30 Steps to Financial Literacy

April is Financial Literacy month. In recognition of that month, a nonprofit credit counseling agency called Money Management International (MMI) created 30 steps to take to achieve financial literacy. These are steps that all of us can incorporate into our lives at any time in order to better understand personal finance.

The steps can be explored in depth through the “financial literacy month” link above. In brief, they are:

1. Make a pledge to accept responsibility for creating the type of financial situation that you want. This is super important because nobody is going to do the work for you. And yes, you can do it!

2. Do an assessment of your financial situation.If you don’t know what’s going on with your money then you can’t make smart decisions about it. In this step, you would look at your overall financial situation including whether or not you pay bills on time, if you follow a budget, how often you review your credit report and whether you set and keep financial goals. Don’t judge your results. Regardless of what they are, they provide great information about where you’re starting when it comes to getting your finances in order.

3. Organize your financial mess. This is all about de-cluttering to get yourself organized when it comes to your finances. In this stage you do things like organize the receipts and paperwork that you need to keep and trash the ones that you don’t need anymore.

4. Assign a family CFO. The idea here is that one person in the household is responsible for keeping the family on track with finances. This is easy to decide in a home with a single head of household but it’s especially important in homes with multiple adults and income earners.

5. Check up on your credit. You need to make sure that you check your credit report regularly so that you know what’s going on with your credit. This helps you monitor your own spending and payment habits as well as to keep an eye out for issues of identity theft. You should order your credit report from at least one of the three major reporting agencies at this time.

6. Get the credit report correct. Building off of step five, this step involves disputing any errors on your credit report.

