Show Me The Money: Is Our Economy One Big Ponzi Scheme?

Do you remember Jerry Maguire? Jerry Maguire was a movie about a sports agent's rise, fall, and eventual rise again. The movie, which was released in 1996, turned out to be a critical and box office success. Say what you will about Tom Cruise but this man has more hits than Laurence Taylor. He proved that he was still one of the biggest if not the biggest movie star in the world. Lets not forget about Cuba Gooding Jr.'s Oscar winning performance as a narcissistic and charismatic football player who stuck by Jerry's side when no one else would. I don't know what happen to Mr. Gooding Jr. after this movie but, the cartwheels and back flips he did on stage after winning the academy award created a memorable moment in not only African American History but Film History as well. Mr. Cruise's jumping around on Oprah's couch didn't get the same response. I guess it's a black thing (I'm black, I can make that joke). I'm sorry, you probably want me to get to the point right? Okay, here we go.

Ladies and gentlemen we are Jerry Maguire. Well some of us are. You see we worked our asses off for years, perfecting our craft through hard work and dedication, only to get fired just when we thought things were starting to look up. Just like Jerry, most people didn't see it coming. Now some of you might still have your job, but are you happy? Are you making the kind of money that you think you deserve? Or are you smiling in people's faces and pretending to like your boss because its the only way to pay the bills?

Sure they gave Jerry a good severance package, but what was he supposed to do after that? Being a sports agent was his job for years. No matter how good that severance was, it surely was not going to support him forever. Imagine if he had kids! Some of us do. Now some people may read this and say, "please, I'll never have to worry about this happening to me, I'm financially stable." Well for those people I say this...So were a lot of the people who had their hopes and dreams living in a cushy apartment on Wall Street.

Life Is Like A Box Of Chocolates...

You see, what I did above is use a popular well known movie to make a point or paint a picture for you. I do that a lot. I think it's easier (and more interesting) to get my point across with the help of metaphors or analogies that most people can understand or relate to. In this case I used the movie Jerry Maguire as a metaphor for life. Jerry was in a tough spot in his life and he had to find a way out. Many of us are in that same position now, and most of the rest will eventually be there soon (believe me this economy is worse than you think).

Another technique I like to use is the G.O.A.T. technique or the Greatest of All Time technique. This technique consists of using people who I consider to be the best of the best at what they do or did. For example, if I was using basketball as a reference to prove a point I might use Michael Jordan in some way, because I consider him to be the greatest basketball player of all time, and many would agree. With that being said I would like you to proceed downward as I attempt to construct my own legacy. The question...where is the money? Now we play connect four.

1. Bernard Madoff

When it comes to scheming people's money this man has to be a contender for Greatest of All TIme. Bernard Madoff, The Ponzi King, swindled so many people out of so much money there are still people trying to calculate the exact numbers to this day. Sure there have been others, like Enron a company that made over $1 billion by taking advantage of California's energy crises in 2000 and 2001. But those guys only swindled a billion or two, my main man Bernie's scheme is estimated to have reached $65 billion or more. Although people argue about how much of the money Bernie actually got his hands on, the fact still remains that he was trusted with a hell of a lot of money, and it all disappeared. So how did Bernie's plan work?

