Hindsight Bias - And Using Cognitive Bias to Your Advantage

Cognitive Bias

It’s natural for one to flown after being told s/he has a poor judgment. Poor judgment comes as a result of distortions in the human mind. A pattern of deviation in judgment that brings about perceptual distortion in humans is called cognitive bias. Each one of us is affected by cognitive bias but the degree varies from one person to the other. Through evolution, humans’ mental behaviors have evolved resulting in cognitive biases which are prerequisite for faster decisions making - you see a guy has crashed his car into a truck and you conclude he must have been smoking something, and you immediately move your brain on to the next item. Some cognitive bias comes about due to limitation of the information that we have which is known as ‘bounded rationality’.

Cognitive bias arises from the following:

- Heuristics - information-processing shortcuts

- Mental noise - thoughts that plays and repeat themselves like a tape

- Limited information processing capacity of one’s brain

- Emotional motivations- feelings (rather than reasons) that are easily excited and openly displayed

- Moral motivations - the principles of right and wrong behavior of human character

- Social influence - attitudes and behavior that are influenced by the implied presence of other people

Unfortunately, cognitive biases have the tendency to manifest themselves automatically and unconsciously in our minds. Even if you are aware of cognitive biases, you will still find yourself unable to detect and mitigate the manifestation of cognitive bias. However, being more learned and with lots of information, relative to those lacking the information, will place you in a better position in tackling cognitive bias.

Memory Bias

Memory bias is a cognitive bias that is responsible for enhancing or impairing the recall of a memory. This memory bias may decide not to recall the memory at all, it may take too long to recall the memory, or it can as well decide to alter the content of the reported memory. There are many types of memory bias, and one type of memory bias is the so-called hindsight bias.

Hindsight Bias - I Knew This Would Happen

Hindsight bias is our tendency towards seeing events that have already happened as being more predictable than they were before the events took place – we always tend to think that things must haveturned out the way they actually have. Hindsight is when you see the outcome of unforeseeable event and you believe, "I knew it all along”, or, “I Knew This Would Happen”. It’s common for a student to say chances of passing the exam are 50/50 before the results are out, and to say, “I knew-it-all-along that I would pass that examination” after the results are out. This is because the moment the event (pass the exam) has happened, the probability of that event occurring is 100%. Before the event has happened, the probability of that event happening may be as low as, say, 20%.

In school, you may have studied very hard for your examinations. And true they brought examination questions from what you had been reading. But when it came to writing down the answers you may have realized that you did not know the material quite as well as you imagined you did. Did you get 100%? If you are a student and you are aware of the hindsight bias, you can develop good revising strategies to avoid the "I knew it all along” phenomenon that may disappoint you during the exams.

Conspiracy Theories and Rumors

Many conspiracy theories and rumors flourishes because of hindsight bias in people. The government and in particular the intelligence services are the biggest culprits of conspiracy theories. Take for example the attacks on the World Trade Centre. The intelligence had hints of something like that can happen but then again they had several thousands hints of different things that could have happened. This would have placed the probability of such an attack at less than 1%. And when the attack happened, a good number of people blamed the government that the government knew-it-all-along that the attack would happen but they ignored it.

Destructive Effects of Hindsight Bias

Financial managers who manage stock funds know too well the destructive effects of hindsight bias. These highly experienced financial managers are well trained and they know all the signals the stock market goes through before it collapses. But with all those qualifications they apparently refuse to see the signals of financial collapse, even after the signals are evident to people on the streets. Do not blame them because everyone wants the status quo to remain – they just see illusions of their own skills which prevent them from pulling the trigger.

Repeating a Lie Over and Over

It’s a well known fact that if a person repeats a lie over and over, s/he will eventually accept the lie as truth. Yes, s/he will believe it to be the truth. If you meet a friend on the way to work and s/he comments you look as if you are sick, you will respond to the negative. If by the time you reach to your work place you meet another friend and s/he comments the same, this time you will cautiously respond to the negative. Perhaps you may consult a mirror. If the same comment is repeated again by a third person, and by a fourth person, you will most likely respond by saying ‘actually I am not feeling well today’. Perhaps this time you may end up consulting a doctor.

