Retirement Calculators - How to Tell the Good from the Bad

Introduction to Retirement Calculators

Retirement calculators are tools that make projections of variables such as savings on anticipated interest, amount needed to save to reach a nest egg goal within a certain time period, and how much one needs to save to be able to spend a desired annual amount. It will calculate the desired variable based on the other given inputs a person places into the calculator.

There are many retirement calculators online. Some of them will do less types of variables than others. Two that have multiple options that I will address later are http://tcalc.timevalue.com/all-financial-calculators/retirement-calculators/retirement-spending-calculator.aspx,. The second one is http://www.bankrate.com/calculators/index-of-retirement-calculators.aspx that has even more options than the first. It has an entire index of every aspect of retirement. As much as these two differ in complexity, they both have a rather serious flaw in their calculation.

Before You Use a Retirement Calculator

There are things you will need to know before using a retirement calculator. Some of them are things only you can answer, because they are about yourself. What are your retirement goals? Most of the common questions to be answered are:

- At what age would you like to stop working?

- Would you like to completely retire, or work part time after retiring from full time employment?

- How extravagantly would you like to live in retirement?

- How much will you need to save to meet your goals?

- How conservative or aggressive will your portfolio be in retirement?

Necessary Guesswork

A good retirement calculator will have an inflation variable. Until the day comes when the Federal Reserve is no longer printing fiat currency, inflation always has to be accounted for. If you are thinking in today's dollars about your retirement 25 years from now, you may be in for a surprise. What cost $1 in 1987 cost $1.99 in 2012. The cost of living doubled in a quarter century. That is an increase of about 3% per year. Inflation calculators that have this variable available will usually have the default setting to 3%. It will probably be wise to raise the rate and do a worse case calculation. Because in the previous 25 year period, what cost $1 in 1962 cost $3.76. The actions of the central bank often bring about unwelcome surprises.

Any calculator worth its salt will also have what I call an extravagance option. This is the amount of income as a percentage of your current or expected salary at retirement you wish to withdraw from your nest egg once you retire. How much of this will depend on how lavishly you wish to live in retirement, and it will also depend on how many other sources of income you expect to have, i.e. pensions, inheritance. The extravagance option is used when you are trying to solve the question of whether or not you are saving enough either monthly or annually to meet your goal.

Theoretical Problems of Some Retirement Calculators

The two calculators referenced in the introduction segment both have contain dangerous advice in their calculations. The first link that I listed has many things wrong with it, among which it can answer no variables other than the withdrawal. The fatal flaw in the withdrawal question is that this calculator tells you how much you can withdraw in various time periods i.e. biweekly, monthly, annually, until the fund runs out. The second calculator from bankrate, the "annuity calculator" option second from the bottom in the link, also projects your permissible withdraws until your nest egg runs out, based on how long you expect to live after retirement. And that is where the flaw lies.

The very idea that the amount you wish to live on every year should be projected as a percentage of a nest egg that will continually deplete and eventually run out over a set number of years is a very dangerous way to look at retirement. This is especially true if you have no set pensions or other forms of income. Calculating the size nest egg you need based on a desired regular income withdrawal has a decent probability of leaving you penniless at some point. The biggest reason should be very obvious - you do not know how long you are going to live. Anything is possible in the future. You might get killed in a car accident the day after you retire and never spend anything. However, you may live much longer than you anticipate. The possibility of this increases with advanced medical technology, nutritional knowledge and biological research. The other reason is that you need to be prepared for a catastrophic event. You could be severely disabled or injured as a result of an accident. You could end up divorced, you may suffer a loss in stocks, or other property loss for a plethora of reasons. These events can result in either an acute or chronic spike in expenses.

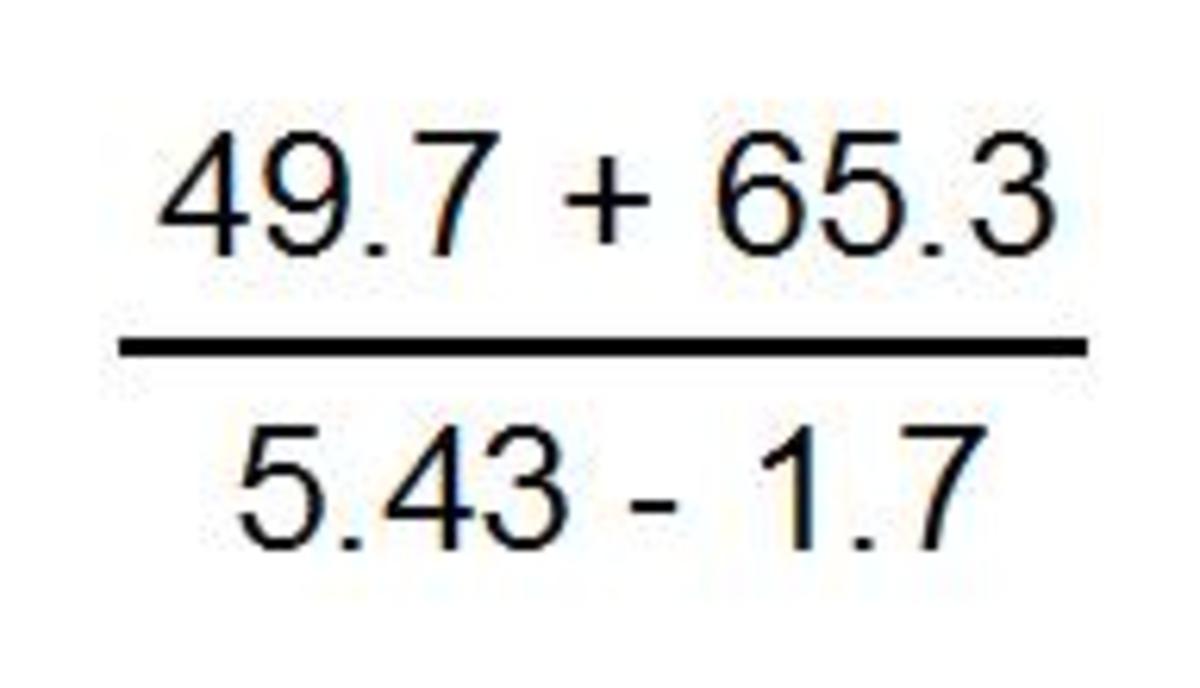

A much more prudent way to figure out the nest egg that you need is to find out how much you wish to live on annually, and calculate how much of a principal you need so that your annual withdrawal is less than the average anticipated annual interest. Some financial advisers consider as much as 6% of the principal to be a safe withdrawal. Personally, I am more conservative. My retirement calculations are based on 3%. I believe the 6% does not adequately provide for various financial problems, including inflation. So, if you wish to live on $70,000 per year after you retire, I suggest that 70,000/0.03 = $2,333,333 would be a better alternative. Utilize the retirement calculators to project how much you need to save per paycheck to reach that goal in the number of years you have between now and the age you expect to retire.