Foreclosures 101: The Basics

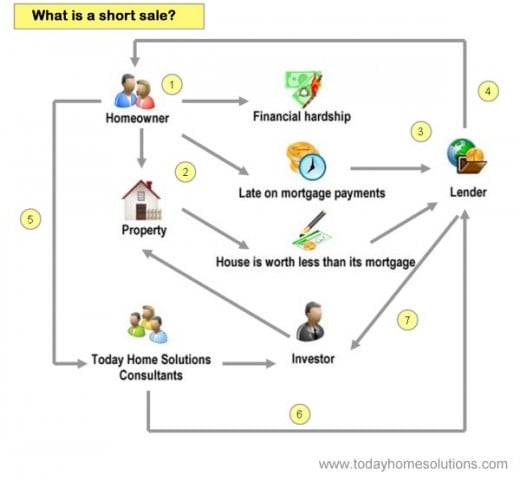

What is a short sale

A short sale is nothing more than negotiating with lien holders a pay off for less than what they are owed, or rather a sale of a debt, generally on a piece of real estate, short of the full debt amount.

Typically, lenders will not accept short sale offers or requests until a notice of default has been issued or recorded with the locality where the property is located. However, this is not always true, especially considering the current state of the the real estate market. Many lenders want to just rid themselves of the problem, and cut their losses early on. There are some that will accept negotiations that have been made with homeowners when they are just one month behind. Some lenders will not hear of it but you never know until you ask. If the homeowner is ready to try a short sale, its just a matter of time before they are 3 months behind.

Now you know what a short sale is .......

Why would a mortgage lender accept less money?

Lenders will accept less money for several reasons:

- Non-performing asset: A mortgage is money lent to you by a bank or mortgage company secured by real estate. When the mortgage is payed every month, the banks asset is performing because it is creating a return for them in your interest portion of the payment. When you are not making the payment, they no longer have a performing asset. This is like having your money in a savings account and it gaining no interest for a bank.

- Banks do not want to own property, they want to own liens on property. If a bank forecloses at an auction or sheriffs sale, and no one bids more than the reserve amount, then the bank is the proud owner of a house they do not want. Banks are in the money business not property management.

- Foreclosure is expensive and the process of filing a foreclosure lawsuit takes time an money.

Who is who and who does what?

Another important thing to know is who the players are in a short sale:

- Real estate investors can negotiate big discounts and buy a property that would have no equity or be upside down in equity.

- Real estate agents can do a short sale to turn a listing that has no room for any commission into a great discounted listing that buyers are knocking down their doors to buy.

- Homeowners can negotiate a short sale to prevent foreclosure and get huge amounts of debt forgiven.

However, anyone with a reasonable amount of organization skills and an ability to communicate effectively can conduct a short sale.

When can a short sale be done?

- After one missed payment, many people will disagree, but I have seen it happen. If you can get the owner to write a great financial hardship letter, you can prove your case, along with your introduction letter, and loss mitigation package, you can prove your case and get the ball rolling early in the game.

- 90 days late: When the owner is three months behind, you have two very eager parties, the homeowner and the lender.

- The house is on the market: If you are a real estate agent or broker, there is a huge untapped market for short sales.

- Homeowner takes the initiative: If you are the homeowner, you know your financial outlook better than anyone.

Real Estate Investors have had a bad rap because it is said they profit in someone elses financial hardship. They have to make a profit in order to continue to stay in business and help other people who are in foreclosure. Know your investors.

Finding Foreclosures

In almost every state, the county deeds and records data can be accessed online. When a home goes into default, the lender records the default at the recorders office in the county that the property is located and the information is a matter of public record.

If you see the term lis pendens, this is a lawsuit that is filed by the lender and means the foreclosure process has just begun. The homeowner still has the right to sell and refinance the property at this time.

In some states where non judicial laws are followed, you will see a notice of default listed. This is the same as above and the foreclosure process has begun.

A property is considered to be in pre foreclosure from the date of the lis pendens or notice of default till the date that the property is sold at auction. The amount of time between these two dates varies from state to state. Some states sell property within 90 days and in some it can take 12 months, be familiar with the laws in your state.

How to buy a foreclosure auction home.

After the judge hears both sides from the owner and the buyer, he will decide if the lender has the right to proceed with the foreclosure. If so, a sheriffs sale is scheduled. The sheriffs sale must be advertised at least three times in the local newspapers. The sale itself typically takes place within 3- 4 weeks after the foreclosure has been announced. The property is sold to the highest bidder and a certificate of sale is issued to the buyer.

The foreclosure process in a non judicial state is similiar but with some key differences. First the security instrument is called a deed of trust, which is a three party process between the borrower, lender, and trustee.

After an owner is in default, usually 60-90 days, a notice of default is issued. The NOD is the official notice that the process has begun. The NOD is recorded and a forced sale is ran in the newspaper for 3 to 6 weeks.

A sheriffs sale is not the best place for a person who wants to buy foreclosed property to begin. Think about this way, we are familiar with how the act of bidding can work itself into a frenzy. Just like on Ebay a bidding frenzy can occur on "the courhouse steps," and the next thing you know the price of the property has been pushed higher and higher. The next thing you know you have overpaid for a home could be in serious need of repair.

There are a lot of things to watch out for when buying at an auction.

- First, you need to do plenty of research on the property. the winning bidder is essentially buying the position of the loan. Therefore, buyers need to determine if there are senior liens, unpaid property taxes, IRS income tax liens, mechanic’s liens, judgment liens,

easements or zoning violations — and these are just some examples of potential problems facing auction investors. - The trustee does not know the physical condition of the home. This is another very big reason to research. You may be purchasing a home that is in serious need of major repair or that could be missing items such as hot water heaters, commodes, sinks etc.

- Do not be involved in a bidding frenzy and overpay for a home.

- BE AWARE: you are expected to have all of the sufficient funds for purchase of the property at the auctions close and will not be allowed time to come up with the funds.

The Bidding Process

The opening bid at the sale must be for at least $1.00 over the amount of the lender's written bid. For example:

if the lender has submitted a bid for $150,000.33, the opening bid must be at least $150,001.33. If another person/entity is bidding on the same property, the second bid must be for an incremental amount no less than $1.00 more AND sufficient to bring the bid to a whole dollar amount (no penny amounts), for example $150,003.00. Thereafter, bidding will proceed in increments of no less than $200.00 until the bidder(s) indicate he/she will not bid any higher and there are no further bids.

If you are the successful bidder at sale, you must immediately provide the full amount of bid funds to the Public Trustee. The Certificate of Purchase (CP) from the Public Trustee will be issued in the name and address of the successful bidder.

You DO NOT have immediate right of access to the property. It is still in the redemption period and you will be notified. there is no longer an owner redemption period after the date of sale; however, junior lienors and others with redemption rights will have 8 business days after date of sale within which to file a Notice of Intent to Redeem with the Public Trustee.

Your best bet is purchasing the property prior to the Sheriffs sale. Your second best choice will be an REO, which is where the property's that are not bid upon become property of the bank or mortgage company. The foreclosure auction is your last resort. However, if done properly and properly researched, you can find yourself a gem of a home.