- HubPages»

- Business and Employment»

- Employment & Jobs»

- Employment Advice & Tips

Investigate Nonprofit Theatre Finances Before Relocating For Employment Or Else

You might face catastrophe, as you find yourself stranded in a distant town, displaced without a job, ruined economically, and stressed emotionally to the limit.

.

April 14, 2014 -- After living through an employment nightmare with a close relative of mine, I advise anyone NOT to relocate to work for a nonprofit theatre without first scrutinizing the company's financial condition. Having observed someone learn the hard way, I suggest doing detailed research.

Learn The Theatre's Legal Name

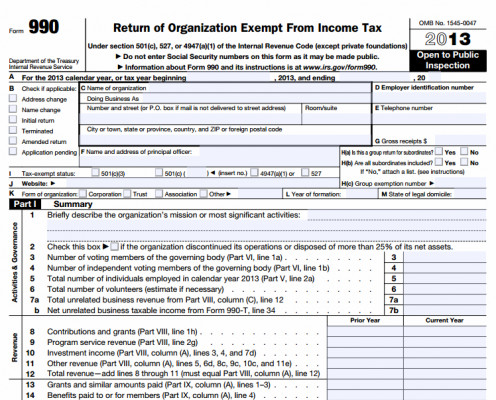

Find out the name appearing on the theatre's yearly tax return. In the case of a nonprofit theatre, this return is actually a tax-EXEMPT return called a Form 990. Since the nonprofit theatre's corporate structure enables it to bypass paying federal tax, federal filing regulations are a little different here.

I have discovered that a nonprofit theatre's legal name can differ significantly from the name under which the theatre operates its business, which can obstruct efforts to scrutinize the company's finances. I, therefore, advise all nonprofit theatres to avoid this troublesome dual naming, in order to maintain crystal-clear transparency with the communities that the theatres serve. In one instance, I used a theatre's familiar name to perform a particular search and came up empty. When I discovered the theatre's legal, nonprofit corporate name and performed the same search, I came up with the information for which I was looking.

Find The Theatre's Form 990

Enter the theatre company's legal name into the search rectangle at … http://citizenaudit.org/ … , which will give you access to .pdf files of the company's 990 Forms for years on record. Here now is your source of financial information about the theatre, where you can find clues about the organization's financial health over past years, and where you can gain valuable insight into the company's current viability as a business entity.

Make Sense Of The Numbers

Start by making a simple table. Write it on paper, and later maybe refine it using Microsoft Word (I use Word 2010, which enables the "insert table" feature).

List the very basics:

- total revenue minus total expenses over the years

- total assets minus total liabilities (also called "net assets" or "fund balance")

- changes in fund balances over the years

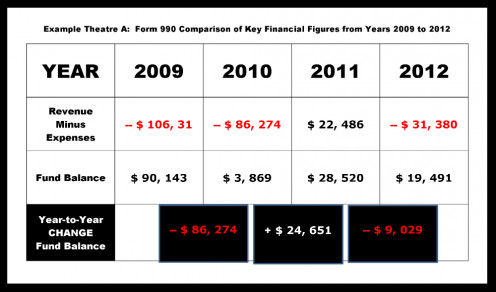

The following tables show real financial figures taken from 990 Forms of three actual nonprofit theatres in the USA. I do NOT identify the three theatres. I merely designate them as "Example Theatre A", "Example Theatre B", and "Example Theatre C". Each of the three tables corresponds to each of three example theatres over the same four-year period, from 2009 – 2012:

Example Theatre A

Example Theatre A is where my close relative experienced her employment relocation nightmare. This theatre closed in 2013, two months after offering a signed contract, along with multiple verbal assurances of a year's salary:

- Notice that for three of the four years prior to 2013, Theatre A was operating in the red (expenses exceeded revenue).

- Also notice that during these same years, Theatre A's fund balance was steadily declining (NOT a good sign), recovering somewhat between 2010 -2011, but declining again between the next years.

This table could have been a red flag showing that the company was not doing well. My gut feeling told me that this company was not doing well, but the organization's leaders hyped their enthusiasm for recovery in total contradiction to the truth of these numbers.

There were other sources of information to clarify these numbers, but, at least, this table could have provided solid, tangible doubt about the unsupported enthusiasm of Theatre A's leaders, who later proved themselves fraudulent in representing an employment opportunity and clueless about managing a viable business.

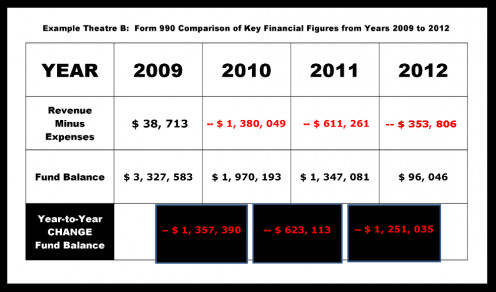

Example Theatre B

Example Theatre B is another theatre with which my same relative interviewed nine months later, except THIS time I was able to provide her with the table pictured here. At first glance, this company appears even scarier than Theatre A:

- Notice that for the most recent three years of the past four years shown, Theatre B operated in the red (expenses exceeded revenue).

- Even worse, the fund balance took a major nosedive between 2009-2010, not even recovering by half between the next years, and falling yet again almost to its 2009-2010 low.

- Observe, then, THREE STRAIGHT YEARS with expenses exceeding income, AT THE SAME TIME the fund balance was dwindling at an alarming rate.

Adding to this with more recent information and more detailed analysis (which I will show later in the article), I can conclude that Theatre B cries out, " Danger! Danger! Do not relocate to work here, unless you are young, fit, have a second income, have a back-up plan, have relatives to give you refuge, or you have some other resources to keep you afloat when this ship likely sinks."

