Double Irish and Reclaiming American Jobs - Learn Incorporated and Headquartered Where and Why

We as Americans pay taxes. Corporations especially large corporations can incorporate globally. What is happening with our Fortune 500 companies in the world needs to be discussed. The Fortune 100 and Fortune 500 companies rule America and currently rule the world. This is rapidly changing but before it does, let's review where the top consultant to 96 out of the top 100 companies in the Fortune 100 is headquartered. Let's ask ourselves why? Let' not blame that company, let's blame ourselves for not responding as citizens and asking our representatives for change. We need these top brains headquartered here in the US. We need to recognize the brain drain that is occurring in the US. America has lost jobs, now it is losing its edge in corporate headquarters. We must return to a tax structure that returns this company to US headquarters.

Double Irish

Double Irish or the "The Double Irish Arrangement"is a transference of corporate ownership for the sake of beneficial tax rates which reportedly change the corporate rate from the mid thirty percentage to an amazing low 2 percent! Often used by multinational corporations to raise the returns for their stockholders by lowering the overall tax expense. Often called a "tax avoidance" transaction. Called the "Double Irish" because it takes two companies to complete the transaction. Giant multinational are said to use this strategy include Google, Google, Microsoft, Forest Laboratories, Oracle Corp., Eli Lilly & Co, Pfizer Inc., etc.[1]

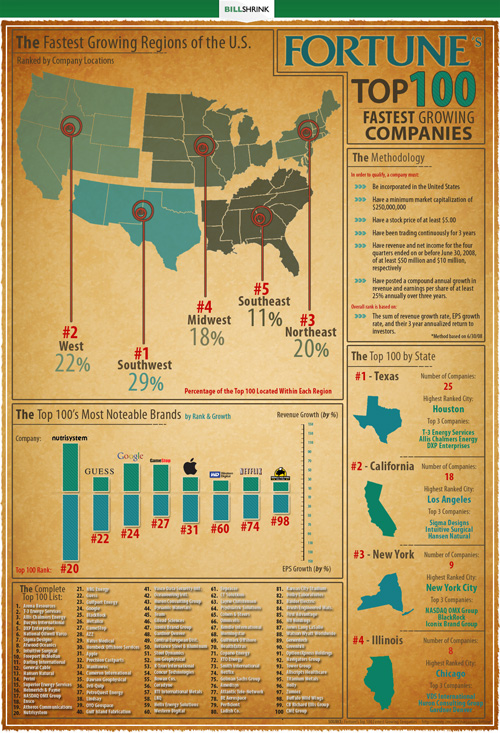

Fortune 100

"The Fortune 500 is an annual list compiled and published by Fortune magazine that ranks the top 500 U.S. closely held and public corporations as ranked by their gross revenue after adjustments made by Fortune to exclude the impact of excise taxes companies collect.[1] The list includes publicly and privately-held companies for which revenues are publicly available. The first Fortune 500 list was published in 1955.

Wal-Mart was the largest company on the list in 2007 and 2008. ExxonMobil was in second place[2] in 2007 and 2008, but overtook Wal-Mart in 2009.[3] Wal-Mart once again regained the top spot in 2010.

Although the Fortune 500 list is the most familiar one, similar gross revenue lists of the top firms range from the highest ranking Fortune 100 including the top one hundred to the broader ranking Fortune 1000 that includes the top thousand firms. While the membership on the smaller lists is somewhat stable, the ranking on the lists may change over time, depending upon revenues and often, because of mergers among firms already listed.

The original Fortune 500 was restricted to companies whose revenues were derived from manufacturing, mining, or energy exploration. At the same time, Fortune published companion "Fortune 50" lists of the 50 largest commercial banks (ranked by assets), utilities (ranked by assets), life insurance companies (ranked by assets), retailers (ranked by gross revenues) and transportation companies (ranked by revenues). These have been consolidated into one single list, so the Fortune 500 as it exists today includes companies that in previous years would have been on one of the "Fortune 50" lists."

Sadly Accenture is a 4 Stars not 5 Stars Company for Celebrate Made in USA

Accenture is the consulting arm of what was known as Arthur Anderson. Accenture was a American as apple pie - originally - sadly that has not been the case for many years. First incorporated in Bermuda to decrease their corporate taxes and now incorporated or headquartered out of Ireland and using what has been called the "Double Irish" - a method of transferring wealth to obtain the best return on investment for the stockholders.

Effective September 2009, Wikipedia reports that Accenture is incorporated in Ireland with its glogal headquartered located in New York - according to information provided by Wikipedia. The trading symbol for Accenture is ACN. A Fortune 500 company who once upon a time relied heavily upon Tiger Woods for corporate promotions. A Fortune 500 company who serves the best and brightest in the world - sadly is not headquartered in the United States.

