Fixing the Stagnant Economy

Introduction

When we are faced with a problem, we need to identify the source or cause before acting. Sometimes, a proposed solution is only addressing symptoms and not the cause. That is usually a short term fix and in some cases actually hide the source and makes the ultimate solution even harder. The current economic malaise is one such case. I hope to point to the source and how to fix it.

- August 2016

Background

The current economic crisis started in the fall of 2008. We had a severe recession caused mainly by the housing bubble. We had a fix that involved a massive government bailout of wall street banks. It worked some what and brought us out of the recession. However, the problem persist in the lack of growth of GDP which is tied to the employment numbers and to the deficits and the total debt.

It has been 8 years since the last recession. The question is why the recovery is so weak? and in fact, the weakest recovery in 50 years.

What is the Source?

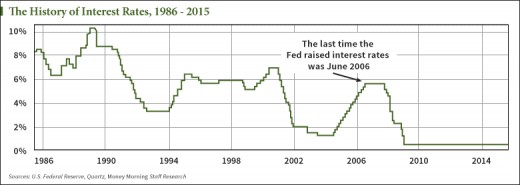

The main source is the Federal Reserve keeping the interest rate at near zero per cent. All economist agrees that a healthy interest rate is normal and usually fluctuates between 2-3% above the inflation rate.

The interest rate is the cost of money. When one borrows money to buy a house or a car, traditionally, the cost of borrowing is in the range of 5-10%. That is what the bank charges it's borrowers for the loan and the services associated with that loan. The bank also takes in deposits from savers and pays the customers an interest of 3-5%. The difference between the two rates is the overhead of the bank and it's profits. This system has worked for the better part of the 20th century.

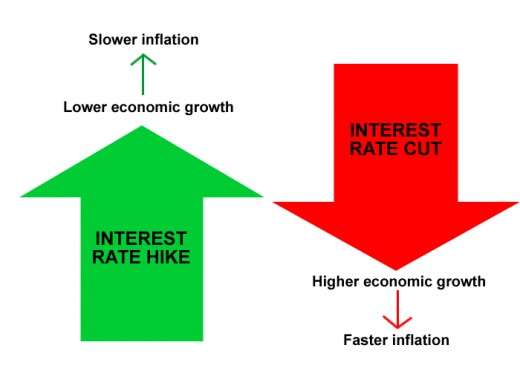

The Federal Reserve was put in place to manage the money supply so that we have a stable banking system in the ups and downs of an economic cycle. The interest rate is adjusted to manage growth. In boom cycles, the interest rate is raised to slow down the growth, alternatively, in recession periods, the rate is lowered to stimulate growth and investments.

Why did it not work this latest recession of 2008? What was driving the Federal Reserve to maintain the interest rate at 0% for 7 years? Who were the beneficiary of this policy?

What is Wrong with this Chart?

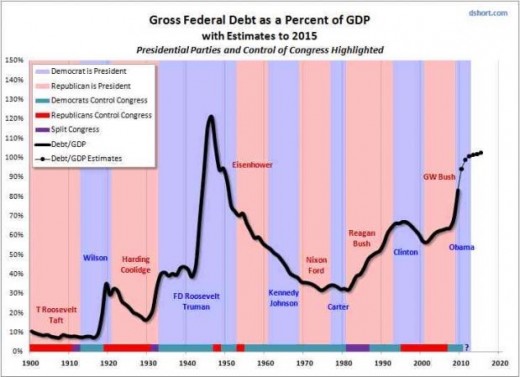

Federal Government Debt

For a long time, our federal government was living above its means. Year after year, it spent more money than it took in by way of taxes. This deficit spending created a national debt of near 20 trillion dollars. This debt must be repaid just like any other loan. When the interest rate is high, our payment to service that debt goes up. When the interest is low, our payment is much less. When the interest is zero, guess what, it cost us nothing to borrow. That is the key to understand the actions of the Fed.

Most governments operates in the red. As long as the debt is within reason, we can afford it by borrowing from the future. That is to say, we spend it today and pay for it tomorrow with an interest tagged on. As long as we have a healthy economy with an annual GDP that is positive, we can afford to use a small portion of that in interest payments. The problem arises when the debt gets too large, and at the same time, we have a recession, with negative GDP. In this case, we have to service the debt with money that we don't really have. It becomes a vicious cycle spiraling out of control. In order to slow down this spiral, the Fed was forced to reduce the interest rate to zero. This was only suppose to be a short term "fix" to a dire situation. It was not a long term prospect.

What does a zero interest environment mean? It has two effects. The borrower benefits because it can repay its debt with no penalty. On the other hand, the savers loses in income from deposits. It is worse for people in retirement and on fixed incomes. Traditionally, people in their retirement years, move their savings into safer investments such as CDs and bonds. They want to preserve their assets while generating some income to offset inflation.

However, if the interest rate is set to zero, the banks will not be able to offer a decent savings rate to their customers. The people are forced to move their money into other investments that may carry more risk such as stocks and mutual funds. This also creates a bubble in the stock market and drives stock prices higher even though the companies many not perform financially to justify the higher prices.

In effect, this policy by the Fed, is like a huge transfer of funds from the savers to the borrowers. The Federal Government being the largest beneficiary because it is the biggest debtor. It is almost like a "tax" except it is not passed by our legislators. It was imposed by a regulatory agency whose board members are appointed by the President.

Wall Street and The Big Banks

The investor class who runs Wall street also benefits from this artificially created low interest environment. The DOW index reaches new highs while businesses layoff employees and cuts back on plant expansions.

When the Fed gives hint of a possible rate increase, even a small amount, the market has a correction. It became the job of the Fed to keep the stock market from collapsing. This is a bad policy. It is not the job of the Fed to help wall street. The free market economy demands a hands off policy from government. The market will rise and fall due to basic economic conditions. If companies starts to make profits, their stock will rise. If companies do not perform in the market place, their stock should adjust accordingly.

The economic cycle has ups and downs. By arbitrarily constrain that cycle in the name of protecting the investors, it s doing a disservice. Moreover, by providing bailouts as in 2008 and 2009 in the last recession, it has damaged the credibility of an impartial government who sides with big business and harm the average tax payer. This distorts what free market is suppose to work and creates a "too big to fail" environment where business leaders gamble with our tax dollars while taking no risks. This is a simple concept that everyone can grasp.

Summary

The source of our economic stagnation is the low interest rate set by the Fed. Our national debt is the over bearing reason behind the Fed's instance of low interest rates. The simple solution short term is for the Fed to start raising the interests rate back towards normal levels. In the long term, we need to reduced the debt to a more manageable level. To reach that goal, Congress needs to pass a balanced budget Amendment. It is the only sure way to insure future government solvency and responsibility. In addition, usury laws needs to be adjusted to a resonable level. There is no reason to allow a bank to charge 16% interest rates on credit card debt while the basic interest rate is less than 1%. Things like this is what gives big banks their bad name.

© 2016 Jack Lee

![Obama's General Motors [GM] Tarp Bailout - The Untold Details Obama's General Motors [GM] Tarp Bailout - The Untold Details](https://images.saymedia-content.com/.image/t_share/MTc0MTU0NDA1OTcxNzY1MTE2/obama-general-motors-gm-tarp-bailout-untold-details.jpg)