How to Plan a Market Study for Product Launch?

How to Plan a Market Study

Industry Analysis

Markets and Industries: What’s the Difference?

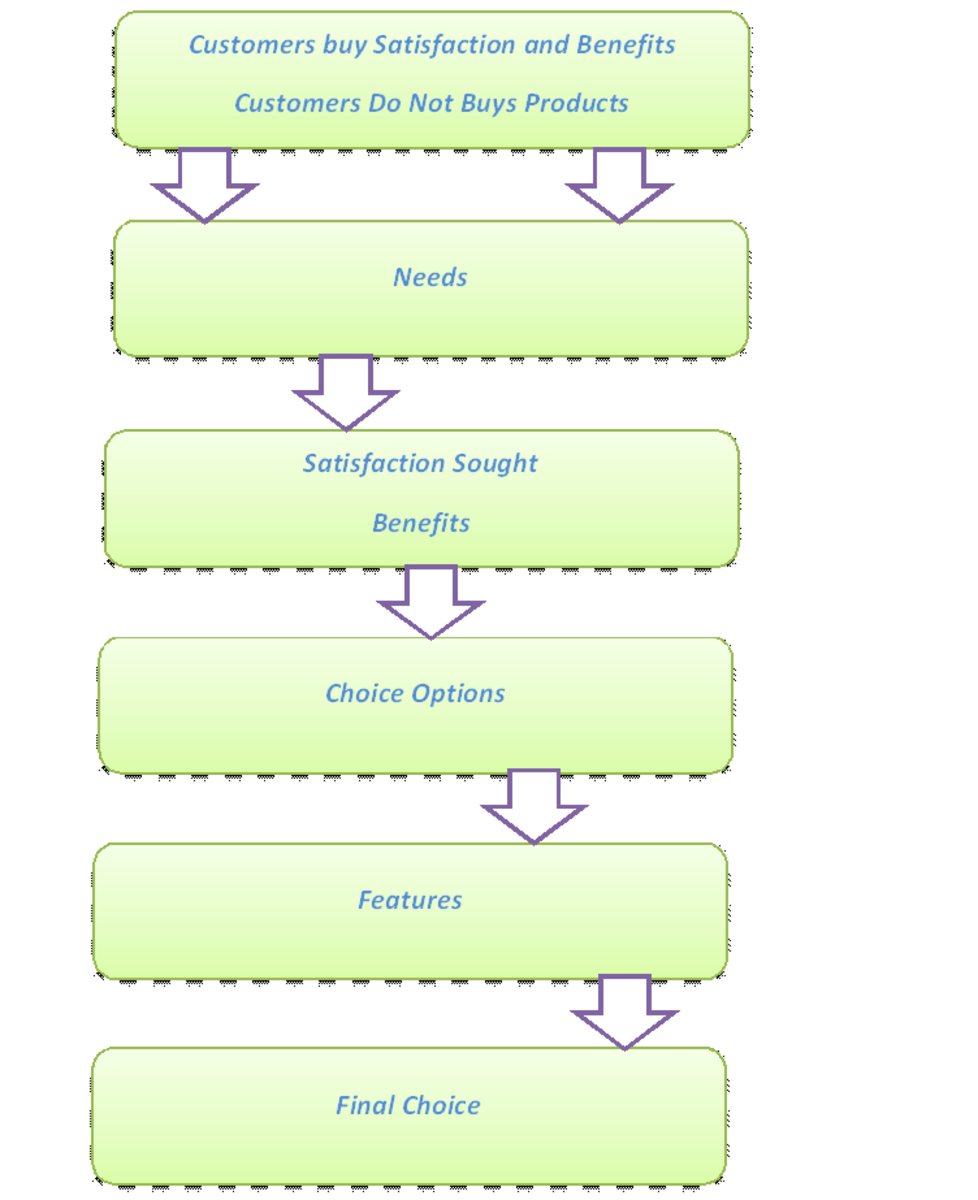

A market is defined as being comprised of individuals and organizations that are interested and willing to buy a good or service to obtain benefits that will satisfy a particular need or want and who have the resources to engage in such a transaction. An industry is a group of firms that offer a product or class of products that are similar and are close substitutes for one another.

