Easy Ways To Increase Your Savings And Reduce Expenses Everyday!

Easy and simple tricks to save money!

The lifestyle of many have changed since the recent economic recession. To survive, most families adapted with the economic downturn. The global situation called for the survival of the fittest.

Looking past through the recent financial struggles, the end still deserves to be praised. Why? People became united to campaign against greedy companies. Some humongous corporations backed-down on their excessive profit-charging-motives. Families re-directed financial priorities to make ends meet. Many communities helped homeowners fight with bank foreclosures. Good businessmen helped generate employment on their own. And the list goes on and on from many unrecognized good Samaritans.

Years down the road when the economy will fully recover, do you think many Americans will go back to their old ways of care-free spending? I don't think so. People are already aware of the financial repercussions of economic hardship. Everybody had its share of lesson learned.

Going through financial hardship, many individuals used a lot of common sense to be thrifty. This article will capsulize the four ordinary ways most people used or learned recently to save money everyday. This is a reminder of not letting go of the lessons from the recession.

1) Compare! Compare! But check the price and quality

Learn to compare prices. The fancier term for this in the business world is to make a canvass. A canvass is asking prospective suppliers for their price and product specification on an item that a buyer needs. Everybody's mantra should be, Compare! Compare! Compare!

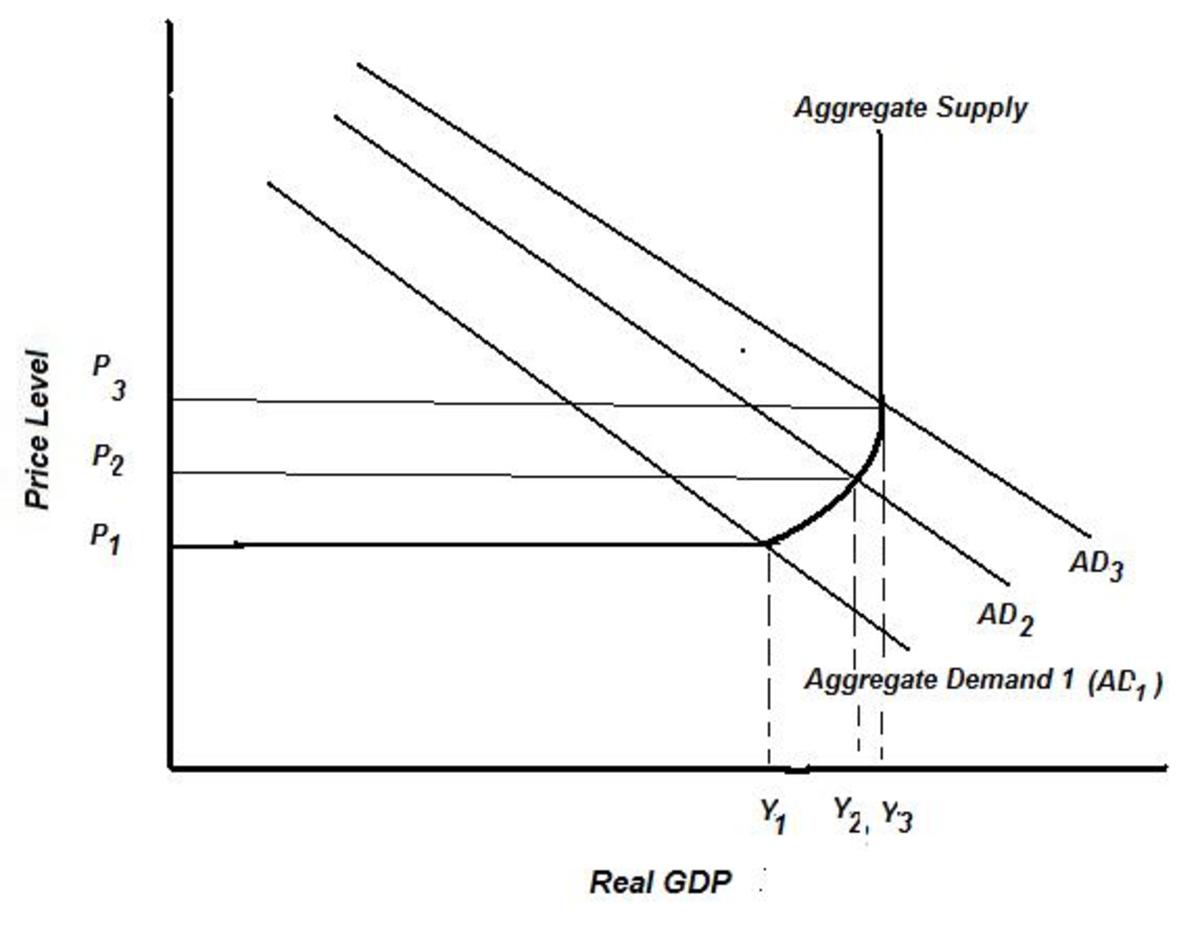

In a free world, businesses openly compete with each other. It is a market where all companies wants a slice of the industry's profit. The economists call it Capitalism. With open competition, the consumers benefit mostly in the end.

