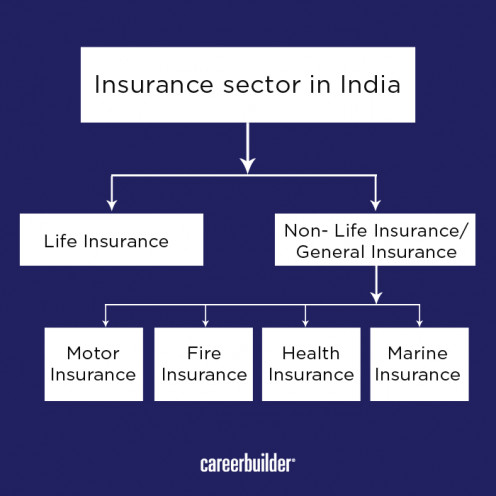

Career options and job opportunities present in the Insurance sector

When the liberalization policies opened its doors for the private players in the Indian insurance sector, this started to grow slowly but steadily. The increasing numbers of players, both public & private, in the sector has resulted in new products, improved customer service, and most importantly, promising employment opportunities.

As per market reports, India's insurance sector is a hugely untapped market, where there is no dearth of good insurance jobs. Of an estimated insurable 500 million people, the life insurance coverage is only taken by 23%. The health insurance sector has the same story as the potential in the region has not even been scratched. So, it's a lucrative sector, which is waiting to be unveiled.

Jobs in insurance mainly involve helping people and businesses to manage their risk and protect themselves from disaster and losses.

Career opportunities for different categories of job aspirants

- Undergraduates= There are enormous job opportunities available for this category in the insurance field, mainly in the sales department. A fresh graduate can start his career by working as the sales executive, trainees and agents.

- Graduates= For graduates, there are immense opportunities available in sales, training, IT, accounts, and administration functions.

- Engineering graduates= In the general insurance field, they can work as surveyors and loss assessors. At present, many engineering students are working as analysts in investment and funds management division.

- Medical graduates= There is a good demand of medical professionals with MBBS, BDS and pharmacy qualifications in the underwriting and claim departments of the insurance company.

Employment opportunities present in the insurance sector are available at various levels, to name a few-

New insurance companies

| Teachers, trainers, etc

| Intermediaries, like brokers, agents, surveyors, third party administrators, etc

|

Legal advisor

| Consultants

| Investigators, traders, adjusters, etc

|

Actuary

|

A bit details about these available jobs in insurance would clarify the matter-

1= Intermediaries

These are individuals and in some cases, companies, who play the role of intermediaries between the insurance companies and people at large. It includes various job profiles, viz, brokers, third party administrators, agents, surveyors, etc.

2= Consultants and legal advisor

Undoubtedly, insurance consultancy is a promising sector, where a person or a company, backed with knowledge & expertise in insurance, can work as an entrepreneur, offering insurance consultancy to individuals and companies.

3= Teachers & trainers

Nowadays, insurance is taught at both school & college level. There are various colleges in the country, which are providing insurance education. Also, thousands of private institutes have come up in the country, especially in major cities, which are providing training to agents through short-term courses. All these education institutes need competent people to be appointed as teachers and trainers.

4= Actuary

These are professionals who are the members of the Actuarial Society of India and have also passed the necessary papers of Actuary. He helps an insurance company in designing insurance products and computing premium. As per the Insurance Regulatory and Development Authority (IRDA) mandate, it is mandatory for every insurance company to appoint at least one actuary. Touted as the most respected jobs in the insurance sector, actuary enjoys hefty salary packages.

Till 1999-2000, only a handful of public sector insurance companies were operating in the sector and India was like an abandon land as far as the insurance was concerned. However, in the year 2000, insurance sector recorded a major boost after the entrant of leading foreign players in the region. Many insurance companies opened their offices in different cities of the country.

At present, over 50 insurance companies are operating in the insurance sector. Commencing from the metropolitan cities of the country, now they are penetrating into the far flung areas also. With further expansion and induction of new insurance players, there is a high demand of people both at senior and junior levels.

