Social Security and Medicare Guide

Baby Boomers Guide To Retirement

Like many of you, I am somewhere in my 60's. Well, to really be frank, I am exactly 64. Though I am still working, I am fast considering retirement. What's holding me up? Well, the one thing that's keeping me going is getting to Medicare age. I still need my insurance and doing the Cobra thing at $500 a month makes me crazy. So I am holding out as long as I can to lessen my payments. I'll bet many of you are right there with me, on the cusp of retiring. So here's all the things I've been thinking about and so should you.

First question should be, "Am I ready to retire?"

Well, like for me, there should be two answers to that question

The first question is , "Can I afford to retire?"

The second question is, "Do I want to retire?"

The sad reality these days is that more and more employers are doing away with pensions. If you don't save ahead of time, you will be living on your social security check only.

When Should You Start Your Retirement Planning?

From the first day of work, you should start planning your retirement. That means that even in your 20's you should start planning for your retirement.

First thing to consider is a 401 K which is a way to save for your retirement through a deduction taking out of your paycheck. The benefit of this plan is that the monies taken from your paycheck are not taxed until you use the money when you retire. And the theory is that at that time you would have a lower income and your taxes would be lower. Some companies encourage their employees to start saving by matching or adding a percentage to their 401 K. Check with your benefit coordinator or a certified financial planner to get more information.

Is Retirement The End Of Something

Or The Beginning Of Something Else?

I have worked for over 40 years in the healthcare profession and have anyways enjoyed caring for people. I have always felt that I had a purpose in peoples lives. As I started thinking about retirement, I wondered if I would miss the work that I do right now. The answer became crystal clear. It wasn't that I was really ending something, but starting a new chapter. In retirement, I could have the time to explore all kinds of new options for my life. For me that included spending time with my husband and doing some traveling. It meant spending time with the grand kids and the one great grand kid. It means being able to become stronger in my passions, because I have the time to persue them. So it became not what I would miss, but what was missing in my life because so much of my time was attached to the JOB. Now as I move forward, so many door look open to me and I am excited for all the new opportunitues

Getting Ready To Retire - Things I Have Been Learning

- 10 Steps To Retire

Once you determine what will give you peace of mind in retirement, it's important to know how you can get there financially. We'll help you get started with some simple (and fun) steps. - Myths And Truths About Social Security

This one is a really good read if you are getting ready to retire

Social Security Facts

In 1935, Congress passed and Democratic President Franklin D. Roosevelt signed into law the “Social Security Act.” This law created “a system of Federal old-age benefits” for workers and their families. In 1956, the law was amended to also provide disability benefits.

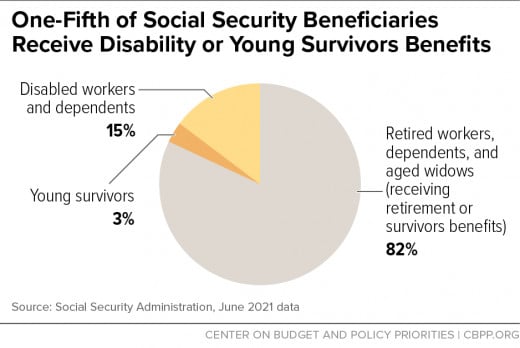

* Social Security is composed of two separate entities: the “Old-Age and Survivors Insurance” program and the “Disability Insurance” program. Each program has separate finances handled through two separate trust funds.

In general, to qualify for old-age benefits, a person must work for ten years while earning at least $5,880 per year.

Old-age benefit amounts are generally related to the amount of Social Security payroll taxes paid by workers over the course their lifetimes. The Social Security Administration has an

The federal government adjusts old-age benefits each December based upon the rate of inflation in the previous year. This is called a “cost-of-living adjustment” or “COLA.

Social Security pays benefits to the families of workers who die and leave behind spouses, children under the age of 20, and sometimes other relations such as parents and ex-spouses

You can get Social Security retirement benefits and work at the same time. However, if you are younger than full retirement age and make more than the yearly earnings limit, they will reduce your benefit. Starting with the month you reach full retirement age, they will not reduce your benefits no matter how much you earn.

