Economic Growth is Killing Us - Part 1

The earth is a sacred vessel of spider webs and the wings of butterflies.

If you try to use it, you will crush it.

If you try to change it, it will shatter.

If you let it go, it will remain useful.

If you leave it alone, it will change for you.

Try to possess it, and it will slip from your grasp.”

Lao Tzu from the Tao Te Ching

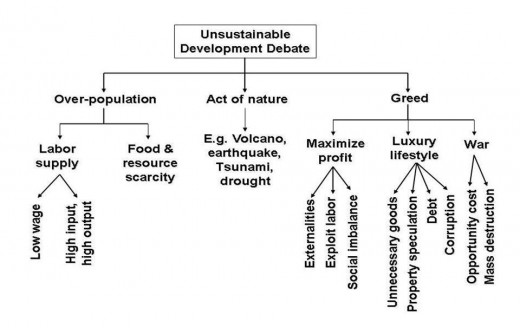

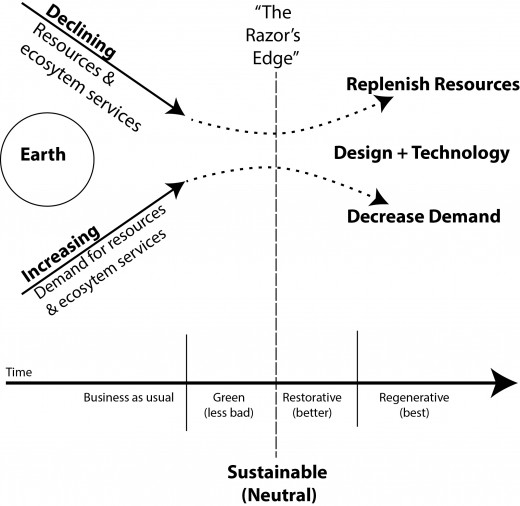

Economic growth is an increase in the human capacity to produce goods and services from one quarter to the next. However, the resources related to this type of economic growth on this planet: oil, gas, coal, copper, silver, tin, zinc, among others, are finite. There is a limit to growth based on extraction and high consumption of fossil fuels and industrial metals; therefore, industrial based growth based on these resources will end. If humans are to survive, we must change our goal of economic success from the zero-sum game of winners and losers to sustainability, “…the global economy is playing a zero-sum game, with an ever-shrinking pot to be divided among the winners.” Heinberg

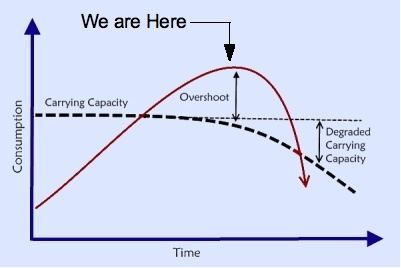

There are physical constraints to continued growth such as a poisoning of the land, air and water; a loss of industrial resources and resources necessary to sustain human populations; and a lack of work and opportunity. This will all lead to permanent economic recession. Moreover, our culture lacks the ability to see alternative ways of solving our problems, and we are stuck in cultural habits that will kill us. For example, we are told over and over that growth is the way out of recession. In reality, growth is exacerbating and causing our collapse.