Defining Marketsand Industries: Levels of Analysis

Assessing the attractiveness of markets and industries requires clarity about which consumers and which of their needs or which sellers of which products are to be included in the assessment. Confusion between market and industry can result since consumer needs are often thought of in product terms – ‘I’m hungry. I need a candy bar.’ – in the same way that industries are typically described by the products they sell. Thus, markets are often defined both in demographic and/or geographic terms (who and/or where the customers are) and in terms of a particular good or service demanded by the consumer, expressed at the generic category, product class, or product type level.

Challenges in Market and Industry Definition

Markets and industries can be defined at several levels of analysis: generic category, product class, and product type are most common. The level chosen fora particular analysis can have important implications for strategic and marketingplanning

Most marketers select product type as their level of analysis for marketing planning because, while products within a product type may serve different subsets of needs, they are typically close substitutes for one another. The product type level of aggregation is considerably more sensitive than the other levels to environmental changes – such as those driven by macro trends, as discussed in that create opportunities or threats for individual product market entries.

The best way to avoid ill-advised temptation or confusion over how broadly or narrowly to define one’s market and industry is to carefully examine both one’s market and one’s industry .It’s also important to take the time to think both broadly and narrowly in defining and examining the attractiveness of one’s industry and one’s immediate competitive environment.

The Market Is Attractive: What About the Industry?

As consumers and businesspeople have become hooked on cell phones, the market for mobile communication has grown rapidly. By most measures, this is a large, growing, and attractive market in time can best be judged by analyzing its driving forces, its critical success factors and the degree to which a management team can perform on these factors, and especially the five major competitive forces: rivalry among present competitors, potential competitors, the bargaining power of suppliers, the bargaining power of buyers, and the threat of substitute products.

Driving Forces

Just as macro environmental trends are important in shaping market attractiveness, they are similarly important in shaping the attractiveness of industries. Michael Porter calls these trends driving forces. These include (1) changes in the industry’s long-term growth rate, which directly affect investment decisions and intensity of competition; (2) changes in key buyer segments, which affect demand and strategic marketing programs; (3) diffusion of proprietary knowledge, which controls both the rate at which products become more alike and the entry of new firms; (4) changes in cost and efficiency, derived from scale and learning effects, which have the potential of making entry more difficult; and (5) changes in government regulations, which can affect entry, costs, bases of competition, and profitability. Collecting and examining trend data in each of these areas helps an entrepreneur or marketer determine whether an industry is sufficiently attractive to enter or remain in and helps shape strategic marketing decisions that enable the firm to compete effectively.

