FINANCIAL ANALYSIS TECHNIQUES - Profitability Ratios

Introduction to Solvency Ratios

In the previous hubpages, we had discussed the how to measured how efficient the management able to use asset (Activity ratio), and how sustainable the company are in short term (Liquidity ratio) and in long term (Solvency ratio).

Now the most importance part (at least for most investors and analysts but not me) the profitability of the company. As a value investor, I prefer to look at sustainability of the company and not the profitability as long there is no red (negative value) in the operating cash flow and income statement I am fined.

Profitability is able to allow analysts to see the company competitive position and the quality of the management. This hubpages would discuss two importance category of profitability ratios : return on sales and return on investment.

Return on Sales

- Gross Profit Margin

- Operating Profit Margin

- Pretax Margin

- Net Profit Margin

Return on Investment

- Return on Assets

- Return on Total Capital

- Return on Equity

Return on Common Equity

Gross Profit Margin

Gross profit = sales (revenue) – cost of goods sold

From the formulae above, gross profit margin is the percentage of revenue available for cost of goods sold. Company will like to maintain the gross profit margin as high as possible by reducing cost or increasing sales price. However, the ability to raise the gross profit is limited by the competitions.

As a value investor, we shall look for a company with high gross profit margin compared to the industry. High gross profit margin mean that the company has a competitive advantage products in term of branding, technology and etc. Besides that, a high gross profit margin than the industry also indicate that the company are able to produce low cost good.

Operating Profit Margin

Operating profit is also known as earnings before interest and tax (EBIT). Operating profit subtract operating cost (administrative expense, general expense) from gross profit. Besides that it also include non-operating gain such as investment income and etc.

If the operating profit margin increase faster compared to gross profit margin in consecutive years it indicates the company has successfully reduce the operating cost successfully.

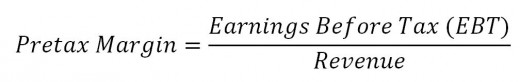

Pretax Margin

EBT or pretax profit is EBIT minus interest payment for loan. Pretax margin is the ratio of EBT over revenue. A company with low pretax margin indicates that the company use most of their earning to pay the interests from loan.

Analysts should look at company that consist of pretax margin close to operating profit margin. When the pretax margin is close to operating profit margin which indicated that the company has low interest payment either they have loan interest loan or low amount of loan. These indicated that the company is able to keep most of their earnings into the equity on the balance sheet.

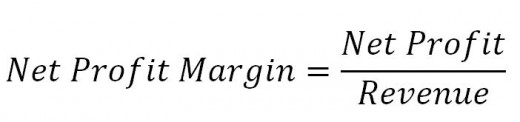

Net Profit Margin

This is the most importance margin in the return on sales. As the name indicated net profit is the final profits that take into account all recurring or non recurring expenses, cooperate taxes and incomes. A high net profit margin indicated the company is doing well and able shift the profit into equity.

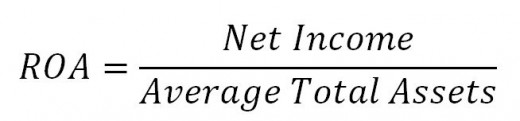

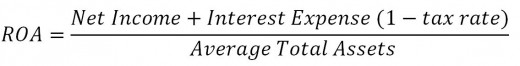

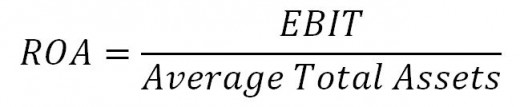

Return on Assets (ROA)

Return on asset (ROA) measure the percentage of earning earn from a company asset. The high ROA indicate that the company generate high income from their asset. There are different ways to calculate ROA. The simplest formulae are as follows:

However the above formula is misleading because the net income does not included the interest expense while the asset on the balance sheet included. Therefore a more accurate formula is adding back the interest expense into the net income as follow:

Some analysts prefer to take the operating profit (EBIT) which included the interest expense and tax payment for the ROA calculation as follows:

ROTC measures the percentage of EBIT over total capital. Total capital included all liability and equity.

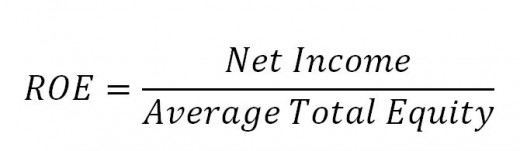

Return on Equity (ROE)

Return on Equity (ROE) measure the return earned by a company on its equity. It is a importance ratio for many analysts, analyst use ROE to calculate growth rate which in term able to project the future earning of the company and the current stock price using Discount Dividend Model, Gordon Growth Model, Cost of Capital and etc. I will write a hubpages regarding the equity valuation method in the future so please stay tune.

Like ROA, ROE also has various ways to calculated, the simplest way is as follows:

ROE can be decomposes further using Dupont there are 3 ways Dupont and 5 ways Dupont. Since it take some time to explain Dupont Methods and it is importance decompose ROE further for stock valuation, I decided to explain it for the next hubpages together with growth rate so please stay tune.

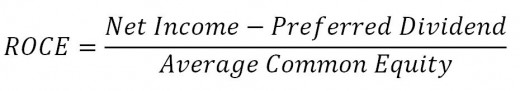

Return on Common Equity (ROCE)

ROE which we have discuss previously take into account the total equity which in prefer shares. As not all of us have the access to prefer shares hence return of common equity (ROCE) is introduce.

As an investor which involves in common equity, I will evaluate a company using ROCE instead of ROE. High ROCE value indicates that the company is in good form.

Profitability Ratio Criterias

Profitablility Ratios

| Criteria

|

|---|---|

Gross Profit Margin

| > industrial norm

|

Operating Profit Margin

| > industrial norm

|

Pretax Margin

| > industrial norm

|

Net Profit Margin

| > industrial norm

|

Return on Asset

| > industrial norm

|

Return on Equity

| > industrial norm

|

Return on Common Equity

| > industrial norm

|