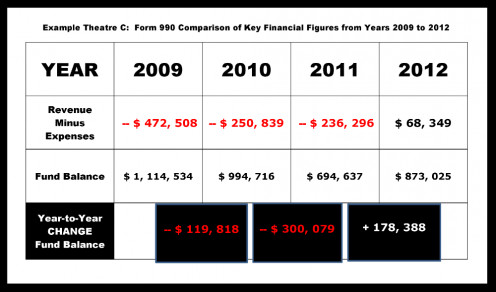

Example Theatre C

Example Theatre C is yet a third theatre with which my relative interviewed:

- Again, in three of four years shown, this organization operated in the red (expenses exceeded revenue).

- For two of these years, the organization's fund balance declined significantly.

- The upside is that Theatre C shows RECENT signs of recovery, making it a theatre to watch in future years to see whether it continues to operate in the black, and whether fund balances continue to stabilize or increase.

Without additional, current information, however, I could NOT recommend that anybody relocate from a distance to work here. 2012 might just be a positive year, followed by negative years. I have observed such a trend in Theatre B, for which I have listed ten years of data (see below), during which time more years were negative than positive.

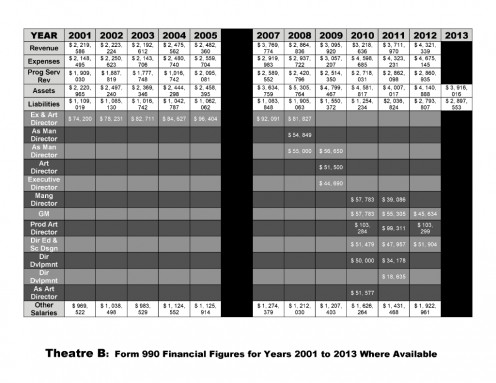

Make More Sense Of The Numbers

In order to determine whether my fears about Theatre B might be justified, I dug deeper and recorded detailed financial figures from years 2001 to 2013 (where available). I used a gray highlighting scheme to clarify what seemed to be a wildly varying paid-officer structure with questionable salary dynamics. Notice (picture below) that between years 2008 and 2013 (a period of five years), TWELVE different paid-officer positions came into being and variously went out of being. This suggests to me a revolving door of employment, where the paid-officer structure does NOT remain stable. Why have there been so many paid-officer positions in so few years? People appear to be coming and going at an alarming rate, which indicates trouble.

Details Of Theatre B

To make even more sense of these numbers, I created a second detailed table of Theatre B's figures, in which I COMPARE various figures from all the years (below).

COMPARE Details Of Theatre B

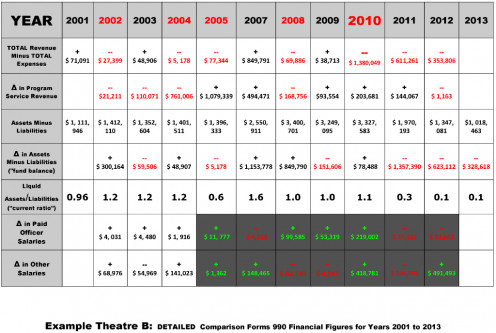

Here is the real meat of discovery (in COMPARISONS).

I, thus, realize that my fears were justified, because:

- For five of eleven years (about half the time), Theatre B has operated in the red (expenses EXCEEDED revenue).

- Three of these negative years have been CONSECUTIVE and RECENT.

- In 2010, Theatre B was in the red by over a MILLION dollars, and it still seems to be struggling to recover from this and, so far, NOT succeeding.

- Fund balances have dwindled significantly during the most recent three years.

- The ratio of liquid assets (total assets minus buildings, land, and equipment, not shown in the table) has fallen to an unacceptably low 0.1 or "one tenth" (meaning roughly nine times more expenses than money to pay for them). A figure of 1.0 or "one" means roughly having exactly enough liquid assets to pay the bills. Some financial experts recommend maintaining at minimum a figure of 1.5 or "one and a half" to tide a company over during challenging times.

- What I find most unsettling are the dynamics of the paid officer salaries, which progressed from an increase of $ 99,000 in one year, to ANOTHER increase of $ 53,000 the next year, to yet another WHOPPING increase of over ................................. $ 200,000 the next year – the very year that Theatre B faced over a million-dollars in the red.

- What I also notice is that from years 2001 to 2005, Theatre B's total assets were at around the $ 2.5 million mark. Total assets increased to around the . $ 3.5 million mark by 2007, and increased again to around the $ 5 million mark by 2008. This indicates to me that the theatre possibly spent large sums of money to build new facilities, to buy land, or to purchase equipment, all of which have resulted in illiquid assets, dragging the company down in debt.

Discussions with a recent managing director revealed that Theatre B had, in fact, built new structures and bought land. The theatre supplemented its historic facility with a new facility and the new facility's associated additional programing. The cost of putting on shows in the historic facility turns out to be twice as expensive as the cost of putting on shows in the new facility, and yet the company holds onto the old facility like a cherished relic. A person, therefore, has reason to question the business intelligence of Theatre B's leaders.

Everything about Theatre B, then, sends negative vibes to anyone who might consider relocating for employment there. I would recommend to such a person interested in employment to be very afraid and to avoid Theatre B like the plague.

Trust No One At First

When it comes to uprooting your life to move across significant distances for employment, do your homework before leaping prematurely at any seemingly attractive opportunity. Especially with nonprofit theatres, do not believe all the words of people with whom you might interview. Look at the numbers behind those words too. Get the most recent numbers, if you can. Besides numbers, also search for news articles about an organization that might reveal further facts or suspicions. Often there are comment sections with these news articles, where the commentators can be painfully honest.

I wish everyone the best of luck in this challenging business, as I hope that no one experiences the employment nightmare that I witnessed recently.