Porter’s Five Competitive Forces

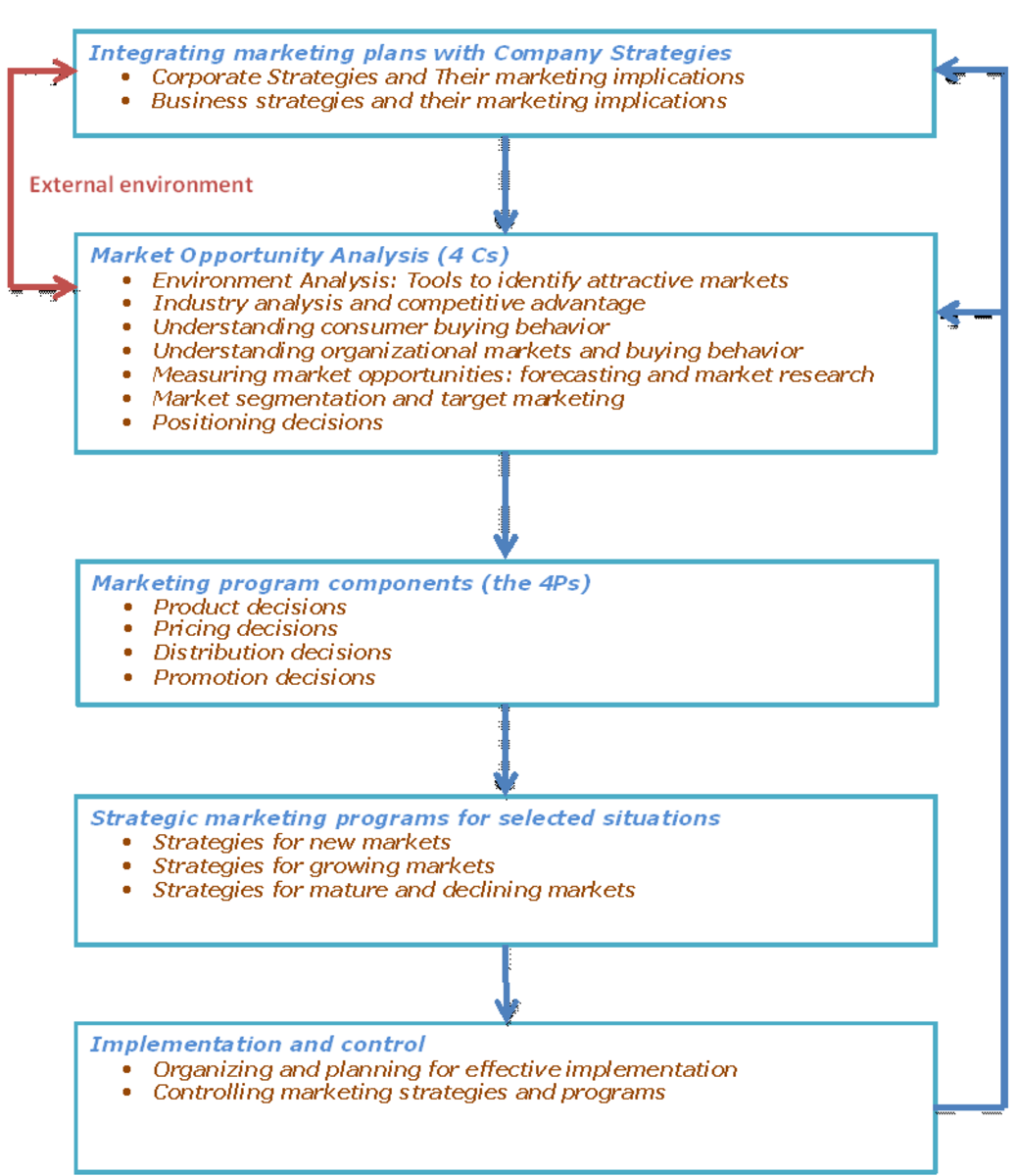

Five interactive competitive forces collectively determine an industry’s long-term attractiveness: present competitors, potential competitors, the bargaining power of suppliers, the bargaining power of buyers, and the threat of substitute products. This mix of forces explains why some industries are consistently more profitable than others and provides further insights into which resources are required and which strategies should be adopted to be successful.

The strength of the individual forces varies from industry to industry and, over time, within the same industry. In the fast-food industry the key forces are present competitors, substitute products, and buyers who are concerned about health and nutrition and who see fast foods as a symbol of a throwaway society.

The major forces that determine industry attractiveness

- · Threat of new entrants

- · Bargaining power of suppliers

- · Rivalry among existing industry firms

- · Bargaining power of buyers

- · Threat of substitute products

Changing Competition and Industry Evolution

Most products and product categories pass through a series of stages in their life cycles: introduction, growth, shakeout, maturity, and decline. All five competitive forces just discussed are affected by the passage of time; therefore, their strength varies as the industry passes from its introductory stage to its growth stage and on to maturity, followed by decline. Competitive forces are apt to be weakest during the fast growth period; thus, there are substantial opportunities for gaining market share. During the shakeout period, competitive forces are at their strongest, and many competitors are forced to exit the industry. During maturity, competition typically slackens, but only if the industry leader holds a strong relative share position. An industry will experience more price competition during maturity if the leader holds a weak relative share position.

