Ba (Hons) Business Management Dissertation: Customer Loyalty Antecedents in Retail Banking -Chi Squared Test

Abstract

Customer loyalty has become an ever increasing concern for the financial services sector and in particular banks. With the financial crash of 2008, banks are finding it difficult to regain the trust lost due to their failures and lack of oversight. Technological advancements have opened the door for „challenger banks‟ over recent years causing the overall market share to dilute from the "big 4‟ banking groups to smaller app based banks. Due to this a study of customer loyalty the banking sector has been completed, with the consideration of various approaches and underpinning variables, enabling the researcher to identify key antecedents and assess the affect age, gender and income have on the key antecedents.

Utilising a predominately quantitative approach to the study, a sample of 100 people responded, with usage of random sampling method. Data was explored in relation to four distinct categories; Age, gender, income and the overall attributes which create loyalty. Numerous significant findings are stipulated from the overall investigation, supported by current and historical academic studies. The overall findings of this study highlighted the antecedents of consumer loyalty and how customer expectations and needs to differ depending on age and income.

Research Background

Consumer loyalty is a concept which has developed an increasing focus from researchers over the last 30 years (Kotler and Keller, 2006), especially in the product sector. In the age of globalisation, accomplishing a high level of customer loyalty is a challenging goal, especially in the service sector and more specifically banking.

The value of customer loyalty for service industries has been recognised by many researchers (Asuncion et al., 2004; Bloemer et al., 1999; Caruana, 2002). Keaveney (1995); Gremler and Brown (1996) identified that customer loyalty has a notable effect on the development and maintenance of sustained competitive edge through customer retention. The importance of customer loyalty is somewhat magnified within the banking industry due to the nature of the industry itself, an increased role of technology over recent years and an increased involvement from the customer in the delivery process of services means the value of the service provided, lies within the entire customer journey and within the service attributes provided (Alok and Srivastava, 2013).

Not only does customer loyalty ensure repeat purchase behaviour it can also provide numerous other long term benefits such as; positive publicity, cross buying intentions, exclusive preference to the company and the services offered, greater market share, greater tolerance to service outages, and lower resistance to price adjustments, which all provide a competitive advantage (Alok and Srivastava, 2013).

Terblanche and Boshoff (2006) argued that identifying the drivers of loyalty is necessary if one wants to achieve the greatest benefits from customer loyalty and went on to acknowledge loyalty drivers may differ from person to person. Thus, there is a growing need for a more in depth analysis into the antecedents of loyalty that help create and enhance the concept and the effect different demographic factors have on the relevant antecedents. A large amount of the available literature indicates the key antecedents of loyalty to be; perceived value, perceived service quality, customer satisfaction, service attributes, image and trust in creating and maintaining customer loyalty. Therefore, this study will look to establish whether demographic factors have an impact on the specified antecedents, in order to understand how different demographics perceive loyalty towards banks in order for them to better serve their wide customer base.

Research problem

The subject of customer loyalty attracts academic attention worldwide. Lam and Shankar (2006) highlight loyal customers are more likely to engage in repeat purchase behaviour, whilst also being more likely to provide referrals through positive word of mouth, thus increasing a company‟s market share and profitability (Griffin, 1995). Numerous academic studies have been conducted focusing on which variables make up customer loyalty, and have largely focused on the two main loyalty approaches, attitudinal loyalty and behavioural loyalty and applied this research to the product industry.

The abundance of loyalty related literature construct the subject of this study, with customer loyalty potentially becoming an out of date topic of research. However, a clear pattern across literature over recent years is the lack of consideration in regards to customer loyalty in the service industry and more specifically the banking sector and how demographic factors such as age, gender and income might affect the overall antecedents of loyalty. Due to this, the overall antecedents and variables will be identified in line with existing literature and the demographic factors of age, gender and income will be scrutinised against them. Through doing so, this study aims to update and enhance the current research pool surrounding customer loyalty in the banking sector, providing a modern interpretation into the constructs of loyalty but also combining demographic variables to help introduce a new area of research to improve banks core understanding of customer loyalty.

Research Aims/Objectives

The overall aim for this research is to develop and enhance banks understanding as to what drives customer loyalty in the banking sector. This will be done through the use of primary research which subsequently will provide relevant results to discuss. Furthermore, numerous developed and widely accepted theories and drivers will be critically analysed in the line with this study. This research study will:

- Provide an understanding of loyalty to banks and its various dimensions and examine the impact of demographic variables on loyalty and their importance.

- Investigate customer attitudes towards bank loyalty by identifying the key dimensions of and reasons for bank loyalty.

- Analyse the collected data to provide bank managers and marketing teams with useful information for customer loyalty building.

Research Plan

The research objectives will be achieved through utilising a methodological approach consisting of solely quantitative research methods although one qualitative question was included but will not be analysed (See appendix 2). A deductive approach will be used, allowing the research hypotheses to be developed from an already existing research pool. Primary data will be collected through the use of a questionnaire.

Primary data will be gathered from a random sample of people from the UK to ensure there is no bias. Once collected the data will be analysed to reveal any significant findings as to what drives loyalty in the banking sector. Data will be analysed by utilising Chi Squared testing using a p-value of 0.05.

The breakdown of the data will be conducted in line with the specified hypotheses which can be found within the methodology section. Furthermore, completion of this study will provide a much needed update to the research pool, to enable to banks to further their customer loyalty strategies specific to numerous target demographics.

literature review

Customer loyalty background

Customer loyalty has no one agreed upon definition, however Oliver (1997, p392) states that „customer loyalty is a deeply held commitment to re-buy a preferred product or service consistently in the future; thus causing repetitive same-brand or same brand-set purchasing, despite the influence and marketing efforts of competitors to cause switching behaviour‟. In addition Dick & Basu (1994) argue customer loyalty is a complex, multidimensional concept which is made up of several sensitive variables which are heavily affected by the changing expectations of customers. The past 50 years has provided much debate in relation to customer loyalty as a concept. The earliest research into loyalty breaks customer loyalty up into two key approaches; behavioural (Cunningham, 1966) and attitudinal (Guest, 1944) which will later be discussed in further detail.

Research in relation to customer loyalty has been heavily focused and related to tangible products, whereas loyalty towards a service provider has remained for the most part, unexplored (Gremler and brown, 1996), this view could be seen as outdated as services are much more prominent today due to the internet and the overall development of technology, however the concept of loyalty towards services is lacking any relevant and up to date research. The lack of literature surrounding customer loyalty in regards to the service industry could be down to the difficulty to measure loyalty in relation to services (Lewis and Soureli, 2006).

Customer loyalty is a key aspect for any company, as when achieved, a company can increase and secure market share, thus providing a competitive advantage (Caruana, 2002).

Approaches to customer loyalty

The two major agreed upon approaches of customer loyalty consist of the behavioural approach and the attitudinal approach. It has been argued that both attitudinal and behavioural approaches should be views as equally important to the overall concept of loyalty (Bove, et al, 2009).

It was noted that customer loyalty had initially been viewed to be entirely behavioural, measured through the collection of repeat purchase behaviour and market share. The behavioural approach was argued against by Day (1969) who found this approach to be insufficient in identifying true loyalty; therefore the attitudinal dimension was introduced (Jacoby and Kyner, 1973).

There is an abundance of research which separate loyalty into the two categories mentioned, however a large part of the available research treat attitudinal loyalty as a driver of behavioural loyalty (Carpenter, 2008). The two approaches will now be explored below.

The behavioural approach

Research conducted in the last 50 years, focused predominantly on a behavioural perspective towards loyalty. The behavioural approach is largely based upon repeat purchase behaviour such as quantity of product purchased over time, purchase frequency and the amount or lack of brand switching. Gremler and brown (1996) acknowledged that repeat purchase behaviour is an essential element of customer loyalty but argued that it cannot be the sole measurement of loyalty due to the lack of exploration of the reason behind purchase choices. This view was backed up by O'Malley (1998) who argued behavioural measures to be unreliable due to the lack of acknowledgement towards situational constraints such as; age, income, gender, geographic region, store stock levels and social view towards brand.

In summary this approach has drawn criticism from several academics such as Zins (2001), Mercier (2001) and Jacoby and Chestnut (1978) due to lack of depth and due to no attempt being made at understanding what causes this behaviour.

The attitudinal approach

The second approach, known as the attitudinal approach has received contrasting feedback from Day (1969), Zins (2001) and Javalgi and Moberg (1997) due to incorporating customer attitudes towards an organisation, therefore gaining an understanding of customers preferences towards products and enabling a more thorough understanding of what may cause customer loyalty.

A customer with a favourable attitude towards a company is likely to develop preference loyalty and have an increased willingness to recommend the service to other potential customers (Gremler and brown, 1996), with this loyalty, customers tend to feel a personal attachment to a company and when their views are backed up by positive company action, they are more likely to cross purchase.