Usually, an insurance company needs people for following job profiles-

Underwriter

| Claims Manager

| Sales Team Manager/Leader

|

Investment Officer

| Accounts Officer

| Agency Manager

|

IT officer

| Risk Manager

| R & D Manager

|

Investigator/Assessor

| HR Manager

| Customer support staff

|

Legal manager

| Re-insurance Manager

| Trainer

|

Requisite skills/traits to find a good job in the insurance sector

1= Analytic skills

2= Communication skills

3= Presentation skills

4= Self-motivated

5= Integrity

6= Able to handle work pressure

Your vote counts!!

Are you holding any insurance policy?

The opening up of the insurance sector has produced new career avenues. At present, it is offering some of the lucrative jobs in the insurance sector that promise to offer fast tracked careers and affluent salary packages, that are at sync with the IT sector. The government insurance companies- United India and LIC have invited applications for diversified job positions, including advisers and Administrative officers.

Recent Initiatives

The government has raised foreign direct investment (FDI) cap from 26% to 49% in the insurance sector. Foreign investors have been long vying for India's promising insurance field, which analysts believe has a huge potential to grow.

Now, various top notch foreign insurance companies will revive their plan to enter the under-matured Indian sector. The passing of the bill means new companies to set up their centers in the country and this will again create more jobs in the insurance sector.

Also, the Securities and Exchange Board of India (SEBI) has relaxed rules to permit more life insurance companies to launch public offers.

Let's have a quick look on the education requirement for the insurance sector

Do you want to make a career in the insurance sector? Typically, there is no clear way to start off your journey. A fresh graduate with a flair for communication is usually hired by insurance companies to sell their products/services. Most of the training is imparted by companies to their employees, though a host of professional courses can also be taken by a candidate.

For other job functions in the insurance sector, freshers are hired on a regular basis. It may include job roles like data entry, accounting, logistics support and customer care. If you want to find a job of the underwriter in the insurance sector, then you should at least hold a post graduate degree in insurance & finance.

There are various good colleges in India which are providing courses in insurance and finance. A handful of them are known for their impeccable curriculum and getting a degree from one of them could help you in landing a good job in the insurance sector.

Some of the good institutes offering insurance education in India

Actuarial Institute of India, Mumbai

| Centre for Insurance Studies and Research ,National Law University, Jodhpur

| National Insurance Academy, Pune

|

College of Vocational Studies (University of Delhi), Sheikh Sarai, Phase II, New Delhi

| University of Delhi, Delhi

| Institute of Certified Risk and Insurance Managers, Hyderabad

|

Academy of Insurance Management, Asia Pacific Institute of Management, New Delhi

| Goa University, Goa

| Manipur University, Imphal

|

Aligarh Muslim University, Aligarh

| Department of Humanities and Social Sciences, Indian Institute of Technology (IIT), Mumbai

| Utkal University, Bhubaneshwar

|

Birla Institute of Management Technology, New Delhi

| University of Bombay, Mumbai

| Kurukshetra University, Kurukshetra

|

How much can you expect to earn?

Government insurance companies pay salary and other benefits as per the government rules. However, those hopping in the private sector may get Rs 15,000-20,000 as a fresher, which would goes up once you will earn more experience and promotion. Commission is one of the most crucial parts of the sector. Both public and private insurance companies offer commission to their employees when they hit or overachieve the target.

In the sales function, advisors & independent agents are paid commission only, whereas employees get salary or salary + commission. Companies also offer bonuses when agents hit their sales targets and sometimes employers also pay transportation & telephone charges.

To bolster their employees, insurance companies also offer exciting perks, that could include foreign trip. In fact, there is no looking back for people who can prove their mettle. Actuaries are considered to be most respected profession in the sector. A fresh actuary may earn Rs 8-9 lakh/annum along with other benefits.

From the above discussion it is quite clear that there is a vast career scope and jobs in the insurance sector. Insurance in India is at its nascent stage and further developments in the sector would likely to generate more employment opportunities.