Avoiding Taxes or Maximizing Return

The corporate headquarters and operations remain in New York. The financial reporting and real wealth of the company and its stakeholders leaves the boundaries of the United States. Some contend they are avoiding taxes. I disagree, it is global world and we must realize the playing field is now different. Accenture has lead the way in serving the global world. We as American citizens and voters must recognize what Accenture has taught us for years. - the US is not competitive in its corporate tax structure.

Bermuda Incorporation Date - Ireland Incorporation Date

I wasn't able to find the date of incorporation for Bermuda for Accenture - if you know that year, please send us the information with documented source IF possible. In September 2009, Wikipedia reports the change to the Ireland incorporation.

Leadership Not Moving

"None of our top executives are moving to Ireland, but that's totally irrelevant," said the company spokesman. "If it was a U.S. corporation, how many CEOs live in Delaware?"[2]

America - The Land of Opportunity

America has lead the way for the world for decades, sadly this is rapidly changing. Brilliance and money will go to where the rewards are the greatest. We as Americans must realize we no longer offer the best opportunities of the world. We may still offer the best universities but that is rapidly changing also. Losing our competitiveness to China has been lamented by the American worker now for over 5 decades. The writing is now on the wall for the beginning of the corporate exodus and the brain drain to overseas. It is our duty as Americans to recognize this trend.

Knowledge is power - Accenture is global leader in corporate consulting. Knowing we have a problem is the first step in correcting the problem.

Why carefully review the action of Accenture? Accenture generated net revenues of US$21.58 billion for the fiscal year ending August 2009.[1] Their size is important, but the critical point is the influence they have in the market and over the top companies in the world.

Sustainability for Corporate America May Hurt Americans

Sadly this transaction (double Irish) is both sustainable and a prudent move for the leading consulting company in the world. I don't blame the consulting company. I do blame us as citizens of a democracy not knowing what is happening and not asking for changes. Why? Because this tax inequality is not sustainable for the American public.

What does this say about the US tax policy? If the top consultants of the world are headquarter in the US for operations but not for financial assets, what does this tell us?

A country built upon democracy and competition and we are failing - failing at what we used to excel at.

As citizens of the United States what changes must we mandate to retain these corporate giants? Is is beneficial to us as taxpayers to retain these firms?

History has taught us we lost in the competitive world as manufacturers, now we are losing in the world of tax havens - do we have the ability to compete or are we as Americans handing in the white flag of concession?

- Accenture Is Seeking To Change Tax Locales - WSJ.com

Accenture is seeking to become the latest company to switch tax-haven locales. The firm's board approved switching the company's place of incorporation from Bermuda to Ireland.

- Proof the Stock Market is Manipulated by Investor Cl...

Sometimes things are right under your nose. They are obvious, but diabolical. Even manipulation of the stock market may be involved. You have to ask yourself why the banks were bailed out. After all, it... - Tiger Woods and the Dollar Value of a Reputation

January 16, 2009 Turning to the MARKETPLACE page of this past Thursday's Wall Street Journal (Jan 14, 2010) the first thing that caught my eye was a color picture of an elephant standing upright on its hind... - Call Center Jobs in the Philippines with the Highest...

Call center jobs or the business process outsourcing jobs are the number one gateway to receive the highest pay in the Philippines for years now. Yep, one of the highest salary. Call center solutions are...

Famous Quotes on Change

“To err is human, to blame the next guy even more so.”

Dr. Robert Anthony - “When you blame others, you give up your power to change.”

General H. Norman Schwarzkopf - “Do what is right, not what you think the high headquarters wants or what you think will make you look good.”

Incorporated and Headquartered Where - Does it Really Matter?

America in its ignorance didn't speak up with we exiled Charlie Chaplin. America didn't speak up when we hoarded Chinese products and allowed our jobs to be lost. With the advent of the Internet, will American speak up now and vote with our hard earned dollars to retain corporate America headquartered and paying taxes here in the US?

Women gained the vote in the United States on August 26th, 1920. The women's sufferage movement was much more than just political voting. It was about contributing, speaking up, land ownership and much more. The power of the political vote is critical. However, we must remember, our real voting power remains in our wallet.

Americans vote not just at the ballot box. Americans vote every day of their life - we vote with the dollars that we spend. How do you wish to cast your vote? Will the dollars you choose to spend provide jobs for our children? Provide jobs for our grandchildren? Vote today, make it a new habit and start voting wisely everyday. Talk it up, share it, make the American dream a reality once again. Know the real issues. Don't be fooled by the fancy advertising, know the facts and vote with a conscience for a sustainable America.

Enjoy Hub Pages? Enjoy sharing? Join Hub Pages for FREE!

sources

http://www.famousquotes.com/search.php?search=corporate+taxes&paint=1

[1]wikipeida.com

This content is accurate and true to the best of the author’s knowledge and is not meant to substitute for formal and individualized advice from a qualified professional.

© 2010 Ken Kline