Using Cognitive Bias to Your Advantage

Now that you have come this far, how can you use the knowledge gained after learning about this cognitive bias called hindsight bias - I knew-this-would-happen – and I knew-it-all-along, to your advantage? You can use your knowledge of hindsight bias in trading the stock market and benefit immensely.

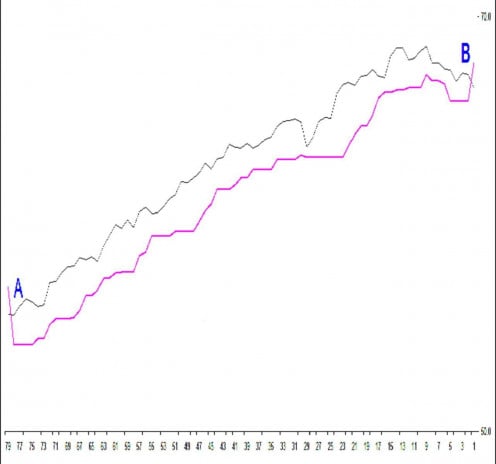

Let’s consider a basic stock trading plan: You trade the stock long if the stock price is above the 32-day moving average. And you trade the stock short if the stock prices are below the 32 day moving average. Below is a chart showing the prices of QQQ exchange traded fund as well as the QQQ 50-day moving average. The pink line is the 32-day moving average line.

At point A the stock prices crossed above the 32-day moving average at $55.6. At point B the stock prices crossed below the 32-day moving average at $66.6. It took 78 trading days for the stock price to rise from point A to point B, a price change of $11. If you had invested $5,560 you would have gotten a profit of $1,100 in 78 trading days. This can be annualized to 68% p.a. Then factor in the multiplier effect and you get pretty wealthy people in the stock market. The questions are: Are the people trading in the stock market making 68% profit per year, and isn't it very easy to forecast the movement of stock prices. The answers in both question is no. In fact most of the traders are performing ‘no better than chance’. Don’t they have trading plans? They have very good trading plans but they fail to follow their trading plans. Why?

We have already said that if a person repeats a lie over and over, s/he will eventually accept the lie as truth and believe it to be the truth. We have also discussed about financial managers with top qualifications who will apparently refuse to see the signals of financial collapse, even after the signals are evident to people on the streets. These financial managers are not alone. We all go through it as cognitive biases have the tendency to manifest themselves automatically and unconsciously in our minds.

If you look at the chart above, to move from point A to point B took 78 trading days. You have put your hard earned money in the stock and what happens is that your brain is subconsciously concentrated on the stock prices. The concentration is very intense because it’s your hard earned money which is on the table. The brain is subconsciously repeating over and over again that the prices have to be above the 32-day moving average for all that period of 78x24 hours. And then one day and unexpectedly, at point B, the price crosses below the 32-day moving average. Here, your trading plan says you should stop trading the long positions and instead open trades on short positions. Your eyes are seeing this signal very clearly but your very own brain deliberately refuses you to trade in the downside hoping that the prices will come back. The prices never come back. You have now lost your money. Your brain has gotten accustomed to trading on upside. That may sound simple but it’s a 'mystery' to many traders. It’s such a serious problem that it’s considered as the single main reason why many traders hardly make a profit in the stock market. If you can train yourself again and again on how to mitigate this effect of cognitive bias, then you can quickly make all the money you may ever need before the age of 29 years. If you have interest in the stock market, you should repeat this until breakfast tomorrow morning: if you can train yourself again and again on how to mitigate this effect of cognitive bias, then you can quickly make all the money you may ever need before the age of 29 years.

Again, I would like to stress that cognitive biases will always have the tendency to manifest themselves automatically and unconsciously in our minds. Even if you are aware of cognitive biases, you will still find yourself unable to detect and mitigate the manifestation of cognitive bias. However, being more learned and with lots of information will place you in a better position in tackling cognitive bias.