3 Basic Steps To Create Your Financial Freedom And Gain Peace Of Mind With Your Finances!

How do you define your financial freedom?

Financial freedom can be defined in many ways. It can be the extra money to go on your dream vacation, or your debt is pretty manageable, or there's extra funds sitting in the bank, or the available funding to acquire your dream house and car is within reach, or simply just having it all at the same time.

There are 3 basic and important steps to acquire financial freedom. You don't need to break your back to save a few bucks. With the exception of extraordinary events in life, no one needs to experience the worst financial situation like being tied with horrendous debt for many, many years. What is the most important thing to do is to manage the income that you earn. Why do you have to do that? The answer is predictability. You need a financial foresight of the future from knowing how much you earn today.

The money you earn basically comes from your ability to look for it. Don't throw it around like there's no tomorrow. During this process, the hardest part is the constant feeling of unrelenting desire to manage your income. It needs to arise from within yourself.

The basic and important steps are:

1) Budget

2) Stick to your budget

3) Help others

I will explain briefly the significance of these important steps. As we all know, there is no short cut to success. Take a short quiz below to understand your financial health today.

What's your money situation?

view quiz statistics- 4 Steps to Budget your Paycheck Effectively: When Do You Use My Income Advice? Start With How Much M

Manage your money and learn to save. Start your effective personal budgeting today. - Easy and Simple Tricks To Save Money Everyday!

How did the economic recession affect our lives? Saving money now is more important than ever before.

What's a budget?

Can you really afford all the things that you want in your life? If not, then you need to budget your money.

Buy what you can afford to pay. There are scientific ways of computing complex situations of future values or net present values but you don't need to learn the complex math. There are professionals who does that.