It could be argued that customer loyalty viewed in either approach is too simple and some researchers have suggested a composite measures of loyalty stating that customer loyalty is established by the attitude of the customer as well as the customers behavioural approach (Pedersen and Nysveen, 2001) and due to this loyalty should be consolidated using behavioural and attitudinal approaches together. (Dick and Basu, 1994; Day, 1969; Zins, 2001).

The antecedents of loyalty

To fully understand whether demographic factors such as age, gender and income affect customer loyalty within the banking sector it is necessary to identify the key drivers of loyalty within the banking sector. An abundance of research has been conducted on consumer loyalty, in which they have identified the key drivers of consumer loyalty to consist of; Perceived service quality, customer satisfaction, service attributes, corporate image, and trust (Bloemer, et al, 1998), (Lewis and Soureli, 2006), (Rai and Medha, 2013). The range of literature provides views from the last 30 years, giving insight into how loyalty antecedents may have changed, however some literature may prove outdated due to the vast change in technological dependence of today‟s business environment.

Perceived service quality

Perceived service quality is the difference between the customers experience of a company performing a service against the customers prior expectations of the same service, which in turn creates the perception of quality (Parasuraman, et al, 1988). Furthermore, Service quality relates to the over perception or attitude a customer has in regard to the superiority or inferiority of the overall company and its services (Fogli, 2006). Service quality has been found to impact the willingness to recommend a company and has also been identified as a key influence to a customer‟s sensitivity to price change (Baker and Crompton, 2000). Therefore it can be argued perceived service quality is very much an attitudinal aspect toward loyalty due to the reliance of the customer‟s emotions.

Initially, Gronroos (1983) believed service quality was made up of two components; Technical quality; relating to what is being delivered and functional quality; relating to how a service is being delivered. However, this was built on by Drake et al (1998) who believed Service quality is made up of several factors such as; speed of service, efficiency, opening hours, complaint handling, and service attributes, friendliness and ease of contact, which were all relative to the technical and functional quality of a service.

Service quality within banks may have slipped over recent years, due to the increased need to outsource business areas, such as call centers, this saves the company, but they sacrifice a high level of customer service. Language barriers and automation are seen as a negative when it comes to service quality.

Customer Satisfaction

Satisfaction is a multi-dimensional antecedent which can be seen on multiple levels including satisfaction with the service provided, with the person providing the service and with the overall organisation, furthermore it could well involve the customers purchase and usage experience (Andreassen and Lindestad, 1998).

Customer satisfaction has been argued to be highly important in creating customer loyalty (Ribbink, et al, 2004). It has been identified that within the service industry, where face to face interaction with customers is limited, the need for satisfied customers is greater, this is down to the ease of switching to alternate providers (Ribbink, et al, 2004). Earlier literature backs up the importance of customer satisfaction by stating competitor influence is weakened considerably when current customers are satisfied (Methlie and Nysveen, 1999).

Service quality plays a huge role in creating satisfaction. Customer satisfaction cannot be achieved without a high level of service quality (Lewis and Soureli, 2006) , this can be seen in the key factors which influence customer satisfaction, as they are similar to that which impact service quality; efficiency, speed of service, complaint handling, and the customer journey as a whole all influence customer satisfaction (Lewis and Soureli, 2006).

It was established that Customer satisfaction and loyalty share a strong relationship when customer satisfaction is high and weak relationship when satisfaction is low (Coyne, 1989). Furthermore it was established that that customer satisfaction is very much a cognitive reaction, defined by the customer‟s attitude and emotions surrounding a purchase experience, indicating this antecedent is that of a attitudinal aspect.

Service attributes

Service attributes relate to the characteristics of the overall service, so in the case of the banking sector, online banking, telephone banking, credit cards and savings accounts are all examples. Service attributes should offer as a response to a customer need (Filser, 1994). The impact of age on customer needs and overall behaviour has been noted in previous studies (Yoon and Cole, 2008) and will be further analysed in this study. Service attributes are directly linked with the overall image of the company. Offering a wider range of service attributes tend to provide a greater image and in turn increase the size of the potential target market (Lewis and Soureli, 2006).

Corporate image

Corporate image relates to the public‟s perception of quality and social class associated with a brand name (Methlie and Nysveen, 1999). It was argued by Nguyen and Leblanc (2001, p228) that corporate image consists of several attributes relating to the overall business; Business name, premises, range of products/services and the perceived overall service quality, which is then perceived by the public, again reiterating the complexity of loyalty.

It has been argued that a positive corporate image can play a pivotal role in customer retention (Nguyen and Leblanc, 1998) , furthermore, I has been established that maintaining a favourable image will help reduce negative influences from competitors and bad press, while enhancing the appeal of the organisation to current stakeholders and potential stakeholders (Bravo, et al, 2010).

Trust

The UK banking system is believed to have played a significant role in causing the financial crisis (Gillespie and Hurley, 2013; Grayson et al., 2008) and due to this, loyalty towards the major banking groups has declined. Trust is the feeling of security, and the belief that the company in question has the best interests of the customer at the core (Delgado-Ballester and Munuera-Aleman, 2003).

Customers tend to focus on what is relevant to them in terms of the drivers of trust. The drivers are likely different from customer to customer. Pirson and Malhotra (2008) specify staff competence, integrity and transparency as the key drivers to trust in the banking sector. These drivers have been distinguished in a previous study from Ennew and Sekhon (2007) in which it was identified that customers who have been with their banking institution for a longer period of time report a higher level of trust.

Papadopoulou et al (2001) stated that trust is an integral driver for the creation of loyalty and long term customer relationships. Doney and Cannon (1997), perceived trust to be that of a behavioural aspect due to the associated intentions to repurchase, however Foster and Cadogan (2000) argued against this, mainly due to the increased likelihood of customer recommendations when trust was high, furthermore trust is an emotion built from positive customer satisfaction.

Demographic influences - Age

The impact of age on customer loyalty and customer behaviour as a whole is acknowledged widely (Yoon and Cole, 2008). Age has a major influence on the way customers perceive experiences and develop behaviours and attitudes towards companies and their marketing efforts (Patterson, et al, 1997). It has been reported that older customers tend to show higher levels of loyalty and are less likely to change purchasing habits in comparison to younger people (Yoon and Cole, 2008). Older customers also tend to resist technological change, this can be seen in the reluctance to adopt new technologies such as internet banking and contactless payments, and it is argued that this is due to the challenges of adapting to modern devices and learning new skills (Wood, 2004).

The differences in loyalty for the ranging ages was supported by Wood (2004), who went on to argue the older age range is more likely to practice loyalty than the younger age range due to the lack of need for risk and because of the developed attitudes towards certain brands. Within banking, the needs of varying age groups is apparent, younger people may require interest free student overdrafts whereas older people may require better mortgage offers. Older people also tend to want lower risks, and practicing loyalty to a bank can help achieve this (Zeithaml and Gilly, 1987).

Older people are more likely to become victims of fraud and are more susceptible to making poor investment decisions (The Economist, 2017). Furthermore with old age, comes declining health which may indicate why older people prefer to talk over the phone than use internet based banking tools, in which they would be required to remember passwords and other security information, (The Economist, 2017). On the subject of age and loyalty there does seem to be an absence of related literature (Ndubisi, 2006)

Demographic influences – gender

Palan (2001) argues that gender is a key influence of behaviour and attitude. The major difference between men and women are physical differences, which likely won‟t play a part in banking decisions (Fischer and Arnold, 1994). Gender and associated behaviours and attitudes are most likely to cause an effect on loyalty, societal norms and expectations are argued to be the key driving force affecting the contrasting behaviours and attitudes of males and females, for example males are associated with a more masculine, independent and aggressive persona, whereas women tend to exhibit a more nurturing and caring societal role (Roxas and Stoneback, 2004). Furthermore it was established that females were less likely to practice controversial or unethical behaviour (Ameen, et al, 1996). These views could be considered outdated, but will be considered when analysing relevant data.

In regards to customer loyalty, a study conducted by Ndubisi (2006) concluded that there are significant differences between men and women when it comes to loyalty. Women showed a higher rate of loyalty within their product/service selection, whereas males tended to take higher risks in regards to utilising different service providers and lacked the means to build lasting relationships (Bahia et al, 2005). It was further found that women tend to value relationships with employees as much as the core product itself, indicating the customer journey as a whole, is scrutinised more by females (Snipes et al., 2006).

In regards to decision making Meyers-Levy and Sternthal (1991) associated a higher level of emotional decision making with females and a higher level of scrutiny with males, meaning women tend to be influenced greater by marketing efforts, whereas males tend to repel, marketing efforts. Again, much like the literature gap on the affects age has on loyalty, there is also a considerable lack of literature relating to how loyalty is affected by gender, and with the shifting norms of today in regards to gender, and it opens the door for much needed research to be conducted.