Problems with, and natural impediments to, continued growth

The labor market and world-wide unsustainable population

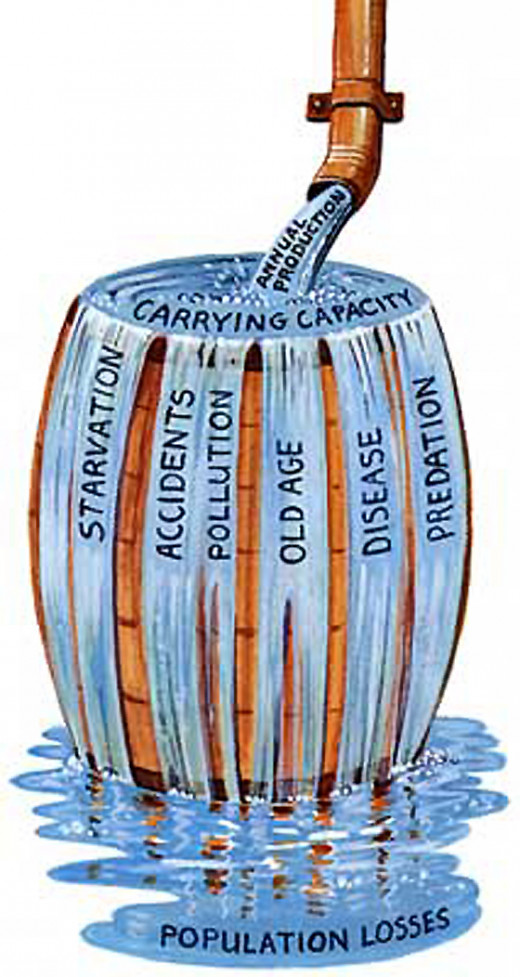

Economic growth is almost always presented in the mainstream media in a positive light. In the film “Wall Street,” stockbroker Gordon Gecko said, “Greed is good.” Today’s Wall Street tycoons would say, “Growth is good.” However, this growth is based exploitation of resources and labor in a harmful manner that may be successful in the short term but is destroying the carrying capacity of the planet as our population increases.

Growth is higher when events occur and products are consumed that make us sick and are bad for us and the planet. Getting cancer from smoking increases the GDP because of all the money people spend on cancer treatments. The earthquake in Haiti raised their GDP as well. Meanwhile, the people suffered.

Disasters such as tornadoes, pollution, landslides, flooding, consumption of polluting minerals, and despoiling of the environment are examples of what Naomi Klein calls disaster capitalism, and all boost the GDP.

Then there is what I call destructive consumerism such as eating fast food, consuming sugary and fatty foods, large debts we can’t afford, smoking and other clearly harmful addictions, and addictions to harmful and costly activities. According to market economics of the 21st Century, these are all positive because they increase growth even while they kill us. This consumerism is also destructive because it means purchasing products such as beef, cars and cell phones that use large quantities of resources to produce.

During the 20th century, population and industrial booms meant more economic growth. There was an increase in agricultural technology to feed the growing population, increased construction of housing and transportation, and other life sustaining expenditures. This increased economic output.

Meanwhile, advances in health care have reduced infant mortality and increased life expectancy, increasing the Earth's population. With the rising population, the use of our planet’s finite resources rose exponentially. This growth is unsustainable. Currently, the world has about a billion people living malnourished and in abject poverty.

Jobs: fewer and lower paying

Jobs driving trucks, taxis, limousines and jobs involving transportation will soon disappear due to automation. Bots already dominate factories and industry and are now making headway into warehouses, farm labor and soon, long-hall transportation. Pharmacists will be replaced and so will regular cleaning jobs. Millions of jobs will be lost to further automation, including white-collar jobs.

An Oxford study puts the chance at 50% that a job will be replaced by a machine in the near future, “47% of the labor market in the US alone is at risk of being mechanized out of existence.” Approximately 702 jobs thus far held by humans are now threatened by mechanization. (ibid)

Investment in education and training is no longer a guarantee of a good job that pays a middle class wage. Human capital investment that boosts the economy includes spending on universities and education, healthcare, training, food stamps, unemployment insurance, all sorts of human supports that face continued budget cuts. The national debt, economic contraction, economic slowing due to limited resources and fewer consumers will lead to cuts in spending on human capital. Even if people can get a university education, few jobs will be left for them.

On top of their diminishing income and job prospects, the recent crop of university graduates will be in so much debt that their contributions to the economy will be smaller than any time since WWII. That is a further impediment to growth we current rely on, “From a macroeconomic standpoint, the massive debt burden facing "Millennials" could potentially become a very big impediment to growth over the next decade.” (ibid)

Labor power is weakened as is purchasing power

Not only will machines be taking over much of our labor, fellow workers with their high productivity will continue to replace other workers by being more efficient, “In the four years since the Great Recession officially ended, the productivity of American workers — those lucky enough to have jobs — has risen smartly. But the United States still has two million fewer jobs than before the downturn…”

It is not only the quantity of jobs but the quality of jobs has also taken a hit; more people are working part-time than ever. Many people work more than one job and more than full time just to make ends meet. In 2014, “Insecure, low-paid jobs are leaving record numbers of working families in poverty, with two-thirds of people who found work in the past year taking jobs for less than the living wage, according to the latest annual report from the Joseph Rowntree Foundation.”