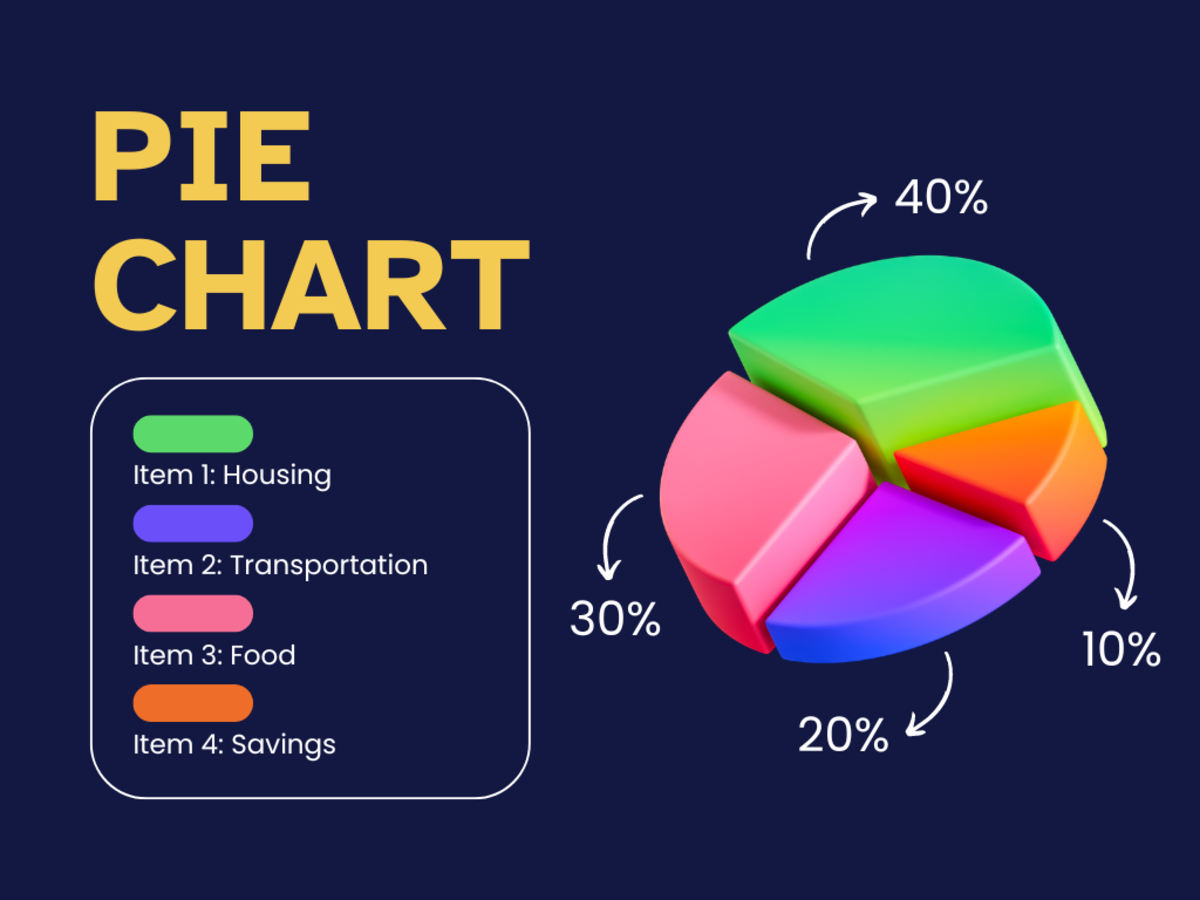

What you need to learn is basic management of your money. Create a budget that is suited to yourself. Be realistic by accepting how much you truly earn every month. Then write down your expenses. It will give you a clear picture of how much you really spend on a monthly basis as well. After figuring out the totals of your income and expenses, it will give you an idea if there's something left. The residual amount can become your savings or a contingent fund for future important payments.

Why do I need to follow a budget?

Defy your weak self. When you are asked to follow your own budget, the worst enemy is yourself.

It takes discipline to succeed. Reward yourself every financial victory you make even it is trivial, to continuously help motivate yourself. You can start now by doing your baby steps.

Following a budget helps you keep track with your plans. As an example, your written program of action on how much to spend for grocery, clothes, gas, etc will be monitored easily. It'll help you understand if you can afford to pay for it. If not, what are the actions you need to take? Do you have to to buy alternatives or skip it altogether? All the answers depend on you.

At the end of the month, you will exactly know if your money is enough to sustain your basic needs and live decently. There is no magic solution to our financial problems. The best thing to do is to manage this scarce resource properly.

I need help, why help others?

In the biblical times, do you wonder why tithes were encouraged? Though it's a tall order way back then, giving back 10% of what you earned, it is still possible today. Others encourage you to share one-hour of your wage or any amount your generous heart can give.

You can also support a charitable organization of your choice or help send somebody to school. As the saying goes, it is better to teach someone to fish than to give him fish for food. When you "give", don't count it. The blessing will given back without you knowing it.

When you help others, you will feel better. You don't need to be rich or overly abundant to share only when there is an excess.The grace is given back to you. Others call it good karma. The Dalai Lama calls it compassion. Whatever is the adjective of your action, you will notice that your well will not run dry, even how shallow it is.

Claim your financial freedom and have peace of mind!

Learn to manage your spending habits. Satisfy your needs without compromising your life in the future. Don't burden yourself with too much financial obligation that could have been avoided in the first place. A written budget plan put in place will help you understand where you are right now. It also shows a sneak peek of your future and where you will be.

When your finances are in order, there is clarity. Being free of unnecessary worries if your money will be enough or not, improves your intellectual decision to deal with your situation. A clear picture of your financial direction will ultimately provide you with peace of mind.

The irony in life is, the more you give the more you receive. The ones who are hard up in life and helps, receives even more in return. The story of the Dead Sea is a living example. Due to its high salt content, it is devoid of life.

On the northern part of the same water is the Jordan River. The Jordan is clear, with fish and plants surrounding it. Yet both bodies of water comes from the Sea of Galilee. The difference why the Jordan River is abundant and full of life is that, it let its waters flow out to other streams while the Dead Sea catches it all. The Dead Sea holds all the water to itself, doesn't share and doesn't let go.

Each of us have our own money situation to deal with. But there are helpful tools available, like budgeting, to help us cope with the problem. With the three steps to financial freedom hope you'll be able to say more "yes" than "no" with this short quiz next time. Have a good written budget and share your blessings!

Copyright © 2012 The Girls. All rights reserved. Reproduction in whole or in part in any form or medium without permission prohibited.