Demographic influences – income

The impact of income on customer‟s behaviour and overall attitude has remained for the most part, unexplored. The limited literature available, points towards the idea that with a higher income, loyalty is less prominent (Mittal and Kamakura, 2001). It is argued that consumers with a higher income tend to come from a higher educational background, so in turn the decisions made are more detailed and cognitive, furthermore, people with a higher income tend to show a higher willingness to shop around for greater value, even if it means spending more (Cooil et al., 2007). In relation to banks, people with higher incomes will expect higher rates of interest on their savings.

Loyalty in the UK banking sector

Customer loyalty in the banking sector could be seen as more difficult to establish than that of a company in a sector which provide products, mainly due to the intangibility which comes with the service industry (Mittal and Lassar, 1998). Due to the lack of a tangible product, reliability, trust and satisfaction become major building blocks in the creation of loyalty (Bloemer et al, 1998).

The UK banking sector is a highly turbulent and competitive market made up of four major banking groups; HSBC, Lloyds banking group, RBS group and Barclays. In the last 10 years since the financial crisis, the banking sector has seen retail giants enter the market with their own financial services, utilising their loyal customer base to attain custom. In 2008 the UK was hit by a financial crisis which was heavily influenced by banks and the lack of legislation surrounding them (Gillespie and Hurley, 2013; Grayson et al., 2008). Due to the part banks played in the crisis, huge reputable damage occurred and trust was lost, a decade on and banks are still rebuilding the trust lost. Increased legislation and authority has been introduced as a result of the financial crash, this complicated the customer on-boarding journey and could also be considered a potential determinant for reduced loyalty in the larger banking groups (Hurley et al, 2014; Jarvinen, 2014).

Aspects such as technological advancement offer both opportunities and threats to the banking sector. Due to the rapid growth and increased dependency, the internet has become an essential channel connecting customers with businesses in all industries (Markham, Gatlin-Watts & Cangelosi, 2006). Increasing dependency of the digital environment is evident, with digital/internet usage surpassing 3.4 billion users in 2016 (Statista, 2016).

Baltes (2016) suggests that the continued growth and usage of the internet and internet based services is ensured, both as a method of communication and for the everyday business use. However, for all the good that the internet offers, the banking sector is still adapting to the new ways in which customer expect to be able to access their money and apply for financial products, this has paved way for “challenger banks”.

literature review summary

In summary, after reviewing relevant existing literature based on loyalty, a range of antecedents were identified and demographic factors explored. Firstly it has been determined that there are two major views of loyalty known as behavioural and attitudinal and occasionally a combination of the two known as composite loyalty. Furthermore it has been established that there are 5 key antecedents which make up loyalty which consist of; Perceived service quality, customer satisfaction, service attributes, corporate image, and trust (Bloemer, et al, 1998), (Lewis and Soureli, 2006), (Rai and Medha, 2013). Three key demographic factors have also been identified consisting of; Age, income and gender.

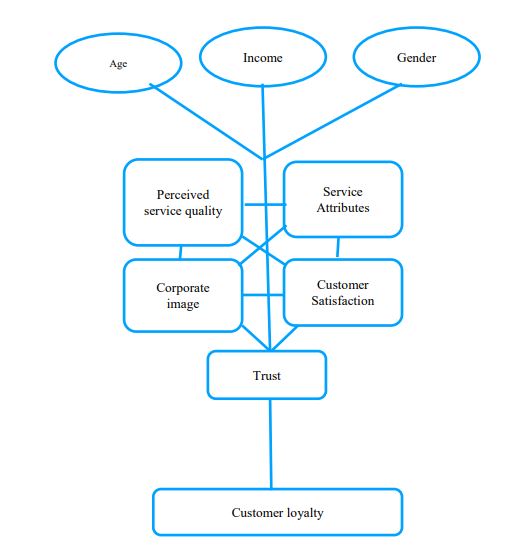

Proposed framework for loyalty and associated demographic affects

As you can see from figure 2, the proposed framework for loyalty shows how the antecedents interlink to create trust and only with trust can loyalty be achieved. The 4 central antecedents affect each other as established within the literature review. Outside of the key antecedents, demographic factors impact them, meaning the key antecedents will not be consistent across a range of markets and individuals

Methodology

research hypotheses

H1- Customer loyalty antecedents in retail banking are affected by age.

H2- Customer loyalty antecedents in retail banking are affected by income.

H3 - Customer loyalty antecedents in retail banking are affected by gender.

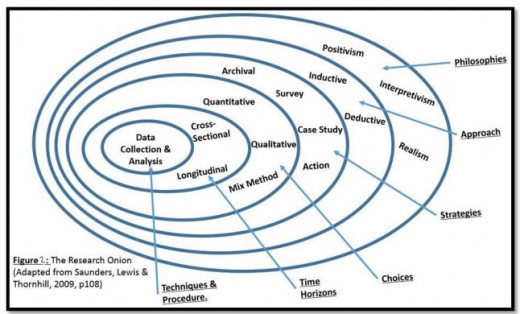

The research onion

A research methodology requires a critical consideration in order to select the most appropriate research approach (Remenyeni, Williams, Money & Swartz, 2005). Thus this study has adopted Saunders et al., (2009) research onion approach (figure 2). The research onion provides a logical framework which breaks down social research into 6 layers which have been implemented to effectively structure the research study as a whole. The use of the research onion provides clarity and helps justify decisions made in regards to each of the 6 layers.

For the purpose of this study, exploration of each of the 6 layers is appropriate and will provide justification of the methodological decisions made.

Research philosophies

The research philosophy relates to the beliefs and values of the researcher and provides insight into why the researcher has chosen the way, in which data is collected, scrutinised and later utilised (Greener, 2008). Barrow, (2013) argued that serious consideration of research philosophies preceding data collection can provide a definitive and well established direction helping strengthen the overall methodological approach.

Greener (2008) argued that researchers may experience confusion regarding their philosophical standpoint due to unclear definitions of research philosophies, which is seen as one of the major difficulties researchers may face.

It has been argued that ontology and epistemology should be considered the major research philosophies as there is an inter-dependency between the two (Easterby-Smith et al., 2014), whereas by utilising the research onion (Saunders et al., 2009) the researcher puts methodologies and methods at the centre of the overall methodology.

As previously stated above, this research study adopts Saunders et al,. (2009) research onion. A pragmatic approach will be utilised in this study which will allow the research to utilise epistemology, ontological, axiological methods (Saunders et al., 2009).

Epistemology

Epistemology is concerned with the methods of attaining knowledge and acknowledging any limits associated with the knowledge (Kumar, 2014). This study utilises the epistemological approach of positivism as it attains quantitative data through internet mediated questionnaires, which is free of biased results and subjective responses and is measured objectively with emphasis on the observed facts (Blaikie, 2012).

On the other hand, the contrasting approach of interpretivism was incorporated in the form of one open question at the end of the questionnaire; however, qualitative data can create generalised conclusions due to the inclusion of personal opinions which in turn may weaken the reliability of any results (Kumar, 2014). Thus the open question will be excluded from the overall analysis but can be found within appendix 2.

Ontology

Ontology in relation to research is about identifying reality and its surrounding nature. Ontological studies involve objective and/or subjective philosophies, (Saunders et al. 2009). Accordingly, both objectivism (positivism) and subjectivism can be seen as the two major approaches of ontology.

Throughout this research study, quantitative data collection and analytical methods have been utilised, thus, this study has adopted the approach of positivism. Positivism adheres to the view that only knowledge attained through observation is accurate and therefore trustworthy. Positivism requires quantifiable observations which then lead to statistical analysis, and excludes subjectivism therefore excluding the potential for biased results (Wilson, J. 2010). The method of analysis will be discussed later within the methodology section.

Axiology

Blaikie, (2012) argues axiology is the study of value and how personal values impact research and the way in which research is conducted. Saunders, et al (2009) argues that primary data collection may hinder the overall study and the ability to collect objective results due to the inclusion of personal experience and personal values, thus this study collected the vast majority of data through internet mediated surveys which will reduce the amount of personal interaction, in turn increasing the validity of the results. To decrease the inclusion of peoples personal values and experience, the questions asked within the questionnaire were closed and multiple choice.

Research approaches

The research approach relates to the method in which data is collected, Matthews and Ross (2010) identified two key approaches within social research, known as the deductive approach and the inductive approach. Kumar (2014) argues in favour of a third approach known as the abductive approach, which is a mixture of the previous two mentioned. Hammond & Wellington, (2012) believe a deductive approach aims to draw comprehensive conclusions from an initial idea, which ultimately leads to the creation of new data, thus providing support or an opposing argument against the specified hypotheses.

Emory and Cooper (1991) claim that a deductive approach intends to be conclusive, with the resulting data stemming entirely from the initial specified issue. Pursuing a deductive approach in research requires an in depth assessment of secondary data relating to the subject in order to develop the initial hypotheses which then would be tested through primary research. In contrast an inductive approach aims to create new theories through primary research filling any gaps in the related areas (Matthew & Ross, 2010). Furthermore an inductive approach will allow the findings to naturally reach a conclusion while raising new views which may not have been considered from a deductive research approach.

