Mid-Year Economic and Market Update / Ameriprise Financial

On August 13, 2008 I had been invited to watch a special broadcast featuring a panel of Ameriprise Financial’s leading economic and investment professionals. Submitted achiever circle client questions were used to help create this discussion. The special broadcast was recorded on July 23, 2008.

The leading investment professionals on the panel answering questions were:

Ted Truscott

President of U.S. Asset Management and Chief Investment Officer for Ameriprise Financial, Inc.

Dan Laufenberg

Chief Economist for Ameriprise Financial, Inc.

David Joy

Chief Market Strategist and Chairman, Capital Markets Committee

RiverSource Investments, LLC

A review from what the leading investment professionals views were on the economy and financial markets and also some of their comments and answers to the questions that are at the top of all our minds today.

Ted Truscott headed off the 1st segment of the broadcast with some of his own opinions about some of the tough times we’ve experienced over the last year and he said that it really boils down to one word and that one word is debt or also known, as leverage. Truscott said that we’ve seen excessive amounts of debt or leverage creep its way into the economy, in two very important sectors, 1) the financial sector and 2) the consumer sector. Truscott explained that the consumer has increased his or her debt largely in the mortgage market and that’s why we have a housing crisis at the moment. And he said quite frankly, that people just bought too much house, with too little money put down and too much debt piled on top and that we will have to work our way through this crisis and that will take some time. Secondly, the financial sector also loaded up on debt. Many financial companies, investment banks and business banks, increased debt to levels that were simply unsupportable. That helped increase returns over the last few years because of the magnifying power of this debt, but now Truscott said we’ve gone the other way and just as debt can add to returns, it is now subtracting from returns in a really vicious way and that’s why we have seen financial stocks under such pressure, over the last many many months. It is going to take some time to work its way through the system but it is also important for us to remember that it doesn’t mean there is no opportunity in the market. There is lots of opportunity, right now.

Next on the broadcast was Dan Laufenberg, Chief Economist who gave us his perspective on the U.S. economy over the next one or two years. Laufenberg started off by saying that the economy is in a slow period but doesn’t think we’re in a recession right now but he does think one is coming. He said that they are relearning a very important lesson which is that the business cycle has not been repealed and that is why they expect a recession to occur. He thinks it will be an inflation induced, consumer led recession.