One of the interesting Social Security fun facts is that before 2011, the Social Security number was generated using markers like the issuing office’s zip code and the order in which people applied for the number. Since 2011, newly issued numbers are completely randomized, making it less likely for hackers to guess them. Many people also don’t know that any 9-digit Social Security number is only ever used once and is retired once its assignee dies.

When Do You Plan To Retire

At What Age Do You Plan To Retire?

Have You Planned Financially For Retirement?

We're Ok On That End

I had always heard that your expenses are less when you retire.So I am thinking which expenses were they talking about? The monthly bills are the same, you still have to eat and pay taxes, There is still car insurance and appliances and cars wear out. So you really still have expenses. But what we have done is to be at zero debt. That is an important statement for anyone who is thinking about retirement. If you still are carrying a mortgage or other heavy debt, you may be locked into staying at the JOB. Even if you are married. Because the simple fact is, that if one of you passes, your income is cut in half. Worse yet, if you are single and carrying extra debt, you may be working for a while.Keep in mind, you can earn up to $15,500 in income before you lose any part of your social security income. Lots of people still work part time, even after retirement.

Can You Afford To Retire-The Calculator

If you are thinking about retiring, but aren't sure if you actually could afford it, here are some calculators. Hopefully you will be pleasantly surprised. Things to consider include how much debt you are currently carrying and how much assets other than your social security you have available. Because there are still bills, taxes and home repairs and maintenance that still have to get done.

- Retirement Planner-Calculating if you can afford to retire

Our retirement planner helps you estimate how well your savings program is preparing you for retirement. First we help you figure out how much you'll need. Then we tell you your chances of getting there. And if it looks like you'll fall short, we off - Social Security Benefits Calculator

Not exact but gives you a close idea

Being Debt Free Is An Important Part Of A Comfortable Retirement

The biggest thing to consider when you are planning to retire is to consider that fact that your bills and debt will continue, but you will be living on less money than when you were working. Your first goal in planning to retire should be to pay off any debt that you have. Consider what your monthly expenses are. Find out what social security payments you have coming at the age you are considering retiring. Think about your 401K, any Roth IRA or pension as income too. Determine how it all balances out. If there is more on your list of payments than your social security will pay, you may not be able to retire. The first step to take in changing that, would be to wipe any debt that and reduce your expenses. It's easy to decide if retirement is right for you based on a simple balance sheet.

Want To Work Part Time In Retirement? Here's How

The Closer I Get-The More Calls And Junk Mail

Find A Planner You Can Trust

Helping you through the maze of social security can be tricky and time consuming. There is so much information that you need to know. Having someone to trust to help you get through these decisions is important. When it is time for you to begin to think about your Medicare and Social Security, make sure to deal with a professional planner, not just someone who is looking to make a sale. We chose a special individual who is interested in our needs for the second part of our life. He presented the options professionally and spent a lot of time with us. There was no pressure and he came to our home. He helped us make the right choice for us. We feel that we have a person who will be there in the future for us. He took the time to address our needs. He addressed what was good for us and what we could afford !

He actually took the medications that I take and will compare to see which perscription plan will pay the best !

Know the person you are delaing with and make sure that he/she is more interested in you than the sale

Things I Just Learned About Medicare - Facts About Medicare Coverage

One of the things that I have started to do is to learn everything that I can about Medicare Coverage. After all, they will soon be my carrier. While many of my retired friends have weighed in on the subject, I like to be well informed. So, here's what I have learned.

- Medicare is for people 65 yrs old and older

- People under age 65 who are disabled as determined by the Social Security Administration

- People of any age with End-Stage Renal Disease (ESRD); permanent kidney failure requiring dialysis or a kidney transplant

You should Sign Up for Medicare Three Months before your 65th birthday! This guarantees that your coverage will be there as soon as you are eligible. If you don't there will be a delay in coverage

Part A

Part A (Hospital Insurance): Helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care.