Based on the two key approaches, a deductive approach has been selected due to the abundance of related secondary data available and thus this will assist in the creation of relevant hypotheses. The hypotheses can then be further scrutinised against the existing research pool.

Research Strategies

The third layer of the research onion relates to the choice of research strategy, Remenyi, et al (2005) outline the differing strategies available. The strategies outlined in figure () are classified as; case studies, surveys, archival research and action research (Saunders, et al, 2009). Further classifications have been suggested, such as; Grounded theory and ethnography (Parrington, 2002).

In relation to this study, primary data was collected through the use of an internet mediated survey consisting primarily closed questions in order to attain quantitative data and 1 open question to gain insight into the samples ranging opinions (see appendix 1). The internet mediated questionnaire was chosen due to the ease of use for both the researcher and the chosen sample furthermore, internet based questionnaires offered a quicker turnaround for the data collection and therefore data analysis (Oppenheim, 2000). It has been argued that online questionnaires create results with less bias, and therefore more reliability (Szolnoki and Hoffmann 2012). The questionnaire was distributed randomly via social media platforms allowing for a wide target audience.

Research Choices

Within the world of social research there is a continuing debate surrounding how research should be conducted to ensure the most effective and reliable conclusions are drawn (Partington, 2002). Blumberg, et al (2008) reinforced the opinion that researchers often favour the use of one of the two contrasting research choices which are known as "Quantitative‟ and "Qualitative‟ research.

In relation to Figure 5 it can be seen that Saunders, et al (2009) indicated that the use of a mixed method can be utilised. The mixed method approach provides the researcher the opportunity to incorporate both choices in order to provide more reliable data and help further validate any themes and trends although the use of this method can be time consuming and provide greater analytical barriers, thus, a mixed method approach was avoided due to time constraints (Congers, 1998).

This study utilises quantitative research for the most part through closed questions via the previously discussed survey, however the survey does include 1 open question in order to better understand participants opinions, as previously stated this will be included within appendix 1 but not analysed due to time constraints

Research time horizons

This layer assesses two different types of time horizon which can be potentially utilised in studies, the two forms are known as "Cross-sectional‟ and "longitudinal‟. Both forms are observational studies, meaning researchers record data about their participants without manipulating the surrounding environment, thus avoiding the creation of biased results or inaccurate data; however there are key differences which influence a researcher‟s choice (Remenyeni, et al, 2005).

Cross-sectional surveys provide a here and now snapshot of the topic area and are done over a shorter period of time, providing low cost and quick results. On the other hand longitudinal approaches often utilise different measurement techniques over a longer period of time, sometimes years, the costs are greater and quite often this method is utilised when assessing individuals rather than a large sample of society (Remenyeni, et al, 2005). On this basis the chosen "time horizon‟ for this study is "cross-sectional‟.

Sampling

Saunders, et al (2009) argued that researchers must make a rational and justified choice of which sample is best suited for the overall study, furthermore it is imperative that an understanding of the correct sampling approach is gained in order to target the correct population sample and size, which in turn increases the chances of collecting relevant and reliable data (Partington, 2002).

Remenyeni, et al (2005) argued the selection of sampling method can greatly influence the subsequent findings and therefore, varying sampling techniques must be considered before beginning data collection. Furthermore Blumberg, et al (2008, p228) states different sampling techniques offer various beneficial affects which also should be considered, possible benefits consist of; speed and efficiency of data collection, low costs and provide greater accuracy.

Emory & Cooper (1981) state the major techniques of sampling consist of convenience, cluster, stratified and systematic sampling. Primary data was collected through random sampling due to the short time frame the study faced. Social media sampling was utilised partly due to large audience reached. Respondents to the survey remained anonymous enabling honest and unbiased results to be collected, thus creating reliable data trends and ultimately reliable conclusions (Saunders et al, 2009). The study‟s sample size was a minimum of 70 participants; as a result this stud will gather 70-100 surveys at random.

Data collection and analysis

The data collected through the online surveys will be processed into Microsoft Excel. Chi squared testing will be utilised. Campbell (2007) praised the reliability and analytical abilities provided through Chi Squares tests, however Campbell (2007) did acknowledge the potential reliability issues in regards to smaller sample sizes. A probability value of p<0.05 was applied to determine the significance of results throughout the analysis. The most significant results were analysed and compared in regards to the demographic factors specified within the hypotheses.

Research Ethics

Saunders, et al. (2009) believes research ethics relates to the overall behaviour of the researcher and the possible effects the research has on the participants. In summary ethics can be referred to as what is considered „right‟ and „wrong‟, which is a subjective concept (Kelemen & Rumens, 2008).

The subject of personal finance can be a sensitive subject to some which is why ethical considerations must be taken into consideration. The main consideration ethically was surrounding confidentiality; to increase participant confidence and not break ethical boundaries the survey is completely anonymous. Full consideration of potential ethical issues can be reviewed within the ethical approval form (Appendix 3).

Methodology summary & limitations

In summary, this research study has adopted a deductive approach within a crosssectional time horizon. By utilising a deductive approach hypotheses were generated through the review of existing literature and theory based on customer loyalty, thus the chosen methodological approach aims to prove or disprove the specified hypotheses. The use of a short internet mediated survey, consisting of 10 statements/questions, broken down into 9 closed and 1 open ended question, providing both quantitive and qualitative data (appendix 1).

The major limitation faced within this study was time frame, which the major contributing factor for the use of an online survey. With such a short time frame from ethical approval to completion, gathering a large sample size proved difficult, thus the sample for this study consisted of 100 participants.

A larger sample size would have been preferred in order to create more reliable data, however time constraints proved influential. Furthermore in relation to time-frame, a qualitative approach could have been further utilised in the form of semi structured interviews with banking staff and customers to further the overall understanding of loyalty and how banks aim to create the concept and what customers expect from their bank.

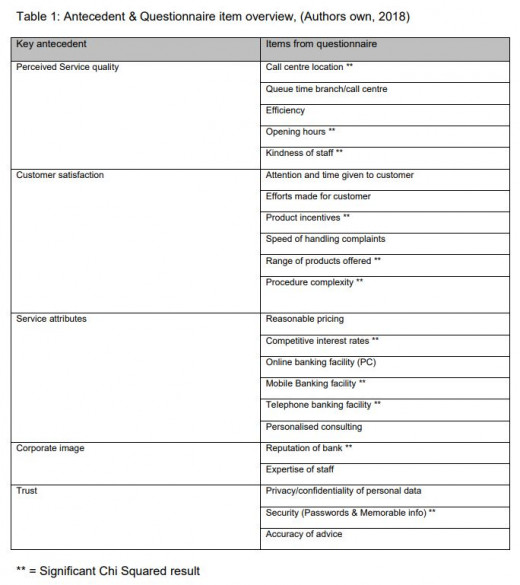

Research findings

As outlined in the prior section, data was gathered using a 10-question questionnaire including numerous matrix questions. These results will now be tested against the hypotheses. The questionnaire questions have been broken down and collated into groups relevant to the antecedents identified, see table 1. Resultantly, this will enable a greater understanding as to which demographic drivers influence the overall antecedents of loyalty in banking. Throughout this data analysis, relevant findings will be explored and analysed to accept or reject the specified hypotheses. Findings from the data will be contrasted against secondary data explored in the literature review.

To test the relevance of the data, chi-squared testing will be utilised. Chi-Square testing can be used to determine how significant the resultant data is, whilst also providing insight as to whether the observed data are in line with the expected data (Lemeshko, 2015). When using the Chi-Squared test, significant findings fall at 0.05% or under, if any results fall below this percentage, it is considered to have significance and will be further discussed.

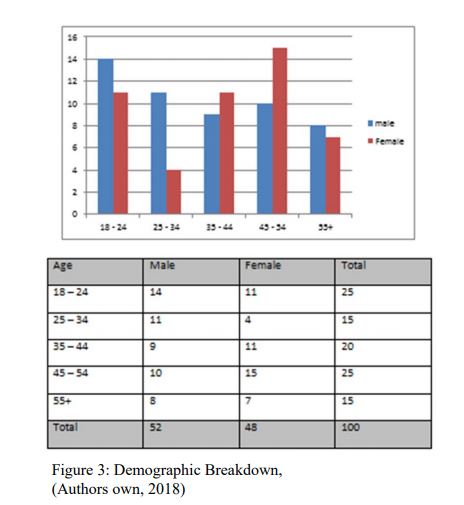

Sample Breakdown & Demographics

Adopting the sampling approach defined in the methodology, a total sample of 100 respondents has been collected at random from across the UK. The sample has been converted into percentage representations to ensure consistency throughout the analysis. Figure “” shows, the total sample of 100, consists of 52 (52.00%) males and 48 (48%) females.

