A slump hovers across the Atlantic!

Its doom and gloom. Many are forecasting a recession for the United States economy in 2012. This is a second recession within four to five years, since 2008 which is becoming a major worry for economic strategists who are now saying this points to major problems in the global economic system that can't be controlled because of its fractious nature.

The impending recession in the United States economy is not only due to the mounting US debts which has been the case for over three decades, and the fact that America exports its debt to the world, but it is related to the present interconnectedness of the global economic system.

At present, there is geographical connectedness where one problem in one region has a knock on effect in another. Today's global economy is sensitive and susceptible to activities and developments in far distant corners of the globe.

Today's global economic problems are becoming "global" in nature, there is an eerie 'walking-the-tight-rope' scenarios. Its endemic, the economic problems in Europe, rising debt in Greece, structural weakness in Italy, Spain, Portugal and Ireland means there is a potential spiraling effect where the situation is getting out of hand.

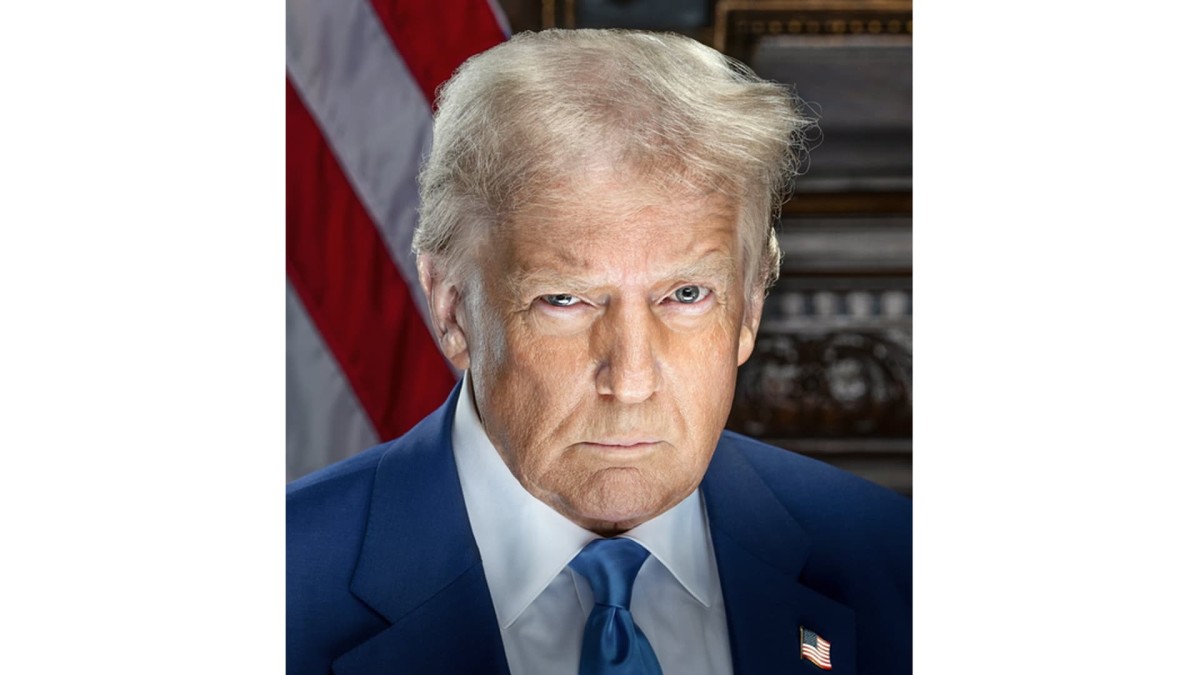

American President Barack Obama didn't mince words recently when he said Europe has to get its house in order. He clearly understands that if the European Union continues to dither, it will have a major effect on the economy across the Atlantic.

The economic situation in Europe heralded by Greece, and the fact that everyone is expecting the government there to default on its raising debt and can't even pay the salaries of its employees, is creating major worries among other European countries like Germany and France who are posing themselves as the strongmen of Europe and protectors of the European integration project.

They are now in a state of anxiety and worry about the extent of averting the default on the Greek debt that is in the region of $490 billion. The immediate worry is to provide loans to ensure that a default will not occur because that would have a run-on effect on the banking system not only locally in Greece, but in the whole of Europe, and very likely internationally.

But this is clearly another story. Many, as is the case with the United States are forecasting also a recession for Europe in 2012, because they fear that the economic crisis is no longer as a result of the banking system and its lending of too much credit and which finally came to climax in 2008, but this crisis is to do with "crises of states as in Greece, and the other European states mentioned above.

As well many experts are saying that what is needed is the pumping of massive amounts of injections that must be in the trillions rather than billions of dollars to allow them to get back on their own two feet made through loan schemes, bonds and the like.

Many are saying as well the present crises has to be handled in a more structural way, like providing more regulations to the financial, fiscal and banking institutions in Europe where state control is more forceful. It is maintained unity in laws, above state laws across over the 27 member states, would ensure "unity of action" regarding dealing with particular crisis situations. There is almost a call for less reliance on market forces and supply and demand machanisms and more state interventionist approaches.

This is what is contributing to the impending crisis in Greece, and that is the fact that decisions are slow.. Each country's parliament has to vote on aiding Greece, and that takes "political time" which means the country gets deeper and deeper into crisis.

The problem here is that despite the European Union which came into being in the early 1990s, there is no solid equation based on what is seen as a "United States of Europe" where laws are not in contradiction and are unified for quicker and most effective action.

This is partly why Obama is frustrated with the Europeans who are finding it difficult to maintain a united stand, and one that will not worsen the crises even further.

The crises in Europe has also heralded talk of an impending crisis in the euro, the previous par excellence currency introduced in 1999, and in its own way, to compete with the dollar.

Although it has become legal tender for many countries in Europe, today, the euro itself maybe facing crisis, in light of the recession across the continent because of the inevitable lack of confidence it is creating in the currency. Bad news for the euro is not necessarily good news for the dollar as it might represent as well a strain on American exports. Economically it’s a vicious circle.