Living Within a Budget, Paycheck to Paycheck and Without Debt

Budgeting Your Finances

Do You Struggle Financially?

By: Cow Flipper

It happens each month, you check your bank account and that paycheck you just got has begun to dwindle back down to zero as all of life's costs begin to add up. You pay rent or a mortgage, you pay for utilities, trash, gasoline and car maintenance, insurance, you buy household items and in the end what seemed like it would be enough just barely gets you by. You feel strained as other bills add up as well for things like cell phone bills and data plans, credit card bills, cable or satellite T.V.... all of life's little extras. If that isn't enough at some point in the month you splurge on eating out or going to a movie or something like that, that doesn't fit into your household budget. There are many people that have addictions and feel compelled to fulfill these addictions every month. In the end you have just managed to make it through to the end just to have to do it all over again.

I Know I sound as if I am being a cry baby, but lets face it, this is the reality for a big part of America's society. For many of us this is life and at times it feels like you live in a life of bondage. Having not enough or just enough to slip by can make a person feel trapped and in doing so cause them to lash out and hurt themselves financially by not controlling their spending habits or paying their bills because of their own frustrations about struggling each month.

Instead of messing yourself up you need to make a few wiser choices and a few sacrifices. Do I mean getting rid of all the good stuff? That is an emphatical "No", I mean sacrificing some of the good stuff like movies, fast food, addictive substances, and video games temporarily is a good idea but by no means to I mean that you should deny yourself the pleasures of life. To do that is to make take happiness out of your life. But maybe it is time to tackle quitting unhealthy habits and changing unhealthy behaviors that cost you extra money. I know it super hard to give up your vices but in the end you feel so much better once you do. If you do you can use the money you would have used for those things and create for yourself a buffer and an account that will be there for you when you need it.

Below I am going to give you some advice on what it takes to budget your money and then I'll talk about snowballing yourself out of Debt.

Important Tips

Have a place for all your financial and important documents. Keep good records of major expenses, insurance information, copies of documents and identification, tax information, bills and reciepts you need to keep. A file box with tabs is a good idea. If you can scan them all to .pdf and go paperless even better.

The Keys to Budgeting

Once you learn to budget your expenses and prioritize them you will find life is much easier to manage.

- Avoid Going into Debt: Never spend more than you bring in. If your expenses are so much that you have no extra then you are living beyond your means. The less money going out means more money for financial security. If you owe money and are in debt it is important to pay it off as quickly as you can. Use a debt elimination calendar and track what you have paid to the creditor or company. Keep receipts and check stubs, account balances and dates. This way if they debate that you didn't pay them you have proof that you have. Use a budget work sheet that you and your spouse can reference when there are questions about bills and money.

- Separate Your Needs from Your Wants: We must be humble in our wants. Just because many others have a cool new computer phone or other gadget or article of clothing, or whatever we shouldn't just run out when we have enough money and get one as well. Most people's spending is more about a yearning than it is on their earnings. They think life will be better if they have this or that and have to many THINGS. What ends up happening is a life filled with anxiety about bills and a feeling of stress. Knowing what you must have and need will help you cut out the stuff that doesn't really matter. Things like paying for your home, food, power, water, heat, household items... those are essentials and they are much more important that an iphone or facebook. Once those are paid you can worry about stuff like phones, cable and satellite, internet, and entertainment.

- Create a Reserve: This is the most important tool you can have, it is the ability to put aside money for when you really need it. Things like deaths, medical expenses, car problems, and other family emergencies. This is a sort of parachute that can help ease worry about the what if factor. It will amaze you how fast this reserve builds when it is not touched! Even as little as $20 a check can make a huge difference.

- Have a Spending / Savings Account: You should have two accounts one for your expenses and another that you put the money you would have spent on your habits and wants so that when you really want to have something or you need to get a gift for someone special you will have that extra. you can also use it for your outings or to eat out when you splurge.

Teach your kids and family about these habits early with their own savings account. Show them how to track their money, how to budget and balance their funds. Teach them to prioritize what they need vs what they want. This is a valuable lesson most parents don't teach their kids.

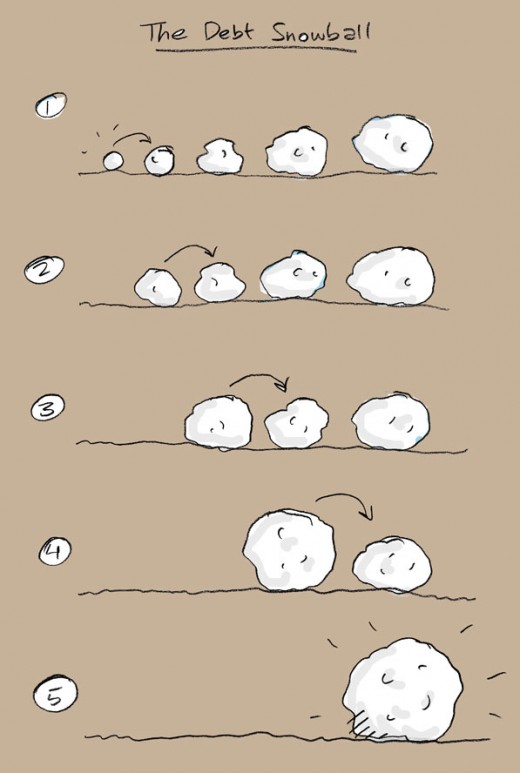

The Debt Snowball

Getting Out of Debt; the Snowball Effect

A Debt Snowball is a way of paying away debt by organizing your debts from the lowest balance to the highest.

- Gather up your debts and put them in order from lowest to highest balances.

- Focus on paying off the lowest balance first, the main reason is that when it is paid off it builds confidence and hope as one bill drops away.

- Make sure you pay the minimum payment on all the other debts you have.

- Pay as much as your budget allows you to pay toward your debt.

- When the lowest debt has been paid off you take what you were paying on that debt and roll it over to the next lowest debt balance, along with the minimum balance of the bill or debt.

- Repeat this step until you are paying your biggest debt, this is the snowball.

Soon enough you will be debt free with no bankruptcy, isn't that worth it?

Do You Live Paycheck to Paycheck?

Do you live paycheck to paycheck?

Savings Tips

- Be thrifty when at all possible. Try to save yourself money by using deals and coupons. Don't use them though if you would not have needed the product or service in the first place. Always make sure that when you do use them there are no special conditions because it's true the devil is in the details.

- Buy at the first of the month when most people get their paychecks because stores have more deals at that time.

- Recycle cans a bottles!

- Keep a change jar - separate your coins from quarters, dimes, nickles, and pennies. When you multiple jars are filled take them down to the bank and you may have a small fortune.

I hope these tips have helped you and good luck on your staying within a budget, paying off you debt. and saving what you can.