Additionally, the age of participants has been collected in line with the specified hypotheses and has been broken into 6 categories, 18 to 24, which accounts for 33.33% (25), 25 to 34 accounting for 12% (9), 35 to 44 accounting for 16% (12), 45 to 54 accounting for 25.33% (19), 55 to 64 accounting for 10.67% (8) and 65 to 74 accounting for 2.67% (2).

Customer Loyalty Drivers

The customer loyalty antecedent which will be referred to have been identified through previous literature and items from the questionnaire have been categorised alongside the relevant antecedent. (See table 1)

Perceived Service quality

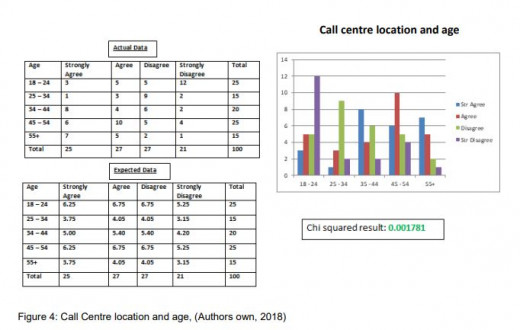

Importance of call centre location – Question 6

Analysing the call centre location element of question 6 helps gain an understanding as to whether different participants find call centre location an important aspect of the banking product. As can be seen there is a significant Chi squared result of 0.001781 in regards to age. The clear result is that older age brackets (34+) agree or strongly agree that call centre location is important (40%) whereas younger people (18-34) disagree or strongly disagree (28%). This could relate to Wood‟s (2004) view that older generations have a reluctance to adopt new methods of banking, therefore utilising a call centre is the primary option, thus, affects them more than that of the younger age brackets. If that is the case this particular driver is very much a behavioural one, as the use of a call centre or an alternative is down to convenience and resembles repeat purchasing/repeat usage.

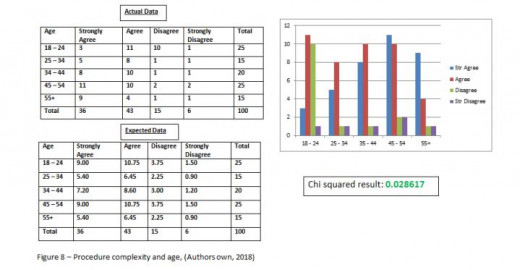

Procedure complexity

Procedure complexity relates to how easy it is for new products to be taken out, such as current accounts, mortgages and loans. Age was the only significant demographic, with a Chi Squared result of 0.028617. It can be suggested from the above results that ease of applying for products is more important for the 3 older age brackets, with 54% agreeing or strongly agreeing, whereas compared with 18-24 year olds and 25-34 year olds 27% agreed or strongly agreed. This again could be pinned against Wood‟s (2004) argument that older people are unwilling to adopt new technologies, so tend to find the application process in branch, long winded due to increased regulation post 2008 financial crash.

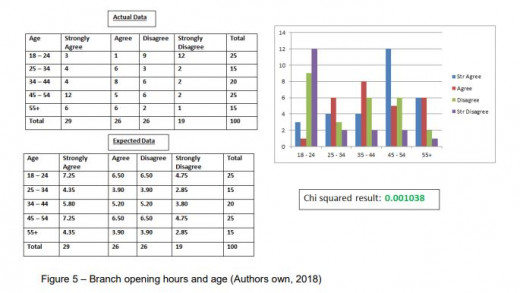

Opening hours of branch

The „opening hours of branch‟ element of Question 7 looks at the views on branch usage. Again, income and Gender returned insignificant results; however age returned a highly significant Chi Squared result of 0.001038, indicating contrasting views between different age groups. Strong disagreement and disagreement was highly prominent with 18-24 year olds (84%) whereas the older brackets of 45-54 and 55+ resulted in high levels of strong agreement and agreement (72.5%). This again, can be related back to lack of intent from older people, to adopt new technologies. Furthermore it has been documented that older people tend to me more habitual and less likely to change, thus, exposing them to less risk (Yoon and Cole, 2008; Zeithaml and Gilly, 1987). This particular driver again seems to be behavioural as repeat behaviour is present and there is a lack of cognitive thinking (Gremler and Brown, 1996).

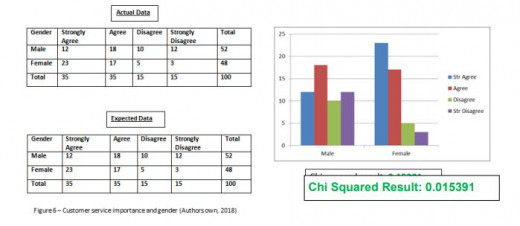

Kindness of staff

Kindness of staff is a key indicator to the overall customer service provided by a bank, whether it is over the phone or in branch. Age and Income returned insignificant results in relation to this driver; however gender returned a significant Chi Squared result of 0.015391 indicating there is contrasting views between men and women of how important customer service and the kindness of staff is. 83% of females agreed or strongly agreed that kind staff is an important aspect of the banking service, whereas only 57% of males agreed. The results of this drive can be related back to the views of Snipes et al (2006) and Bahia et al, (2005) who argued that women tend to value relationships more with a business and show increased willingness to build relationships with employees. This driver falls firmly under the attitudinal approach to loyalty as emotion plays a key aspect.

Service quality Summary

3 of the 5 items relating to service quality in table 1 provided significant chi squared results for both age and gender, therefore for this particular antecedent H1 and H3 are accepted, whereas H2 is rejected as there were no significant results found. As previously touched upon, service quality impacts the willingness to recommend a company (Baker and Crompton, 2000) therefore it can be argued service quality is very much an attitudinal aspect of loyalty.

Customer satisfaction

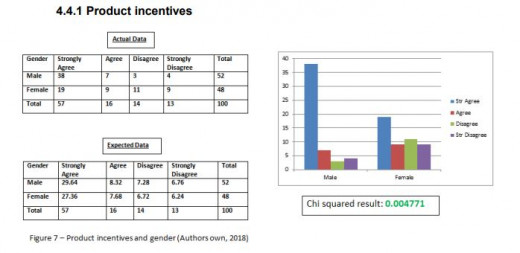

Product incentives

This aspect is analysed considering gender and the importance of product incentives. Gender was the only significant demographic, returning a Chi Squared result of 0.004771. The trends identified within this sample suggest male participants predominantly agree (90%) in some form that product incentives are key to bank loyalty, whereas females were split in terms of opinion. This could suggest males are more willing to switch banking services when new product incentives are release, confirming the view of Bahia, et al (2005) that males lack the means to build lasting relationships with companies and are willing to utilise different providers. Switching behaviour is that of an attitudinal approach, as cognitive thought must play a part (Zins, 2001).

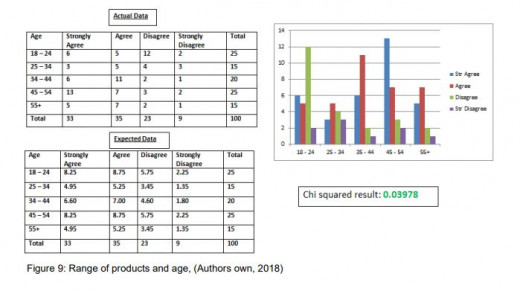

Range of products offered

The range of products offered is a key aspect to creating loyalty, the wider of products means customers have to shop around less to get what they need. Income and gender again returned largely insignificant results, whereas age returned a Chi Squared result of 0.03978. 49% of the older age brackets (34 – 55+) agree or strongly agree that a wide range of products is important. The trends amongst this sample suggest older people value a wider range of products than younger people, indicating intent to be loyal, this again backs up the argument that older people are willing to take less risk (Zeithaml and Gilly, 1987), whereas younger people will shop around to find the products needed. This indicates both composite loyalty traits as older people are willing to repurchase due to convenience but are also willing to build lasting relationships.

Customer Satisfaction summary

3 of the 6 items relating to customer satisfaction provided significant chi squared results for both age and gender, therefore for this particular antecedent H1 and H3 are accepted, whereas H2 is rejected as there were no significant results found.

Service Attributes

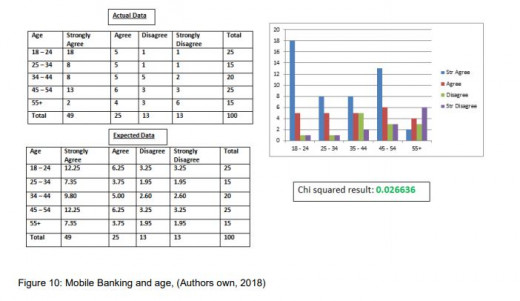

Mobile banking facility

Mobile banking is one of many channels offered by banks in the modern day which enables users to manage their money at their fingertips. Of the 3 demographics analysed only age attained a significant Chi Squared result of 0.026636. The clear trend visible is the importance younger people place on the use and availability of mobile banking. 92% of 18-24 years strongly agreed or agreed that mobile banking is important, whereas 40% of 55+ at least agreed of the importance. This may indicate a reluctance to utilise modern technology and again strengthen the opinions of Wood (2004). A contrasting argument however is that, it is not a reluctance to utilise modern technology but a difficulty in adjusting to the ever changing technology and learning new skills (Im, et al, 2003).

