Microeconomics Review: Perfectly Competitive Market

This article is part of my review guide for Principles of Microeconomics. It is an organized version of concepts from notes I have taken during reading and lectures. It is not meant to be your first introduction to the topic, but instead, should be a clarification of things you are already familiar with. It is a REVIEW tool used to brush up before an exam.

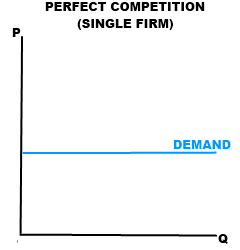

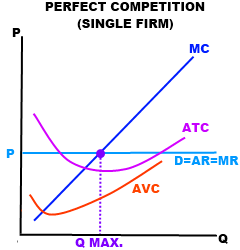

A Single Firm's Demand Curve

Firms in perfectly competitive markets are price takers. They must use the market price for their product. Raising their price would result in the loss of sales to the competition. Lowering the price can result in more sales, however the competition will do the same until all firms are selling at cost.

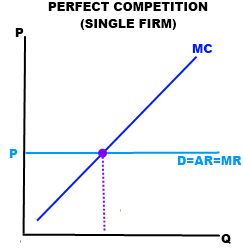

Maximizing Profit

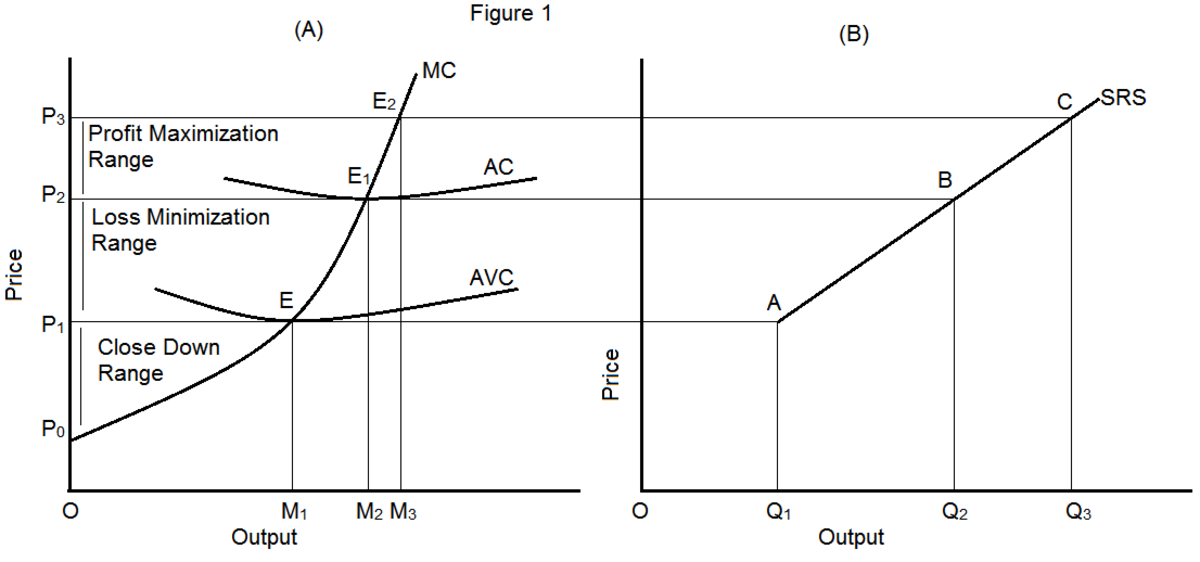

It can be assumed that all firms are selling at cost in a competitive market. To maximize profit, a single firm must produce the quantity of product that balances Marginal Revenue with Marginal Cost: The intersection where MR = MC.

Shutdown Point

A firm should shut down operations if Total Revenue is less than Variable Costs.

TR < VC → Shut down

This can also be thought of in terms of averages. If Average Revenue is less than Average Variable Cost, the firm should shut down.

AR < AVC → Shut down

Since Average Revenue for a perfectly competitive firm is actually the Price, we can say that when the Price is less than the Average Variable Cost the firm should shut down.

P < AVC → Shut down.