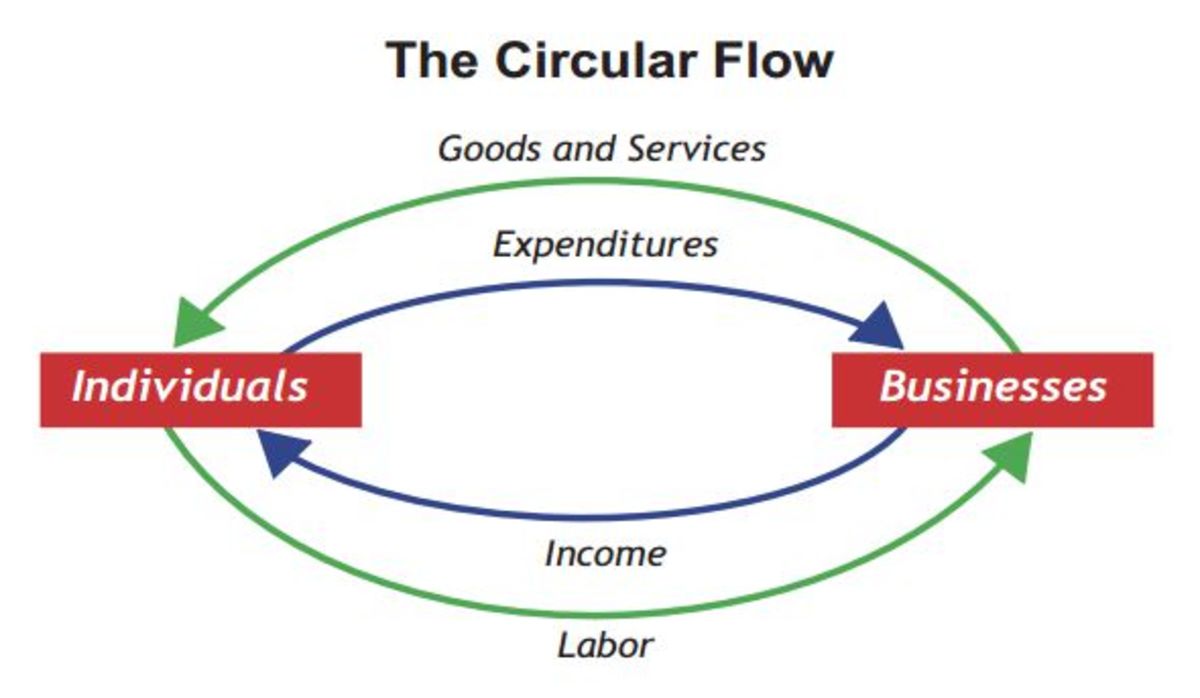

In explaining what he means here, Laufenberg said he is talking about the consumer which is 70% of the economy. The consumer is actually finding themselves in a situation where it becomes very difficult for them to continue to spend at the pace they were. When the consumer does that, Laufenberg thinks that is when they are typically faced with a situation where inflation becomes a serious problem for them and it’s more than just food and energy that really causes consumers to retrench. He does state though that food and energy is very important but the consumer has some ability to substitute around those price increases and he thinks it becomes more difficult when inflation starts to spread across all goods, all services and that’s when consumers have to really find a way to pull back, to retrench and stop spending.

Dan Laufenberg thinks that consumer recession is likely to occur next year and not this year. He thinks there is a good chance the economy will do a little better before it starts to really slowdown in a more significant way. He said the good news is that we’ve had nine recessions since 1950 and we will recover which is important to remember. He said that they know what to do in these times and have the resources, the ability, and the flexibility that’s required to recover and much faster and stronger. He said that the opportunities that Ted Truscott talked about earlier will be developed because the survivors will be stronger and we as an economy will be stronger as a result.

Next segment, David Joy, Chief Market Strategist, gave us some observation of what’s going on including the fact that markets already seem to be anticipating some of what Dan Laufenberg was talking about in terms of an upcoming recession. Joy began by putting the market behavior into its appropriate context. He said we’re down about 20% from the peak, back in October of last year. So we are decidedly into bear market territory. David continued to say there is a lot of pain ocurring in the financial and consumer sectors felt by investors of all kinds.

So where do we go from here? David thinks given the forecast from Dan that it is premature to say that we have hit the bottom. He believes there is another leg down in terms of economic activity and thinks it’s going to be reflected in continued weakness of earnings growth and some of the weakness will spill over into some of the other sectors of the market. So it’s time to be playing a little more defensively then the first five years of this bull market. The business cycle hasn’t been repealed so there’s a time to play offense and a time to play defense. David Joy thinks now is the latter. He adds that there are some long term opportunities beginning to emerge. We are down 20% so there are some very good values out there for the long term investor. David Joy continued, we are a little bit cautious relative to stocks, as well as bonds because he thinks interest rates are going to rise, coincident with that higher inflation. Looking beyond the valley if you will, he said we too would agree that there are some opportunities beginning to emerge and now is the time to prepare your portfolios to take advantage of that upside.

Questions Submitted from the Achiever Circle Members

First Question:

Given the current state of the national economy, the oil/energy crisis and the global economy, is it safe to assume that over the next eight to ten years the market will grow at the same historical average and yield the same return?

Answer by David Joy:

“A difficult question to answer with any specificity, but I think there are a couple of things we can probably say, one is that, as we’ve been talking about, we will have business cycles and so for the next eight to 10 years, we’ll probably start out by being in the early part of a downturn, but then we should enjoy a typical recovery. Recoveries have lasted more recently, maybe five, six, seven years even in length and typically speaking that’s when the equity markets tend to do their best. Historically, returns in the equity markets, in the United States have been about 10% per annum on average. But there is one additional factor that I think may mitigate against returns being that good and that is that inflation may be moving somewhat higher. We’ve enjoyed an environment, where inflation has come down over the last 20 years. That is very beneficial for stock prices and stock values. If inflation is moving higher, it tends to put stock prices under some degree of pressure. So while I think equities can do quite well, I’m not sure they’re going to match the same types of annual returns that we’ve enjoyed over the last 20 years perhaps.”

Second Question:

A recent column in Business Week pointed out that when home building and auto production are factored out, the rest of the economy is actually performing at a healthy rate. Do you agree with this and if so, do you expect this situation to continue or are we facing a likely spread of the downturn, to other sectors of the economy?

Answer by Dan Laufenberg:

“Well that’s a good question because obviously it is homebuilders and automakers that are really beginning to drag on the economy at the current time and we do actually expect the slowdown to spread beyond those two particular sectors and the reason we think that’s going to happen is primarily, because we think inflation again is going to be the problem. Consumers if you are faced with an inflationary environment that becomes a problem, it’s because prices are going up faster than our wages. So even if you have a job, you’re going to lose purchasing power and if you lose purchasing power, you’re going to have to retrench. You’re going to have to slow down your spending and that’s what we think consumers are going to have to do, to such a degree in 2009 that it’s actually going to be a consumer recession and we haven’t really had a consumer recession since 1990/91 was the last time. So I think this time, the consumers are going to participate in the recession. It’s going to be similar to the ‘90/’91 experience, but it’s certainly going to be something that I think is going to be driven more so by inflation spreading to other goods and services, making a much broader problem then just homebuilding and, or homes, or autos.”