Telephone banking

Telephone banking is a dated method of managing bank accounts and products. However, Age once again, returned significant Chi Squared result of 0.032503. The clear trend with telephone banking is that of the importance the older generation put on the service. The older two age brackets agreed or strongly agreed (33%) with the need for telephone banking, whereas the remaining 3 age brackets account for 32% for agree or strongly agree. These results support the results of figure 10, pointing towards the argument that older people exhibit a reluctant attitude in adopting new technology and therefore stick to what they‟re comfortable with (Wood, 2004). This reluctance can arguably be categorised as an attitudinal trait, as it falls in line with the customer personal preferences towards a product.

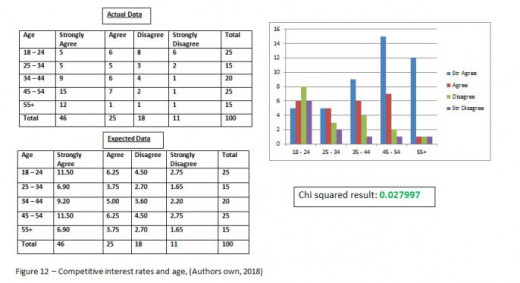

Competitive Interest rates

Interest rates are key part of a banking service; it is the reward a customer receives for taking out services with a provider. The more money with a provider will see higher amounts of interest earned and potentially better rates of interest. Age provided a significant result of 0.027997 indicating a contrasting view between younger and older age brackets. 71% of the entire sample agreed or strongly agreed that interest rates play an important role in banking, of which 35% was achieved by the oldest 2 brackets, whereas in contrast, 21% was achieved by the youngest 2 brackets. No relevant text was reviewed in regards to this particular trend, however, it could be argued that the older age brackets will have a more monetary value within their bank accounts therefore interest rates are more significant to them. Further research is required to fully understand this trend.

Service Attributes summary

3 of the 6 items relating to service attributes provided significant chi squared results for only age, therefore for this particular antecedent H1 is accepted, whereas, H2 and H3 are rejected as there were no significant results found.

Corporate image

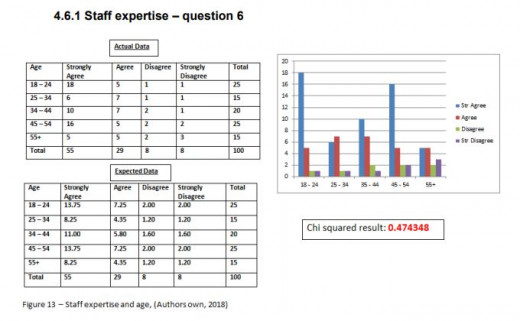

Staff expertise

This question relates to the overall quality of the staff and what level of information they provide, 84% of respondents across all age groups agree or strongly agree that staff expertise impacts the overall image and is key for them in creating loyalty. The Chi squared test brought back an insignificant result, however it is worth pointing out the importance this particular driver plays in the overall corporate image.

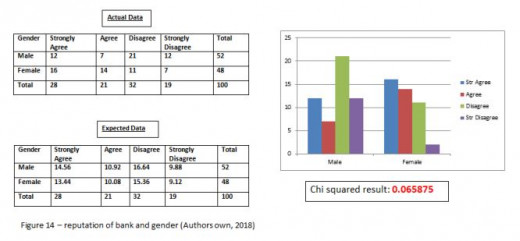

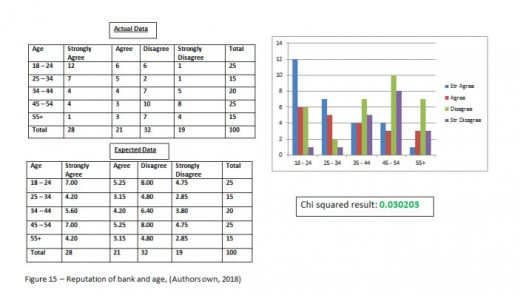

Reputation of bank

The reputation of the bank is a key driver in creating the overall corporate image. The chi squared test in relation to gender returned an insignificant result, however a result of 0.065875 does indicate that there could be contrasting views between men and women and this may need further scrutiny with a larger sample. This is supported by the views of Bahia et al, (2005) who argued that males are more prone to switching behaviour, whereas women will show loyalty at higher levels.

When analysing the data in relation to age, the trend identified indicates younger people care more about the reputation of the bank with 30% of the sample across the youngest two brackets agreeing or strongly agreeing whereas older people are less affected by the overall reputation of the bank with only 11% of the sample agreeing or strongly agreeing across the oldest two brackets. This indicates once again older people are less likely to take risks and move banks, regardless of reputation and are increasingly likely to express loyalty to one bank (Zeithaml and Gilly, 1987)

Corporate image summary

Both items relating to corporate image provided significant chi squared results for only age, although a gender related test did bring back a slightly result, which with more testing may prove significant. For this particular antecedent H1 is accepted, whereas, H2 and H3 are rejected as there were no significant results found.

Trust

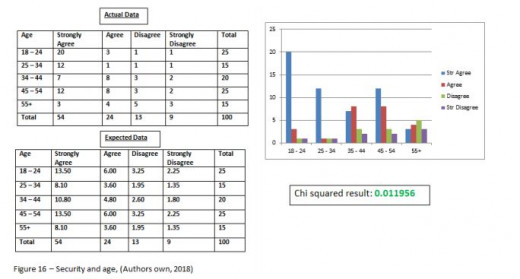

Security (passwords and memorable information)

A significant Chi Squared result of 0.011956 indicated a sharp contrast between younger people and older people in relation to passwords and memorable information. 20% of 55+ strongly agreed at the importance of passwords and memorable information, whereas 80% of 18-24 year olds strongly agreed. This likely signifies the lack of technological adoption older people have taken and links back to figure 5 and figure 10 supporting the results that older people still resort to going into branch rather than utilising new channels such as online banking and mobile banking which require passwords and memorable information.

Accuracy of advice given

A highly insignificant result of 0.983863 in relation to the accuracy of advice given indicates how important the aspect is in creating trust. Inaccurate advice can cause errors and complaints to arise therefore affecting the overall service quality.

Privacy and confidentiality

Chi Squared testing did not provide any significant results however it is worth mentioned that 100% of the sample agreed or strongly agreed that security in regards to their personal information was an important aspect of trust and loyalty towards banks, providing support to the proposed framework (figure1) and the suggestion that loyalty cannot exist without trust.

Trust Summary

1 of 3 items brought back a significant chi squared result in relation to age. For this particular antecedent H1 is accepted, whereas, H2 and H3 are rejected as there were no significant results found.

Final discussion

Age and antecedents

Summarising, hypotheses 1 outlined within the methodology has been positively proven through Chi Squared testing of numerous drivers. Underpinning this, the findings have indicated that older people do reject the new channels of banking, such as online and mobile, and exhibit habitual behaviours by utilising older and outdated methods such as telephone banking and utilising branches. Younger people show an increased willingness to use digital channels and abandon the older and more costly channels, therefore potentially being a more profitable demographic. However, older people were significantly more likely to exhibit loyalty which was in line with the views of Zeithaml and Gilly, (1987).

A potential recommendation for banks in relation to the older demographic would be to introduce educational material which could present the necessary knowledge and confidence to move away from the older channels

Age affected each one of the 5 identified antecedents in some way; the results showed a significant difference between the needs and expectations of younger age groups in comparison to the older age groups. Subsequently to create loyalty for differing age groups, consideration of all relevant needs must be taken into account.

Based on the age orientated results, it can be evidently stated that age does significantly affect customer loyalty drivers.

Gender and antecedents

Summarising, hypotheses 3 outlined within the methodology has been positively proven through Chi Squared testing of numerous drivers. Underpinning this, the findings have indicated that women express higher levels of loyalty, whereas males exhibit higher levels of switching behaviour (Bahia, et al, 2005)

Gender affected 2 of the 5 outlined antecedents in some way; the results indicated differences between the needs and expectations of males and females.

Based on the gender orientated results, it can be evidently stated that gender does affect customer loyalty drivers.

Income and antecedents

There was no significant result to report regarding income and the impact it has on loyalty drivers, therefore H2 must be rejected.

conclusion

To conclude this research study into the antecedents of loyalty towards bank and whether age, gender and income affect the identified antecedents and the relative items (see table 1), numerous key findings have been identified and supported by the academic literature discussed within the literature review. Significantly, two of the three hypotheses were accepted through rigorous Chi Squared testing of the multiple drivers and the relative items. These results indicated a positive correlation with existing research, helping support arguments raised throughout the analysis section. It is to be acknowledged that through analysis it can be accepted that the key antecedents which create loyalty within the banking sector are impacted by age and gender.