Critical Success Factors

The critical success factors that differentiate between the success and failure of firms within an industry differ from industry to industry. These factors often are concerned with one or more of the elements in the marketing mix – product (e.g., the capability to generate successful new products), price (be a low-cost producer), place (obtain widespread product distribution), and promotion (strong relationships with large customers). As the old saying goes in the retailing industry, only three things are critical to success: location, location, and location. Thus, location, a potentially powerful source of competitive advantage, often makes the differences between which retailers are successful and which are not.

Market in Hubpages

- Strategic Marketing Plan Example

WINDOWS COMPANYSTRATEGIC MARKETING PLAN TABLE OF CONTENTS ... - Marketing Plan Template Examples & Sample-Outline of...

Marketing plan template can help you make your own business marketing plan more effective and efficient.Most of the important sections for writing a marketing plan has been discussed in this article.Not necessarily you have to follow or address all t - How to Write Marketing Plan Strategic | Sample & Exa...

Marketing plan is one of the most important plan that you need to write with due care in order to align your marketing with you business strategy.All the basic requirements for writing a strategic marketing plan has been focused in this article.

Innovation

The Adoption Process

The adoption process involves the attitudinal changes experienced by individuals from the time they first hear about a new product, service, or idea until they adopt it. Not all individuals respond alike; some tend to adopt early, some late, and some never. The five stages in the adoption process are awareness, interest, evaluation, trial, and adoption:

1 Awareness -In this stage, the person is only aware of the existence of the new product and is insufficiently motivated to seek information about it.

2 Interest - Here the individual becomes sufficiently interested in the new product but is not yet involved.

3 Evaluation -This is sometimes referred to as the mental rehearsal stage. At this point, the individual is mentally applying the new product to his or her own use requirements and anticipating the results.

4 Trial - Here the individual actually uses the product, but, if possible, on a limited basis to minimize risk. Trial is not tantamount to adoption; only if the use experience is satisfactory will the product stand a chance of being adopted.

5 Adoption - In this stage, the individual not only continues to use the new product but also adopts it in lieu of substitutes.

The Rate of Adoption

If plotted on a cumulative basis, the percentage of people adopting a new product over time resembles an S curve. Although the curve tends to have the same shape regardless of the product involved, the length of time required differs among products – often substantially.

The time dimension is a function of the rate at which people in the target group (those ultimately adopting) move through the five stages in the adoption process. Generally, the speed of the adoption process depends on the following factors:

- • the risk (cost of product failure or dissatisfaction);

- • the relative advantage over other products;

- • the relative simplicity of the new product;

- • its compatibility with previously adopted ideas;

- • the extent to which its trial can be accomplished on a small-scale basis; and

- • the ease with which the central idea of the new product can be communicated.

Implications of Diffusion of Innovation Theory for Forecasting Sales of New Products and New Firms

Optimistic entrepreneurs or new product managers sometimes wax euphoric about the prospects for the innovations they plan to bring to market. They naively forecast that their innovations will capture 10 per cent or 20 per cent of the market in its first year. How likely is it that a truly innovative new product, even a compellingly attractive one, will win all of the innovators plus most of the early adopters in its first year on the market? History suggests that such penetration levels are rare at the outset.

Rate of Diffusion of Innovations: Another Factor in Assessing Opportunity Attractiveness

Before entrepreneurs or established marketers invest in the development and introduction of an innovation, they should evaluate how rapidly the innovation is likely to be adopted by the target market. The faster the adoption rate, the more attractive an innovative good or service is to the marketer, as competitors are caught short while consumers build loyalty to the new product. Diffusion of innovation theory seeks to explain the adoption of a product or service over time among a group of potential buyers. Lack of awareness and limited distribution typically limit early adoption. As positive word about the product spreads, the product is adopted by additional consumers. Diffusion theory is useful to managers in predicting the likely adoption rate for new and innovative goods or services.