Currency Markets - Part One

You may know a lot about forex trading or the forex markets or even know the difference between a bid and offer rate. But, how much do you know about the history of forex trading? This article is going to give you an overview of the history of forex trading leading up to the early 1960’s. It is going to look at the events that shaped the foreign exchange markets.

Barter

Before paper money became a medium of exchange the barter exchange allowed people to exchange both goods and services. For example a farmer might exchange grain for firewood or a cow for food. Even today international barter systems remain in use throughout the world. Sometimes in a quite sophisticated fashion. Nevertheless it was the introduction of paper money that allowed the development of sophisticated international commerce by establishing a set of common characteristics for the money for all countries.

Characteristics of Money

Portability: Money must be easily moved. While a building represents wealth it is not in itself money.

Divisibility: Money has sufficient value of size and denomination to accommodate trade.

Convertibility: Money is readily accepted as a medium of exchange for goods and services by all parties.

The Gold Standard System

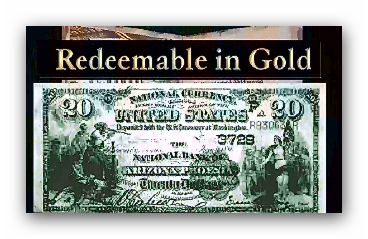

Precious metals in the form of gold or silver coins were a perfect example of early types of money. An important concept of early paper money was that it was backed by gold or silver. The holder could request convertibility to gold at any time. Ultimately people’s faith in the value of paper money was linked to the underlying value of hard assets in each country. In fact the gold standard ensured the soundness of everybody’s money and controlled inflation as well.

When a holder of paper money in the U.S. found the value of his dollar holdings falling in terms of gold he could exchange dollars for gold. This had the effect of reducing the amount of dollars in circulation. As the supply of dollars fell its value stabilized and then rose. Thus the exchange of dollars for gold reserves was reversed. As long as the discipline of linking each countries currency to reserves of gold the simple economics of supply and demand would dictate both currency valuation and the economics of each country. Money supply was linked to the success of the economy and the ability of the country to retain reserves of gold.

The gold standard system of exchange sounds ideal. Currency values linked to a universally recognised store of value, with low interest rates and virtually no inflation, yet the gold standard ended in the early 1930’s. Why did the world’s monetary authorities move away from the gold standard?

The answer lies in one word ‘leverage’. The conservative monetary policies of the world in the first half of the 20th century could not accommodate the growing needs of the world’s economy. People could not afford to by such luxury items as cars, fridges and houses with the cash balances they had. A cash balance would only buy you a part of a car, or a fridge and an even smaller piece of a house. Today we casually use our credit cards to buy things we need, or we obtain a loan to buy a house or a car to leverage our current and future income streams. Imagine how unsatisfying it would be not be able to buy items which would enhance our life styles. We think nothing of obtaining a loan and making monthly payments out of our cash reserves.

Let’s look at an example of finance leverage. If you bought a house for $200,000 with a down payment of 10% and an annual price increase of 10%, what do you think would be your return on capital? It would be 100% because you only spent $20,000 in cash for your down payment and the increase in price over one year is also $20,000 so your return on your capital investment of $20,000 is 100%.

From then on the amount of money in circulation equalled the amount of the gold reserves plus the amount of credit in the market. Increased credit also increases the money supply.

Bretton Woods

In 1944 the post war system of international monetary exchange was established at Bretton Woods in New Hampshire. The intent was good to create a gold based value of the American dollar and the British pound and linking other major currencies to the dollar allowing small fluctuations of about 1% in value. The International Monetary Fund was established to lend foreign currency to members who required assistance. In fact the IMF was funded by its members according to their wealth. Gold was pegged at $35 an ounce and other currencies were pegged to the dollar. Under this system inflation was precluded. In the years following the war the western economies grew. While the amount of gold held in the US central reserves system remained constant. The supply of dollars grew and in fact the increased supply of dollars in Europe funded post war reconstruction. The extension of US multinational companies in Europe led to greater dollar reserves in Europe. In fact the amount of dollars in Europe became greater than the gold supply in the States.

The History of the Foreign Exchange Markets Part 2 looks at the early 1960’s to the present day system of floating exchange rates.