A deductive approach was selected utilising a cross sectional time horizon. Through the use of previous studies and relevant literature, the literature review was established, and from the reviewed literature 3 hypotheses were generated and tested through a 10 question questionnaire (Appendix 1), of which a 4 tiered Likert scale was utilised. The sample audience was attained through random sampling utilising social media to reach a wide range of individuals from different backgrounds; a sample size of 100 was achieved consisting of 48 females and 52 males, from varying ages (figure 2). Analysis of the data was done through Chi Squared testing, which helped identify any significant results.

Concluding the data analysis, it can be identified that bank loyalty is made up of the identified 5 antecedents, all of which interlink and affect the other. It has been identified, Income does not play any significant role in affecting the overall loyalty within the banking industry, as there were no significant results found through chi squared testing.However through Chi Squared testing, it was identified either age and gender affected all 5 antecedents in some way.

The results achieved indicate loyalty towards banks as highly attitudinal amongst women and older age brackets, the willingness to create relationships is very much attitudinal as they feel a part of the company, behavioural views work off the premise of repeat purchases only and do not take into consideration the thoughts, values and beliefs of customers.

Demographically, it was identified that predominantly younger males showed less overall loyalty to banks, and were often swayed by competitor incentives; this is supported by the statistics showing how many banks younger males have been with over the last 10 years and the statistics surrounding how important customer incentives are.

Furthermore, another interesting progression of learning which can be taken from the current study is that loyalty is incredibly subjective concept as it changes based on a person‟s age and gender.

Research Limitations

The major limitation faced throughout this study was that of time constraints, this study was conducted through a cross sectional method over 5 months, whereas utilising a longitudinal method over a longer time frame would have helped increase the understanding of what drives loyalty in banking and how demographic factors influence this. Furthermore, to get a more in depth representation of demographic factors throughout the sample, additional factors could have been considered, such as competency in regards to technology and education level which was previously mentioned.

In regards to competency with technology it could have been identified whether there was a trend with the older people and lack of adoption of new channels, further backing up the arguments raised. In regards to educational level, this again could have supported the claims raised in the literature review that with a higher level of education comes with lower levels of loyalty due to an increased level of cognitive thinking.

Questionnaire design was also an issue; due to time constraints a sample questionnaire was never distributed meaning the effectiveness of the questions was never determined and could have been more efficiently designed to make analysis more effective. A mixed method design also could have provided more insight into people‟s attitude towards bank furthering the theory around attitudinal loyalty. As loyalty is a subjective concept, individuals opinions would have proven valuable in understanding why people the way they do.

The available literature surrounding customer loyalty was considerably outdated, and there seems to be a lack of modernised and relevant data.

Finally, Chi Squared testing can become unreliable when the number of observations is below 5. On numerous occasions this was the case, meaning some data may be unreliable due to small sample size.

Recommended Further Research

Customer loyalty has been studied considerably over the last 30 years, but for some reason modern and relevant interpretations of past studies do not exist. Thus, it is suggested, previous studies to be redone in today‟s technology driven environment to gain a better understanding of just how loyalty has changed. Consideration of corporate social responsibility (CSR) is also recommended for future research as this may prove significant in the creation of loyalty in today‟s heavily regulated business environment.

References

- Ameen, E., Guffey, D. and McMillan, J. (1996), “Gender differences in determining the ethical sensitivity of future accounting professionals”, Journal of Business Ethics, 15(5), 591-597.

- Bahia, K., Perrien, J. and Tomiuk, M. (2005), “Some antecedents and consequences of the client’s relational predisposition: an application to the retail banking industry”, Proceedings of the AMA SERVSIG Research Conference, Singapore: National University of Singapore, 2-4 June.

- Baker, D. A., & Crompton, J.L. (2000). Quality, satisfaction and behavioural variables. Annals of Tourism Research, 27(3), 780-805

- Baltes, L. P. (2016). Digital marketing mix specific to the IT field. Bulletin of the Transilvania University of Brasov. Economic Sciences. Series V, 9 (1), 33-44. Available from http://search.proquest.com/docview/1833104052?accountid=11526

- Barrow, R. (2013). Empirical Research in Education: Why Philosophy Matters. In William Hare & John Portelli (Eds.), Philosophy of Education/ Alberta: Brush, Alberta.

- Blaikie, N. (2012). Approaches to social enquiry, Cambridge, polity - Bloemer J, Ruyter K, Peeters P. 1998. Investigating drivers of bank loyalty: the complex relationship between image, service quality and satisfaction. International journal of Bank Marketing 16(7): 276-286.

- Bove, LL, Pervan, SJ, Beatty, SE., Shiu, E.: Service worker role in encouraging customer organizational citizenship behaviors. Journal of Business Research 62(7), 698-705 (2009)

- Bravo, R., Montaner, T. & Pina, J.M. (2010): Corporate brand image in retail banking: development and validation of a scale. The Service Industries Journal, 30(8), 1199-1218

- Campbell, I. Chi-squared and Fisher-Irwin tests of two-by-two tables with small sample recommendations. Statistics in Medicine, 26, 3661–3675, (2007).

- Carpenter, J. M. (2008). Consumer shopping value, satisfaction and loyalty in discount retailing. Journal of Retailing and Consumer Services, 15(5), 358-363. http://dx.doi.org/10.1016/j.jretconser.2007.08.003

- Caruana, A. (2002). Service loyalty. The effects of service quality and the mediating role of customer satisfaction. European Journal of Marketing, 36 (7/8), 811-828.

- Cooil, B., Keiningham, T., Aksoy, L. and Hsu, M. (2007), “A longitudinal analysis of customer Satisfaction and share of wallet: investigating the moderating effect of customer characteristics”, Journal of Marketing, 70(4), 67-83.

- Conger, J.A. 1998. Qualitative research as the cornerstone methodology for understanding leadership. Leadership Quarterly, 9(1), 107-120. 63 63

- Coyne, K. P (1989). Beyond service fads: Meaningful strategies for the real world. Sloan Management Review, 30, 69-76.

- Cunningham, Scott M. 1966. "Brand Loyalty--What, Where, How Much?" Harvard Business Review 34 (January-February): 116-128.

- Day, G.S. (1969). A Two-Dimensional Concept of Brand Loyalty. Journal of Advertising Research, 9(3), 29-35

- Delgado-Ballester, E., Munuera-Aleman, J. and Yague-Guillen, M. (2003). Development and Validation of a Brand Trust Scale, International Journal of Market Research, Vol. 45, Issue. 1, pp. 35-56.

- Dick, A. S., & Basu, K. (1994). Customer Loyalty: Toward an Integrated Conceptual Framework. Journal of the Academy of Marketing Science, 22(2), 99-113.

- Doney, P. M. and Cannon, J. P. (1997). An Examination of the Nature of Trust in Buyer-Seller Relationship. Journal of Marketing, 61, 35-51.

- Drake C, Gwynne A, Waite N. 1998. Barclays life customer satisfaction and loyalty tracking survey: a demonstration of customer loyalty research in practice. International Journal of Bank Marketing 16(7): 287-292

- Easterby-Smith, M., Thorpe, R. and Jackson, P. (2014) Management Research. 4th Ed. London: SAGE Publications Ltd.

- Emory, W., & Cooper, D. R. (1991). Business research methods (4th ed.). Homewood, IL: Irwin.

- Filser M (1994). Le comportement du consommateur. Collection Précis de Gestion. Dalloz. Paris - Fischer, E., and Arnold, S. (1994), “Sex, gender identity, gender role attitudes, and consumer behavior”, Psychology & Marketing, 11(2), 163-182.

- Fogli, L. (2006). Customer Service Delivery. San Francisco: Jossey-Bass.

- Foster, B.D. and Cadogan, J.W. (2000). Relationship selling and customer loyalty: an empirical investigation. Marketing Intelligence and Planning, 18 (4), 185-99.

- Gillespie,N and Hurley,R.(2013), “Trust and the global financial crisis”, in Bachmann,R and Zaheer,A (Eds), Handbook of Advances in Trust Research, Edward Elgar, Cheltenham, pp. 177- 203. 64 64

- Grayson,K.,Johnson,D and Chen,D. F.R.(2008), “Is firm trust essential in a trusted environment ? How trust in the business context influences customers”, JournalofMarketingResearch,Vol.45No.2, pp. 241-256.

- Greener, S. (2008), an introduction to business research methods, Copenhagen: Ventus publishing

- Gremler, D.D. and Brown, S.W. (1996), “Service loyalty; its nature, importance and implications”, in Edvardsson, B., Brown, S.W., Johnston, R. and Scheuing, E. (Eds), QUIS V: Advancing Service Quality: A Global Perspective, ISQA, New York, NY, pp. 171-81.