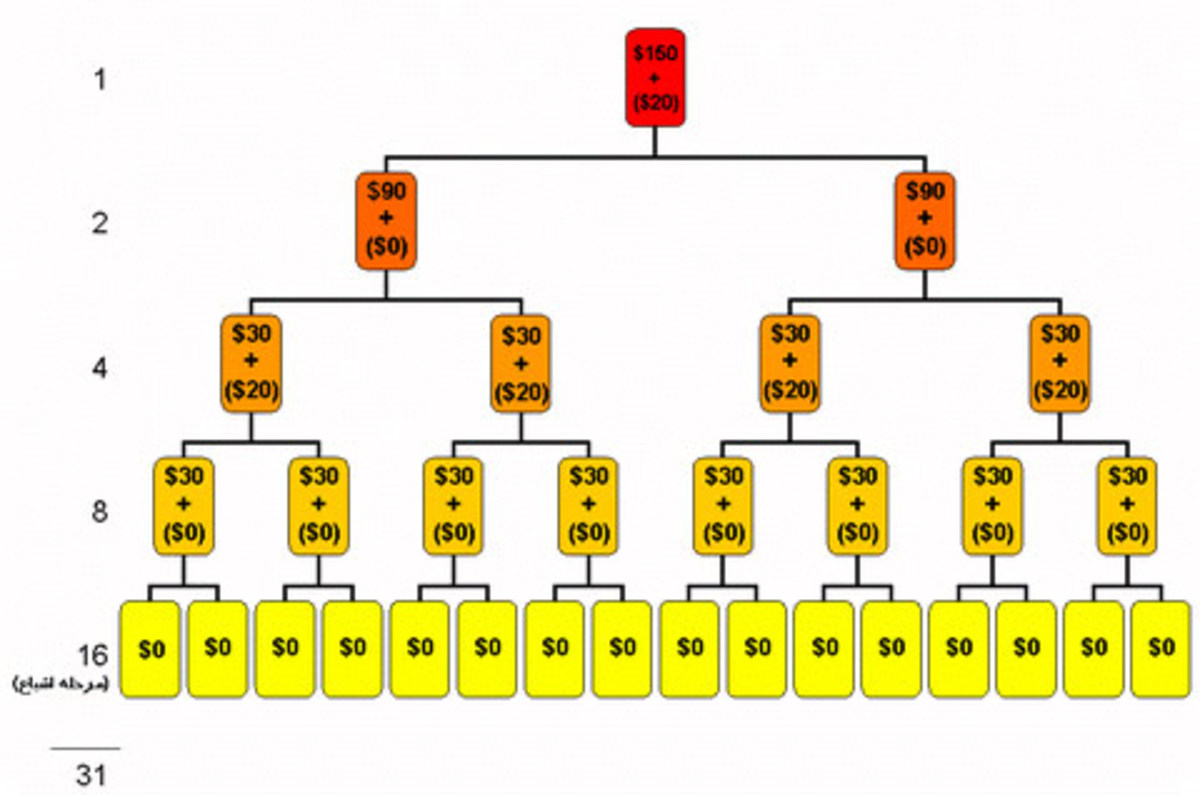

"A ponzi scheme (named after Charles Ponzi) is a fraudulent investment operation that pays returns to separate investors, not from any actual profit earned by the organization, but from their own money or money paid by subsequent investors. The Ponzi scheme usually entices new investors by offering returns other investments cannot guarantee, in the form of short-term returns that are either abnormally high or unusually consistent. The perpetuation of the returns that a Ponzi scheme advertises and pays requires an ever-increasing flow of money from investors to keep the scheme going. The system is destined to collapse because the earnings, if any, are less than the payments to investors. (Wikipedia)"

There are many different ways to conduct these schemes, here's how Bernie did it:

First off you have to understand that Madoff was well respected.

"One reason that Madoff was so successful was that he was a highly respected, well-established and esteemed financial expert -- his reputation was bolstered by the fact that he helped found the NASDAQ stock exchange and served a term as its chair." (Clark and McGrath)

Using the name he had made for himself Madoff convinced a lot of wealthy, famous, and even not so well off people to give him there money for investment purposes. Along with his good name Madoff earned investors trust by being able to come up with the investors money whenever they asked for it. How did he do this you ask? Well look at it like this, lets say everyone in america puts money into I don't know, social security right? You've all gotten those pamphlets in the mail before right? The ones that tell you how much money you will have when you retire. Anyway, when a person reaches retirement age that money is there. Just like the pamphlet says. You see here's the trick, there is no fund.

Imagine you have a change jar at home that everyone puts their loose change into everyday, and this jar is supposed to be used for emergencies only. Now lets say the change jar is monitored by one person who is responsible for taking the change from your hand and putting it in the jar. And just so this all makes sense lets say you live in a mansion and there's 100 people that come in and out of the house all the time (play along trust me it will all make sense by the end). Oh, and you never get to actually see the jar. So, now you have one person who is being trusted with all of your extra money but you never get to actually see it until you need it. Sure he can give you a piece of paper showing you how much money is in the jar, but you never get to actually SEE it. Now comes the day when you need some money.

