Some Unconventional Investment Strategies

Introduction

Some investment strategies that are unconventional and yet simple and seems to work. I will explain a few examples here and give some real examples.

- July 2016

Basics of Investing

- Diversify

- Buy low Sell high

- Dollar Cost Average into an index fund (SPY)

- Buy good stocks and hold for long term returns (Buy and Hold)

- Keep some in cash to survive down turn

- Invest in no load funds

- Invest in Companies with good Balance Sheets

- Invest Companies with high dividends

What are Unconventional Strategies?

Investing is an art. There are no guarantees. Some people are better at it than others. It is a skill that can be acquired but it requires time and experience and patience and diligence. There are some strategies that are unconventional but it works most of the time. The following are some that I have developed for myself and so far it has done reasonably well.

Use of Hedging

What is hedging? It is the idea of trying to minimize your losses by investing in such a way so that the chance of a large loss is minimized by trading off some gains on the positive side.

The way it works is to find two investment vehicles that are opposites. When the DOW or S&P index is rising, one investment such as SPY also rises. But, a volatility index such as VXX or SPXU tends to drop during rising DOW index. Contrarily, when the DOW index drops, the SPY also drops and VXX/SPXU rises sometimes by a factor of 3 or higher.

To take advantage of this strategy, you need to monitor both investment vehicles and trade them at the same time. Lets assume you have $10K in SPY and $10K in VXX/SPXU. During a DOW rise of say over 150 points, you would sell a portion of SPY and use the fund to purchase VXX /SPXU on the same day. On a drop of the DOW over 150 points, you would sell a portion of the VXX/SPXU and use the funds to buy SPY also on the same day.

Why does this work? It works because the VXX/SPXU seems to be highly volatile. It usually rises or falls about 3 times the rate of the DOW index. Assuming over the period of a year or two years, you see a fluctuation of the DOW index a few times that meets the threshold. You will make a profit by these trades.

In the case when the market have a huge drop, the loss in SPY would be offset somewhat by the rise in VXX/SPXU.

Invest based on News

This strategy is based on you following the news on a daily basis. Occasionally, the news of one particular company can influence its stock prices by a large amount over a very short period. I am talking about positive news.

One recent example is Nintendo (NTDOY). This stock has risen from $25 to $37 in the span of 1 week since the release od the Pokeman Go app. If you had bought the stock after the initial report in the news, you would have bought it around $28.5 and if you sold one week later at $36, you would have made a profit of over 25% gain.

HOLX making the Headlines...

On June 20, 2016 FDA announce Hologic zika virus test gets nod for emergency use. I purchased the stock at 34.25. July 28, 2016, sold it for 38.50, a gain of 12%.

Invest based on New Technologies

This is more of a risky investment scheme. I recommend using a small portion of your portfolio to try it. (less than 5%). Once in a while, a new technology come to the market and it captures the imagination of some. It may take a while for this new stuff to make a profit but the risk reward is great.

For example, a few years ago, 3D printing became a new technology that is on fire. there were only a handful of companies doing it. One such company is DDD. It had a price in the single digits. There were no dividends or earnings to speak of. It had great potential. The stock has more than doubled in the past year. It is still a very volatile stock. Timing is everything.

Invest based on Opposites

This strategy is basically doing what is opposite of conventional wisdom. When a company has good fundamentals, and yet, some bad news or a setback became known, and the financial advisors put a "sell" or "hold" on it and the stock drops suddenly maybe 10% or more in one day.

This is a sign for the long term investor to buy. Invariably, over the next few month, the news would have been forgotten and the stock will recover and you would make a nice gain in the process.

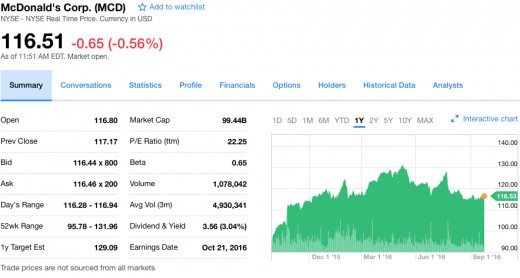

Invest Based on Own Experience

One final strategy is just use your own experience. For example, I own McDonalds stock. I like it because I like their fast foods. Every time I visit one of their franchises, they are busy. Families are there with their kids. The food is tasty. They are everywhere in every small town and large cities. Service is fast. How can they not do well? Notice they pay 3% dividends.

Snapshot of MCD - Sept. 26, 2016

Summary

As I said in the introduction, there are no guarantees in the stock market. However, that does not mean there are no good strategies to follow. It is up to the individual investor to determine what risks and rewards he is comfortable with and how much time he wish to spend on managing his portfolio. I hope this helps.

© 2016 Jack Lee