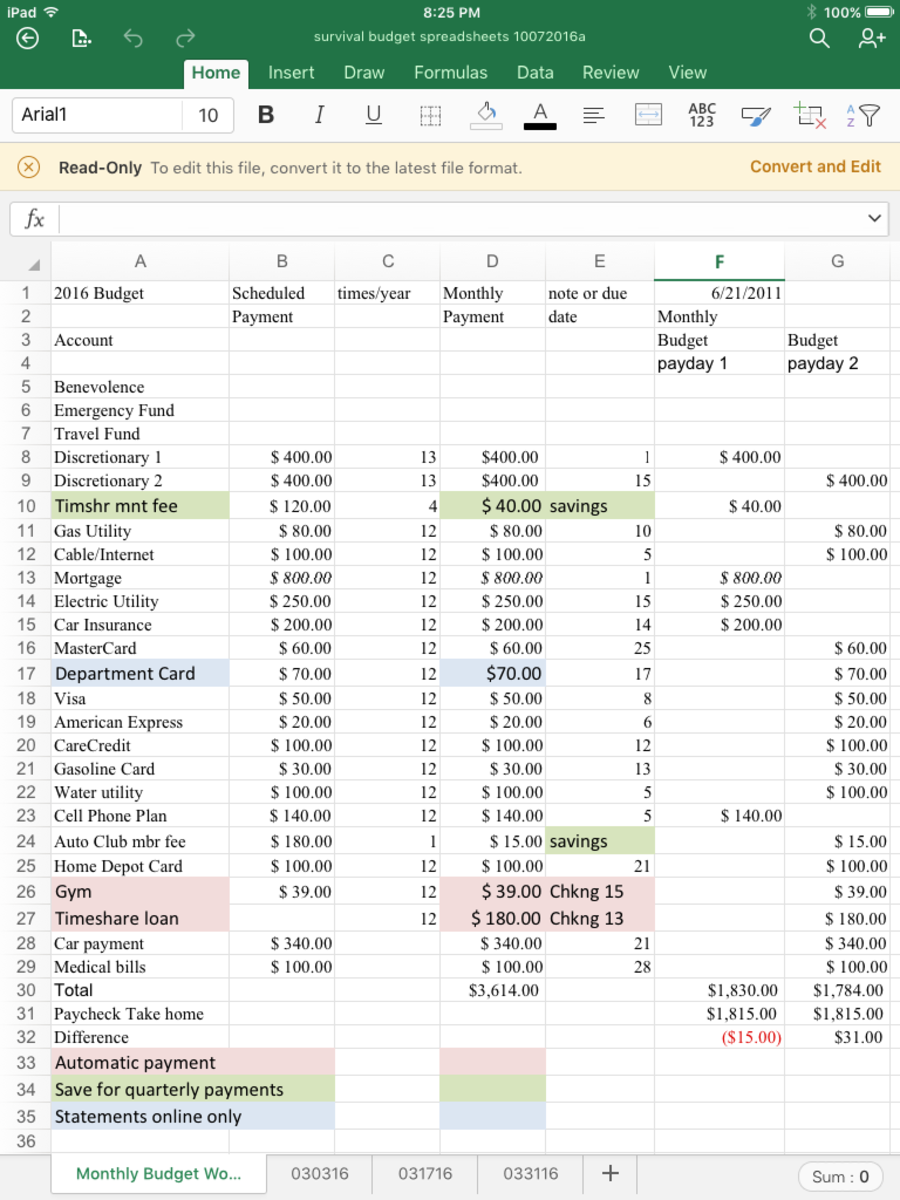

7. Complete an income worksheet. This is a detailed worksheet that looks back at the past year or two and provides you with a great picture of your household income. It looks at all types of income, various deductions and the difference between your monthly gross and net income.

8. Complete a net worth worksheet. You are worth more than just the cash that you have in the bank. To determine net worth, you need to look at all of your assets and all of your liabilities. This information is useful for budgeting, loan repayment and other aspects of total financial literacy.

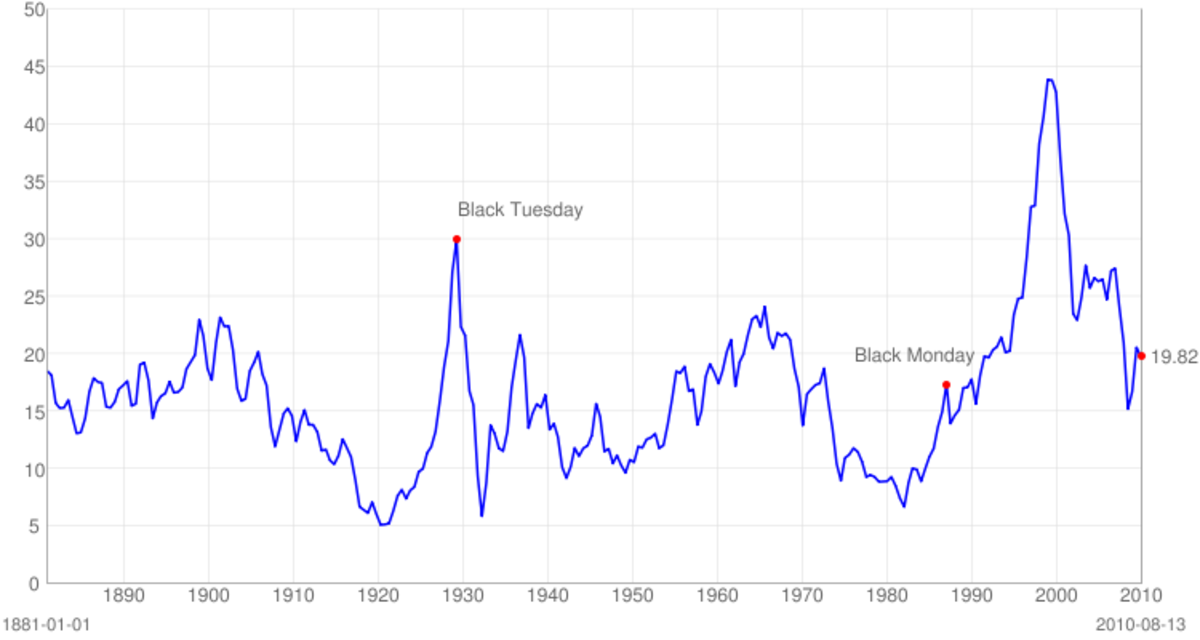

9. Review your debt. You need to get honest with yourself about your debt. Look honesty at what you owe, how often you overspend, and what your repayment currently looks like.

