Trading Stocks with Low Capital

Why trading is a good idea.

- Stock trading is not gambling because everyone is trying to win, not just the house.

- Investing money is more useful than spending on almost anything else because it can provide both entertainment and future earnings.

- Only invest money you can afford to lose. If you chose your companies with some forethought you will probably not lose the money you invest; but it is a possibility you have to be able to live with.

How much money do you spend on toys and games every month?

Understanding some key points before we get started

Many of us have been told all our lives that stock trading is not a handy way for the layman to make money. This is simply not the case. As with anything in the real world though its important that you start with your mind right before you make your first foray into the stock market. I will debunk some common statements that kept me away from the stock market for far too long.

"It's just like gambling."

False. In a casino the house is trying to make money, YOUR money. The stock market is filled with companies who are trying to make money, and investors who are trying to make money off the companies. The companies get their investment capital from two sources; investors(you) and consumers(their customers). It is in the best interests of the companies to make as much money off their consumers as possible so that they can show a consistent profit to their investors who will then continue to fund the companies growth. In the stock market all the players are out to win by taking money from consumers in an effective way. This is an important difference from gambling because in a casino they are trying to pay out just often enough to keep people spending, whereas in the stock market they are trying to pay out as often as possible while still earning.

"You'd be better off buying toys"

Also false. But it does give us a nice starting point to think about. Consider how much money you spend on games and toys like TV's, or on movies and such like. If you are willing to spend that much money on things with guaranteed no return, why not spend half that, or equal to that, on something that is also entertaining and that MAY provide you with more money at the end of the season?

The last thing you have to get right in your mind is the possibility that your earnings will be low, or that you will in fact lose everything you have invested. Low earnings are a given for low capital investment accounts; after all the more money you have in the better advantage you will get when prices fluctuate. It is possible, but not common, for you to lose everything when a company goes out of business; I will teach you some methods to minimize this risk. The thing to take out of this paragraph is that if your investing in the stock market you should NOT put in money your not willing to lose. Only spend disposable income on this endeavor.

Getting started with trading.

There are a million different strategies and systems involved in stock trading, some using detailed screener strategies, and some using dividends, and hundreds more besides.. I will go over what you need to get started with the basics.

Your broker is the company who is responsible for communicating your trades to a clearing house, who then communicates your trades to a market center where the trade actually happens. The brokers fee is to pay for agreements with the clearing houses and other costs associated with running a brokerage. Cheaper brokers use fewer clearing houses which generally means more downtime and slower trades. For low volume low capital investors this is not a problem because we are NOT relying on up to the second trades and prices to make our money. The more money you have invested the smaller the changes you can profit from will be, but with low capital trading the differences have to be bigger, so we can afford to use a cheaper product. My personal brokerage is TradeKing, with no minimum account balance and a very low broker's fee.

Are you comfortable releasing private information that is federally required for the brokers to operate?

Registration

Registration is frustrating, but it's a step by step process that can take up to a few weeks.

You will be asked for GOBS of private information including your social security number. EVERY brokerage is required by federal law to get this information and verify it before you are allowed to trade and fund your account. Don't be concerned about your security if your using TradeKing. Go through the registration process, it will take less than half an hour. Then wait. You will be given several options to fund your account, I chose the longest option of mailing them a check. You will have to print out a form and mail it with your check and your TK account number(located in the top left of your my account screen). Once your funding has cleared you will receive another email that says you forgot to give them your identification information; you will be able to email them an image of your social security card and your ID and about two days later you will be able to trade!

Trading Smart

Don't hit the buy button yet! I wouldn't leave you here without some tips to make your first foray into the trade world more safe and enjoyable.

First you want to understand when to buy and sell. There is no magic method or else I'd be rich. You need to understand your break even point before you purchase a stock, your break even point is the point at which you can sell a stock and get all your money back. To calculate this you need to take the total brokers fees on the transaction(plus a safety margin) and add that to the total cost of your stock, then divide that by the total number of shares to find your break even share price.

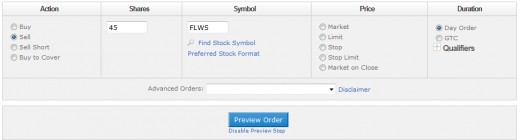

EXAMPLE: you buy 45 shares at 4.50 a share. Your brokers fee is 5 dollars to buy it, then 5 dollars to sell it, and a ten dollar safety margin in case the lot has to be split up to be sold(this is VERY uncommon with such small stock lots.

Your Break even point is (4.50)(45)+5+5+5+5=22.5/45=4.95

$4.50 is what you paid, 45 is the number of shares, the 5s are the transaction fees and the doubled safety margin, 4.95 is what you have to sell those stocks at to break even(or make a little money if they all sell in one lot, which is probable with lots of lower than 100 shares.

Your stock screens are going to be priceless in helping narrow down you search, you can save screens on tradeking very easily and they have many forums open for you to ask for help(or message me). Check out this article for stock screener help.

Select quotes and research-->stocks-->screener.

I suggest saving a screen for the price range you want per share, and then setting rate of change over the last 30 days if you want to be risky, or longer term if your looking for more stable stocks. Higher rates of change in a shorter period of time will give you a greater chance of the price changing, up or down, faster. This screener will narrow down your stock list by quite a bit. After this you just need to pick one from the list.

To pick one, look at the headlines for any signs of a company going out of business, or replacing major executives, or going to court. These are all signs that buying may be a bad idea. Headlines awarding big contracts, or big earnings reports, or new facilities opening up are usually signs of a safe buy. No headlines isn't a bad sign, but its best to keep searching through stocks on your screened until you see some positive headlines.

Some important tips to remember when your making a trade, no matter what trade over the 4 dollar mark; these stocks are cheap enough to be higher volume for lower capital investors, but in a price range where they are likely to be more stable than penny stocks. Also as long as you are low capital, use the limit function on price. This means that the clearing house won't sell your stocks or buy stocks unless they are at or better than your specified price; this is important when dealing with smaller margin profits.

Under duration, day orders cancel at the end of the day; so its possible to wake up every morning, open a sale on the price you want, and then leave not worrying about it until the next day, this way you don't have to keep tracking the prices. GTC means good till canceled, you can only select this order on trades of over 100 shares, and this way you can set your high and low price orders and leave them for a year not worrying about possibly missing a sale because you are in Tahiti. Likewise under qualifiers you can select to sell as all or nothing on sales of over 100 shares which will prevent you from paying extra broker fees selling your stocks bit by bit.

What's next?

Time to learn about dividends?

I started my stock account with $250, I make at most ten dollars per trade every few weeks. This is NOT a huge amount of money; but a journey starts with the first step. Starting a small account with TradeKing will help you learn about the system and see if you enjoy the process, and doing a little research in their community along the way will teach you about all the jargon and fancy systems in use in the market today. Its a great little sandbox to play in until your ready for what's next.

I earn a steady amount from Google Adsense by using primarily Webanswers, and all the money that I make from that goes directly into my stock account. In this manner the income I use to live my life is not affected, but my stock account grows, and with each deposit my earnings potential increases. If you enjoy the stock trade game, start treating it like a game. Instead of buying a new game at fifty dollars each month, send a fifty dollar check into your broker, and download an emulator to get free games for your fix!(all you gaming addicts like me should've discovered that a long time ago!) Likewise, if the stock game isn't your cup of tea you can sell your stocks and take the money back, losing very little most of the time. All in all its not a big price to pay for a chance to learn a system that can possibly lead to a fully independent source of revenue.