Economies will die without energy. What’s needed is a major economic shift.

Like any living organism, the world economy will wither and die as energy and other resources are exhausted. As we use these fuels, we pollute our planet and the corresponding ill human health will further reduce growth. We can only offshore pollution to poor parts of the U.S. and the third world so long until the whole world is contaminated.

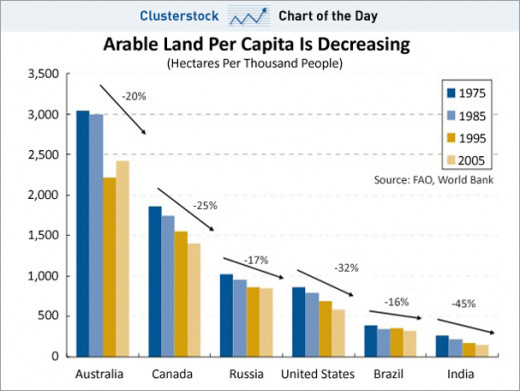

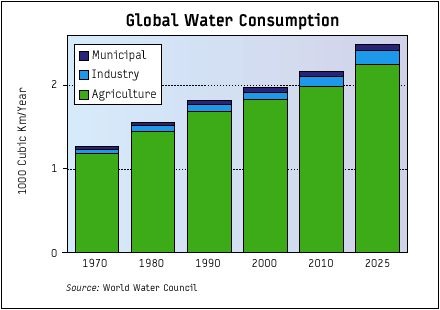

As fossil fuels run out, we will no longer be able to ship products around the globe. Trade will be more expensive, limited and no longer the engine of the world economy. Moreover, growth rates will encounter other non-negotiable global constraints such as the exhausting of arable land and water resources. Food stocks from the seas are also being depleted at an ever increasing rate.

Growth and food security

Water for human growth is either being exhausted or polluted, and soon, humans will no longer be able to keep pace with the increase in food production needed for the earth’s growing human population. As arable land is lost, water won’t be available for human consumption or industry, in fact, “…economic growth is only sustainable if all countries have food security.” Poor nations will be hit even harder than wealthier nations, but no one will avoid the affects of the loss of water resources.

Deforestation on every continent is occurring and will continue to result in a loss of topsoil, a reduction of farm productivity and an increase in pollution due to lost carbon sinks.

Energy resource depletion, drinking water and minerals for industry

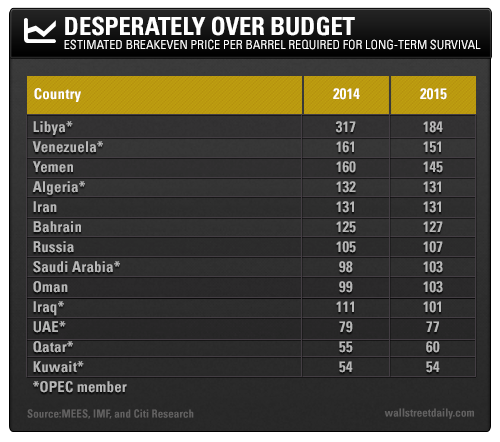

There is a temporary glut in oil on the market, but that will end and oil will rapidly rise in the U.S. to over $4 a gallon by 2016. Currently, the speculative markets in oil are taking a huge hit. Global markets are not stable. In the long run, increased demand due to reduced prices, reduced oil stocks of easy to access oil, costly production for deeper wells and less accessible oil, and the fire sale by fracking companies that are feeling the pinch will all lead to increased gas and oil prices.