You walk up to the jar gatekeeper and you say, "hey man I need $200 bucks for this new suit, I have a real important meeting at work next week." The gate keeper says, "no problem" and hands you $200. Little do you know that this guy is taking his girlfriend out to eat filet minion, and lobster 5 days a week, not to mention paying for her hair, nails, and wardrobe maintenance. But it doesn't matter, he won't get caught until either the money stops coming in or somebody needs a huge amount of money at one time. So, am I calling social security a ponzi scheme? Hmm. You won't hear me say that, not while my pockets anorexic.

So Bernie was basically the jar gate keeper and the people he ripped off was the household. The difference is the piece of paper that he showed to his investors always made it seem like they were making lots of money. And when you're making people happy, they love you. Just ask Jerry Maguire.

2. Peter Schiff

Can You Repeat That Please?

Oh man does this guy look like a genius now. If you watch the video to the above you will see an American investment broker by the name of Peter Schiff getting mocked and laughed at in his face, for forecasting a recession in 2006. I wonder how those people feel now? You see there incompetence while ignorant, can be easily understood. The so called fincancial experts that were mocking Mr. Schiff were high off the numbers, just like madoff's investors were. And just like Madoff's investors these experts should have took heed to that old adage, "if something seem to be too good to be true, it probably is." Everyone from crooked Wall Street bankers to car dealers were fudging their numbers and giving out credit like there was no tomorrow. But who wants to listen to that person in the group who's telling you to stop swiping that credit card just because you got a limit increase. People like that are lame, right?

3. Wall Street

What if I told you that one block in New York City has the ability to control the whole worlds financial future? Would you believe me?

Facts depicting the evolution of Wall Street all mainly tell the same story, but I found one article that puts it in a way that I couldn't have done better my self, so I won't try. These quotes are from an article tilted "History of the Stock Market," found here http://www.hermes-press.com/wshist1.htm.

"In March, 1792, twenty-four of New York City's leading merchants met secretly at Corre's Hotel to discuss ways to bring order to the securities business and to wrest it from their competitors, the auctioneers. Two months later, on May 17, 1792, these merchants signed a document named the Buttonwood Agreement, named after their traditional meeting place, a buttonwood tree. The agreement called for the signers to trade securities only among themselves, to set trading fees, and not to participate in other auctions of securities. These twenty-four men had founded what was to become the New York Stock Exchange. The Exchange would later be located at 11 Wall Street."

Oh it gets better...

"A century before, Dutch settlers had built a wall to protect themselves from Indians, priates, and other dangers. The path had become a bustling commercial thoroughfare because it joined the banks of the East River with those of the Hudson River on the west. The path was named Wall Street. Early merchants built their warehouses and shops on this path, along with a city hall and a church. New York was the U.S. national capitol from 1785 until 1790 and Federal Hall was built on Wall Street. George Washington was inaugurated on the steps of this building."

So, New York 'used' to be our nations capital? I say it still is, in fact you know what? I'm going to go ahead and say that "New York is the center of the world." Well I think that's half right. Actually Wall Street is.

What name seems to always come up whenever I'm looking into anything that has to do with the history of money in the United States? What name always comes up when I research The Great Depression or The FInancial Crisis of the late 2000s. What name is synonymous with money and power?

J.P. Morgan

This guy could have been one of the connect fours here, but he is so connected to Wall Street that I just decided to put them together. Hmm...I just thought of something. How come you never see J.P. Morgan and Wall Street at the same place at the same time? Oh and Clark Kent has glasses on, so he can't be Superman.

