Beat The Banks-Make Your Own Budget.

Manage your Own Money

We are continually being informed that certain banks are in trouble, yet many make a profit and the shareholders and top financiers are earning big bonuses..

However trying to manage our money and finances is becoming increasingly more difficult with food,energy and fuel prices continuing to rise.

What we need to do is take control of our money, make our own budget and become less reliant on banks and credit cards.

Banks and Credit Cards

Do banks really provide us with the services we need? I am inclined to think not.It is heavily loaded in the favour of the financiers, there are outrageous charges for letters and going overdrawn. Overdraft rates are poor with little flexibility if you go overdrawn.If you want to borrow money you are treated with unreserved suspicion as justify your reason, oh and they will want the deeds to your home.

The credit card companies will also lean on you heavily,forget to pay your bill and you will have a letter within two days demanding excess charges.If you happen to have a complaint you are usually directed to a call centre and an inept advisor .

I would actually prefer to deal with banks and credit card companies as little as possible.

If you can just use one credit card and keep your limit as low as possible.If you owe money on a credit card,change to a card that gives you the best deal.

New v Old

Older generations would not have bought any thing on credit they would have saved up , making little pots of money for different things. They never lived beyond their means and would cook from scratch using basic ingredients as well as making the most of money off coupons.

Today people will spend their time switching credit cards and mortgages, as well as finding cheaper energy bills.This can all be done on money saving websites, which can be a huge way of saving money.

So which way is the best I think you need a mixture of new and old, you do not want to waste time comparing prices if you are only going to save a few pennies.Make you you are not wasting valuable time when the offers just aren't worth the trouble.

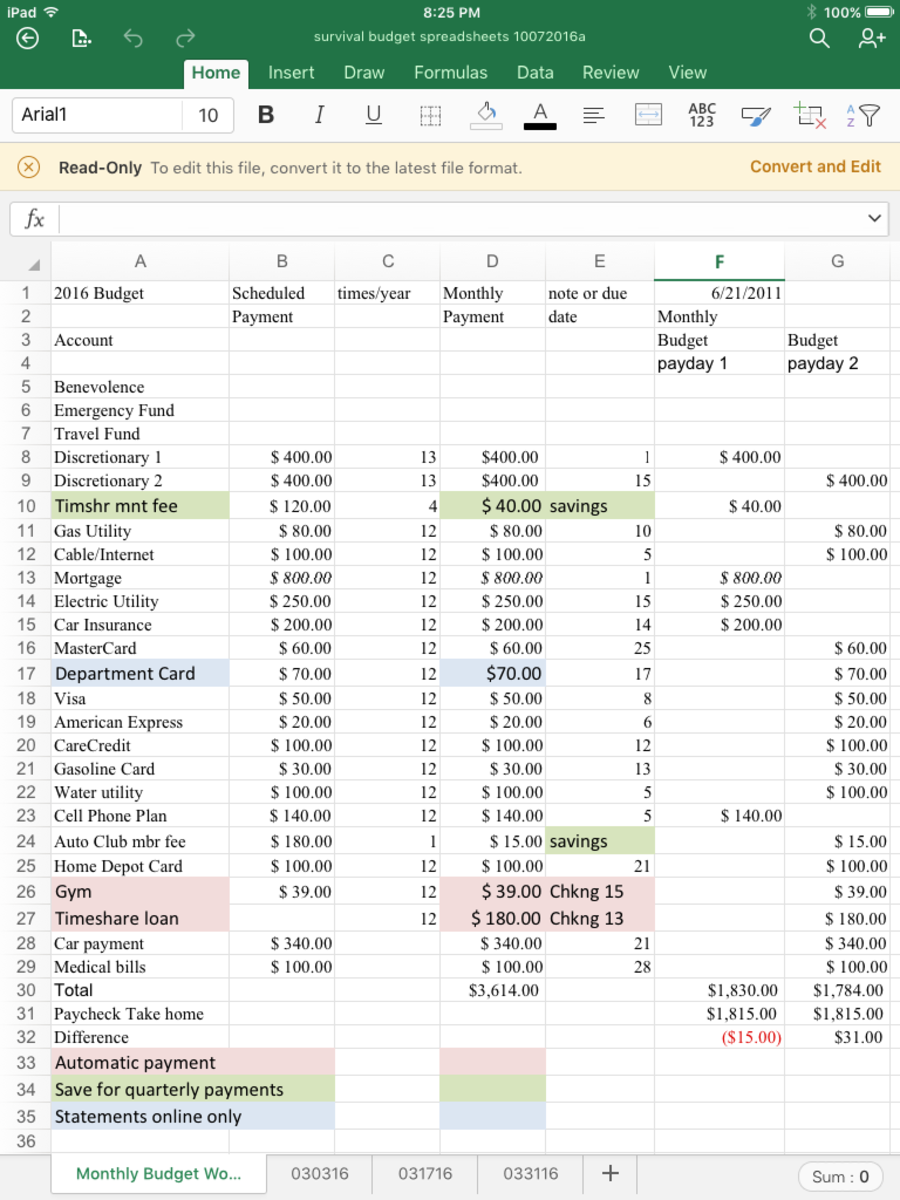

Make Your Own Budget

To start with this will take some time.You will need to collect all your receipts for a month, and have your bank statements to hand as well as any quarterly bills.

Now as you work out what you are spending, divide it into your categories:

- Basic essentials - mortgage and rent payments,fuel costs(gas and electric),water rates and council tax.

- Essentials - food and transport costs,communication costs(phone and Internet).

- Luxuries - this list could be long. shoes , CD's, perfumes,magazines, books,clothes,DVD's,computer games etc.

Of course, pets and other care responsibilities will have to be considered.

You will eventually be able to gain a better idea of how you can make savings.

Essential savings could be switching your fuel suppliers and credit cards for a better rate,or maybe changing your mortgage.

Non essentials;you may find you don't need as many pairs of shoes, the tacky magazines, the DVD's you never watch and subscriptions you do not use.

Put aside a little money for unexpected events, presents and holidays.

You should put your earnings into your main bank account and then open a second account to pay for your essential household bills and standing orders.Open a third account which can be your spending money or wages.This will stop you splashing out on any thing you can't afford and yo know your limit.

Also make sure you set up a standing order for credit card bills to avoid fines for late payment.

Time is Money

We all want to save money,but you don't want to waste your time if it is only for a small amount. Making your own budget may take some of your valuable time,but in the long run it is worth it as you can see exactly what you spend and if you really need many things you buy on the spur of the moment.

- Will the Euro Survive?-How Would the Demise of the E...

The euro is still with us and has caused much controversy as speculators continue to debate the demise of the euro.There is still no euro in the UK,but if it fails how will it affect the UK - Who Would Want The Euro To Fail

Who could benefit from the failure of the euro. Is i t possible America would want to protect the dollar as a benchmark for trading in oil, and not the euro or any other currency. - Quick Money Quotes-Great Quotations About Money

Money speaks sense in a language all nations understand, is one of lifes great quotes about money.Here are some more great Quotes about money.