Healthcare Reform and the Affordable Care Act

A fun short video explaining Healthcare Reform

I am not a Healthcare Reform Specialist, I just play one on TV

Actually, I am an agent for a Fortune 500 company that is associated with certain types of insurances and it is my job to understand changes related to health insurance. However, I just want to make it clear that I am not a specialist and can't guarantee the statements that are to follow. This is just my understanding of what is to come.

This being said it is also important that you know that I am not stating that I oppose or agree with this act I am just stating what is. I will attempt to explain some facts about Healthcare Reform, what this means for large and small business, what this means for individuals, list the fines associates with not pariticipating in the reform, what will be offered, who is required to participate and who is exempt, and list the pros and cons as an employer and as an individual. Even though these changes won't be made mandatory until 2014, as an American it is inportant that we become proactive in our knowledge instead of waiting until it is mandatory. The more we educate ourselves the better decisions we can make.

Have something to say. Join Hubpages for free. Click here.

- HubPages

HubPages is your online space to share your advice, reviews, useful tips, opinions and insights with hundreds of other authors. HubPages is completely free, and you can even earn online ad revenue!

Patient Protection & Affordable Care Act

This act came into effect March 23, 2010. Some features where made available just not enforced In 2014 this will be mandatory. Some people have stated that if we vote in a different president that the Healthcare Reform Act could be repealed. It is very possibility, however, it's not that easy or that fast. It could take quite a while before we see any changes. Until then we have to do what the law requires. As of now, the one thing that has not been determined is whether it will be state or federally mandated.

Big Business VS Small Business

Businesses with more than 100 full time employees are considered large businesses and will be required to make affordable qualified health plan to their employees. The state may say 50 employees instead of 100. If the business does not make health insurance available and the employee goes through the Exchange then the employer will have to pay a penalty of $250 per month per employee that does this.

Now, what is deemed "affordable"? If the premium charged to the employee for self-only coverage exceeds 9.5% of the employees household income. Or if the coverage provided does not meet minimum value (at least 60% of the total allowed cost of benefits provided provided under the plan.)

Businesses with fewer than 50 employees are considered small business and are exempt from being required to make health insurance available to their employees. However, if you are a small business under 25 employees (or equivalent) and the average annual salary is less than $50,000 and choose to make health insurance available to your employees then you may be elligible for a tax credit up to 35% (25% for non-profit). This will increase up to 50% in 2014.

Please note full time employees are employee that work 30 or more hours per week. If you have part time employees their is a formula to determine how they are calculated in relations to full time employees. This will need to be determined monthly. Companies are not required to offer coverage to part time employee.

___ Number of full-time employees (defined as those who average at least 30 hours a week for that month).

+ ___ All hours worked by part-time employees that month ÷ 120 hours.

= ___ Number of full-time equivalents.

Penalty's for Companies

If business's do not offer coverage the business will be penalized determined by this equation

____ Number of employee

- 30 (minus 30)

=____ x $166.67 per employee, per month.

If you have an employee that does not participate in the coverage you offer, and chooses to go through the exchange because it is not affordable the company will be penalizes $250 per month, per employee that goes through the exchange.

What if I already have coverage? What about the Grandfather clause?

More will be on this section soon.

Four Tiers of Coverage

There will be four tiers of coverage that is deemed to be elligible for employers to offer medical coverage.

Tiers % of coverage required cost (co-pay cost)

Platinum 90% 10%

Gold 80% 20%

Silver 70% 30%

Bronze 60% 40%

Maximum Deductable is from $2000 to $4000 and will rise annually.

What will this Cost?

I do not have the answer for how much the coverage will cost, however, I do know that whatever the cost is in 2014, it will rise each year until 2019.

As far as penalties, they are as follows:

If you do not have coverage...

In 2014 the penalty is $95 per adult & $47.50 per child (up to $285 for a family) or 1% of the family's income - whichever is greater.

In 2015 the penalty is $325 per adult & $162.50 per child (up to $975 for a family) or 2% of the family's income - whichever is greater.

In 2014 the penalty is $695 per adult and $347.50 per child (up to $2,085 for a family) or 2.5% of the family's income - whichever is greater.

These penalties are for the whole year.

What does this mean for Individuals?

Basically all American's are to participate in the healthcare reform unless you are exempt.

Who is Exempt?

The people who are exempt from having to participate are as follows:

Native Americans

Undocumented aliens

Persons with only brief gaps in coverage

Members of certain religious groups currently exempt from Social Security taxes (which are chiefly Anabaptist — that is, Mennonite, Amish or Hutterite).

People that have endured hardships ( This could be determined by the Secretary of Health and Human Services - but not exactly sure)

People that are below the poverty levels.

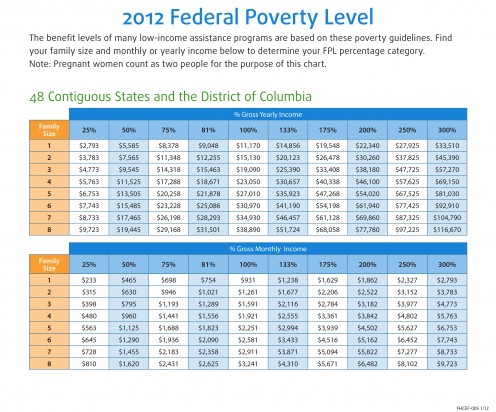

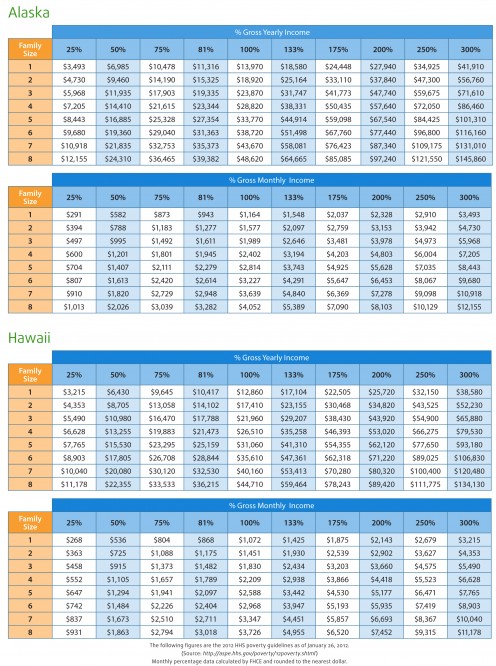

What is the Poverty Level?

The following is the Federal Poverty Level for 2012. These levels are supposed to rise with inflation. I have also come to also understand that people that are in the 200% and below are eligible for state services such as medicaid and food stamps.

Pros and Cons of Healthcare Reform

Pros

Children are now covered under parent healthcare plans until age 26

People with pre-existing condition can now get coverage

Employees will have a choice of using employers offered coverage or the exchange

Exemptions

Tax Breaks

Cons

More government control.

Bigger gaps in insurance (Possibly bigger decuctables and co-pays)

Cost of premiums will rise for 5 years.

More cost for Employers

More cost for Employees and Individuals

Please note this section will change depending on the public's comments. As you comment I will add to the list.

In Closing...

As you post your comments I will update information and add to the Pros and Cons list. Please excuse any typos they will be corrected over the next couple of days.

Any information you have to add to this I ask that you please cite the information so I can reference the material. I will also add my references in a few days.

Thank you!