Estimated Worth of Earth and the Space Around Earth

Estimating the wealth of the world is a difficult question, and in reality only estimates can be used. In this article, I attempt to give an estimate of the total wealth that we currently have, and the worth accessible by current technology.

In 2012 the total value of derivatives only was about 1500 trillion dollars, and that's just the derivatives market. The stock of broad money is over 80 trillion, and domestic loans are over 100 trillion. In offshore account there are about 25 trillion estimated. Add to that the black market's (crime and illegal stuff) estimated size of 10 trillion. The daily turnover of the spot forex market is 4 trillion, multiplying that by 260 days, we get about 1000 trillion dollars. So I think that you would get over 1700 trillion dollars. That would give us 2700 trillion USD of current worth of Earth, excluding natural mineral reserves of Earth.

On the other hand according to Wikipedia, the estimated value of earth is at least 195 quadrillion dollars. That is 195 000 trillion dollars. This is the ecosystem of Earth. I think we could double that by adding the value of both non-renewable and renewable resorce. So I think that the worth of Earth is about 400-500 quadrillion dollars. Another way to estimate the value of earth is taking the value of a near earth asteroid. An asteroid of 1.6 km in diameter could have 20 trillion USD of rare metals. Earth diameter is 12,756.1 km, so relating that to the value of earth is 159 450 trillion. We could add to that the value (cost) of energy hitting earth from the sun. About 3,000,000,000,000 megawatt energy reaches earth from to sun each DAY. Using 25 cents per KW hour, 1 MW for 24 hours cost about 6000USD, so daily solar energy worth is 18 quadrillion dollars per DAY. Using 365 you get, 6570 quadrillion dollars worth of energy from the sun, addig to that the rough estimate of 500 quadrillion dollars of Earth's energy, we get 7000 quadrillion dollars of estimated earth value. That is 7000,000 trillion dollars. Staggering number for sure!, However it doesn't stop there! A 1.6 km diameter near earth asteroid is estimated to worth 20 trillion dollars in minerals. Estimates say that there are close to a million near Earth Asteroids are out there. Multiplying 20 trillion with 1 million you get 20, 000 quadrillion dollars. Adding to that the 7000 quadrillion USD Earth estimate, we get 27,000 quadrillion USD. Let's go a step further: the average distance between the moon and Earth is about 384,400 km. If we colonize space around Earth with a radius of the Earth-Moon distance, we get a circle with an area of close to 464 000 million sq km. The total surface area of earth is about 510 million sq km. The total world GDP is about 80 trillion USD on Earth's 510 million sq km. Applying that to the Earth-Moon area, we get a GDP of close to 73 000 trillion, which equals to 73 quadrillion dollars.

Earth is worth 7 quintrillion USD.

The area of space between Earth and Moon is worth 20, quintrillion USD.

The total estimated, current worth of Earth and space around Earth is 27 quintrillion USD.

Potential worth

Studies show that in about 2050 Earth's population will peak between 10 and 11 billion. The current population of earth is a little over 7 billion (including the population of indigenous people in rainforests, which are estimated at 20 million or so). 10.5 billion is 1.5 times current population, so using current GDP of about 12000 per capita, we get 126 trillion USD. We saw that the estimated worth of Earth is 7000 quadrillion with current population, so we need to multiply that by 1.5 times the current population. Potential worth of the GDP is 10,500 quadrillion dollars. Current value of derivatives are about 1.5 trillion, which is about 20 times the size of the GDP of world which is about 80 trillion. So to get the potential size of the derivatives market is 20 times 10,500 quadrillion which is about 200,000 quadrillion USD. We also saw above in this article, that the forex market is worth about 1040 trillion, which is 13 times world GDP. So when we multiply Earth potential real GDP, we get 91,000 quadrillion dollars of potential Forex worth on Earth. Add together the potential worth of derivatives market, the potential of forex markets, and the potential real GDP of Earth we get: 10,500+91,000+7,000=108,500 quadrillion USD. 108,500 quadrillion is close to 110 quintillion. This is about 15 times Earth worth.

We saw that with the potential size of the financial markets, the potential worth of Earht is 15 times the natural resources. To get what the space around earth is worth, simply multiply the 20 quintillion (about 20,100 quadrillion) by 15. We get 300 quintillion USD This equals to 300,000,000 trillion USD!

Potential worth of Earth is 110 quintillion USD.

The potential worth of area of space between Earth 300 quintillion USD.

The total estimated, potential worth of Earth and space around Earth is 410 quadrillion USD.