- Gronroos, C. (1983). “Seven key areas of research according to the Nordic School of Service Marketing”, In Berry, L. Shotack, G.L. and Upah, G.D. (Eds), Emerging Perspectives on Services Marketing, American Marketing Association, Chicago, 108-110.

- Guest, L.P. (1944), "A Study of Brand Loyalty," Journal of Applied Psychology, Vol. 28, pp. 16-27. - Hammond, M., & Wellington, J. (2013; 2012). Research methods: The key concepts. GB: Routledge Ltd. doi:10.4324/9780203097625

- Heinonen, K., 2007. Conceptualising online banking service value. Journal of Financial Services Marketing, 12 (1), pp. 39-52. Available from: https://www.researchgate.net/publication/240232937_Conceptualising_online_banking_servic e_value

- Hurley, R.F., Gong, X. and Wagar, A. (2014), “Understanding the loss of trust in large banks”, International Journal of Bank Marketing, Vol. 32 No. 5, pp. 348-366.

- Im, S., Bayus, B. and Mason, C. (2003), “An empirical study of innate consumer innovativeness, personal characteristics, and new-product adoption behavior”, Journal of the Academy of Marketing Science, 31(1), 61-73.

- Jacoby, J. and Chesnut, R. W. (1978); “Brand Loyalty Measurement and Management”, Wiley, New York, NY

- Jacoby, J., & Kyner, D.B. (1973). Brand Loyalty versus Repeat Purchasing Behavior. Journal of Marketing Research, 10(1), 1-9. http://dx.doi.org/10.2307/3149402

- Jarvinen, R.A. (2014), “Consumer trust in banking relationships in Europe”, International Journal of Bank Marketing, Vol. 32 No. 6, pp. 551-566.

- Javalgi, R. and Moberg, C. (1997), “Service loyalty: implications for service providers”, The Journal of Services Marketing, Vol.11, 3, pp.165-179;

- Kelemen, M., & Rumens, N. (2008). An introduction to critical management research. Los Angeles, [Calif.]; London; SAGE. 65 65 - Kumar, R. (2014) Research methodology, (4th ed.), Los Angeles, Sage publications

- Kumar V., Shah D., Venkatesan R.: Managing Retailer Profitability-One Customer at a Time. Journal of Retailing 82(4), 277-294 (2006) - Kotler, P. and Keller, K.L. (2006), Marketing Management -12th Edition, Pearson-Prentice Hall, New Jersey.

- Lam, S.Y., Shankar, V., Erramilli, M.K., Murthy, B.: Customer value, satisfaction, loyalty, and switching costs: an illustration from a business-to-business service context. Journal of the Academy of Marketing Science 32(3), 292-310 (2004)

- Lam,R & Burton, S (2006) "SME banking loyalty (and disloyalty): a qualitative study in Hong Kong", International Journal of Bank Marketing, Vol. 24 Issue: 1, pp.37-52

- Lewis, B., Soureli, M., 2006. The Antecedents of Consumer Loyalty in Retail Banking. Journal of Consumer Behaviour, 5 (1), pp. 15-31. - Markham, S., Gatlin

- Watts, R., & Cangelosi, J. (2006). The Internet and Its Relationship to Buyer Behavior Theory. Journal of Internet Commerce, 5 (1), 69-86. doi: 10.1300/J179v05n01_04

- Matthews, B. & Ross, L. (2010). Research methods: a practical guide for the social sciences (1st ed.). Harlow: Longman. - Methlie, L., Nysveen, H., 1999. Loyalty of On-line Bank Customers. Journal of Information technology, 14 (4), pp. 375-386.

- Meyers-Levy, J., and Sternthal, B. (1991), “Gender differences in the use of message cues and judgments”, Journal of Marketing Research, 28, 84-96.

- Mittal, B. and Lassar, W. (1998) "Why do customers switch? The dynamics of satisfaction versus loyalty", Journal of Services Marketing, Vol. 12 Issue: 3, pp.177-194

- Mittal, V. and Kamakura, W. (2001), “Satisfaction, repurchase intent, and repurchase behavior: investigating the moderating effect of customer characteristics”, Journal of Marketing Research, 38(1), 131-142.

- Ndubisi, N. (2006), “Effect of gender on customer loyalty: a relationship marketing approach”, Marketing Intelligence & Planning, 24(1), 48-61.

- Nguyen N., LeBlanc G.: The mediating role of corporate image on customers’ retention decisions: an investigation in financial services. International Journal of Bank Marketing 16(2), 52-65 (1998)

- Oliver, R. L. (1997). Satisfaction: A Behavioral Perspective on the Consumer. New York: McGrawHill. 66 66 - O’Malley, L. (1998) "Can loyalty schemes really build loyalty?", Marketing Intelligence & Planning, Vol. 16 Issue: 1, pp.47-55, https://doi.org/10.1108/02634509810199535

- Palan, K. (2001), “Gender identity in consumer behavior research: a literature review and research agenda”, Academy of Marketing Science Review, 10, 1-31.

- Papadopoulou, P., Andreou, A., kanellis, P. and Martakos, D. (2001). Trust and relationship building in electronic commerce. Internet Research: Electronic Networking and Policy, 11 (4), 322-332

- Parasuraman, A., Zeithaml, V. A., Berry, L. L., 1988, SERVQUAL: A MultipleItem Scale for Measuring Consumer Perceptions of Service Quality, Journal of Retailing, [Online] 64 (1), pp. 12- 40. Available at: http://search.ebscohost.com.ipacez.nd.edu.au/login.aspx?direct=true&db=buh&AN=6353339& site=ehost-live [accessed 11 June 2018].

- Patterson, M., O'Malley, L., and Evans, M. (1997), “Database marketing: investigating privacy concerns”, Journal of Marketing Communications, 3(3), 151-174 - Partington, D. (2002;2005;). Essential skills for management research. London: SAGE

- Rai, A. and Medha, S. (2013), The Antecedents of customer loyalty; an empirical investigation in life insurance context. Journal of competiveness, 5(2) pp 139-163

- Remenyi, D., Williams, B., Money, A., & Swartz, E. (2005). Doing Research In Business Management (3rd ed.). London: SAGE Publications.

- Ribbink, D., van Riel, A., Liljander V., Streukens, S., 2004. Comfort your Online Customer: Quality, Trust and Loyalty on the Internet. Managing Service Quality, 14 (6), pp. 446-456.

- Roxas, M. and Stoneback, J. (2004), “The importance of gender across cultures in ethical decision-making”, Journal of Business Ethics, 50(2), 149-165.

- Saunders, M., Lewis, P., & Thornhill, A. (2009) Research Methods for Business Students (5th ed.). Essex: Pearson Education Limited. - Saunders, M., Lewis, P., and Thornhill A. (2012) Research Methods for Business Students (6th ed.). Essex: Pearson Education Limited.

- Shim, S., Serido, J. and Tang, C. (2013), “After the global financial crash: individual factors differentiating young adult consumers’ trust in banks and financial institutions”, Journal of Retailing and Consumer Services, Vol. 20 No. 1, pp. 26-33.

- Snipes, R., Thomson, N. and Oswald., S. (2006), “Gender bias in customer evaluations of service quality: an empirical investigation”, Journal of Services Marketing, 20(4), 274-284. 67 67 - Statista. (2016). Number of internet users worldwide from 2005 to 2016 (in millions). Viewed 12 June 2018,< https://www.statista.com/statistics/273018/number-of-internet-usersworldwide/>

- Szolnoki, G., Hoffmann, D. (2012). Consumer segmentation based on usage of sales channels on the German wine market. In: Paper Presented on the International Conference on Innovation & Trends in Wine Management, Dijon, France.

- Terblanche, N.S., & Boshoff, C. (2006). A generic instrument to measure customer satisfaction with the controllable elements of the in-store shopping experience. South African Journal of Business Management, 37(3), 1-14. - The Economist. (2017). The elderly, cognitive decline and banking. [online] Available at: https://www.economist.com/finance-and-economics/2017/02/11/the-elderly-cognitivedecline-and-banking [Accessed 16 Jul. 2018].

- Wood, L. (2004), “Dimensions of brand purchasing behaviour: Consumers in the 18–24 age group”, Journal of Consumer Behaviour, 4(1), 9-24.

- Wilson, J. (2010) “Essentials of Business Research: A Guide to Doing Your Research Project” SAGE Publications

- Yoon, C., Cole, C. AND Lee, M. (2009). Consumer decision making and aging: Current knowledge and future directions. Journal of Consumer Psychology, 19(1), 2-16.

- Zeithaml, V. and Gilly, M. (1987), “Characteristics Affecting the Acceptance of Retailing Technologies: A Comparison of Elderly and Non-Elderly Consumers”, Journal of Retailing, 23 (Spring), 49-68.

- Zins, H. (2001) "Relative attitudes and commitment in customer loyalty models: Some experiences in the commercial airline industry", International Journal of Service Industry Management, Vol. 12 Issue: 3, pp.269-294, https://doi.org/10.1108/EUM0000000005521