10. Complete a financial priorities worksheet. You need to look at your financial needs and wants. For example, you may want to buy a car but need to pay down your debt. You can rank your needs and wants on a 1-3 or 1-5 scale to give you an idea of what your financial priorities should be.

11. Learn about SMART goals. This is an acronym that refers to the process of setting financial goals that are specific, measurable, achievable, rewarding and trackable.

12. Set financial goals. It is recommended that you set short-term, mid-term and long-term financial goals using the information obtained in steps 10 and 11. You’ll list your goals, set a target date and review the financials required to meet those goals by that target date.

13. Start paying down debt. You simply can’t be financially literate if you’re accruing more and more debt.

14. Create an emergency fund. You need to have an emergency fund that consists of 3-6 months worth of living expenses in order to be truly financially secure. Start saving now.

15. Assess your retirement savings. This is a part of your financial future that you need to look at seriously. Review what your resources are and where you can get help to plan better for this stage of life.

16. Post your financial goals. Put them where you can see them so that you can stay on track with the work that you’re doing. Reward yourself when you achieve your goals.

17. Implement tricks to save towards your financial goals. There are many savings tricks that you can implement such as turning a hobby into a secondary income or downsizing to reduce costs.

18. Track daily expenses. Do you know where your money goes? It’s the day-to-day expenses that most people let slip by unnoticed and then their money just disappears. Track what you spend to get a better picture of where your money is going.

19. Complete a fixed expenses worksheet. This tells you what you’ll almost always be spending each month on things like rent, insurance, utilities, childcare and transportation.

20. Identify the hidden periodic expenses. These are the items that happen now and then but aren’t fixed expenses or daily expenses. They may include auto repairs, back-to-school costs and vacations.

21. Complete a full expense worksheet. Using the information that you’ve obtained in the past few steps, you can create a total picture of what all of your expenses are.

22. Brainstorm ways to save money. Learning to live frugally can help you stay financially responsible. Brainstorm a list of all of the different ways that you can start saving money here and there.

23. Emphasize saving at the grocery store. This is an area where it’s possible to really get some big savings if you put in some effort. That’s why it’s included as one of the thirty steps towards being financially literate.

24. Communicate your financial literacy to others. Basically, talking to others about your financial goals and the tips that you’re learning helps to hold you accountable and keep you on track.

25. Complete an adjusted expense worksheet. Return to step 21. Review how you would like to see your expenses change in the future. For example, maybe you spend $100 per month on fuel but want to change that to $80. Changing your expense worksheet in this way will help you make more financial goals.

26. Review your insurance. You need to have adequate insurance coverage but not be paying too much for it. Review what you have, what you need and what you’re paying.

27. Educate yourself about credit. Take the time to fully understand credit cards and loans. Educate yourself generally and then apply what you learn to review your own credit situation. This will help you on your way towards eliminating debt.

28. Put together your own financial team. You need to take responsibility for your own financial situation but you don’t need to do all of it alone. Having a team of qualified professionals to help you is part of being financially literate. People to add to your team may include a tax person, a financial planner and a credit counselor.

29. Brainstorm the benefits of achieving your financial goals. This will remind you why it is that you’re doing all of this hard work so that you can keep on going with it and ultimately reap all of those benefits.

30. Reflect upon the steps that you’ve taken and create a plan for the future. Look at what you’ve learned and how you feel about your finances then write a plan of action for the next 1 month, 3 months or 6 months to keep on top of being a financially literate individual.