If you’re already getting benefits from Social Security or the Railroad Retirement Board (RRB), you’ll automatically get Part A starting the first day of the month you turn 65

Medicare Part A helps pay inpatient care. This includes hospitals, rehabilitation hospitals, critical access hospitals and skilled nursing facilities (not custodial care or long-term care). It also helps cover hospice and home health care when you meet conditions for coverage of these benefits.

Part B

Medicare B is optional

Most retirees enroll in Medicare’s Supplementary Medical Insurance (also known as Medicare Part B) and have Part B premiums deducted from their Social Security checks. As health care costs continue to outpace general inflation, those premiums will take a bigger bite out of their checks.

- Services from doctors and other health care providers

- Outpatient care

- Home health care

- Durable medical equipment (like wheelchairs, walkers, hospital beds, and other equipment)

- Many preventive services (like screenings, shots or vaccines, and yearly “Wellness” visits)

Part C

- Medicare Advantage is a Medicare-approved plan from a private company that offers an alternative to Original Medicare for your health and drug coverage. These “bundled” plans include Part A, Part B, and usually Part D.

- In most cases, you’ll need to use doctors who are in the plan’s network.

- Plans may have lower out-of-pocket costs than Original Medicare.

- Plans may offer some extra benefits that Original Medicare doesn’t cover — like vision, hearing, and dental services.

- Medicare Part C This one is a little more tricky-so plan on spending time thinking about this one. This ia a Medicare Advantage Plan.If you opt to join this plan, it covers Part A-your hospital insurance, Part B and your medical coverage, plus it adds other coverage such as vision, hearing, dental, and or health and wellness programs. Most include the Medicare D or prescription coverage. Medicare pays a fixed amount for your care every month to the companies offering Medicare Advantage Plans. According to the Medicare website, "each Medicare Advantage Plan can charge different out-of-pocket costs and have different rules for how you get services (like whether you need a referral to see a specialist or if you have to go to only doctors, facilities, or suppliers that belong to the plan for non‑emergency or non-urgent care). These rules can change each year."

Part D

Part D (Drug coverage): Helps cover the cost of prescription drugs (including many recommended shots or vaccines). You join a Medicare drug plan in addition to Original Medicare, or you get it by joining a Medicare Advantage Plan with drug coverage. Plans that offer Medicare drug coverage are run by private insurance companies that follow rules set by Medicare.

Medicare Supplemental Insurance (Medigap): Extra insurance you can buy from a private company that helps pay your share of costs in Original Medicare. Policies are standardized, and in most states named by letters, like Plan G or Plan K. The benefits in each lettered plan are the same, no matter which insurance company sells it.

Medicare B Is Taken Out Of Your Social Security Check

If You Opt For It

Yipes that premium is taken right out of your social security check ! Well, I guess it's more painless that way !

If you sign up in advance, your medicare will become active on the first day of your birthday month. Since for most people, thier social security becomes active the month after thier birthday, medicare will bill you for your part B for that month !

Medicare Guides - Must Reads For Medicare Recipents

One of the things that I am discovering is that there is a lot of layers to the medicare program. Since I am a soon to be consumer of the product, it is very important to understand my benefits. Here are some of my favorite Medicare Guides. Even if you have been in the system for a while, they are terrific information sources

Medicare Isn't Totally Free !

Some parts of Medicare come with a premium and there are co payments, so I know that I have to have backup insurance to pay the rest.

Everything You Want To Know About Medicare

- 10 Medicare Mistakes and How to Avoid Them

Missing deadlines, delaying enrollment or choosing the wrong plan can cost you - Medicare Fact Sheet

A simple sheet to learn about medicare - Medicare Part D Guide

Great information from ARRP - Medicare-The US Government Site

Everything you need to know about your Medicare coverage. You can apply there and get lots of free information - How To Compare Medicare Plans

Great article everyone should read

Would love to hear your stories and experiences about your retirement. Was it easy to make the decision? How has the experience been for you?

© 2014 Linda F Correa