When you shop around for a better price, consider the quality of the product too. The good's or service's benefits should outweigh its cost. Don't rush to buy the "cheapest" one. You need to get the best price with good quality too. If you purchase an item that breaks down easily, you will keep replacing it more frequently than you expect. Sacrificing a product's quality for rock bottom prices becomes more expensive in the end. Learn how to balance both.

Here are basic ways to compare prices:

A) Compare prices on-line. The internet has vast information for you to compare prices of similar products or services. You write the key words on the search bar and viola! you have hundreds of data to read and compare. As the saying goes, Google it!

B) Use your telephone to call companies. The internet took charge the world but remember that not everybody are on board yet. There are enterprises who still use the conventional ways of listing their business like the telephone book, magazines, newspapers, etc.

If you are one of the impatient clients, dial the phone number and talk to their sales or marketing department directly. You usually get immediate results from your inquiries but in return, you have to spend a lot of time on the phone.

C) Read advertisements. Caution: Be wary of the false one and the overly done.

The basic rule is to compare prices with at least three stores or companies. If you have time to shop around for prices, the more you can the better it will be. You also need to consider both the lower cost and good quality. Once you get both worlds, your purchase becomes the best-priced item.

There are magazines that are dedicated for advertisements. They are usually given for free to prospect buyers. This is a good way to cross reference certain products priced as "new" or "used". Make your options open and weigh in what product will serve your needs best.

