0.0001 Stocks

0.0001 Stocks

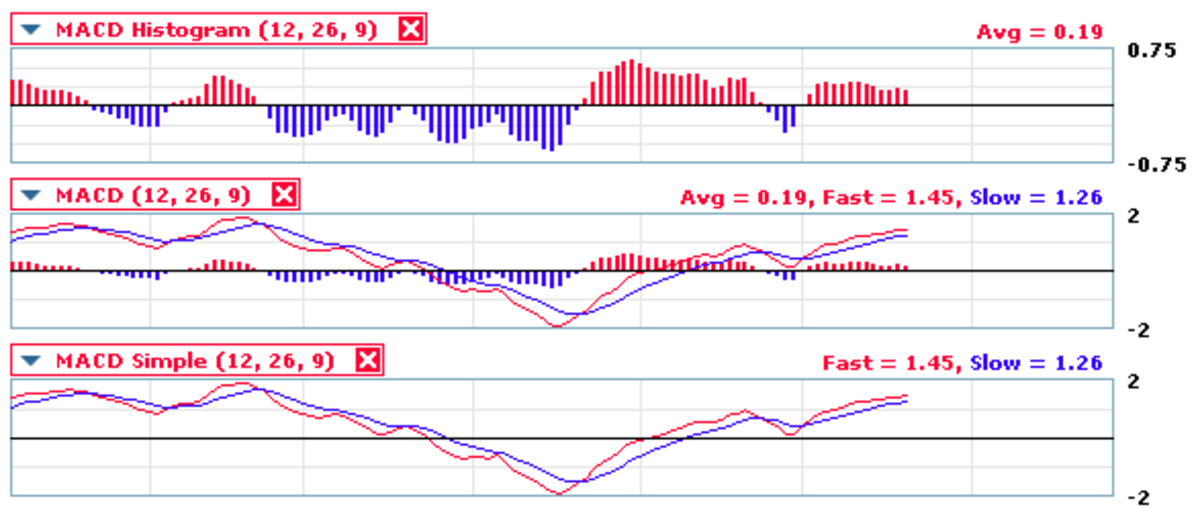

So what’s the big deal with 0.0001 stocks? You hear about them all the time on penny stock message boards or forums, and the general consensus is normally that any stocks going for this price are automatically considered to be a “hot opportunity”. For the most part, you’ll find stocks trading in the 0.0001 range on the Over-the-Counter Bulletin Board Exchange (or OTCBB for short). Many investment advisors strongly urge their clients to stay the heck away from the OTCBB market completely due to the wild-but-powerful swings in price that most of those stocks tend to experience. The OTCBB market doesn’t have the same degree of stringent regulations and oversight as do the NASDAQ, AMEX, or NYSE exchanges, and that’s one of the reasons why extravagant profits can be extracted from OTCBB stocks if you know what you’re doing. I will be the first to admit that trading 0.0001 (or somewhere in that price range) stocks is not for the squeamish, nor is it for people that have a hard time parting with their money, or seeing their money move up and down quite rapidly. All of these things I just mentioned are elements of trading stocks of that caliber, and they cannot be avoided. But if you know this going into it, you’ll be that much further along in developing the “nerves of steel” that it’s going to take in order to trade microcap stocks successfully.

0.0001 Stocks and Leverage

So what exactly is the “big draw” of 0.0001 stocks? The main thing that makes them attractive is the LEVERAGE that they offer. Just think about it: ONE UPTICK on a stock trading at 0.0001 means that you have just doubled your investment. No, I’m not kidding. Think about it: If the stock goes from 0.0001 to 0.0002, that’s a 100% increase! All you have to do is time your entry right to get into a stock at 0.0001, and then hope that the market has enough volatility and price activity to increase to 0.0002, and then pull out…you just made 100% on your money. I will admit, however, that this is easier said than done, because there are quite a few factors at play when actually trading the OTCBB markets that may not be readily apparent, and what works in theory may not always come through when you’re in the real environment. One thing to consider is how liquid the market is of the particular stock that you’re researching. Sometimes it’s hard as heck to get filled on limit orders with OTCBB stocks—shoot, it’s hard to get filled with straight-up market orders sometimes. Anytime you have difficulty getting filled, especially if your order is set at the prevailing market price (or not too far from it), that’s a good indication that the stock you’re trading is slightly illiquid. This will make it a lot harder (and take a lot longer) than a stock with hundreds of millions of shares being traded daily (i.e., strong average daily volume). Another thing to consider is that you really don’t know whether or not the stock is on the verge of going “kaput”, so to speak. I hate to sound like a pessimist, but this is just the reality of the situation. One of the reasons why OTCBB stocks are considered high-risk is because everyone knows that the companies backing the stocks are not always exactly…er…legitimate, or have their legs under them yet. So, you better go ahead and accept the fact that the very 0.0001 stock you’re excited about could very well go belly-up at any minute…this is simply the cost of doing business, folks. That’s why they call the money that you invest with “risk capital”, not “mortgage money”, “power bill money”, or anything else like that—it’s money that you should ONLY be using for investing in the stock market, and it’s money that you could lose without drastically changing your financial picture. Never forget that.

As far as a list of 0.0001 stocks, this hub doesn’t even have the room to contain such a list. My best recommendation if you’re looking for specific stocks is to do a quick Google search for “otcbb stock screener”, or some type of similar stock screener that can filter by price. Simply filter your results based on price, and set that price for 0.0001. You’ll quickly see that there are a ton of potential stocks to choose from. Another way to go about it is to go the OTCBB website and look at the “Most Active”, “Biggest Gainers”, “Biggest Losers”, etc., and you’ll get a good feel for the truly vast number of stocks that you can research. All that’s left is the research…go forth and find those 0.0001 stocks!