"The early 1900s saw the rise of huge fortunes made on Wall Street. In 1901 J.P. Morgan astounded Wall Street by creating a billion dollar merger resulting in the U.S. Steel Corporation. In 1907 a wave of panic hit Wall Street. Eight hundred million dollars in securities were unloaded within a few months. Stock prices plummeted and runs on banks became a daily occurrence. When the Knickerbocker Trust Company was forced to close its doors a panic swept banks throughout the country. Morgan pressured the leading New York bankers to forestall a total financial collapse of the country. They set up a single banking trust, with most large banks across the U.S. contributing to its financing. Morgan's own group, as you might imagine, had controlling interest."

In 1929 the market crashed and The Great Depression was born. There are a lot of theories on why the market crashed, but in most accounts the same facts remain. Wall Street convinced everyone to put their money into the Stock Market by pushing stock prices way beyond the actual worth of the company, and talking up all the average Joe's who had hit it big in the market. Wait a minute...this sounds kind of like a PONZI SCHEME, but Madoff wasn't even born yet, it couldn't be, could it? After J.P. and his buddies made a good amount of money, mysteriously the market crashed and stocks fell deep! Hey, where did all that money go? And how come J.P. and the other fat cats seemed to not only rise from the wreckage unscathed but also better off than they were before it. Bernie may not be the G.O.A.T after all.

So lets fast forward 218 years, the financial crash of 2008. The average "Joe" or "Joe the Plummer" (remember that crap) started losing money in the market through, 401k's, stocks, bonds, etc. And all the while we're losing money, President Bush and his successor, President Obama both agreed that certain companies and banks were to big to fail.

Chrysler

Fannie Mae

Freddy Mac

Bear Stearns

Goldman Sachs

Wells Fargo

Citigroup

Bank of America

and of course J.P. Morgan Chase

Our government basically said that if these entities were to fail, then the world as we know it would be over. So we gave these multi-billion dollar companies more money, which they spent on bonuses, trips, and parties (Goldman Sachs). J.P. Morgan Chase actually seems to have been able to really benefit from this crisis. If you haven't noticed, they've bought up most of the failed banks (woke up one morning and my Washington Mutual debit card magically turned in a Chase debit card). So, I ask this question. If theses entities are too big to fail, and we have to bail them out no matter how many times they screw us over, what's stopping them from being totally corrupt? Morals? Wow, I'm starting to think J.P. Morgan is the Jordan of ponzi schemes and Madoff maybe Kobe. What do you think?

4. You

Not just you, but me too. We all sat around for years while this same group of people swindled, mismanaged, and even forcefully took our hard earned money from us. We should have seen all of this coming ahead of time. After all "history always repeats itself." I'm sure most people know the quote but few people use it to their advantage. But does it really matter? The things that I have just pointed out to you are factual, taken from our nations history, but you won't hear about it in any history class in America.

"History is written by the winners."- Alex Haley.

When is enough going to be enough? How many times do the same people have to do the same cruel things to us before we say, "I'm mad as hell, and I'm not gonna take it anymore?" All this history about all this money disappearing right before our eyes. After a few blinks the rich end up richer and the poor end up poorer. Where is all of our money? Where are the jobs? Where is the America that we all use to know and love? Unfortunately as crazy as it seems, that America never really existed.

It was all one big ponzi scheme. We were all spending money that we never actually had (credit, loans, etc.). And just like the victims of Madoff and his predecessor J.P. Morgan, it seems like a futile attempt to get all of it back. I began this story comparing us to Jerry Maguire, but now I see that I was wrong. We are more like Rod Tidwell, the talented football player who lays everything on the line every night he plays. The bankers of the world are Jerry Maguire. We go out and win games, promote products, produce good stats, we basically do all the hard work. The Jerry Maguire bankers on the other hand, they are in control of how much money we can make or lose. They hold our lives in the palm of their hands. With so many other clients and so much money and power, it's very hard for those Maguires to show or even care about showing any one client special attention.

This is where the comparison has to be cleared up. Unlike the bankers Jerry Maguire discovered what happens when all the chips fall. He realized that his clients were people and not just numbers in his check book. Rod Tidwell saw that ability in Jerry, that's why he stuck around. I don't see that ability in our Maguires. Do you?

Do you trust the government with your money?

Works Cited and Links

"The History of the Stock Market" hermes-press.com. Web. June 2011