Third Question:

What are the underlying causes of the rapid increase in oil prices? Granted, demand is high, but it is not increasing nearly as fast as oil prices. Is it the weak dollar? Speculators? How much does each of these contribute?

Answer by David Joy:

“Yeah. This is an interesting question, obviously a lot of time and energy is being spent right now, even in the public sector, trying to find out what the answer is. We think it’s really the fundamentals of supply and demand. Demand is increasing in a lot of places around the globe, where it never existed before, particularly in the emerging world, mostly in Asia, but in other places as well and this is happening at a time when the world’s ability to deliver supply is at a razor thin margin of error. The excess capacity both within and outside of OPEC is very limited right now. So while there has been no shortage of oil, the reserves that could be delivered to the market are very slim and so that has driven the price higher.”

“There are some elements however that are abetting the situation. One is the weaker dollar which was mentioned. The other is potentially to some extent, this issue of speculation. My own view is that if I had to ascribe a percentage, I would say 90% of this is supply and demand; maybe some of it is speculation. But it is an issue that is going to be with us for a long time. Oil is correcting right now. It is down about 15% from its peak. We think it may correct all the way down to about $100 a barrel or so. But at that level, we think it should plateau out because of the underlying supply and demand dynamic and therefore, we think we’re in a long range era of persistently higher energy prices and that represents an investment opportunity in the long run.”

Fourth Question:

What is America’s comparative advantage in the world economy?

Answer by Dan Laufenberg:

“I believe in the long run our comparative advantage is the fact that we are innovators. Innovation is extremely important and there’s a lot of aspects of that innovation because innovation means that you’re more productive. Innovation means that you can actually produce things at a lower price and makes it possible for people to buy more. It improves purchasing power. It improves living standards. So the comparative advantage I believe is innovation and one of the examples that I like to offer in response to that question generally is 3M.”

“I was sitting at dinner with the former CEO of 3M and I asked him, with the type of products that you produce, you must not produce anything in the U.S. anymore. He said that’s not true. We produce a lot in the U.S. because every time we come up with a new product, we produce it here for the first three to five years. And then maybe after the production process is perfected or somebody learns how to copy the product, it goes someplace else. And he said we come up with 300 new products every year. So it’s really important that the innovation is there that allows us to have that comparative advantage because other people can produce things probably cheaper then we can, in most cases. So what we have to do is come up with that new product that everybody wants to buy and everybody wants to copy and then that will be, I think, our advantage.”

Fifth Question:

What is the medium term three to five year outlook for commodities?

Answer by David Joy:

“Well three to five years I would say the outlook is very good. We happen to think that we’re in a long term uptrend for commodity demand and you have to really take a look backward maybe over the last 15-20 years to make some judgments about the next five to eight years. The world underinvested in commodity production over the last 20 years and now all of a sudden the demand is increasing exponentially. The world is catching up or desperately trying to catch up, to supply that, satisfy that demand and it has found it a struggle to do. And although we will have business cycles and demand will have a cyclical aspect to it, we think that the long term secular trend is higher for commodity demand.”

“So for example, when I talked about the price of oil correcting perhaps down to $100 a barrel, you’re also seeing this occur in other parts of the commodity complex right now, agricultural commodities coming down, industrial metals coming down a little bit, but we think that is setting us up for a good reentry point if you will, into these commodities, as long term investments because once we get through an economic cycle and start the recovery again, the demand is going to be there. The industrialization process in the emerging world is not going away. It is going to be with us for a long, long time, many decades and so commodities, after a little period of correction here, we think are very attractive.

Sixth Question:

What impact do we expect this fall’s election, to have on the economy generally and the stock market in particular?

Answer by Dan Laufenberg and David Joy

Dan Laufenberg:

“Well I’ll try to address the economy. Actually it’s sort of interesting. Right now you’re going to probably see a lot of articles written as the election gets closer about how the economy will affect the outcome of the election, more so than the election affecting the outcome of the economy. In the near term, I think that’s probably the appropriate causal and relationship. Over the longer term, the election and how it impacts the economy, I contend that politicians for the most part or political administrations for the most part will have an impact on the long term viability of the economy, the ability of the economy to perform at its potential over a long period of time. So it’s not something that’s going to immediately be observed, in the economy. I think it’s more of what the impact is on our potential growth over the long period of time and then a lot of things sort of fall into those categories, like tax policy, spending policy, regulation, a lot of things that sort of affect our ability to perform our job for the economy to do it’s thing which is to grow. The normal condition of the U.S. economy is upward, not downward. So the normal condition is that we’re expanding, not contracting.”

