Covered Calls Investing: OTM (out-of-the-money) Covered Calls

Covered Calls: OTM (out-of-the-money)

An OTM (out-of-the-money) Covered Call (CC) is a CC position where the call option strike price is ABOVE the price of the stock.

For example:

- Stock at: $48

- Call option strike (OTM) at: 50

An OTM CC is usually written (sold) when the investor thinks that the stock has room to move up. This allows the CC writer (investor) to not only capture the premium from selling the Covered Call, but also allows the investor to profit from upside gains of the stock.

By selling an OTM CC, the investor is willing to have the stock sold at the call option strike price.

So, from our example above, if the investor purchases the stock for $48/share, and they write (sell) a CC position at a strike price of 50, the CC investor is willing to let the stock be called away (purchased) at $50 (the call option strike price).

In addition (and this is one great aspect of Covered Calls investing), the CC investor will get paid a premium upfront for taking upon themselves this obligation (to deliver the stock at the strike price of $50).

Pros and Cons of the OTM Covered Call

PRO's:

- The OTM CC position can participate and gain from upward stock movement

CON's:

- Less premium is received upfront (compared to an ITM/in-the-money Covered Call)

- Because less premium is received upfront, there is less downside protection (if the stock moves downward)

When to use an OTM CC (instead of an ITM CC)

Basically, if you feel the stock has some room to move to the upside, then the OTM CC would be preferred over the more conservative ITM (in-the-money) Covered Call.

To compare the OTM CC versus the ITM CC, see our Hub on:

ITM (in-the-money) Covered Calls

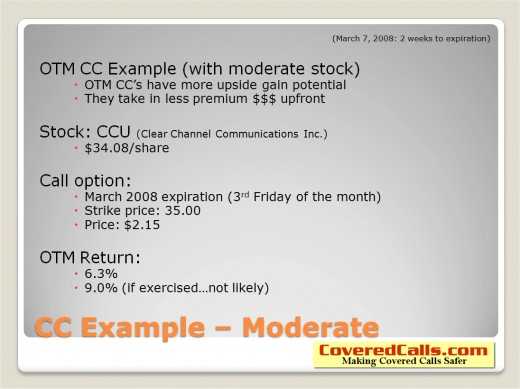

OTM CC - Example

Thank you, and Contact Information

Thank you for taking the time to visit our Hub on Covered Calls Investing.

Best Regards, ----- Shane Johns, President http://www.CoveredCalls.com Email: Writer@CoveredCalls.com