Keynesian Theory of Liquidity Preference

Introduction

Liquidity preference theory is one of the great theories in Economics, which was developed by J.M Keynes through his famous work ‘General Theory’ in 1936. After the great depression of 1930s, Keynes introduced many revolutionary changes in Economics. The theory of liquidity preference was one of them. Until 1930s, the economists were believed in the classical theory of quantity theory of money. The idea of classical economists was entirely based on the concept of full employment. But the great depression and the other problems like inflation, price rising etc proved that the classical theory was a wrong notion. Then Keynes entirely altered the classical view by adding the factor ‘interest rate’. Classical economists did not say anything about interest in quantity theory of money. Liquidity preference theory deals with how the people demand money and for what purposes.

Liquidity Preference Theory

According to Keynes there are three motives for which people demand money. That is Keynes divided the demand for money in to three parts like given below,

i) Transaction Demand for Money

ii) Precautionary Demand for Money and

iii) Speculative Demand for Money.

These three factors of demand for money are separately described in the following section.

I) The Transaction Demand for Money

We know all the segments of an economy are participating in economic activities, whether it is a firm or an individual or government. Keynes analyzes transactions demand for money by looking from individual and firms.

Individuals or households are demand money for meeting their day to day expenses, since money used as a medium of exchange. In our society we can see different income earning people. Some people are earning in terms daily wages, other people are earning in every week, month and so on. But whenever a person receives reward or money they purchase commodities to satisfy their wants. So, to meet the transaction requirements, people demand money to hold in the form of cash itself.

On the other part, firms or individuals are also demand money for transaction purposes. That is to meet the daily expenses or working expenses of a business firm. Here also the expenditures are not one time in nature, but it recurring in every day of the business. So, entrepreneurs demand money for the transaction purposes.

So far, we understood what demand for money is. Now it is the time to analyze how the demand for money for the transactions purpose is determined. According to Keynes income is the only one factor which determines the demand for money. And the theory concluded with that, there is a direct relationship between income and transactions demand for money. That is when the income increases, the demand for money for transaction purposes will also increase and vice verse.

The liquidity preference theory of money developed by Keynes has some mistakes, which are the Keynesian view of transactions demand for money neglected interest rate. He says it is the only function of income. But later is proved that, the interest rate is also a vital factor which influence the transactions demand for money. This was discovered by two post-Keynesian economists William J Baumol and James Tobin. So, bye modern view of transactions demand for money is the function of both income and interest rates.

II) The Precautionary Demand for Money

Precautionary demand for money is the demand for money which people keeps to meet unforeseen and unexpected dealings in the future. People may keep money to meet accidents, illness, and unemployed condition or even for unforeseen gain. Here also individuals’ demand money to face the contingent conditions. Similarly the businessman are too demand money with the precautionary motive. Further Keynes says that the level of income is the main function of precautionary demand for money. Gradually the post-Keynesian economists argued that the interest is also an influencing factor of precautionary demand for money. According to them, when the interest rate is too much higher people may be have a tendency to deposit money with bank rather than keeping money with precautionary motives. In short, according to Keynes both precautionary and transactions demand for money are the function of income only.

III) Speculative Demand for Money

Speculative demand for money was a new concept introduced by J.M Keynes. Speculative demand for money is arisen when the transactions and precautionary demand for money are satisfied. That means it is an excess amount of money which left by the people to make gain from the market changes. So, people are demand money with speculative motive based on the economic conditions. So, here money’s function is as like store of value.

To explain speculative motive of demand for money, Keynes dealing with the rate of interest and bond prices. According to him the market interest rates and bond prices are inversely related. That is when bond prices are too much higher the interest rate will be smaller and vice versa. In other words we know that bonds are earning a fixed rate of interest. Suppose when the interest on bonds is greater than the market rate of interest (on bank deposit) people will invest in bonds rather than depositing money with bank. So, the value of bond will increase. Similarly at a higher rate of market interest people will ready to deposit with bank. It will also lead to the declining of bond prices. So, in short under the speculative demand for money, market interest rate and bond prices are varying in an opposite direction.

Liquidity Trap

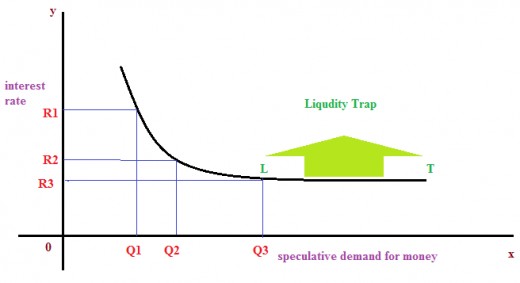

The concept of Liquidity Trap was also an outcome of Keynes’ thought. It is an unfavorable condition of an economy in which the monetary authority cannot do anything. As mentioned above speculative motive of demand for money in depending on the market rate of interest. At a lower rate of interest the bond price will raise. So, peoples’ demand for money increases. But in an unfavorable economic condition, a sharp reduction in the interest rate will lead to a trap which is popularly called by economist ‘the liquidity trap’. This can be represented as shoeing in the following figure.

In the figure, speculative demand for money is represented on the ‘x’ axis and the rate of interest on ‘y’ axis. Initially interest rate is R1, when the money is demanded at Q1 level. When interest decreased to R2 the money demand for speculative motive increased to Q2. Similarly at interest rate R3 level, the money will be demanded at Q3 level. There after the perfectly elastic part of the curve ‘LT’ is known as ‘liquidity trap’.

Why Liquidity Trap?

As mentioned above, when the monetary authority fails to control the economy it will result the phenomenon of liquidity trap. Generally the monetary authority can reduce interest rates (cheap monetary policy) to push economic activities. When the demand for bond increases it will generate more investment and employment opportunities. But in unfavorable condition the interest rate cannot reduce beyond a specific rate (R3 in the figure). The reason is that the modern banks cannot operate without interest rate. It would not be zero. So, banking institutions can only reduce interest rate within limited scope. Such kind of trap is known as liquidity trap. This was one of the reasons for great depression of 1930s.