You Can Pay Now, or Pay Later: Climate Change

The evidence for climate change is indisputable. In fact, 2014 was the hottest year on record with other years this century filling most of the top ten hottest. These rising temperatures is not an anomaly, it is a trend. Not only will the necessary steps to slow and reverse climate change cost us billions of dollars and cut into economic growth, natural disasters will be more frequent and more costly. (Heinberg pg. 106)

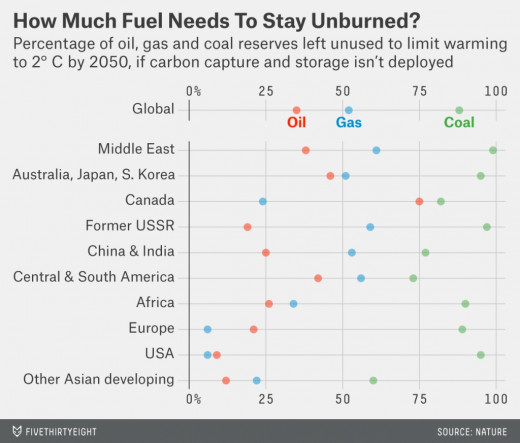

Coal and oil account for a vast majority of our fossil fuel use in the United States (about 70%) and also accounts for a majority of the human production of green-house gases. Fracking is only a costly short-term solution, “Moreover, the externalities of pollution and disasters of production will make this fuel more expensive than ever and increase the global warming crisis that will reduce and possibly end all high energy use economic activity.” (Heinberg: ibid)

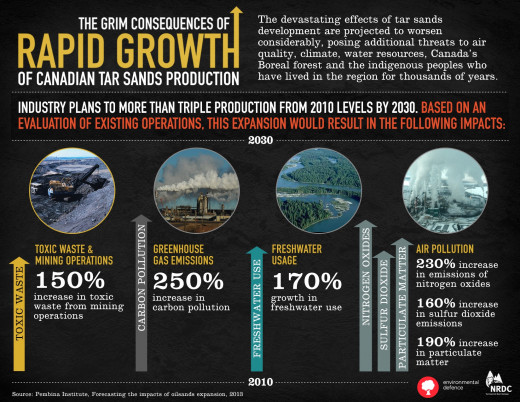

Tar Sands

Oil coming from Alberta, Canada in pools of sludge is an environmental disaster, “The most obvious reason is that tar sands production is one of the world’s most environmentally damaging activities. It wrecks vast areas of boreal forest through surface mining and subsurface production. It sucks up huge quantities of water from local rivers, turns it into toxic waste and dumps the contaminated water into tailing ponds that now cover nearly 70 square miles.” Also, this tar only produces only 4-6 joules of energy for every 1 joule expended. Conventional oil drilling has a ratio of 15 to 1. (ibid)

And the energy used to produce the tar oil releases carbon, as do the open pits and the waste tar, “Combining the associated climate impacts with the exceptionally poor environmental track record and the inevitability of future tar sands oil leaks, it becomes extremely difficult to justify exploiting this resource rather than simply leaving the fossil fuel carbon in the ground." (ibid)

A one for one replacement of fossil fuels with alternative sources of energy is not possible. A 2009 Post Carbon Institute Report called “Searching for a Miracle: ‘Net Energy’ Limits & the Fate of Industrial Society” concluded that there is no alternative energy source that will replace fossil fuels and that by 2100, humanity will have less energy, not more. Increases in alternative energy sources will not be able to keep up with the loss of fossil fuels and other traditional sources of energy. ENROI, energy net return on energy invested, will decrease as energy exploration costs increase.

The current, 2014, drop in oil prices is only a temporary deviation from the trend of rising energy costs. We need to retool our whole society’s energy plan if we are to avoid complete economic collapse.

Water

Fracking and other energy production pollutes our water supplies and cattle consume over 2 million gallons of water a day in 2005 numbers. (Heinberg pg. 124) These are wasteful uses of potable water. (water facts)

Impacts of water loss include:

1. Increase mortality and illness and increased costs of healthcare.

2. Reduction of irrigated land.

3. Less water for power plants, mining, manufacturing and industry

4. Reduction of energy production that requires water

Externalities of large industrial farming include: soil salinization, deforestation (climate change), loss of habitat and biodiversity, fresh water scarcity, pollution from pesticides and other resource loss.