2) Budgeting is important

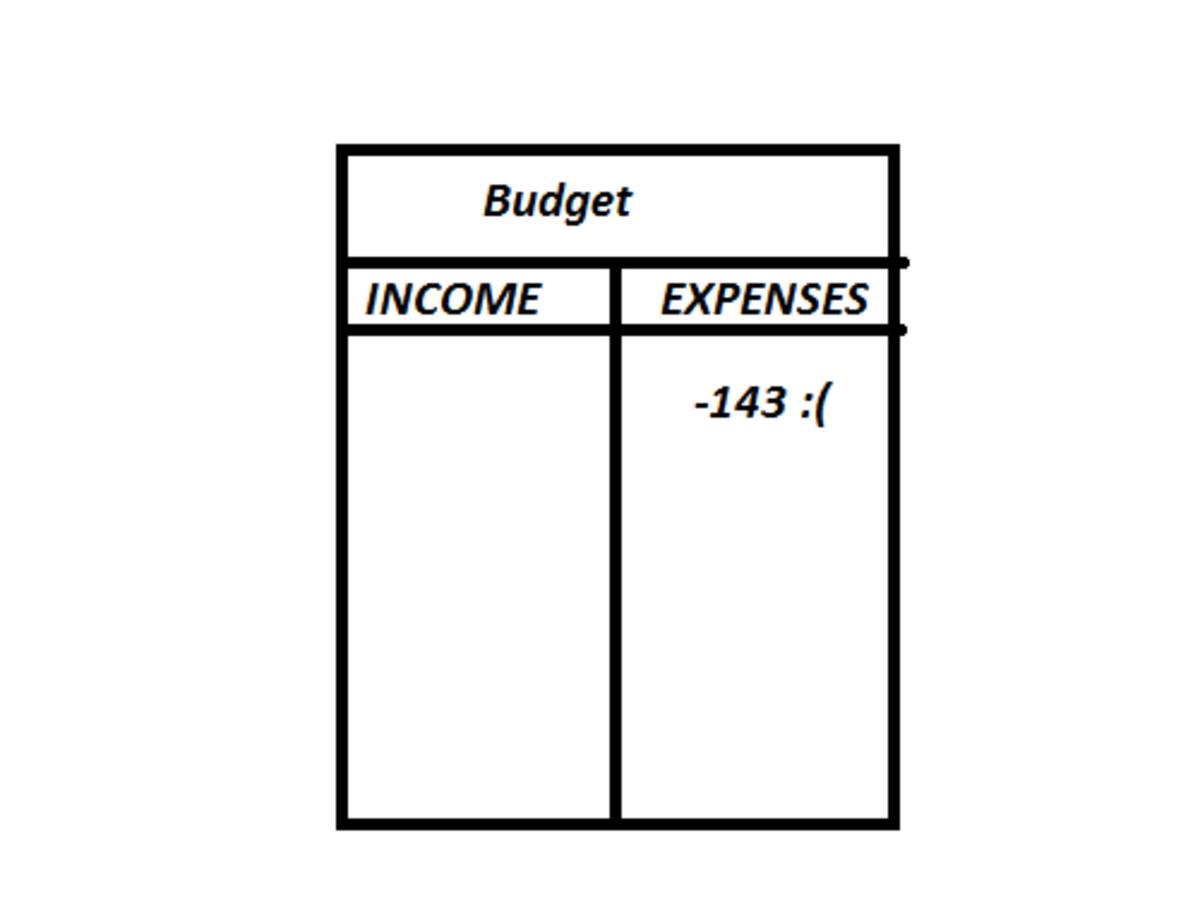

You probably won't like to read this part. For the nth time, your heard the word budget. It's becoming a boring lecture and sounds like a lot of work to do! Allow me to simplify its meaning. Budget is your money map from one day to the next.

You can earn hundreds and thousands of dollars and at the end of each month but you still complain you need more. Isn't it true the more you earn the more you spend? The less you earn the more you spend, still? Your expenses doesn't really end. It is a matter of managing it properly. What is proper management? It is the act of writing it down, income minus expenses. That is called a budget.

Today, you can pull your finances together or just keep with the "spending flow". Like a river, your money runs out faster than you can imagine. You can be serious with your plans today and keep on reading this article or just be insouciance, as usual.

Here are five common factors that will affect creating your budget:

- You need to have an "approved budget". If you are by yourself, it is easier to approve your own self. But with a spouse of partner, both should agree on the same budget to be in-synch with one other.

- Your expenses needs to be thoroughly thought of and studied properly. Stick with the basics as much as possible.

- Don't buy on impulse. Unless it is life-threatening, go home and sleep on it. Decide on buying it after carefully weighing its importance.

- Provide a contingency for unforeseen events. Prepare your budget in a way that you have a wiggle room. Life is uncertain. As much as possible, don't get caught offhand.

- Despite the odds and everyday expenses, do you have money left? The bottom figure of your budget will spell out your savings or having none at all in the end.

Your money management decisions will depend on your unique factors. What is important is that you have the basic knowledge and tools to create your specific budget. You need to learn how to prepare your financial plan now.

