Who's Really Watching the Stock Market?

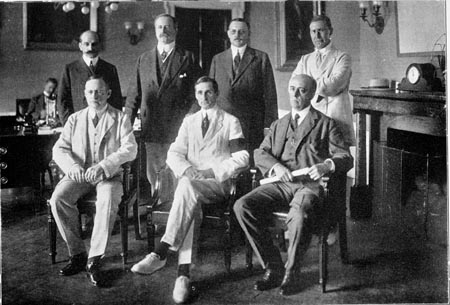

Federal Reserve Board -- 1914

Federal Reserve Board Chairmen

When I studied public relations at New York University's School of Commerce, Accounts and Finance (now the NYU Stern School of Business,) a sage old professor told a story about a financial magnate who stopped to get his shoes shined on the way to his Wall Street suite.

The garrulous shoeshine man waxed poetic about the stock market, eagerly talking about how everybody was making a killing in the market that was headed sky-high. He even offered the financier a few stock tips.

A Clear 'Sell' Signal

The magnate couldn't get to his broker fast enough -- to sell! When optimism about the market reaches the man on the street, the theory goes, that's as clear a sell signal as you can get.

Some market watchers say there's a new economic paradigm -- the old rules no longer apply. They talk about the Internet, computers -- anything with a tinge of technology -- turning the economy upside down. Maybe.

Certainly computers, the Internet, et al, are here to stay. They are improving productivity by leaps and bounds, and they're developing at an astronomical rate. There's little doubt that many of the top companies will grow rapidly in the years to come, at least those who offer new, innovative services or provide the hardware or software for companies that do. A lot of investors in these businesses will find themselves filthy rich.

But, the red flag is waving.

What Goes Up Must Come Down!

As the saying goes, what goes up must come down. That hasn't changed and never will. Neither will the various other economic fundamentals: Supply and demand, inflation, deflation, disinflation, recession, depression and the rest.

Wise investors have little to fear. America remains strong and continues to be the world leader, not only politically but economically. Long-term investments in our country's leading corporations are as much of a sure thing as you'll ever see.

But, I believe, Federal Reserve Board Chairman Alan Greenspan and the U.S. Treasury Department are not doing enough to protect the growing number of sheep-like investors from the growing number of financial wolves. They need to do more than jockey interest rates around while the potential for abuse of unsophisticated investors grows by leaps and bounds.

Market Played Like an Accordion

Any casual market-watcher can see there's more than normal "market forces" affecting stocks -- and the overall market. There's no way to prove it, of course, but it's clear the "big money interests" play the market like an accordion.

I've been watching the ups and downs of the market for some time. I've been following a number of Dow 30 stocks, the technology companies and various other market leaders. I've learned, more than anything, that the current price of any stock is not based on earnings, the competence of management or its potential for profit. Rather, a stock's price is based on whether the "money men" want it to go up or down.

Big investors can't make money on a stock market that doesn't move significantly. They make their money either way -- up or down -- provided they know, and can influence, the direction.

One thing's for sure. You, and I, will only know when it's too late!

I wrote this column as a "My View" for The Hour newspaper of Norwalk, Conn., on Sept. 4, 1999.