What is Fiscal Policy ?

Introduction

Fiscal policy is an important type of macroeconomic policy. Here the entire control over the economy is left to the government and they will take actions to stabilize the economy. Here the entire role is left to government whereas in monetary policy it is left to the central bank of the country. fiscal policy aimed ti eliminate economic dangerous situations like inflation, price raising, deflation, unemployment etc. This hub is focused to explain, what is fiscal policy, its major objectives, major fiscal policy instruments, and how they are applied during inflation or deflation etc.

Major Objectives of Fiscal Policy

The fiscal policy implemented by governments having multiple objectives. Some of them are,

a) To attain full-employment in the economy

b) To boost economic growth of the economy

c) To stabilize the economy by eliminating the problems of inflation and deflation

d) To make a good value in balance of payments account, that is to reduce the deficit in the balance of payments.

Main Instruments of Fiscal Policy

Fiscal policy is implemented through the support of different tools. Mainly there are three basic tools to control the economy. They are,

i) government expenditure.

ii) taxation.

iii) government borrowing.

Government expenditure includes transfer payments like pensions, scholarships, subsidies etc. The government spending on investment is also consider as government expenditure. It enhance the role of government sector in the economy. Similarly, government borrows loans and advances from international financial institutions and from from foreign countries. This may borrow by the government to activate the economic transactions. Another type of tool using by governments is the imposition of taxes. Taxes are considered as an expenditure of both individual and industries. These tools are adjusted to make changes in the economy to stabilize it. Since taxes consider as a receipt and transfer payments consider as a expenditure to the government, it will be recorded in the budget. So, this fiscal policy is also alternatively known as budgetary policy.

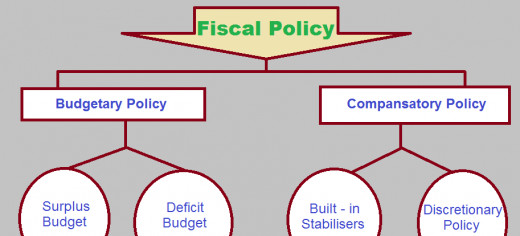

Budgetary policy

Budgetary policy is refers to the policy based on the budget of a country. that is revenue and expenditure of government are recorded in it. So, naturally there are two possibilities in the budget. That is the budget may surplus budget or deficit budget. Surplus budget is a condition in which the government receipts exceeds the government expenditures. Similarly deficit is one where the government expenditure exceeds the government income. Any way the ultimate purpose of any economy is to reduce the deficit balance especially in the developing economy. Since, fiscal policy can be applied as a whole it is better to control an economy. J.M Keynes argues for fiscal policy.

Budgetary Policy During Inflation

Inflation is an economic bad condition, in which the general price level and the money supply will be very high. That is the government budget will be a deficit budget which indicate that, the government expenditure is too much larger than the government revenue. So, the government follow a surplus budget policy during inflation. A surplus budget is one when the government receipts exceeds the government spending.

For the implementation of surplus budget policy, government increase the tax and reduce the government spending. This will reduce the disposable income of individuals. So, gradually the aggregate demand, output, price level will began to decline. This may done by government by an increase in tax only or reducing its expenditure only, or doing both. This is the cure for inflation.

Budgetary Policy During Deflation

Deflation is also another economic burden. In a deflation struggling economy, the money supply will be very less and the price level too lesser. The great problem of deflation is increasing in the rate of unemployment. When an economy follows highly restrictive policies, deflation will happen. During deflation, money supply will be very less which indicate the government spending is lower and the government revenue is more. That is a surplus budget. So, the government will take policy to expand the money supply, unemployment, aggregate demand etc.

So, the government will follow a deficit budget policy which will enable the economy to recover depression or deflation. For that government will expand its expenditure and reduce the tax rates. This may done by government by increasing government expenditure only or reducing tax only or doing both.

Balanced Budget

Balance budget is refers to those budgets in which the government expenditures and revenues are equal. This is actually not possible for majority of the countries like developing and underdeveloped countries.

Compensatory Fiscal Policy

Compensatory fiscal policy is aimed to stabilize the economy from the continues and old phenomenon of of inflation or deflation. Here also the working of the policy is almost same as mentioned above. That is during inflation taxes will increase and government spending will reduce. and during deflation government spending will increases and the taxes will decline. Any way there are two basic approaches on the compensatory fiscal policy. They are,

i) Built in stabilizers, and

ii) Discretionary fiscal policy.

Each of them are described below.

i) Built in stabilizers

According to this view every things will adjust automatically and there is no any criteria for the government intervention. Taxes and government spending will automatically adjusted according to the variations in business cycle. By this view, tax revenue will vary directly with national income while the government expenditure will vary oppositely with national income. More clearly, at a lower level of national income (depression) government required to spend more in the economy to create employment opportunities and by to achieve economic growth.

ii) Discretionary fiscal policy

Discretionary fiscal policy is taken by governments by using two tools. That is tax and public expenditure. The discretionary policy may be in any of three forms as listed below.

a – changing taxes by keeping government spending as constant

By this method when taxes are increased it will reduce the disposable income. So naturally the aggregate demand will decline. So, tax increasing is used to face inflation and tax reduction is used during deflation.

b – changing government spending by keeping taxes as constant

Here when government increases its spending it will generate more employment opportunities and by increase aggregate demand. So government spending increases during deflation and government spending reduce during inflation.

c – changing both tax and government spending

Here both variables are changes. During inflation tax will increase and government spending will reduce. And during deflation government spending will increases and reduce the tax rates.