- 4 Steps to Budget your Paycheck Effectively: When Do You Use My Advice? Start With How Much Money Yo

Effective budgeting with the 4 Steps to Budget your Paycheck. Manage your money and learn to save.

3) Minimize waste

You cannot fully eliminate waste. In your kitchen alone, you throw out a lot of food every trash-day. A survey showed that in 2010, the United States generated more than 34 million tons of food waste (U.S. Environmental Protection Agency, April 9, 2012).

There are a lot of things that goes to waste everyday. If you look around, you will see them. Waste in food, energy, electricity, water, etc. But in reality, wastage can not be fully eliminated. The best thing we can do is to minimize them.

Ways to minimize wastage:

- Turn off unused appliances. It will help reduce you electricity bill

- Conserve water.

- Reduce use of power and energy

- Plan your grocery ahead. Buy what you can only consume until your next trip.

- Use refillable products

- Recycle

Start looking for alternative ways to carry our your day to day tasks. You can start washing dishes, coffee mugs, spoons and forks instead of using the disposable plastics. Use more washcloth to clean surfaces than paper towels. Cooking a good meal from your left-overs will make your wallet happy too.

Every penny you save is a penny added to your wealth. When things add up, it will be hundreds and thousand of dollars in years.

4) Avoid Losses as much as possible

When something gets lost, it is a loss. Losses are usually caused by irresponsibility, negligence, fortuitous event or by accident. It can be from theft, pilferage, misappropriation or it happens naturally by itself.

How do you avoid excessive losses? By taking good care of your stuff. Things of value needs to be kept in a safe place. If you need to lock it at night, then do so. You can also buy a warranty or an insurance policy if you feel it is necessary to get one.

Things that you own which can be left around the house has to be maintained too. Operate it with care. You need to dust, clean, arrange or keep them. Handle your stuff properly at home to be able to increase the life of the product. Make it your money's worth.

Don't throw recyclable items such ink cartridges, bottles, cans, broken appliances, etc. You can go to a recycling area to sell or simply donate it for charitable causes. This way you are making use of the residual value of the product than losing it all together to the garbage pit.

Just do it

The four strategies to save money is simple after all. It has been existing for hundreds of years. The difference between today and before is the millions of things to buy in the marketplace. We easily run out of money because we acquire a lot of them.

This time, it is up to you to handle your spending pattern and taking care of your assets. Don't take for granted the things you own at home. Maintaining the economic usefulness of what you have is cheaper than replacing it more often. In 2012, survey showed that the United States of America has a long way to go understanding financial management (http://ph.news.yahoo.com/most-financially-literate-countries-211036210.html).

The advantages of saving money is not limited to your monetary gain but as well as saving energy, becoming environment friendly and helping ensure the continuity of free commerce. Remember the lessons from the recent economic recession. Sometimes when bad things happen, it is an opportunity to make things better for the future. A silver-lining in a dark cloud.

Copyright © 2012 The Girls. All rights reserved. Reproduction in whole or in part in any form or medium without permission prohibited.

How does recycling work?

Other Articles By The Author:

- 6 Simple Ways to Teach Your Kids How To Earn And Save Money: How Much Do You Get Recycling Water Bot

Different ways teach your child on earning and saving money. How can children make money from home. - How To Help A Parent with Alcoholism (Where To Find A Good Rehab): My Dad Is An Alcoholic and He Liv

Alcohol addiction and rehabilitation center. Helping my father cope with the disease of alcoholism. - Should I Take The Bus In Los Angeles Or In North Dakota? 4 Mistakes When I Drive My Car: Gas versus

Effects of climate change and causes of global warming. Manage your mental stress and physical fitness exercise while dealing with the high gas prices. - Resilience with My Basic Style Herb Garden :How My Mom Left Me

Being out of work as an effect of the recent global economic crisis. How I used used my ingenuity and became resilient.