How can Ben Bernanke the Builder fix it?

Can he fix it?

The minutes of the June 19/20 Federal Reserve FOMC meeting included the following paragraph:

Several participants commented that it would be desirable to explore the possibility of developing new tools to promote more accommodative financial conditions and thereby support a stronger economic recovery.

As the Presidential election of 2012 approaches; the Fed is under pressure to remain apolitical; another round of Quantitative Easing will be difficult to execute. The Fed needs new tools in place of more QE. These new tools will need to be both economically and politically expedient. Above all, they must be successful.

New policy tool

How can he fix it?

How "can he fix it"? To anwer that; one must understand the answer to the question "how".

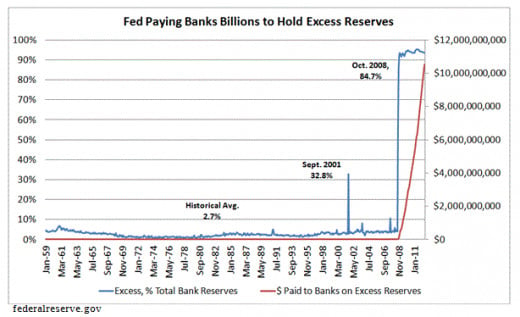

A solution can be found in the interest paid on Reserves held by commercial banks at the Fed. The banks are paid 25 basis points on these Excess Reserves today. The QE programme supplies the banks with billions of Excess Reserves; on which the Fed will pay interest. This means that the banks have no incentive to lend money. Why should they lend when they can earn a riskless 25 basis from the Fed. At a time when interest rates are at extreme lows, that do not compensate lenders for risks, banks are understandably reluctant to lend. The monetary transmission mechanism ; to the real economy, via the banks, from the Fed is broken.

By reducing and removing, the Interest Paid on Excess Reseves; the Fed can fix the broken monetary transmission mechanism. The Fed will then simultaneously force the banks into correctly pricing the risks they take;when they make loans.

Links

- Valuing the Bernanke Put

Commentators talk about the Bernanke Put. What does it mean in monetary terms; and what is its value?