Functions of a Central Bank

Introduction

The central bank is the most important institution in the banking system of a country. There is an almost no country in the world, which does not have a central bank. The central bank differs from commercial banks in many respects. The aim of a commercial bank is to make profits but that is not the aim of a central bank. Its main object is to secure the stability of the economy. Normally, central banks do not enter the field of commercial banking at all. Central banks have the power to control the activities of commercial banks. By doing so, they control the volume of credit and secure the stability of prices.

Functions of a Central Bank

The central bank of a country has to perform some special functions. The main aim of a central bank is to secure the stability of the economy, and that is possible only by having the right quantity of money in the country. Since bank notes form a large amount of money, the central bank has to control credit in order to secure the stability of prices.

Bank of Note-Issue

The central bank is the bank of note-issue. It has the monopoly of note-issue. This is necessary in order to have effective control over the volume of currency and credit in a country. Further, since the central bank has the monopoly of note-issue, it will be possible to secure uniformity in note circulation. Not only that, it will be easy to regulate the volume of currency. In the past, some commercial banks had the powers to issue currency. But now, this function has been taken over by the central banks.

Methods of Regulation of Note-Issue

In modern times, note-issue is almost a monopoly of central banks. There are some regulations for the issue of notes by the central banks. The methods of regulating note-issue aim at securing uniformity of currency and also at making the currency system as elastic as possible to meet the requirements of trade and industry. There are four principal methods for regulating the note-issue. They are (1) Partial Fiduciary System, (2) Maximum Issue System, (3) Proportional Reserve System and (4) Minimum Reserve System.

1. Partial Fiduciary System

Partial fiduciary system was introduced in England according to the Act of 1844. According to the Act, notes issued up to a certain limit known as the fiduciary limit need not be covered by gold. They may be governed by government securities. But notes issued over and above the fiduciary limit should be backed by gold. It is claimed that the system has the advantage of converting notes into gold and it prevents the over-issue of notes. But a great disadvantage of the system is that it lacks elasticity. The volume of currency cannot be easily changed according to the volume of trade, as the quantity of money at any time will depend upon the supply of gold.

2. Maximum Issue System

This system was there in France from 1870 to 1928. Under this system, a legal maximum limit for the note-issue will be prescribed. The maximum limit can be changed from time to time if there is a need for it. An important thing about the system is that no gold cover is prescribed. That is, the currency need not be backed by gold. The system has been praised by great economists like Lord Keynes because it checks the tendency for over-issue of notes. But a defect of this system is that it is a little rigid. It will be rather difficult t alter the legal maximum limit in practice. So the system was given up by France.

3. Proportional Reserve System

Under this system, a certain percentage of the notes issued has to be covered by gold. The rest may be covered by specific assets such as trade bills and government securities. The central bank must have gold against some percentage, say 20 per cent or 40 per cent of the notes issued. The U.S.A. adopted the system in 1914. The Federal Reserve Banks of America maintain 40 per cent of gold reserves against note-issue and the rest of it is in securities. It will be difficult to manage this system in times of crisis.

4. Minimum Reserve System

Under this system, the central bank has to maintain minimum reserves of gold and foreign securities and no maximum limit is placed on the amount of note-issue. The central bank has got the powers to issue the notes to any extent. Thus, it can regulate the volume of currency according to the needs of trade. At present, India follows the Minimum Reserve System.

A great advantage of the system is that the volume of the currency can be increased to meet the requirements of developmental planning. And the gold cover and foreign exchange reserve will support internal currency. Suppose the currency in our country is not backed even to a small percentage by gold and foreign exchange, it may not be acceptable outside the country. Not only that, even within the country, people will have doubts about the value of the money. A great disadvantage of this system is that there may be a tendency for over-issue of notes. For, there is no maximum limit placed on the issue of notes. This may result in inflation in the country. That is why many modern economists advocate a system where a maximum limit is fixed beyond which notes should not be issued. Such a system will prevent the over-issue of notes.

Banker’s Bank

It is the banker’s bank. All the commercial banks in the country have to keep, either by law or by custom, a certain amount of their cash balance with the central bank. It helps commercial banks in times of need by acting as the lender of last resort. It does not compete with the commercial banks in their business. In order to encourage a healthy development of banking, the central bank keeps close watch over the financial position of the commercial banks. It has the power to call for any information from them and issue directions regarding the policies that are to be followed by the commercial banks. In short, the central bank is the friend, philosopher and guide of commercial banks.

