Valuing the Bernanke Put

Ben Bernanke

Intrinsic Value of the Bernanke Put

During Quantitative Easing, the Fed has replaced the defaulting credit, which was created by the Commercial and Shadow Banking system, with Federal Funds. Banks have a new asset called Federal Funds, which pay them a twenty five basis point income on Reserves in excess of the regulatory requirements set by the Fed. The Fed has a new liability called the Interest Paid on Excess Reserves; against which it has a collateral asset in the form of either Treasury Bonds or Mortgage securities, which it has purchased as part of Quantitative Easing and Operation Twist.

The level of Federal Funds credit is in excess of that needed to settle the daily Federal Funds market, so banks have excess Reserves on which they can earn twenty five basis points. Banks are effectively putting credit back to the Fed, rather than using it for private credit creation. The excess Reserves in this put-back represent a Call Option on the private credit markets. The Bernanke Put is therefore the converse of a Call Option on the credit markets. This option is risk free; since it has been written against the full faith and credit US Treasuries.

Out of the Money Call on the US Economy

Put-Call Parity

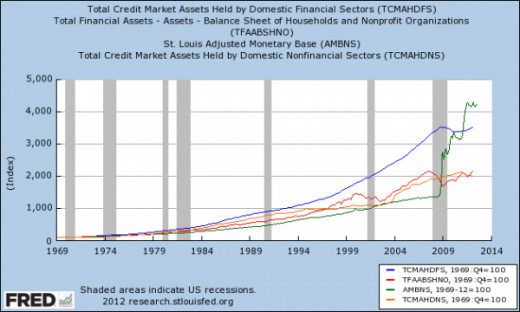

The graph shows that this Call Option has intrinsic value, because it is larger than the current value of all the private credit in the markets. Applying the principle known as Put-Call Parity, it can be seen that the capital markets currently value the put feature higher than the call feature; for this option struck at the current level of American economic activity.

A return of confidence in the American economy will trigger the exercise of this Call Option; as private sector credit is created by the leveraging of the Federal Reserve credit by the banking sector. Put-Call Parity will then be restored. The return of confidence does not imply that interest rates must rise. If the fed maintains the size of its balance sheet; by holding the Treasuries and Mortgage Securities it owns, then it can also maintain the level of Reserves in the Federal Funds market. As long as the Federal Funds market is oversupplied with Reserves, the banks will have excess liquidity to put to work.

The signals are that the Fed will reduce or remove the Rate of Interest Paid on Excess Reserves. Once this incentive to hold Excess Reserves at the Fed has gone, the banks will then be forced to generate returns by private sector credit creation. The removal of the Interest Paid on Excess Reserves is therefore an event that will trigger the Call Option implied by the value of the Bernanke Put.

Links

- Stock Market History is Rhyming Again

Technical Analysis of the S&P 500 is pointing to a bear market. Fundamental Analysis however, says that the bear market began in 2000; and may now be coming to a close. - Intrinsic Value Definition | Investopedia

1. The actual value of a company or an asset based on an underlying perception of its true value including all aspects of the business, in terms of both tangible and intangible factors. This value may or may not be the same as the current market valu - Put-Call Parity Definition | Investopedia

A principle referring to the static price relationship, given a stock's price, between the prices of European put and call options of the same class (i.e. same underlying, strike price and expiration date). This relationship is shown from the fact th - How can Ben Bernanke the builder fix it?

Ever since the June FOMC Meeting minutes were published, analysts and financial markets have been trying to predict what the Federal Reserve will do at its next meeting. The broken transmission mechanism between the Federal Reserve and the real econo