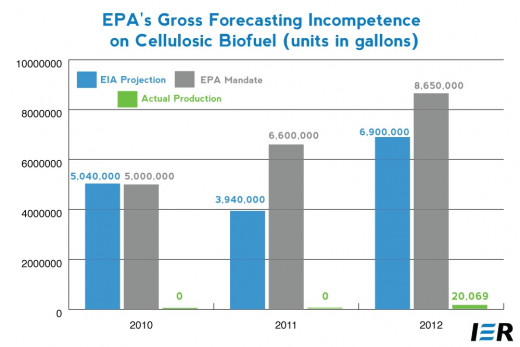

Biofuels are a failed experiment in alternative energies

Biofuels are grown with subsidies from taxes, they are not efficient, and they often consume food resources that would be better used feeding people and not vehicles. While use of bio-fuels from corn, soybeans, wood pulp, switchgrass and other sources will release less CO2 when burned than fossil fuels, “…ethanol policies fail to pass an overall cost-benefit test (Taylor and Van Doren 2007a; Metcalf 2008; Hahn and Cecot 2009), that they have an adverse impact on food prices and poverty—especially in developing countries (Runge and Senauer 2007; Mitchell 2008) and create higher greenhouse gas emissions due to indirect land use changes (Searchinger et al. 2008).” (Oxford Journal)

Studies show that producing ethanol from corn is more costly than other sources, “…UC Berkeley professor and civil engineer Ted Patzek estimates that it takes six times the energy to produce ethanol than the energy made available for automobiles during the process. Put simply, it takes 6 megajoules of energy in fertilizer and other energy costs to create 1 megajoule of energy for use in cars in the form of ethanol.” In summary, bio-fuels are a net energy loss to the system.

The Economic Limits of Fracking

As we use fossil fuels, we release more greenhouse gases. As the supply decreases, we have to look for difficult to access fuels such as seafloor deposits at a higher cost. An alternative, hydraulic fracking, causes serious environmental damage to the soil and water table and other costs that damage long term growth, “Fracking is in no way sustainable. It is a highly intensive process that increases emissions, causes methane leakage, creates low level ozone in some places in the world, and requires vast quantities of water and mass construction to create temporary fracking sites in green, typically countryside areas in both the UK and the US. Also, shale gas is still a finite resource, which means it’s going to run out one day.”

Our choices from a policy standpoint are being limited to: 1) increasingly hard to access and costly environmentally damaging fossil fuels, 2) costly and harmful fracking, or 3) inefficient and expensive biofuels. None of these choices provide a way out of economic and environmental collapse.

Environmental damage from population and growth in farming

Deforestation costs 4.5 trillion annually, according to banker Pavan Sukhdev, $650 for each person on the planet.

Adaptations to population growth through new farming techniques, seeds and other technologies will only delay the inevitable end of growth. Whale oil was replaced by petroleum. There is not equivalent to petrol. Ethanol has failed to do the trick. Electric cars still need to be charged by fossil fuel burning power plants. Solar panel manufacturing uses fossil fuels and precious metals, too. (Heinberg Pg. 156)

Moreover, “For net energy, the news is even worse – the peak will come quicker, and new investments will be less attractive, because more money will be required to produce the same result.”

Humans have outgrown the carrying capacity of the earth at the present rate of resource consumption and waste. Water is being lost and polluted, land is losing topsoil and fertility and is increasingly to salinated. As arable land is lost, more marginal land will be used for farming, more chemicals will be used and it will lead to a downward spiral of productivity. Jobs that were once in demand will be lost to machination, productivity of other workers and lack of demand for new products. Fewer and fewer people will be able to afford durable goods and that will lead to a permanent, global recession. Only the top 0.1% wealthiest people in the world will survive the world-wide economic collapse unscathed while the rest of humanity will live in squaller. Humans will no longer be able to commodify themselves out of global economic collapse.

That is the path we are on. Later, I will elaborate on our challenges and present alternatives to our current economic growth model.

Peace,

Tex Shelters

Bibliography

Heinberg, Richard (2011). End of Growth: Adapting to Our New Economic Reality.

Gabriola Island, BC, Canada: New Society Publishers.