Banker to Government

The central bank of a country acts as a banker and agent to the government. The financial operations of the government are carried through the central bank. It acts as the financial agent of the government. Government loans are floated through the central bank. It manages the public debt of the country. In some central banks, there is a separate department known as public debt department. The central bank makes advances to government. These advances are known as “ways and means advances.” A close co-operation between the central bank and the government is necessary for the economic development of a nation.

Lender of the Last Resort

Whenever the commercial banks are in certain difficulties for funds, they can approach the central bank and get credit. This can be done at the shortest possible notice. Usually, the central bank helps the other banks either by rediscounting bills or by way of loans.

Custodian of the Nation’s Reserve of International Currency

The central bank is the custodian of the country’s reserves of international currency. This is necessary to meet the foreign exchange needs of the country.

Maintaining Stability of the Value of the Currency

The central bank is also responsible for maintaining the stability of the external value of the currency unit. In other words, it has to maintain the stability of foreign exchange rates. Apart from this, it has to keep the internal price level stable by the regulation of the volume of credit and currency.

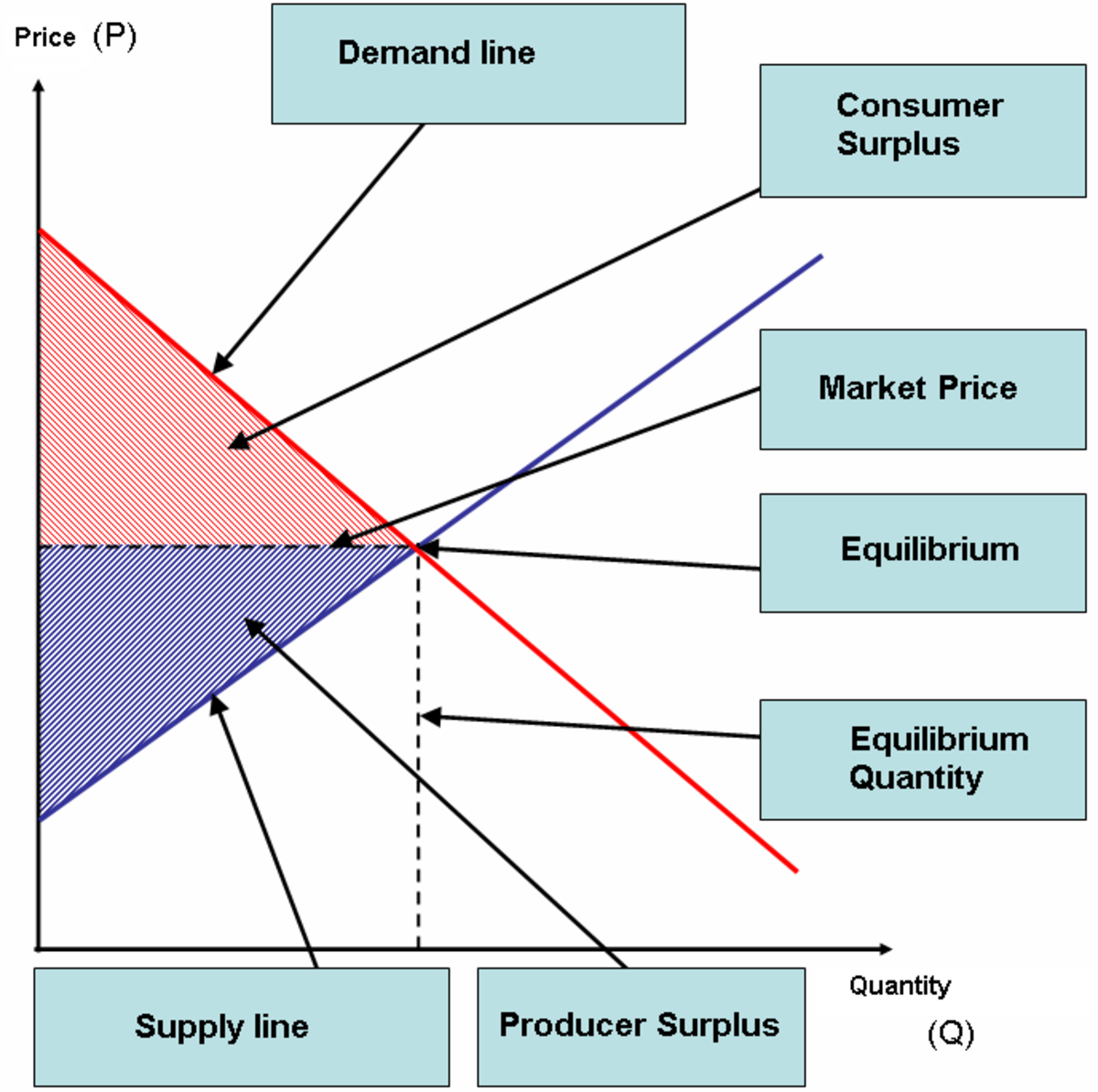

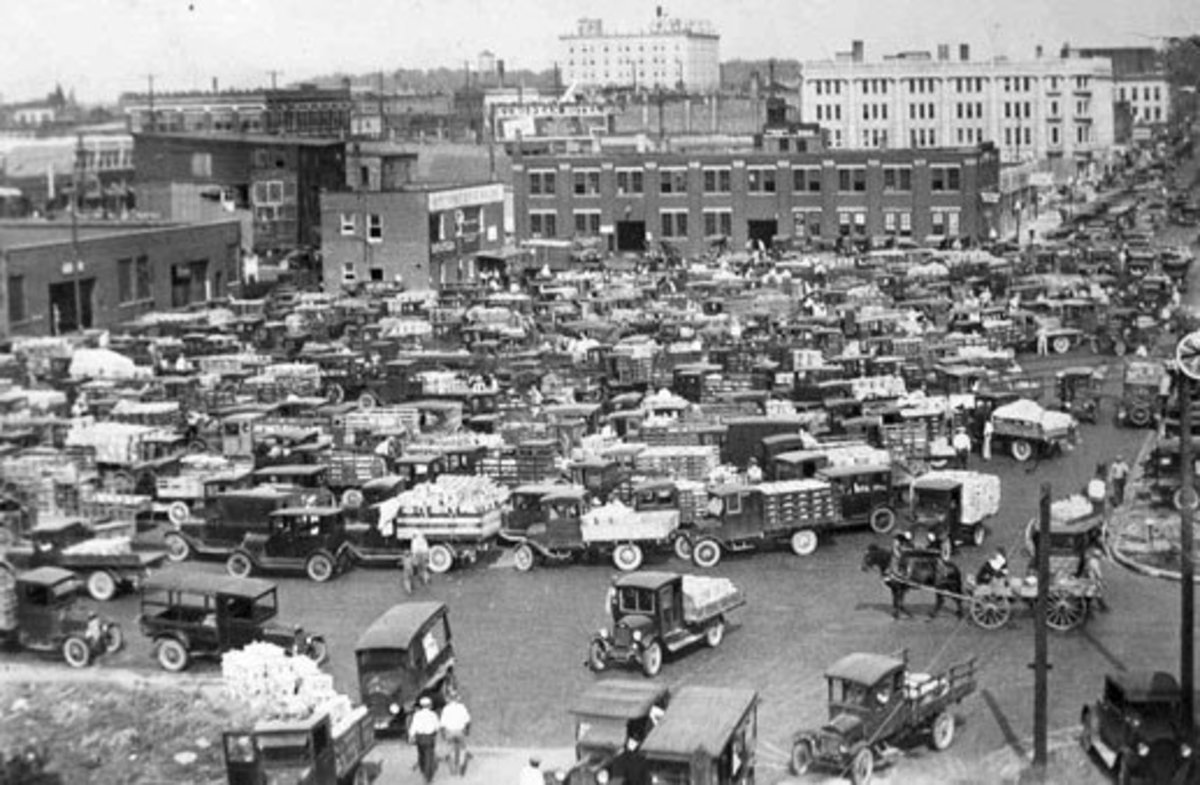

Control of Credit

The most important function of a central bank is to control the volume of credit. This is necessary to control the volume of money in order to have a stable price level. The central bank controls credit by quantitative credit control methods such as bank rate policy, open market operations and the variation of cash ratios. Suppose there is too much of money in circulation. Then the central bank should take some money out of circulation. It can do it by increasing the bank rate. The bank rate is the minimum rate at which the central bank of a country will lend money to other banks. If the bank rate goes up, naturally, the rates charged by other banks go up. The belief is that if the rate of interest goes up, business men will be discouraged to borrow more money. So bank rate is considered to be the most powerful weapon in the hands of the central bank in controlling credit. Qualitative credit control regulates the uses for which the credit money is put.

© 2013 Sundaram Ponnusamy