After avoiding the Second Great Depression what will Equity Markets do next ?

America exports its way to recovery

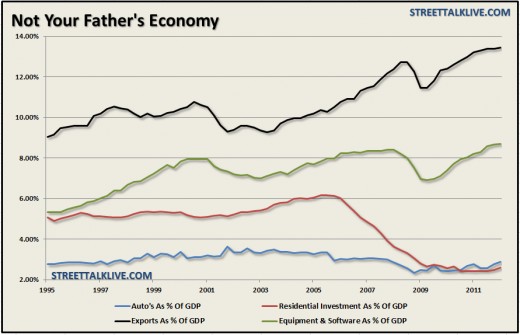

The Export Story

America has rediscovered its export sector. To become an export driven economy however, rebalancing of the global economy must occur. The traditional global trade model has thus far involved America importing more than it exports. In the future, America’s trading partners must be encouraged to allow greater access to American exports. Europe is currently undergoing a recession and a debt crisis, so aggregate demand for American exports is weak. Emerging Economies however are still growing, so they offer the most potential for American exports.

QE saves Equities and Corporate Balance Sheets

Quantitative Easing lifts all boats

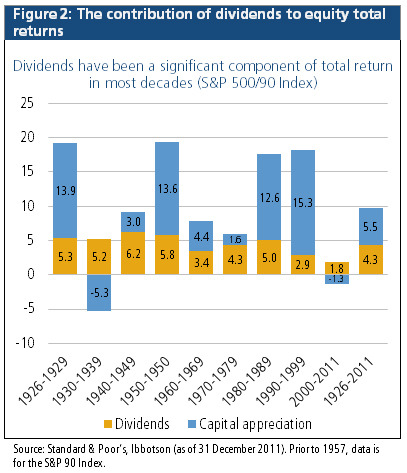

The application of Quantitative Easing, by global central banks, has meant that equity investors have avoided the prolonged agony of the Great Depression; whilst the real economy has continued to struggle. The deliberate policy of targeting asset prices meant that equity valuations recovered rapidly; ahead of the real economy. The industrial sector, of the real economy, has also benefitted from the central bank liquidity. During the Credit Crunch, investors demanded dividend income to prevent them from dumping their stocks; which put pressure on corporate balance sheets at a time of weak economic activity. Companies have retained income during the Quantitative Easing period, which has allowed them to deleverage their balance sheets; because investors have accepted lower dividends as capital gains have been large during the rebound in equity markets.

Looking more closely at the graph, the Second Great Depression began after the dot.com Bubble burst. Equity investors have since experienced a Lost Decade of sub-optimal equity returns from both dividends and capital gains. Based on historic analysis of the means and medians, they can expect both higher dividend income and capital gains in the future; as American financial and business conditions revert back to normal.

Links

- Valuing the Bernanke Put

Commentators talk about the Bernanke Put. What does it mean in monetary terms; and what is its value? - Stock Market History is Rhyming Again

Technical Analysis of the S&P 500 is pointing to a bear market. Fundamental Analysis however, says that the bear market began in 2000; and may now be coming to a close.