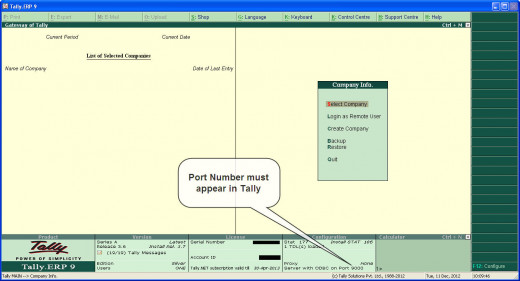

Tally erp 9.0 software? - free help, tutorial

Tally ERP 9 – Steps for Starters

How to Create/ Set up a company in Tally Accounting Software-

- On Gateway of Tally select the “Create Company” option. The below showed screen will occur.

Fill the above page with the help of following table-

Fields

| Details of Field

|

|---|---|

Directory

| This shows the path where co. will get saved. You can also alter it.

|

Name

| This specifies the name of the company as it appears in TALLY.

|

Mailing Name

| The name of company automatically appears on this field. You can also alter it. Final name on which co. shall receive mails should appear here.

|

Address

| Fill this field with Registered Address of the company

|

Statutory Compliance for

| Select your country from the list of available countries

|

State

| Select your state from the list of states

|

Pin Code

| Write the Pin Code of your Address

|

Telephone No.

| Write the Telephone no. of your Company

|

E- Mail

| E-mail address of company, used to recieve & send mails

|

Mobile No.

| Enter the mobile number of the company.

|

Currency Symbol

| It will show the currency symbol in which your business deals. By default it takes Indian Currency Symbol, Rs.

|

Financial Year From

| Tally takes 12 months from the date you give it, as F.Y. Eg- If you give it 1April, 2010. It will take F.Y from 1 April 2010 to 31 March 2011.

|

Books BeginningFrom

| The date from when you start you F.Y will automatically display here. If you want to change it & display the actual date from when your books started you can even do that.

|

Tally Vault Password

| Tally Vault password is a enhanced security feature coming with Tally. It saves the data of the company in encrypted form through a Password. Without this password you cannot view the data. It is very Important to keep this password safe & even remembered because in case this password gets lost. You cannot recover it again. So only use this feature, if you can keep it in safe hands.

|

Use Security Control

| It is also an additional security feature of Tally. Helps in keeping your data safe. Here if password is lost by the user, it can be recovered by the user but only by calling Tally experts & paying them extra fees for that.

|

Tally Audit features

| These are some additional features, which can be only used if you are also using Security Control for your Company.

|

Maintain

| Here selecting Accounts with Inventory is a better Idea as you can also maintain details of goods, godowns, there rates, quantity etc. along with their accounting Info.

|

That's it. Your Company has been created on Tally. Procedure to alter it, update it & take its backup will come in next article of this thread.

- Suggestions & Queries are duly invited.

Tally ERP Tutorial-

- Tally ERP 9 - Tutorial

Basic free details of Tally ERP and ways of using it & its shortcuts.

Tally ERP 9 Tutorial Part -1 New Co Creation & Alteration

Did you liked this hub?

Other Related Hubs-

- How to make Money Writing online on Hubpages And Other Freelancing Sites

Want to make Handsome money sitting at home & having drinks with family. Dont worry, it's perfectly possible if you use the right ways as posted by me in this article of mine. I'm sure this will increase your earnings. So, All the Best mate...... - Online TDS & TCS rates of Income Tax Act for F.Y. 12-13, A.Y. 2013-14 & A.Y.2014-15

List of all the TDS & TCS Rates which you will need before cutting TDS & TCS. Remember, you should be knowing right rates to protect yourself from penalty & other penal provisions of Department. So, Go have a Quick look..... - Indian Income tax act 1961 deductions sections

List of all the Latest Indian Income Tax Act, 1961 Deductions which will help you save a lot of tax & money using Ethical & Legal Sections. So, what are you waiting For- Go Save Your Money. - Depreciation rates chart as per Income Tax Act (F.Y. 2012-13)A.Y. 2013-14 & 14-15

Income Tax Slab Rates, Tax Calculator of Income Tax Act, 1961- A.Y. 2013-14 , P.Y. 2012-13 Tax Guru Schedule vi Depreciation rates slabs rules & laws of Indian It Act, 1961 (Assessment year 13-14) - Depreciation rates & Due dates as per Companies Act, F.Y. 2012-13, A.Y. 13-14 & 14-15

Tax Guru Depreciation rates slabs rules & laws of Companies Act, 1956 (Assessment year 13-14). These rates are totally different from the ones you use in Income Tax Act, so don't get confused. Know the right rates before preparing your books.

![QuickBooks Desktop Pro 2018 [PC Disc] [OLD VERSION]](https://m.media-amazon.com/images/I/41cdgj98bfL._SL160_.jpg)