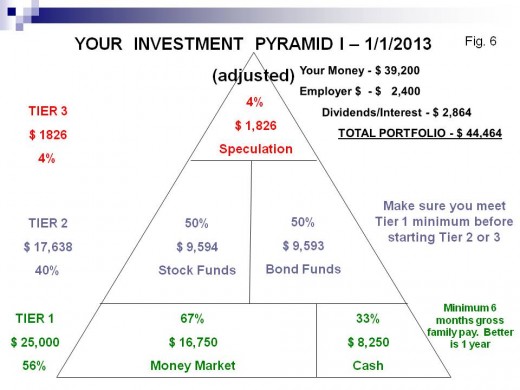

But first, you need to re-balance your portfolio again. By comparing figure 5 with figure 6, you should be able to follow how the funds were moved within and between the Tiers to bring them back into as much of a balance as possible. For example, $277 was moved from Tier 1 to Tier 3. The additional amount in Tier 3 was made up from Tier 2. Then the amounts within each Tier had to be balanced as well.

Notice that the minimum emergency fund of $25,000 in Tier 1 was maintained.

YEAR 3 IS NOW HISTORY

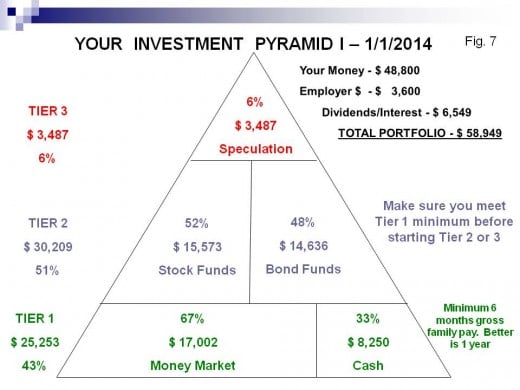

THE example is about finished. The third year of your investment plan is complete and you can review the results in figure 7 below. I repeated the performance for the stock and bond funds from the previous year for simplicity and used the 2009 - 2010 results from an index that matches the Dow Jones U.S. Completion Total Stock Market Index Dow Jones U.S. Completion Total Stock Market Index which is a broad market of stocks not represented in the S&P 500.

So, where do you stand now?

- Your Total Portfolio is $58,949, an increase of 295% from your starting point of $20,000

- 6% was contributed by your employer through their 2% matching arrangement

- 11% was contributed from the dividends and interest earned! So long as the market remains flat or continues to grow, the percentage contribution of the dividends and interest will continue to increase if your contribution remains constant. At some point in time, it will exceed your contribution!!

- There are other rules to follow if the market goes down, but, I am not talking about small downturns. I am talking about downturns like what occurred in 2000 and 2008.

- You would again re-balance your portfolio, getting ready for the next year. Now you should be at your 50/40/10 ratio which you would continue to maintain.

IN CLOSING

Ihope you can see the benefit of having some sort of plan, some sort of structure to follow. It definitely makes things easier. It gives you a foundation to make much more informed decisions about what is probably the most important financial decision you will make in your life. What is sad is that so many people do not make it and end up in their 50s and 60s with nothing but social security to look forward to for sustainment after they retire, if they can retire at all!

In our example, starting in year 4, you might begin looking for very secure but nevertheless slightly more risky instruments than money markets to begin investing Tier 1 savings in. These investments will probably earn more than the 1-2% money markets are currently earning but still have acceptably low risk.

Once you have built up enough capital in your speculation account, you can look to diversify your portfolio to include such things as real estate which, over the long term, is a pretty good investment but is very hard to turn back into cash when you need it. In other words, with a plan and following it you start to have options.

One thing you should do starting in year four is to re-balance semi-annually if not quarterly. As you can see, you need to manage your portfolio or get someone to help you manage it. If you do the latter make sure you do not let them take control; always make the final, informed decision.

I will be expanding on this idea in latter hubs as there are variations on this theme. This is an ultra-conservative plan with the idea of keeping overall risk low. It will do that in most markets. It will not, however, work in downturns like we say in 2000 and especially in 2008. When Bears like those happen, different techniques are needed to ride them out (with the key being knowing when you are in one and I will have more to say on that later). For other downturns, the "dollar-cost averaging" and the 50/50 split between stock and bond funds will tend to mitigate the effects of those and you should be able to ride through them, scary as they may be.

Let me close with my beginning. Regardless of what plan you chose to use for investing your portfolio, the most important thing is to have a plan and to stick to it.

Please let me know if you find this hub useful, I would appreciate your comments on how to make it better.

I WAS WONDERING

Did you find this Hub helpful?

DEMOGRAPHIC POLL #1

Are you

DEMOGRAPHIC POLL #2

Are you

RELATED LINKS

- Household Investment Technique of the Month - Dec: The Pyramid II

THIShub presents a slight adaption to the basic Investment Pyramid in order to provide protection against something that probably will never happen. But, like all insurance policies, you grouse about... - Take Control of Your Bills

There have been thousands of articles written on this and related financial topics; as there should be for it is hugely important. Not knowing how to manage household finances has ruined countless lives and...

© 2010 Scott Belford