Note that I calculated with average average GDP of 12,000 USD per capita. Currently the country with the highest GDP per capita is Qatar with close to 99,000. This is about 8.25 times average world GDP. Multiplying the above figure we get the following potential worths:

Earth: 907 quintrillion

Space: 2,475 quintrillion

Earth + Space: 3,382 quintrillion

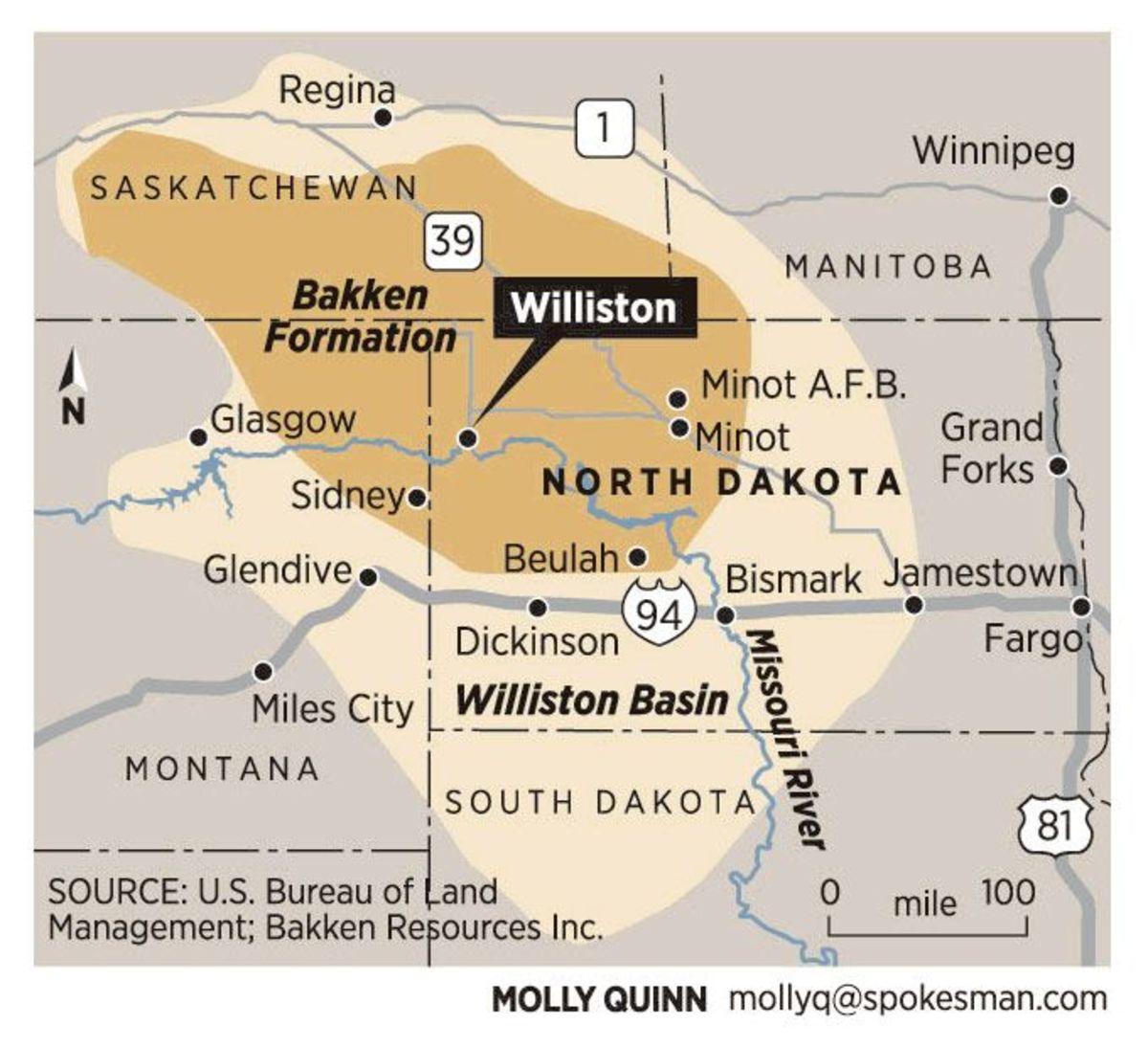

Here are a few examples of large reserves of natural resources on Earth. Estimates say that the total value of the fossil fuel industry is about 500 trillion, that is in known reserves. North Korea has 6 trillion rare minerals, Afghanistan has 3 trillion rare minerals, Mongolia has 13 trillion rare minerals. The oceans contain about 15 000 tones of gold, which is worth 810 billion, with on land resources it is 1 trillion. Russia has over 1 quadrillion dollars of diamond.