David Joy:

“Of course the question that you hear a lot about is tax policy, especially this time around and it seems as though depending on who’s the eventual winner, there is the potential for higher capital gains tax rates, higher dividend tax rates, higher marginal income tax rates, none of which are things that investors look forward to. So if it looks as though those are likely to become policy, I think you’ll see a negative reaction in the stock market. I don’t know if you can quantify it. We’ve had experience with this in the past and the markets have pulled back a little bit, but eventually recovered, as they’ve adjusted to the new tax regime. But as Dan has repeatedly pointed out to me and rightly so, if the economic environment is too weak to allow for this type of a restructuring of the tax code, it may not be likely to occur early in a new administration, maybe not for another 12-24 months, if it happens at all. So we’ll see.”

Seventh Question:

Some of us crossing the threshold to retirement, believing we might have had adequate retirement savings, to maintain a modest lifestyle, now have second thoughts about how aggressively we should pursue our retirement dreams. Any special advice to those of us sitting on marginal retirement savings that a year ago looked pretty darn good?”

Answer by Ted Truscott:

“This is an excellent question. I’d like to take this one myself because I feel pretty passionately about this. The first thing that I’d say to our Achiever Circle clients who are on the verge of retirement or are crossing into retirement out there, is the odds are particularly with advances in medicine and just the notion that people’s life spans are increasing is your retirement may last for a very long time. Nobody can predict this of course but the first notion is that your retirement may last much longer than you think. And so to abandon the markets at this point, to not stay invested, to get much more conservative, just because we’ve had a downturn is actually somewhat self-defeating.”

“Now we’d encourage you to work with your financial advisor on this point but I’d offer up a couple of observations. One, you need to stay invested because just as the stock market can take away, so can it give back and the odds are over your retirement lifespan. You’re going to see a lot of those returns come back your way. Secondly, the number one enemy of a portfolio is inflation. So over time, your portfolio needs to guard against inflation, which means you’re going to need to have some kind of exposure to the stock market. Again, only your financial advisor knows your specific circumstances, but you need to take that into account.”

“And then finally, we’d encourage you to talk with your advisor about product diversification. There is no one silver bullet product out there that can tackle all of the problems that today’s retirees are going to face and they’re numerous. I don’t need to spell them all out for you, but retirement itself is a big burden. There may be college educations to pay for kids or grandkids and of course there’s healthcare. There’s no one single financial product that can help with all of these future obligations, burdens or in fact dreams.”

Eighth Question:

What can I do to preserve my investment value in these times? I have heard that moving from stocks to cash is one way. Is that correct?

Answer by David Joy and Ted Truscott:

“Well I am responsible for a series of portfolios that has the flexibility to adjust to tilt more towards the stock market, a little bit away from it, more towards bonds and some other asset categories in between. For the long term, historically equities have given you the best returns and so in that context, I think that’s where you have to start. Of course, then you have to determine what your fixed income needs are and so forth. But in the short run at least for now, what we’ve done in these portfolios is tilted them a little bit away from the stock market until we get a little bit more clarity about the current situation. But once that arrives and we begin to look through the economic downturn that we’re anticipating, we will go right back to a greater reliance on equities because that will give you the best return over time. Yes, they are accompanied by something, some greater volatility but if your investment time horizon is long enough, you can ride through those periods of volatility and would say in this environment be well diversified in quality assets. That means good, strong companies that pay dividends and on the bond side, investment grade bonds, rather than lower quality bonds.”

“This question has a lot of nuance to it but I’ll start with something I mentioned earlier which is market timing is futile. So the notion that we’re going to preserve value by going to cash at this point, we need to make a few observations on. First of all, it’s highly likely that most investors have incurred some losses already. So if you move to cash, you’re just locking in those losses. By the way, that introduces a second decision. When do you move from cash back into the markets? We have lots of data that indicated people are exceptionally poor at market timing. They tend to sell out at the bottom. They tend to get back in very late and they end up destroying returns that they could have otherwise achieved.”

There were a lot more questions to be answered on the broadcast but time ran out and they couldn’t get to them. You may visit the weathering, a volatile market web page on ameriprise.com. It contains more information and commentary on the markets and the economy.

Disclosure: The views that were expressed in the broadcast reflect the views of Ameriprise Financial as of July 23, 2008. These views may change as market or other conditions change. This is for informational purposes only and is not intended to provide investment advice or account for individual investor circumstances.