Analysing Return on Equity (DuPont)

Introduction to DuPont Analysis

DuPont analysis is an approach to break down the return on equity (ROE), one of the profitability ratios further. Analysts are able to analyse the company’s performances by decomposing the company ROE into basic financial ratios by using DuPont analysis.

Decomposing ROE is useful in finding out the reasons for changes of ROE over a given time period. Besides analyse, the company’s management is also able to use DuPont analysis to determine which area should they focus on to further increase the ROE.

Basic Algebra

DuPont analysis uses basic algebra that we have learnt in the primary school to break down into basic ratios. The algebra uses is Multiplication. For those who have pass back the basic algebra to their primary school teacher below is the formulae to refresh the minds.

Two-part DuPont Equation

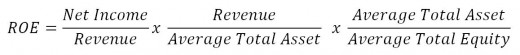

As discuss in profitability ratio, the original ROE equation is given as follows:

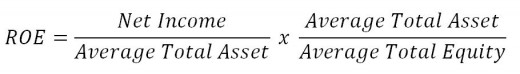

By applying basic multiplication algebra we can extend the formula as follows:

which can be interpreted as ROE = ROA x Leverage

The above formulae show that a company can improve ROE by improving ROA or making more efficient use of leverage. If a company have no liability, its leverage ratio will be equal to 1. Hence the company ROE is equal to ROA.

For a value investor, we shall look for company with high ROA and low leverage. These indicated that the company is able to borrow at lower rate and earn with a higher rate from the company’s assets.

Three-part DuPont Equation

Similar to ROE, ROA from the two-part DuPont equations discussed above can be also decomposed as well to form the following formulae:

which also can be interpreted as ROE = Net Profit Margin x Total Asset Turnover x Leverage

ROA from two-part DuPont analysis is break down further into net profit margin (profitability ratio) and total asset turnover (activity ratio). Net profit margin measure how much is the company income per monetary unit of sales. Net profit margin measure the profitability of the company. While the total asset turnover measures the company’s overall ability to generate revenues with a given level of assets. Total asset turnover measure the efficiency of the company's management managing the company's assets.

From the decomposed ROA, analysts can know whether the company is capital intensive or labour intensive. An capital intensive company will have low total asset turnover and high net income margin. On the other hand, a labour intensive company will have high total asset turnover because most of there asset are inventory which is current asset and low net profit margin because there are high wages expenses . A labour intensive company will perform better when there unemployment wage is high and the labours wages are low. While a capital intensive company is good when the labours wages are high and it is better to invest in equipment to increase productivity compare to hire more labours.

Below is the video from Youtube which explained three-part DuPont analysis.

Five-part DuPont Equation

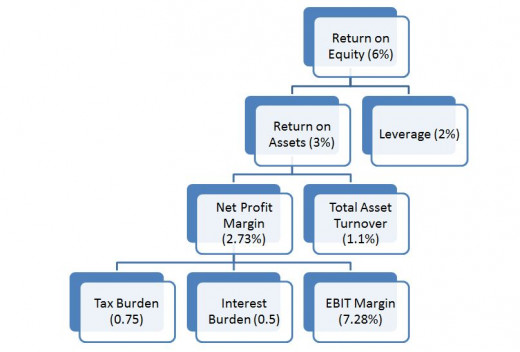

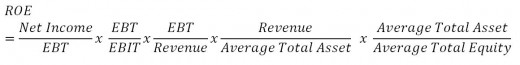

There is another extended version of DuPont analysis (5-part DuPont analysis). If we further decomposed the net profit margin, we can obtained five-part DuPont equation. Nowdays most analysis uses five-part DuPont analysis. The five-part DuPont equation is as follows:

which also can be intemperate as

ROE = Tax Burden x Interest Burden x EBIT Margin x Asset Turnover x Financial Leverage

The five-part DuPont analysis further decomposed net profit margin into tax burden, interest burden and earning before interest and tax margin (EBIT).

Tax burden measure how much money the company is able to keep after tax reduction. It is can be stated as Tax Burden = 1 – Effective Tax Rate. High tax burden indicated that the company is able to keep a larger percentage of the pre-tax earning and vice versa. As a value investor we shall look at company with high tax burden. Tax burden can be either 1 (no tax is paid) or <1.

While the interest burden shows the effect on borrowing interest into ROE. A high borrowing cost will cause the company has low interest burden. High interest burden means that the company is able to keep a large portion of income before tax after the reduction of interests and vice versa. As a value investor we shall look at the company with high interest burden. Interest burden can be either 1 (no borrowing interest) of < 1.

Since both tax burden and interest burden is a value range from 0 - 1, hence an increase either tax burden or interest burden will tend to reduce the ROE.

Finally the last new tern is the EBIT margin which is also known as operating profit margin. The EBIT margin is uses to measure the effect of operating efficiency of the company. A high EBIT margin means that the company is operation efficient and vice versa. As a value investor, we shall look at company with high EBIT margin

Growth Rate

One of the importance reasons analysts calculate the ROE is to determine the growth rate of the company. Growth rate is an importance value many analysts use to estimated the further stock price of a company (intrinsic value). As a value investor we shall buy a stock that is way below the intrinsic value and sell them when they are overvalued.

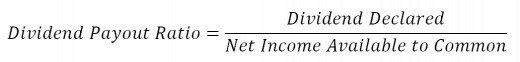

The growth rate of a company is calculated by the following formula:

Growth Rate = Retention Rate x ROE

where:

Retention Rate = 1 – Dividend Payout Ratio

when the company is not giving out any dividend, the company has a retention sum of 1. Hence the growth rate of the company is equal to the return of equity.